- SOL’s worth rallied above its 20-day EMA on the charts on 15 Might

- This pointed to a decline in promoting stress

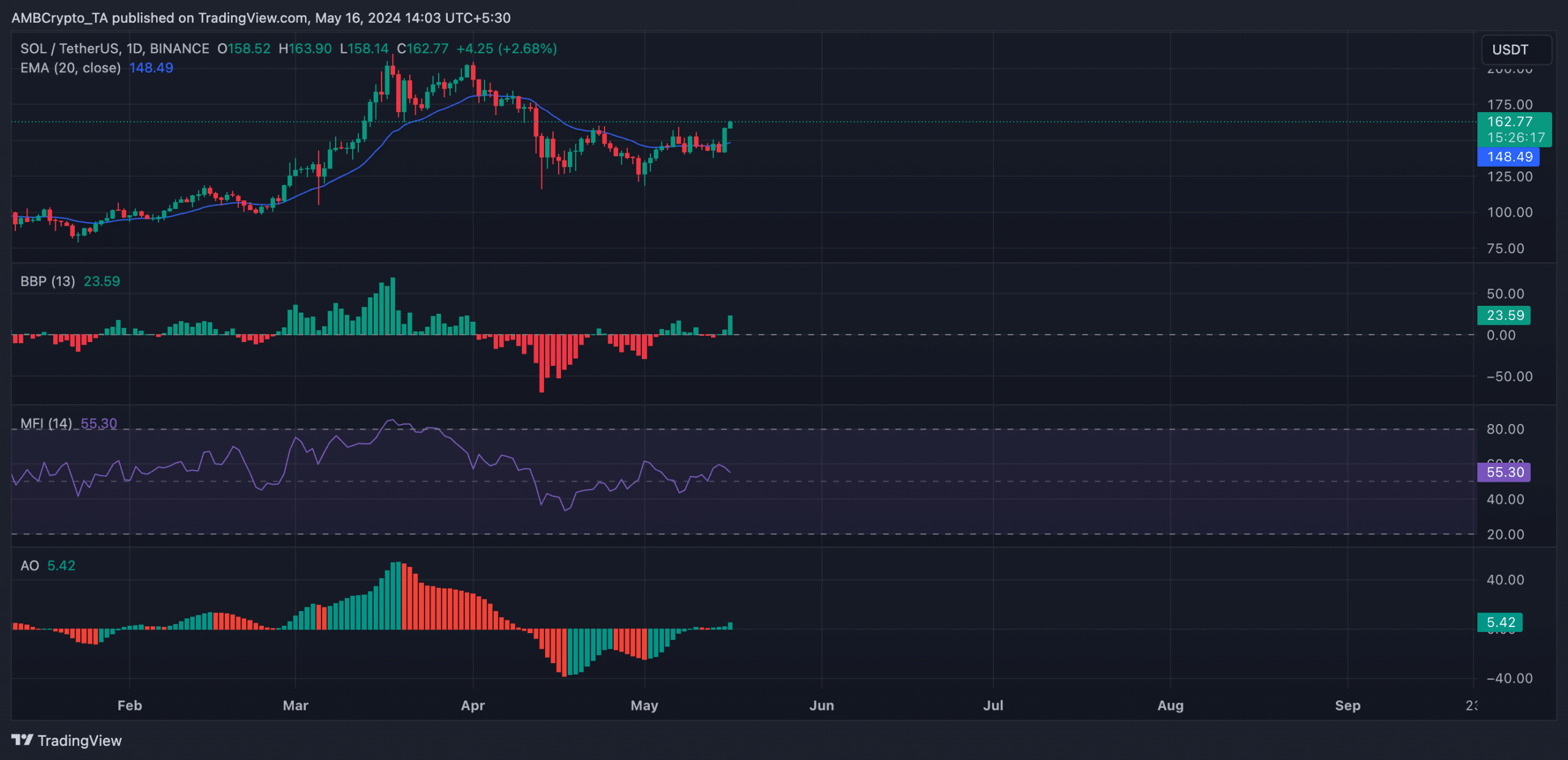

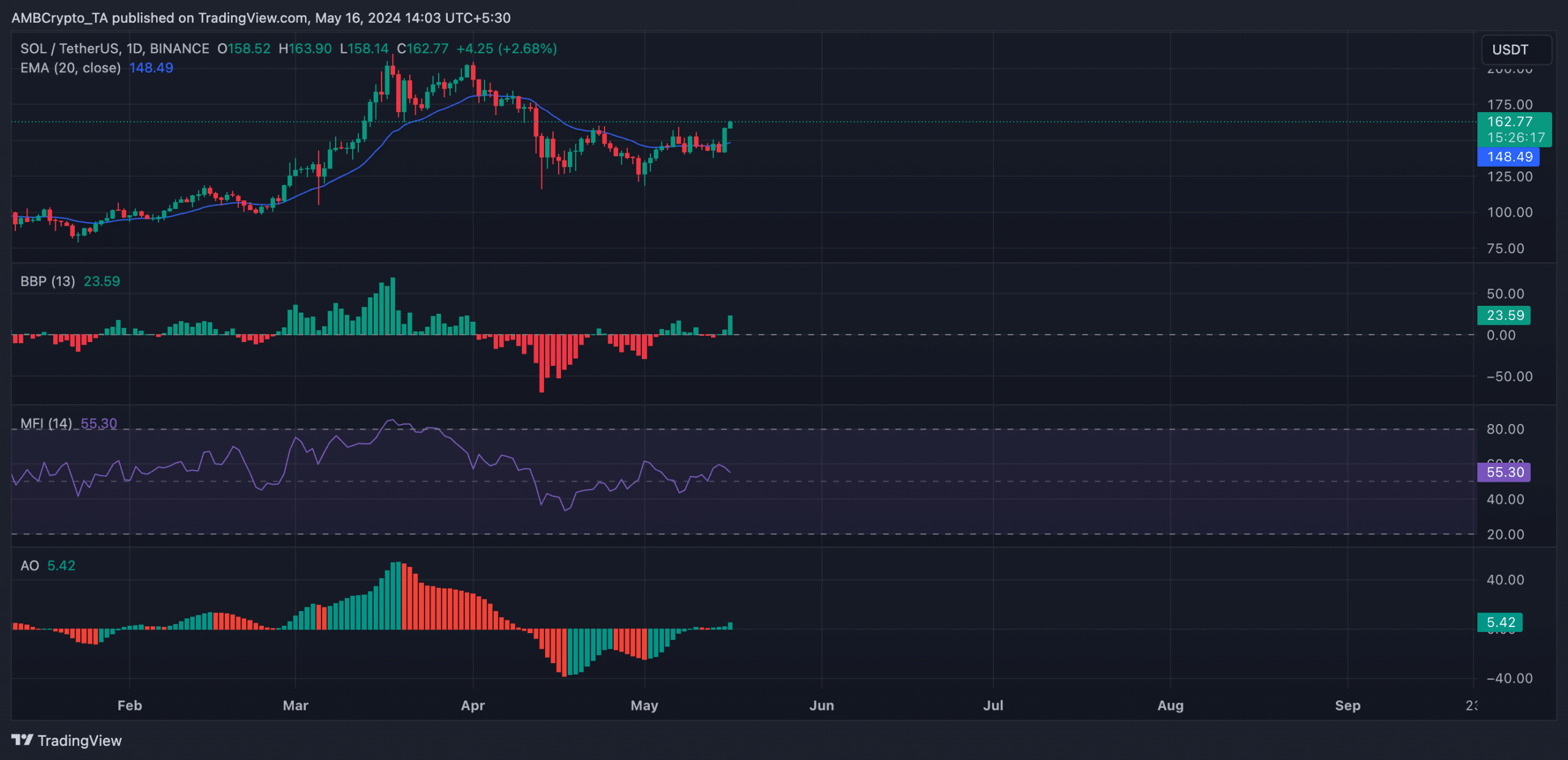

Solana’s [SOL] worth crossed above its 20-day Exponential Transferring Common (EMA) through the intraday buying and selling session on 15 Might. This pointed to an uptick in new demand for the altcoin.

This crossover is notable as a result of it confirmed that SOL’s prevailing worth rallied previous its common worth over the past 20 days. It additionally marked a shift in direction of shopping for momentum and a potential uptrend within the altcoin’s worth.

SOL prepares for extra

At press time, SOL was valued at $163.28, logging a 13% worth rally over the past 24 hours. Its key technical indicators assessed on a 1-day chart confirmed the likelihood that the altcoin could maintain this rally within the quick time period.

To begin with, signaling a hike in shopping for stress, SOL’s Relative Power Index (RSI) was on an uptrend with a studying of 59.20 at press time. Additionally, its Cash Circulate Index (MFI) was 55.29.

The values of those indicators confirmed SOL merchants’ choice for accumulation over promoting off their holdings for revenue.

Moreover, the coin’s Superior Oscillator posted inexperienced upward-facing bars, confirming the bullish pattern at press time.

This indicator measures an asset’s market momentum and identifies potential pattern reversals in its worth. Inexperienced upward-facing bars, typically seen after a interval of consolidation or a pullback, point out that the patrons are taking management of the market and that the asset’s worth rally would possibly proceed.

The coin’s Elder-Ray Index was additionally constructive, lending credence to the aforementioned place. At press time, it had a studying of 23.59, displaying that bull energy was dominant in SOL’s market.

Supply: SOL/USDT on TradingView

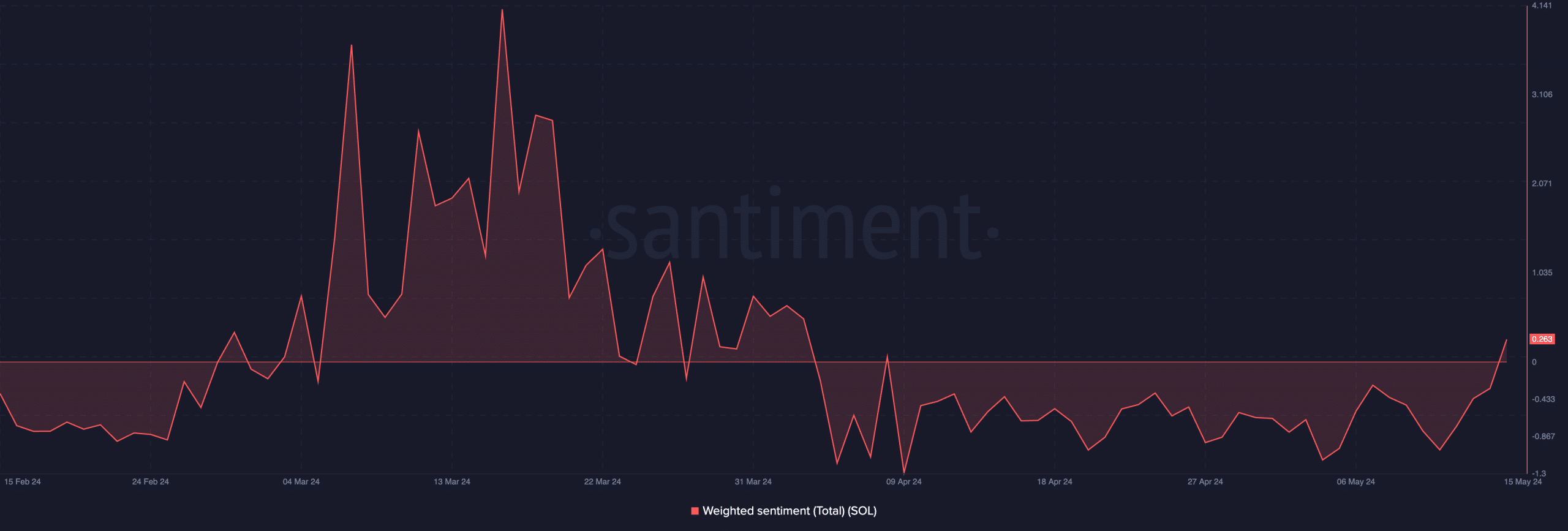

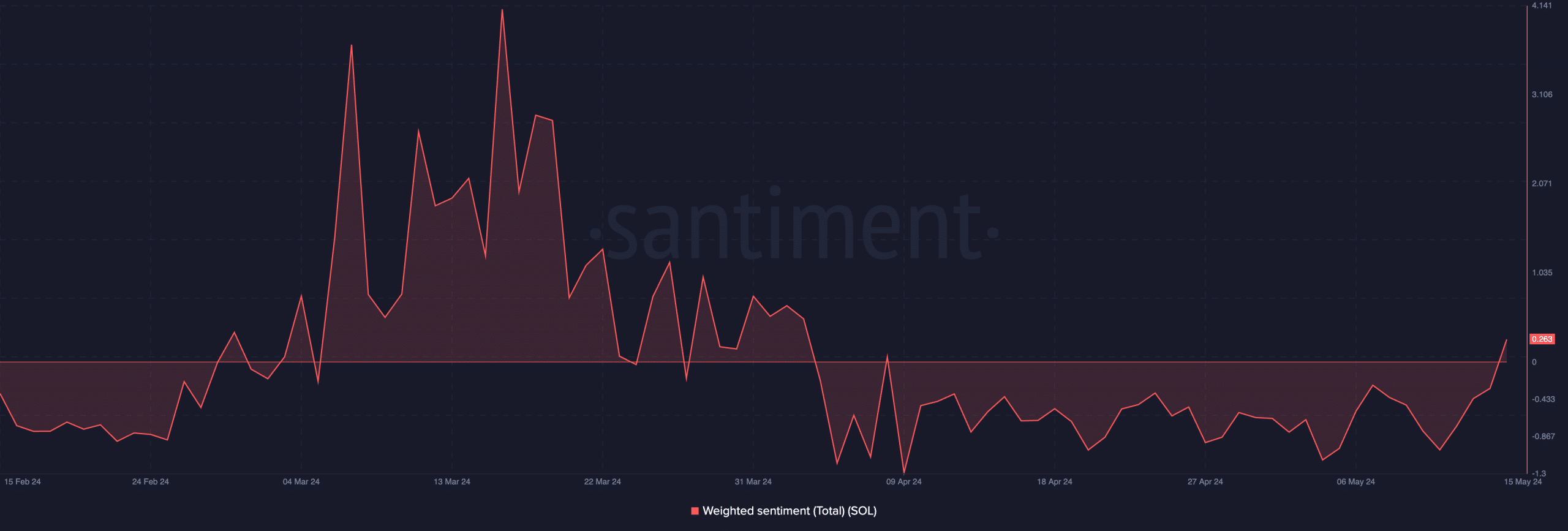

Highlighting the expansion within the bullish pattern for the reason that crossover, SOL’s weighted sentiment turned constructive for the primary time since 4 April too.

In actual fact, based on Santiment’s knowledge, the coin’s weighted sentiment was 0.263 on the time of writing.

Supply: Santiment

Real looking or not, right here’s SOL’s market cap in BTC’s phrases

Don’t get carried away

A hike in market volatility has additionally accompanied the sudden enhance in new demand for SOL. Readings from the coin’s Bollinger Bands revealed that the hole between the indicator’s higher and decrease bands has begun increasing.

Supply: SOL/USDT on TradingView

When the hole between these bands widens on this method, the crypto-asset’s worth turns into extra unstable and should file swings in both path.