- Solana’s TPS remained steady as exercise on the community elevated.

- Social quantity round SOL grew, general sentiment across the token declined.

Solana [SOL] was one of many networks that dominated the bull run which the market noticed just lately.

Solana sees an increase in transactions

Nonetheless, one of many essential criticisms of the Solana community has been the downtime that Solana confronted over the previous couple of years.

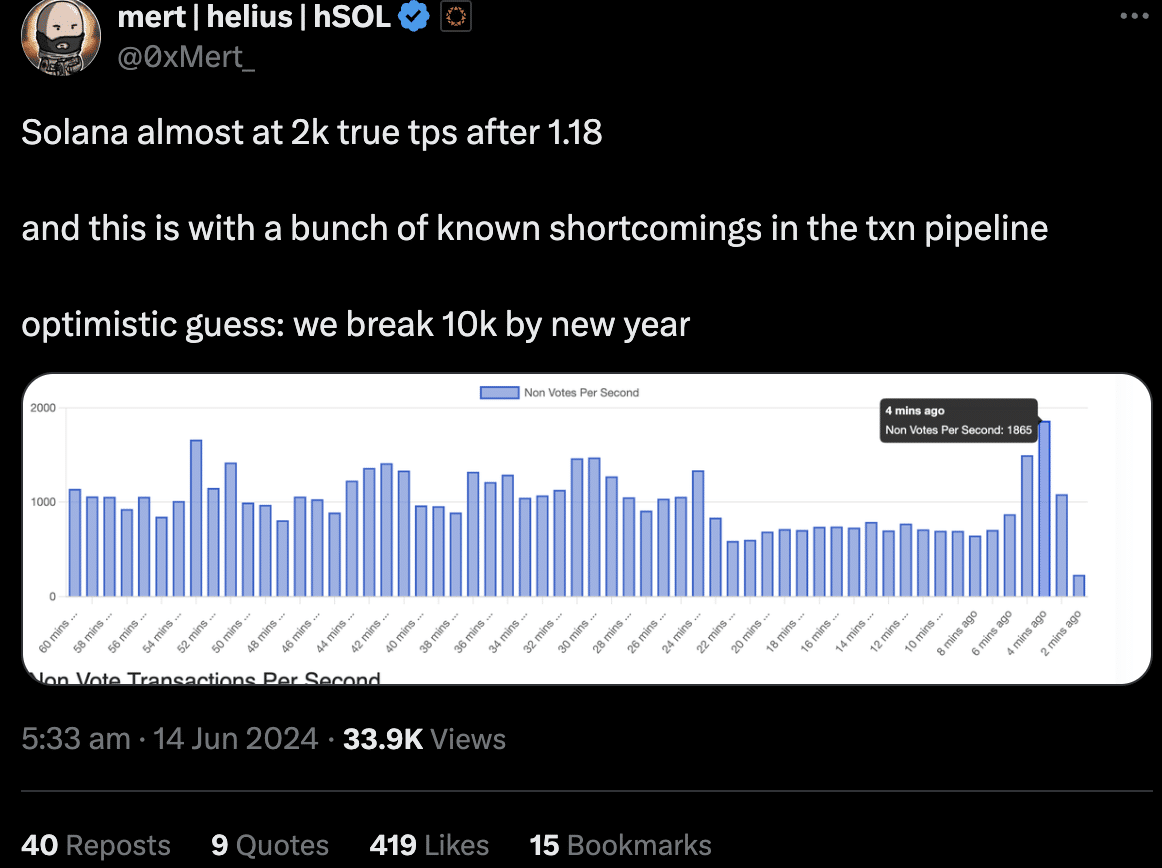

A current improve to the Solana community, model 1.18, has yielded vital efficiency enhancements.

Whereas some recognized limitations inside the transaction processing pipeline persist, present benchmarks point out Solana is nearing a processing throughput of two,000 transactions per second (tps) in real-world circumstances.

Projecting future efficiency primarily based on present developments, helius CEO mert held an optimistic view. He acknowledged that Solana has the potential to surpass 10,000 tps by the beginning of the brand new yr.

Supply: X

value motion

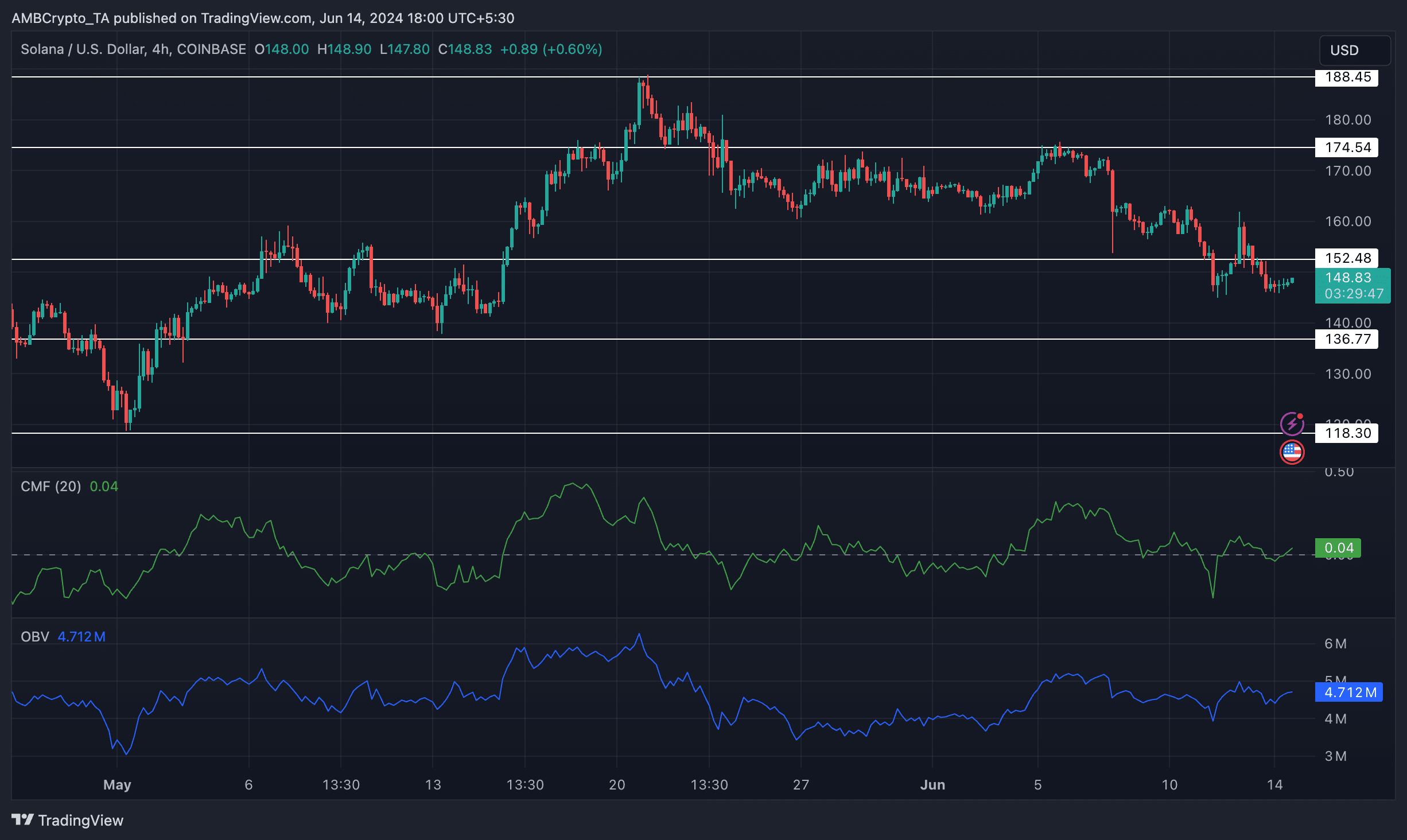

Regardless of the progress made by the community, SOL’s value continued to see purple. At press time, SOL was buying and selling at $148.77 and its value declined by 1.87% within the final 24 hours.

Because the twentieth of Could, the value of SOL has fallen considerably. Throughout this decline, the value of SOL exhibited decrease lows and decrease highs, indicative of a bearish development.

Regardless that the general development of SOL had turned bearish, the CMF (Chaikin Cash Stream) for SOL remained optimistic. This meant that there was cash flowing into SOL on the time of writing.

Furthermore, the OBV (On Stability Quantity) for SOL additionally surged which was one other optimistic indicator for the token. If issues proceed to maneuver in a optimistic path, a reversal might be anticipated and SOL may attain the $174.54 ranges but once more.

Supply: Buying and selling View

Volumes for SOL surged

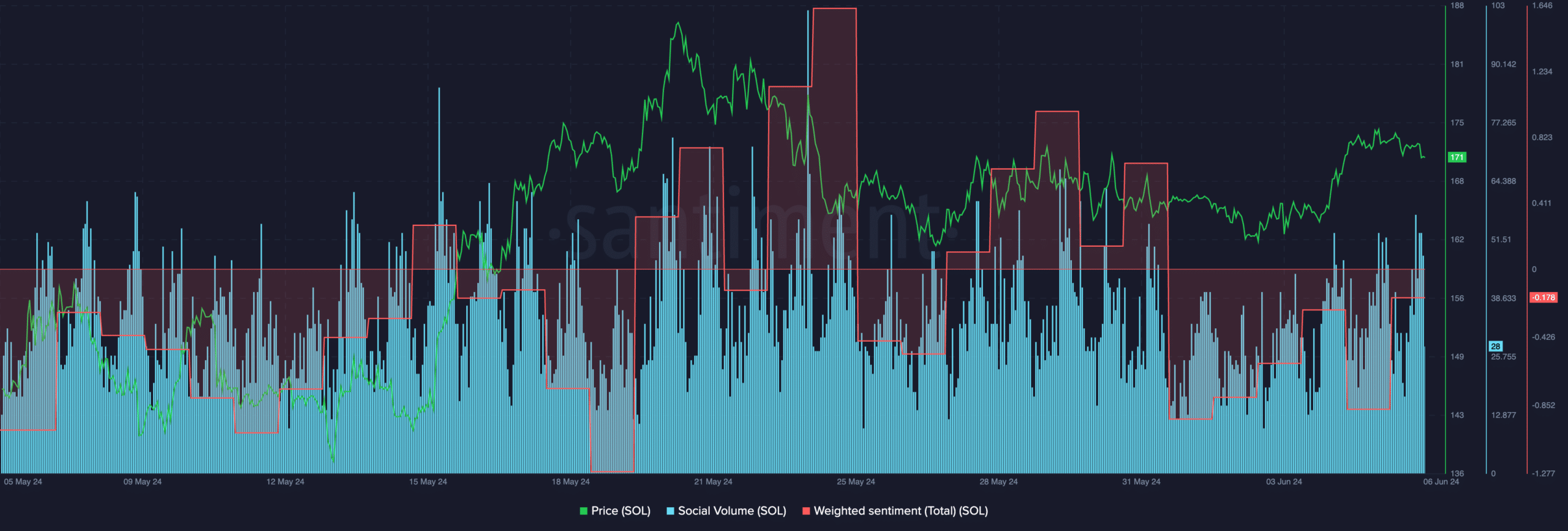

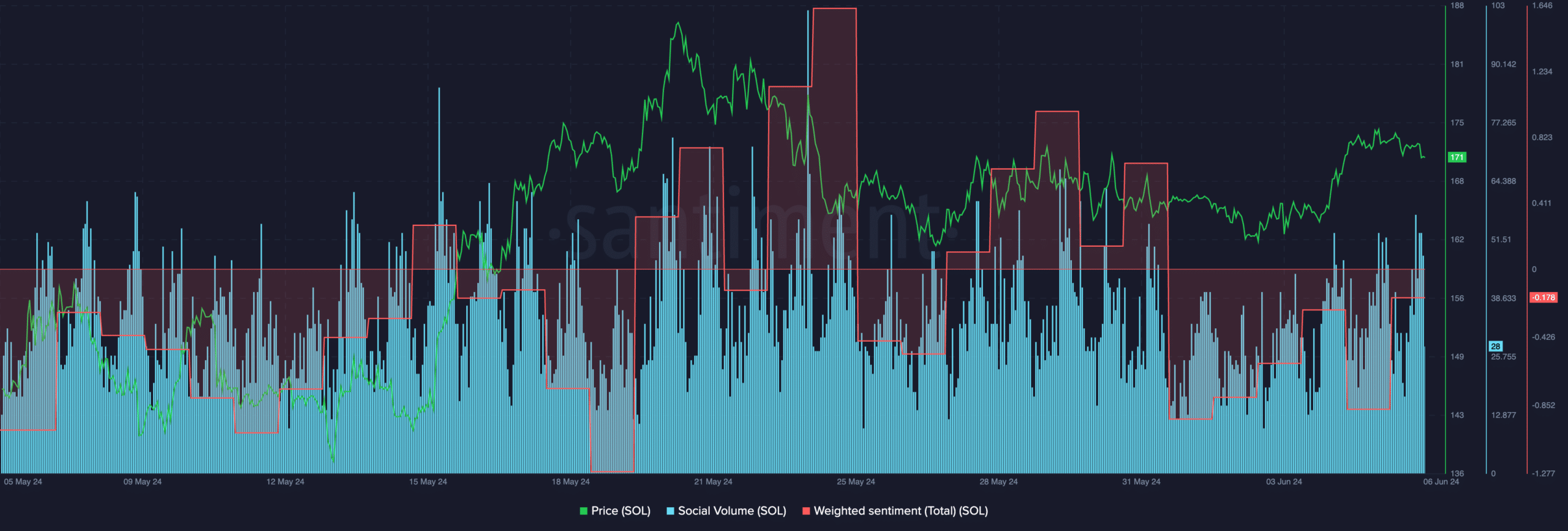

The recognition of the SOL token was additionally on the rise. AMBCrypto’s evaluation of Santiment’s knowledge revealed that the social quantity for SOL remained constant over the previous couple of days.

The rising recognition of SOL may help enhance the value motion of SOL in the long term. Nonetheless, the sentiment round SOL may also have an effect on the token.

Knowledge confirmed that the weighted sentiment across the SOL token fell materially. This meant that the variety of adverse feedback round SOL had grown and outnumbered the optimistic ones.

Is your portfolio inexperienced? Try the SOL Revenue Calculator

The prevalence of those adverse feedback might hinder the probabilities of development for SOL sooner or later.

Supply: Santiment