- Solana’s month-to-month DEX quantity reached $109.8 billion in November.

- The each day transaction quantity on Solana averages 53 million, demonstrating its scalability.

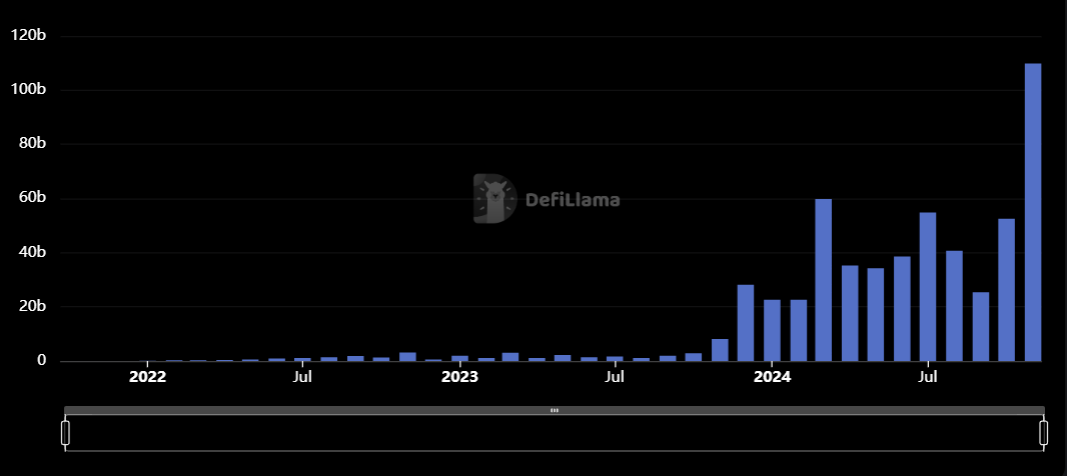

Solana achieved a serious milestone when the decentralized alternate (DEX) quantity exceeded $100 billion in November. In response to DefiLlama, Solana recorded $109.8 billion in DEX buying and selling quantity, doubling Ethereum’s $55 billion. The community additionally posted a exceptional 100% enhance from October’s $52.5 billion, demonstrating its dominance in DeFi.

This development is pushed by Solana’s unparalleled scalability, memecoin exercise and low transaction charges, which energy a each day buying and selling quantity of greater than $5 billion. Solana processes 53 million each day transactions, surpassing different blockchains by lower than 5 million.

With 107.5 million lively addresses in November, Solana might break the file of 123 million in October. These figures spotlight the rising person base and effectivity in dealing with excessive transaction expenses.

Token platforms resembling Pump.enjoyable and Raydium have additionally contributed to this momentum. Each platforms generated file month-to-month revenues of $71.5 million and $182 million, respectively. The fast improvement of the ecosystem displays the market’s rising confidence in Solana’s capacity to steer DeFi innovation.

SOL’s worth and market overview

Solana (SOL) is at present buying and selling at $255.72, up 0.56% within the final 24 hours. Its market capitalization stands at $121.40 billion, with a circulating provide of 474.73 million SOL. Buying and selling quantity elevated by 6.03% to succeed in $5.51 billion. The quantity/market capitalization ratio of 4.55% signifies wholesome liquidity.

SOL is going through resistance at $256.70 and help at $252.25. A breakout above USD 256.70 might push the worth in direction of USD 260 or greater. Nevertheless, a dip beneath $252.25 might result in additional declines.

The Relative Energy Index (RSI) stands at 55.51, near the impartial zone, indicating balanced shopping for and promoting stress. The RSI common matches intently and confirms a gentle pattern. Shifting averages (9-day and 21-day) present a bullish crossover, supporting upward momentum.

With robust fundamentals and technical indicators driving development, Solana might preserve its DeFi dominance and appeal to extra institutional and retail individuals.