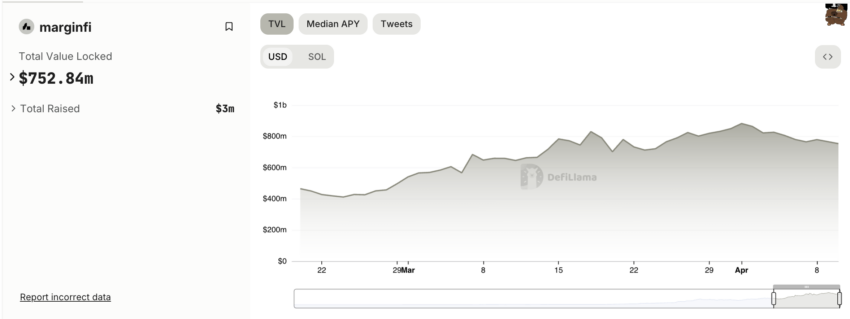

In a dramatic flip of occasions, marginfi, a outstanding participant within the Solana decentralized finance (DeFi) ecosystem, noticed a pointy 25% drop in its Complete Worth Locked (TVL).

This occurred shortly after CEO Edgar Pavlovsky introduced his resignation.

How Marginfi customers reacted to the CEO’s resignation

The sudden departure sparked a large withdrawal frenzy, with customers elevating practically $100 million.

Pavlovsky’s departure marked the end result of the brewing inner strife, resulting in important unrest inside the platform. He left, citing discrepancies with Marginfi’s operational ethos. Because of this, its TVL fell to round $600 million, reflecting eroding confidence and uncertainty amongst its customers.

“It is a world-class workforce – it truly is – however I do not agree with the way in which issues have been finished internally or externally,” Pavlovsky mentioned.

Regardless of the management shake-up, Marginfi tried to stabilize the scenario. The platform assured its neighborhood that its companies would stay operational. Nonetheless, the harm to fame and person belief had already taken its toll.

“All merchandise stay totally operational and usually are not (and can’t be) affected by this departure. The purpose of defi is that the core contributors can stroll away and the protocol strikes on. His departure is because of inner operational disagreements in addition to his personal private causes, and we respect his privateness,” Marginfi wrote.

Learn extra: 13 Greatest Solana (SOL) Wallets to Contemplate in March 2024

marginfi TVL from April 10. Supply: DefiLlama

Moreover, the platform’s current points usually are not remoted incidents. Earlier than the CEO resigned, marginfi was scuffling with technical points and a loyalty program that didn’t meet person expectations. These points slowly undermined person confidence.

The ripple impact of the CEO’s departure prolonged past marginfi’s inner affairs. Opponents and companions responded shortly.

For instance, SolBlaze overtly criticized Marginfi for failing to fulfill its token fee obligations, resulting in an earlier termination of the partnership. Nonetheless, the platform provided to make modifications amid the marginfi turmoil.

Equally, Solend took the chance to criticize marginfi and appeal to its disenchanted customers. It introduced incentives for customers who switch their funds to Solend, strengthening the aggressive dynamics inside the Solana DeFi ecosystem.

The broader Solana community can also be experiencing unrest. Analyst Duo 9 highlighted an ongoing collusion between main Solana entities.

Learn extra: 51% assaults on the blockchain defined: what are the hazards?

He identified that these entities interact in strategic disruptions, resembling DDoS assaults, to realize benefit. Such actions can cripple community effectivity and influence person transactions and platform reliability.