- Solana’s value was caught at press time, with a “dying cross” and bearish dominance.

- Regardless of a bearish pattern, SOL hints on the potential for restoration if bullish triggers emerge.

After staging a outstanding efficiency initially of this cycle, Solana [SOL] appears to be caught in an odd loop in the meanwhile. Its value has stagnated, and neither the bulls nor the bears appear to be in cost.

At a look, it appears SOL doesn’t know what to do. Is there a restoration on the horizon? Or is it a crash?

Solana’s subsequent transfer

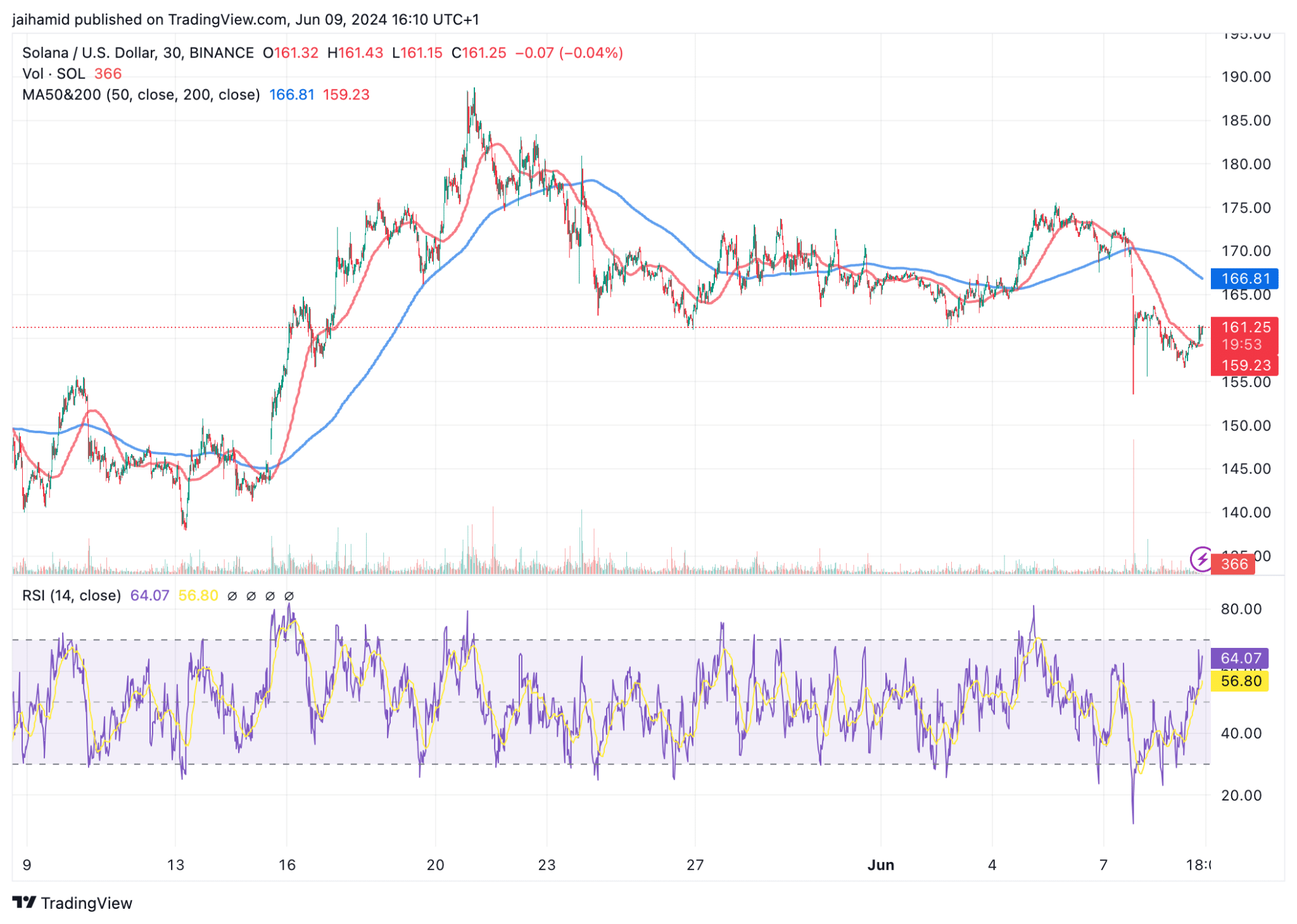

SOL has been caught between $158 and $173 for the previous two weeks. Just lately, the 50-period shifting common crossed under the 200-period shifting common, a basic bearish sign in technical evaluation generally known as a “dying cross.”

Because of this within the short-term, sadly, the bears are prevailing.

Supply: TradingView

The worth motion shoeds a pointy drop adopted by intense consolidation. The RSI is at the moment round 64, nearer to the impartial zone’s higher boundary however not but within the overbought space (usually above 70).

So, there may be nonetheless some shopping for momentum, although it’s not sturdy.

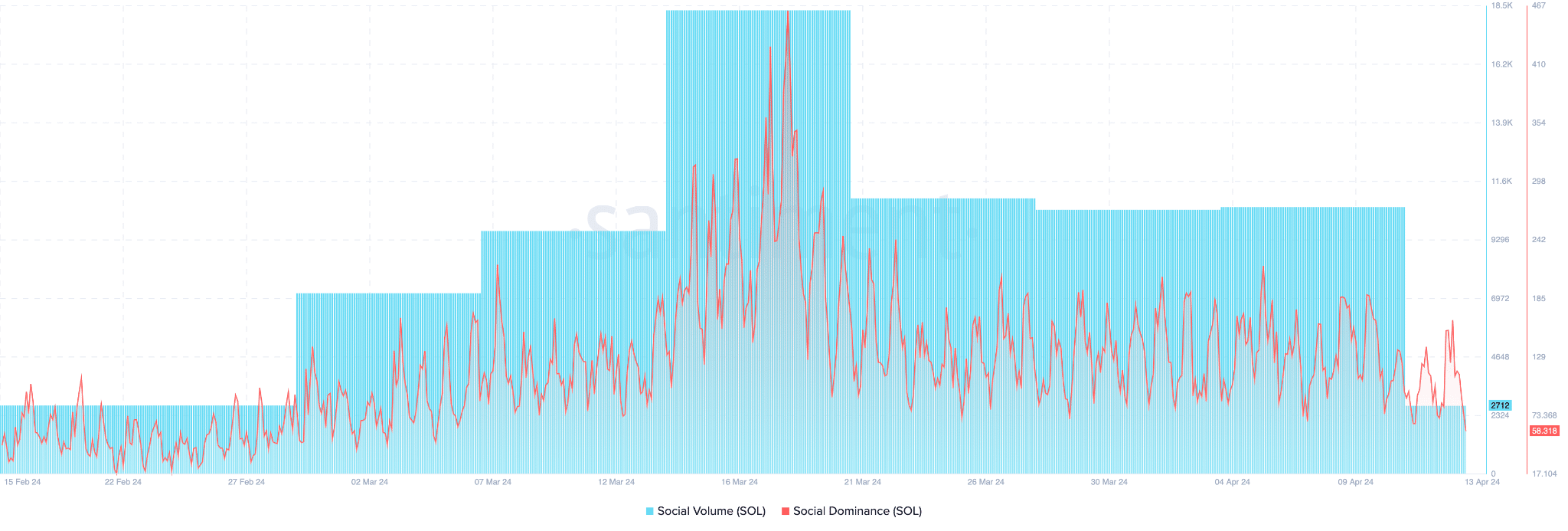

SOL’s social quantity and social dominance are each on a noticeable decline, suggesting that the crypto neighborhood’s favourite altcoin is shedding curiosity and social engagement.

Supply: Santiment

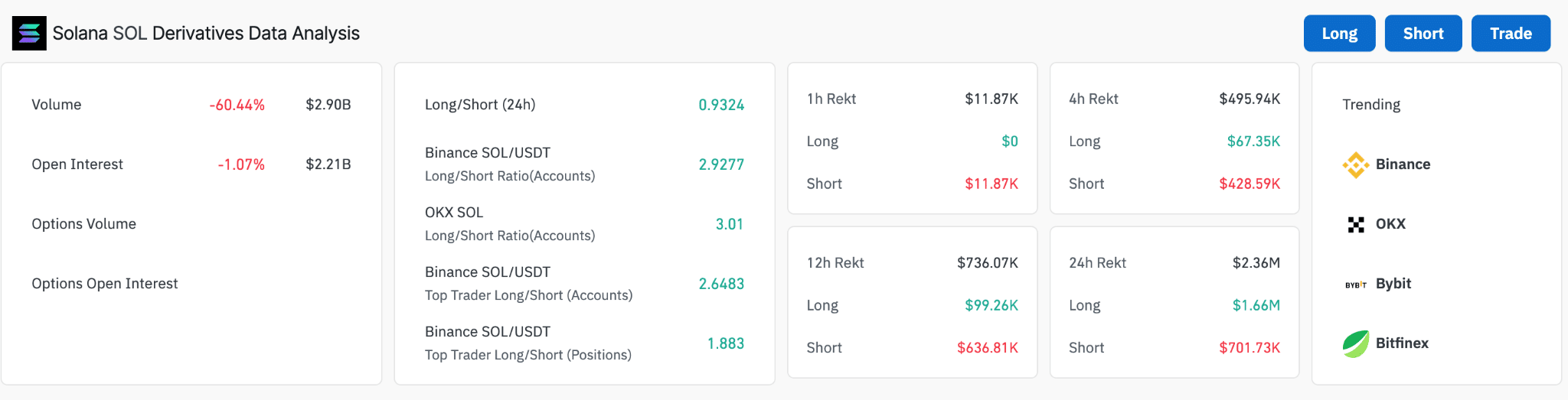

The derivatives market doesn’t provide any solace both. Buying and selling quantity has considerably decreased by 60.44% to $2.90 billion, an enormous drop in buying and selling exercise.

The general lengthy/brief ratio of 0.9324 on a 24-hour foundation exhibits an nearly equal choice for lengthy and brief positions, reflecting the market’s uncertainty about Solana’s subsequent transfer.

Supply: Coinglass

Nonetheless, on Binance and OKX, the lengthy/brief ratios are notably larger (2.9277 and three.01, respectively, for all accounts), suggesting a extra bullish sentiment amongst merchants on these exchanges.

Supply: Coinglass

Learn Solana (SOL) Value Prediction 2024-25

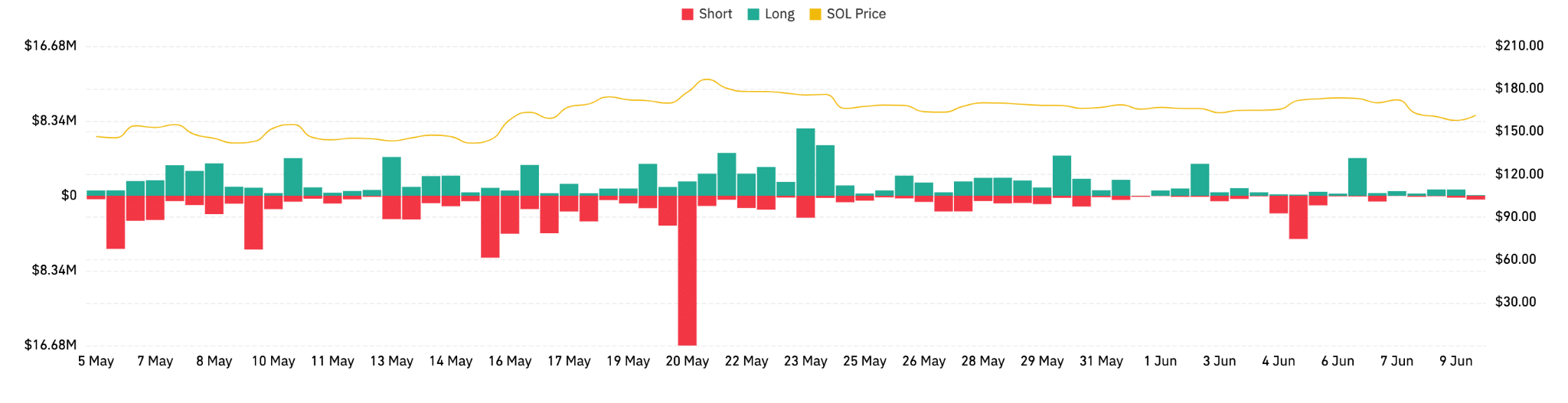

The focus of liquidations, significantly brief liquidations throughout value spikes, implies a market that’s considerably vulnerable to sudden bullish runs, which might aggressively squeeze brief sellers out of their positions.

General, there is perhaps room for a small rally if exterior elements or market sentiment can present sufficient bullish momentum.