- Solana dealt with extra transactions than the subsequent 9 chains mixed.

- Solana was the third-highest income generator in March.

Solana [SOL] signed off the primary quarter of 2024 on a excessive, rising as probably the most broadly utilized blockchain by a ways.

A have a look at Solana’s Q1 achievements

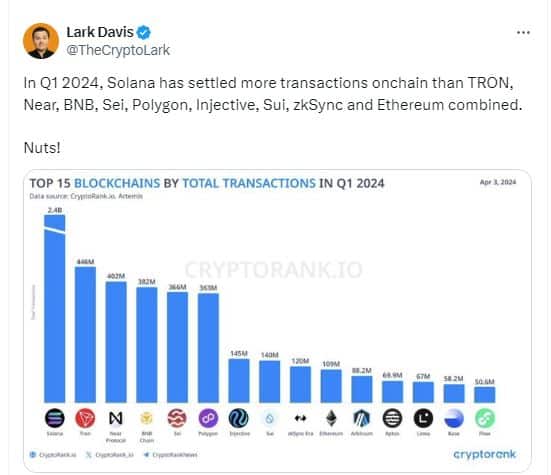

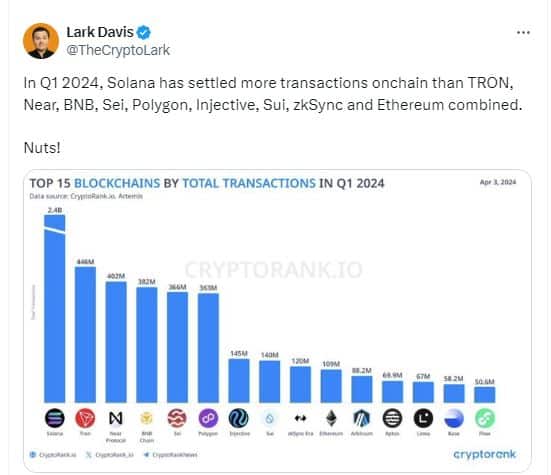

An X submit shared by common crypto influencer Lark Davis confirmed Solana facilitating a whopping 2.4 billion transactions in Q1. The dominance could possibly be gauged by the truth that the mixed rely of transactions dealt with by the subsequent 9 networks on the listing was decrease than that of Solana.

Supply: Lark Davis/X

Whereas Solana has traditionally dominated transaction exercise within the Web3 area, final month’s memecoin frenzy pushed it to its limits. Certainly, a barrage of cash had been created on the chain out of skinny air, drawing hordes of retail merchants.

The hypothesis led to extra variety of transactions, and in flip, larger payment income for the community.

As per AMBCrypto’s evaluation of Token Terminal information, Solana raked in additional than $34 million in March, turning into the third-highest income producing platform in Web3. In comparison with the earlier month, Solana’s income jumped almost 6x.

Supply: Token Terminal

Aside from charges, the variety of customers actively collaborating on the community additionally surged, greater than doubling from 426k in February to 932k in March.

Supply: Token Terminal

Solana will get a actuality verify

Whereas Solana was clearly a beehive of exercise in Q1, the excessive community utilization began to show few chinks in its armory.

AMBCrypto reported beforehand how the chain was scuffling with excessive transaction failure charges and that its builders had been unable to problem a fast repair to deal with the issue.

Reasonable or not, right here’s SOL’s market cap in BTC’s phrases

The FUD from community congestion impacted market sentiment for the native coin, SOL. Based on AMBCrypto’s evaluation of Santiment’s information, the fifth-largest cryptocurrency was grappling with extra detrimental commentary round it than constructive within the final week.

The pessimism translated right into a 7% decline in its worth over the week.

Supply: Santiment