- Solana outperforms Ethereum when it comes to Capital Effectivity.

- Regardless that Solana’s ecosystem noticed progress, the worth of SOL witnessed volatility.

Solana [SOL] has been on a roll over the previous couple of weeks as its costs have surged because of the rising reputation of the community. One of many causes for the rising reputation of Solana can be its Capital effectivity.

Solana takes the lead

Capital effectivity, essential in Conventional Finance (TradFi), displays an organization’s adeptness in using monetary sources.

In DeFi, it underpins protocol vitality and sustainability, driving maximized returns, aggressive edge, liquidity enhancement, danger discount, and innovation promotion.

Liquidity effectivity in DeFi is important, using methods like LP administration, collateral belongings, and protocol-owned liquidity.

Reflexivity Analysis’s evaluation in contrast Capital Effectivity on Solana with Ethereum within the DeFi sector, indicating the way it was significantly better.

The info indicated that Solana’s design boasts a number of options that improve capital effectivity in DeFi. Quicker transaction speeds and decrease charges in comparison with Ethereum which meant much less capital was tied up ready for affirmation.

Furthermore, parallel processing allowed for environment friendly dealing with of DeFi operations. Solana’s structure additionally separates knowledge storage from code, doubtlessly decreasing prices.

Constructive capital effectivity could be a game-changer for Solana within the aggressive DeFi panorama. By attracting customers with sooner transactions, decrease charges, and the flexibility to do extra with much less locked-up capital, Solana can domesticate a thriving DeFi ecosystem.

This virtuous cycle of effectivity attracts extra customers and builders, fueling innovation and additional solidifying the community’s place as a number one DeFi platform.

Finally, optimistic capital effectivity positions Solana to not solely compete with, however doubtlessly outperform, established DeFi gamers like Ethereum.

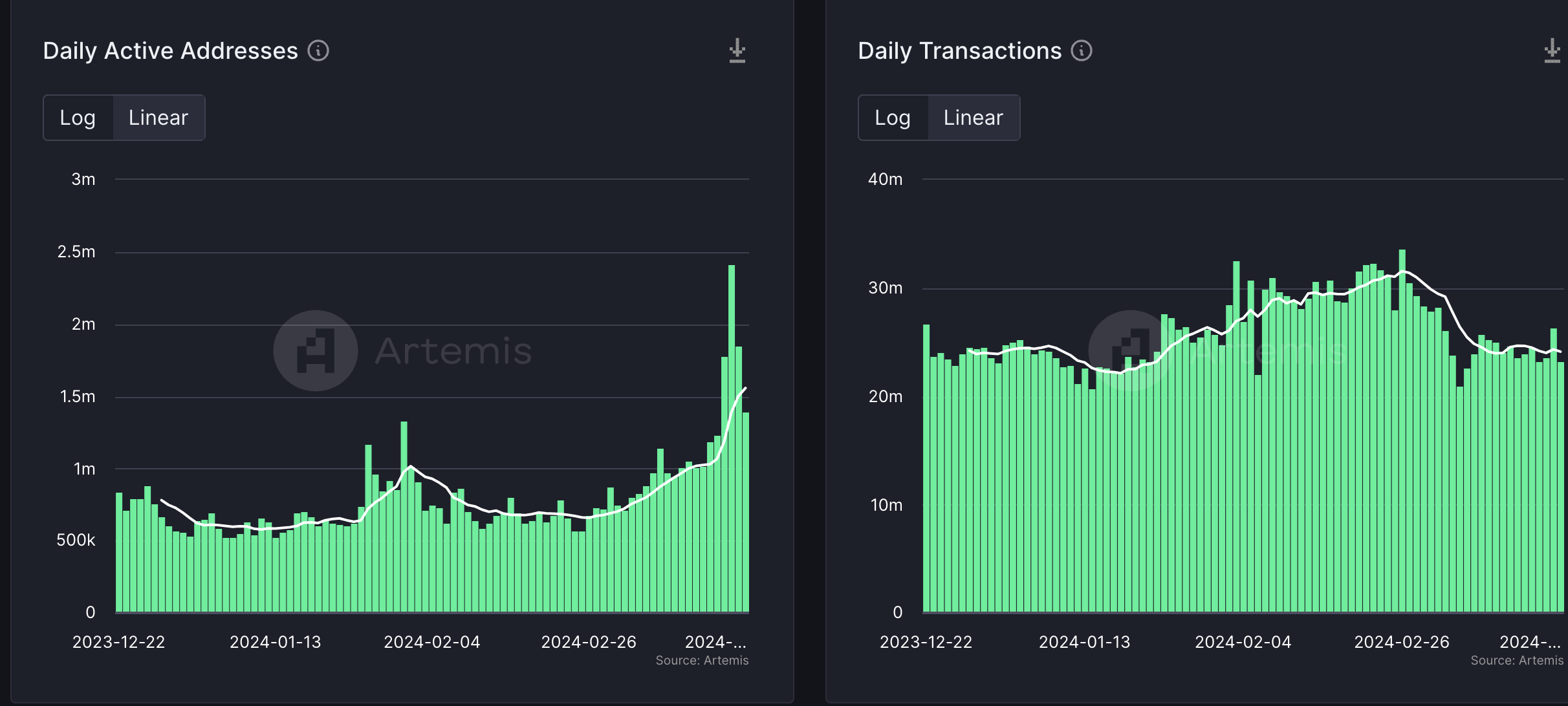

AMBCrypto’s evaluation of Artemis’ knowledge indicated that the variety of each day energetic addresses on the Solana community grew from 870,000 to 1.56 million. The variety of transactions occurring on the Solana community additionally remained the identical.

Supply: Artemis

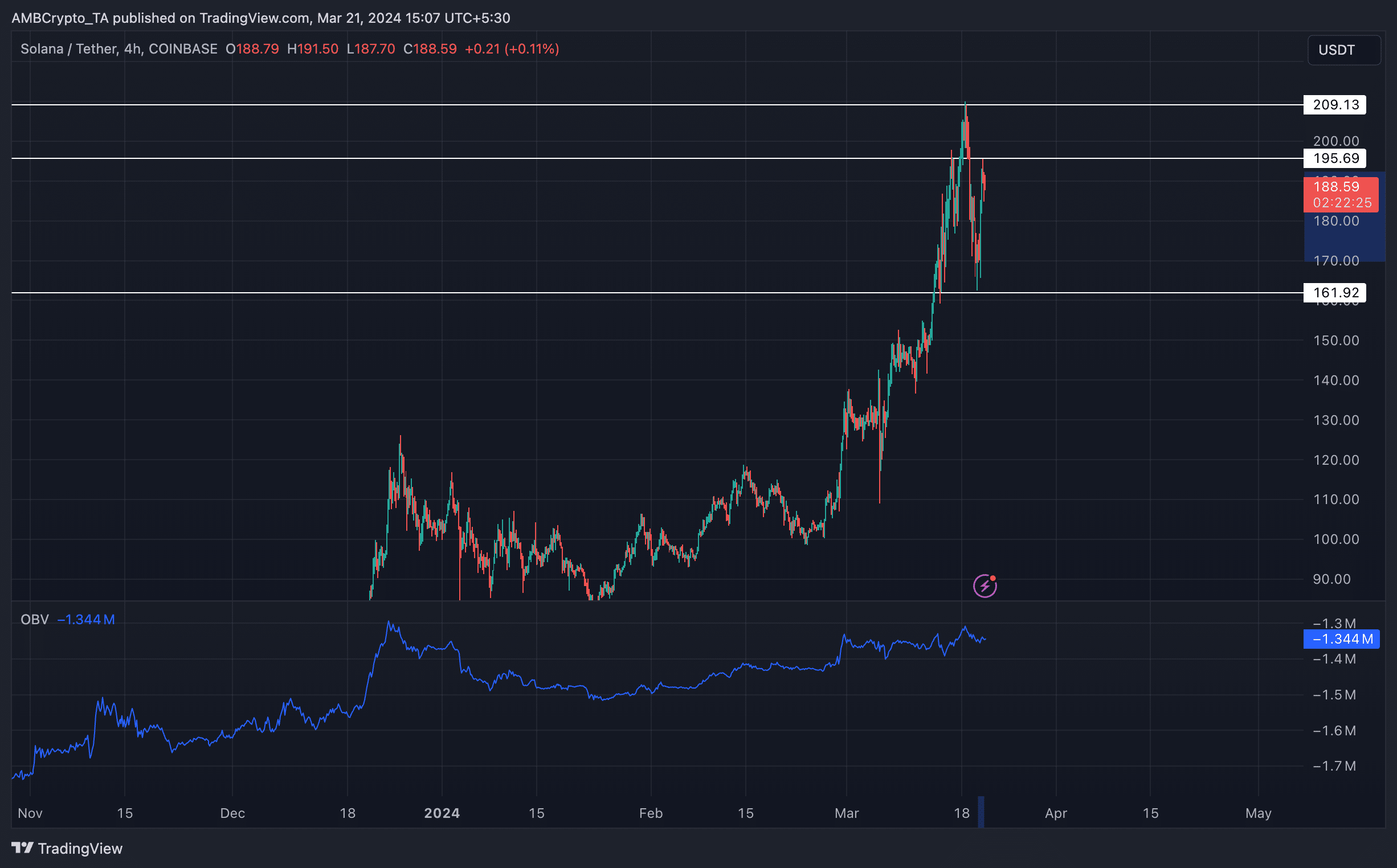

Regardless of the optimistic efficiency of the community, the worth of SOL witnessed some volatility. In the previous couple of days, the worth of SOL fell by 20% after reaching the $209 degree.

How a lot are 1,10,100 SOLs value right this moment?

After that, the worth of SOL regained optimistic momentum and surged by 13.42% and climbed as much as $195.69 degree. Regardless of this, the OBV of SOL declined.

A decline in OBV regardless of a worth rise for SOL suggests weaker shopping for stress, which might result in a reversal within the upward development or restrict future worth positive factors.

Supply: Buying and selling View