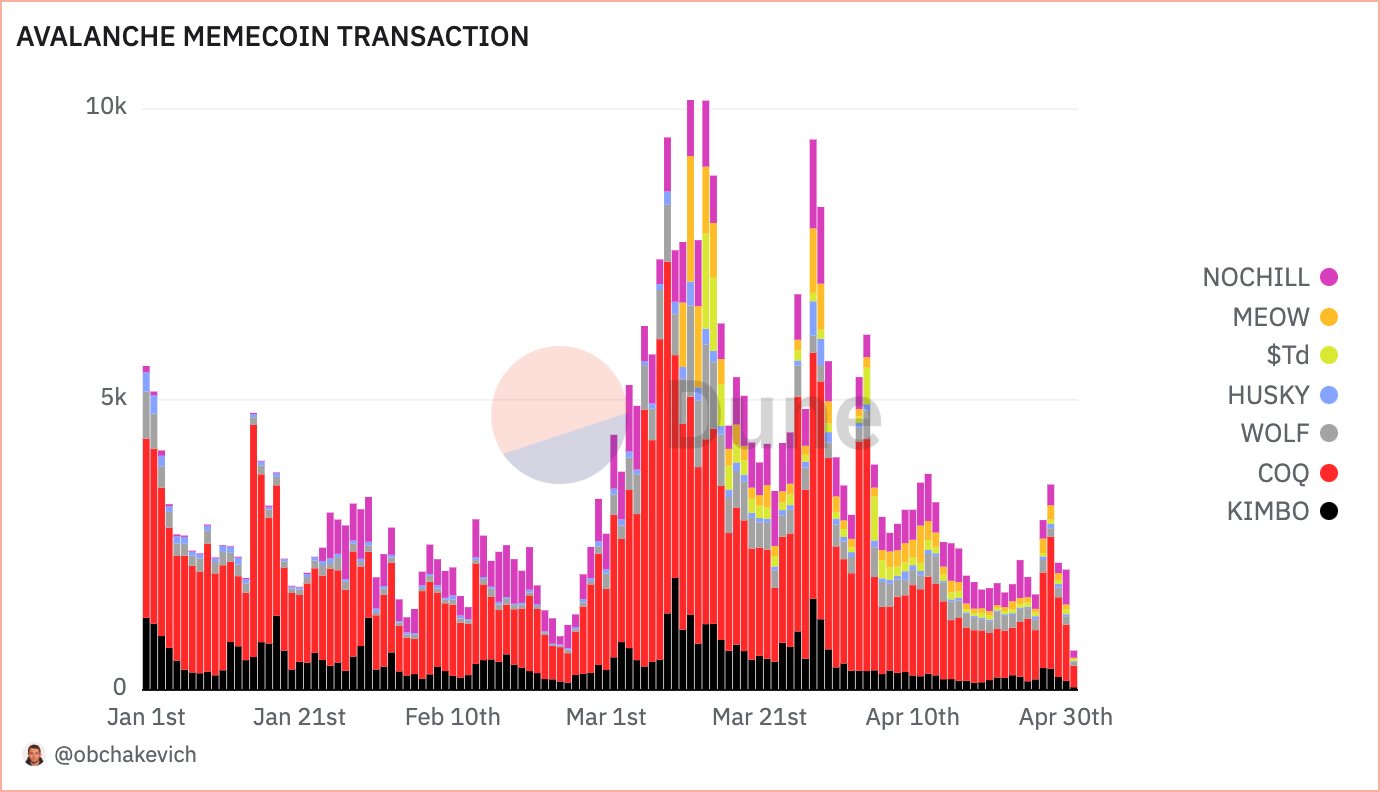

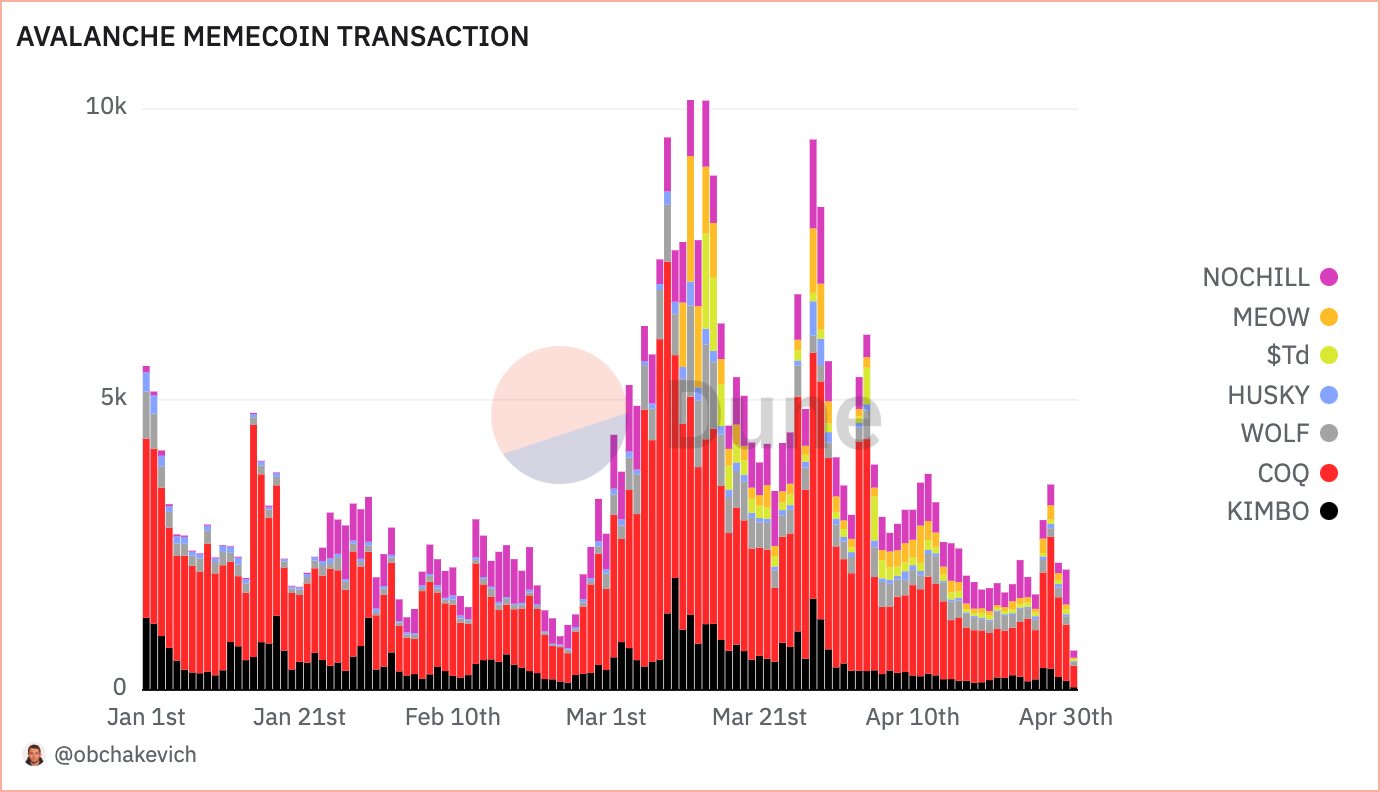

- Avalanche’s every day memecoin transaction depend hit 10k twice in March.

- The memecoin frenzy subsided considerably on Avalanche, aligning with the drop in Solana’s numbers.

Because the market remained awestruck by the size of memecoin exercise on networks corresponding to Solana [SOL] and Base, one other distinguished layer-1 (L1) blockchain was quietly rising by means of the ranks.

Avalanche very a lot within the race

In line with on-chain analyst Alex, Avalanche [AVAX] witnessed important hypothesis round these neighborhood cash within the final two months.

The Dune Analytics dashboard ready by him confirmed every day transaction depend topping 10,000 twice in March, with substantial volumes additionally seen in early April.

Supply: Dune Analytics

Moreover, the variety of customers actively taking part in these transactions additionally surged, ripping previous 4,000 on two events in March. Word that this was additionally the time when Solana was exploding with memecoin frenzy.

The preferred among the many meme tokens was Coq Inu [COQ], a chicken-themed coin. It has maintained a 40%-60% share of all meme foreign money transactions on the community.

In truth, on the peak of the frenzy in March, it had pumped greater than 4x in a span of two weeks, AMBCrypto famous utilizing CoinMarketCap knowledge. At press time although, the token was nursing losses.

As seen within the graph above, the frenzy subsided considerably as April progresses, which aligned with the cool-off witnessed within the case of Solana.

The Avalanche basis, the developer of the Avalanche chain, began making strategic investments in memecoins, seeing their upside potential. Other than COQ, a few of the different cash chosen for investments have been Kimbo (KIMBO) and Gecko (GEC).

Sensible or not, right here’s AVAX market cap in BTC’s phrases

How memecoins may assist AVAX

Larger meme coin hypothesis may improve deflationary strain on the ecosystem’s native token AVAX, as Avalanche burns all of the income it generates from transaction charges.

In the meantime, AVAX, was buying and selling 1.5% lower at press time, a state of affairs barely higher than most main cash available in the market.