- Solana noticed the market construction favor the sellers as soon as once more.

- The liquidity pockets to the south would possible entice costs.

Solana [SOL] famous detrimental market sentiment over the previous week, AMBCrypto reported.

Such setbacks have been anticipated to supply a very good shopping for alternative, however the current value motion supported a bearish bias on the 12-hour timeframe.

With this improvement, extra losses are anticipated over the subsequent week or two. The $90 area is a powerful demand zone, however it is usually the place the place the bulls may need to make a final stand.

The bearish market construction break

The second half of February noticed the bulls lose their grip available on the market. The 12-hour chart fashioned a better low at $103.4, however SOL costs dropped under it on the twenty first of February.

The RSI additionally sank under impartial 50 to sign bearish momentum was stronger.

The OBV additionally fashioned a spread over the previous two months. The tug-of-war between the patrons and sellers has been comparatively evenly poised. Subsequently, the $116-$126 resistance is essential to the subsequent uptrend.

In the meantime, the Fibonacci retracement ranges (pale yellow) confirmed that $94.16 and $87.49 have been help ranges the place bulls might reverse decrease timeframe downtrends.

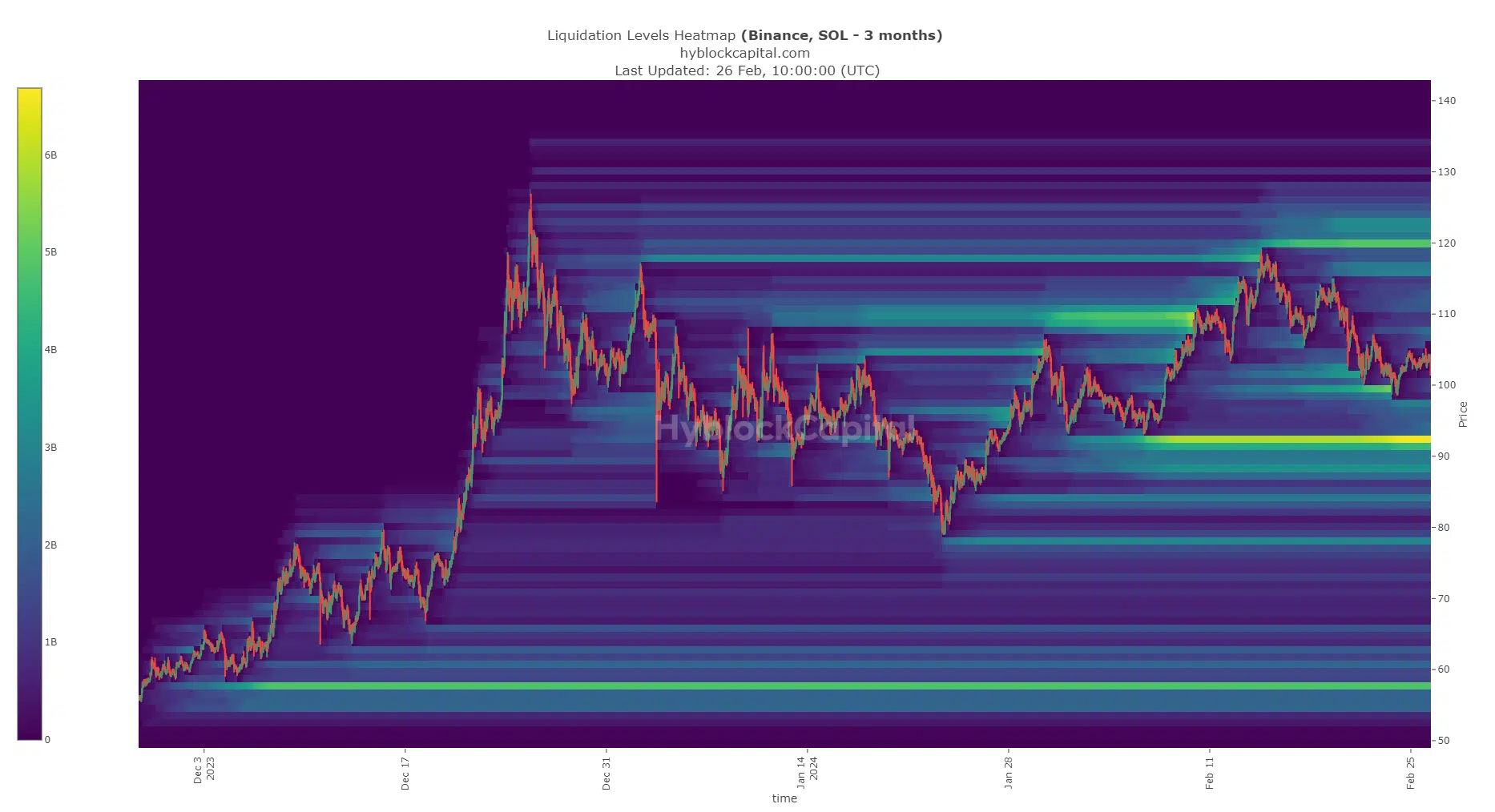

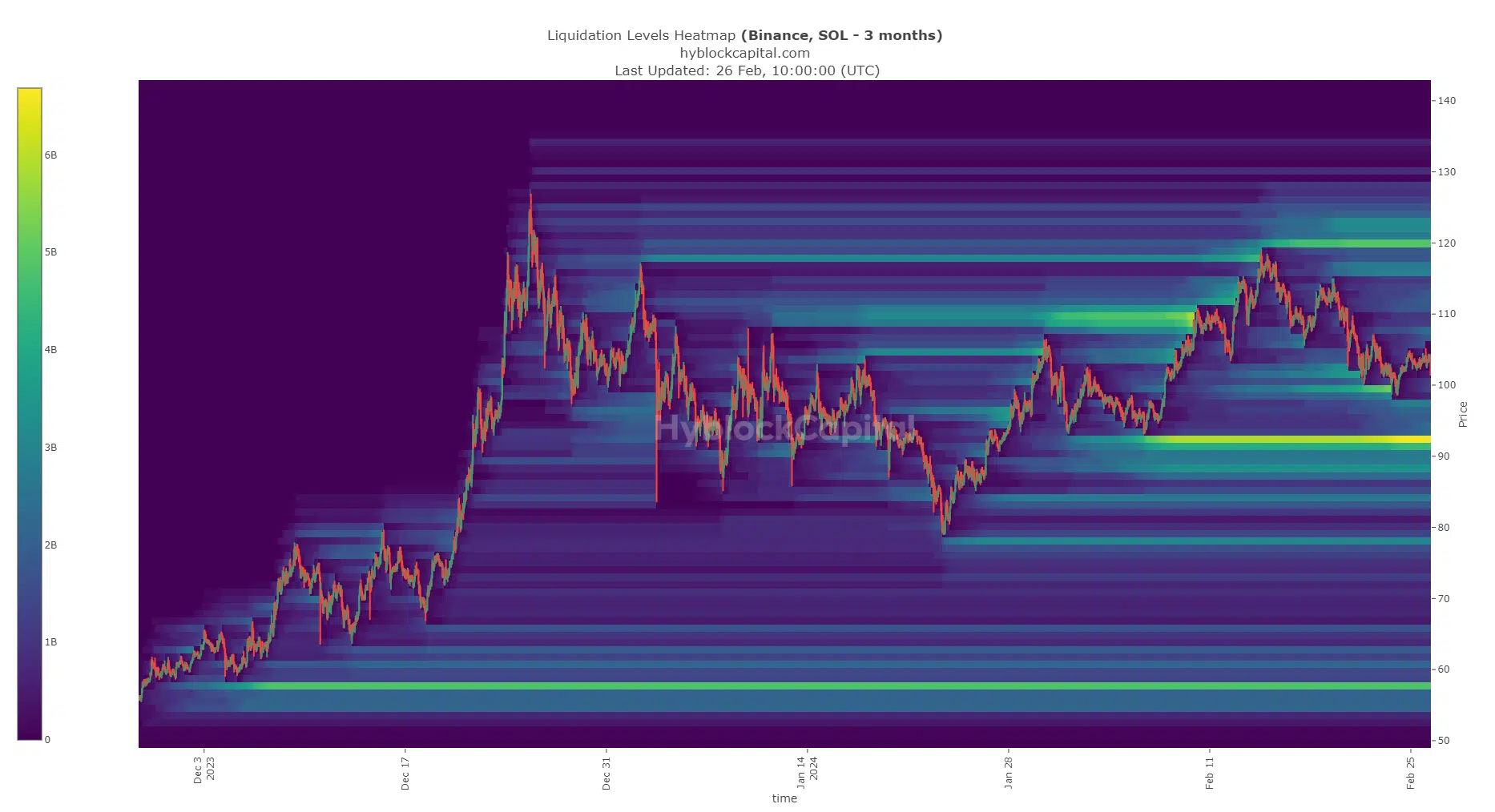

Learning the liquidation heatmap for additional clues

Supply: Hyblock

AMBCrypto famous that the $91.34 and $92.36 ranges had $4.5 billion and $6.6 billion in estimated liquidations. In addition they had confluence with the Fibonacci retracement ranges.

Subsequently, it was extremely possible {that a} sweep of the $87-$92 space was coming.

Reasonable or not, right here’s SOL’s market cap in BTC’s phrases

It’s unclear when such a transfer would materialize, however merchants should be able to capitalize on it. Given the development of Solana since final October, a continuation upward is predicted.

Nevertheless, a fall under $85 would point out that the bears have the higher hand. In that state of affairs, swing merchants ought to train warning and keep away from shopping for SOL till an uptrend is established as soon as extra.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.