Solana (SOL) reached a market cap of $30 billion and virtually $1 billion in Complete Worth Locked (TVL) in DeFi on December 12.

The highest performer, the “Ethereum killer” of 2023, has constantly earned the eye and cash of cryptocurrency buyers this 12 months.

Notably, Solana’s decentralized finance ecosystem is now one of many prime 5 TVL chains. SOL captured this place after a powerful TVL improve of 43.91% in every week to $945.87 million invested tokens value {dollars}.

Finbold retrieved this knowledge DefiLlama, which offers priceless indicators for the ever-growing DeFi ecosystem. For instance, the almost $1 billion TVL on Solana is unfold throughout 244,919 crypto pockets addresses and 117 Solana-based protocols.

Curiously, SOL solely loses to Ethereum (ETH), with a complete worth of $28.17 billion; Tron (TRX), with $7.92 billion; BNB Chain (BNB) or Binance Good Chain (BSC), with $3.13 billion; and Arbitrum (ARB), Ethereum’s second layer, with a TVL of $2.30 billion.

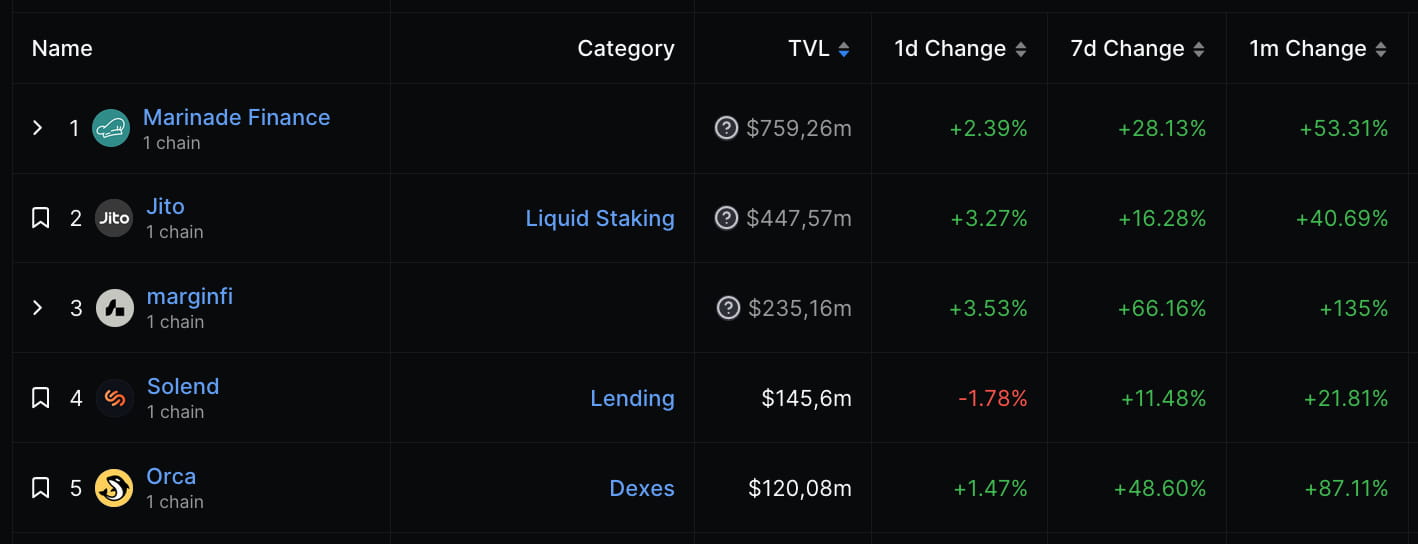

Most Invaluable DeFi Protocols on Solana

Due to this fact, the significance of Ethereum for each DeFi and Web3 is undisputed. However, Solana is steadily rising in relevance as priceless protocols are constructed utilizing the framework. SOL thrives on this aggressive setting by providing quicker and cheaper transactions than the market chief.

Marinade Finance (MNDE) leads the pack of DeFi protocols on Solana with a complete worth locked (TVL) of $759.26 million. Jito (JTO) follows with $447.57 million in TVL. Marginfi (MFI) holds $235.16 million, whereas Solend (SLND) and Orca (ORCA) safe $145.6 million and $120.08 million, respectively.

On that entrance, marginfi and Orca have proven the best weekly and month-to-month will increase. MarginFi grew 66% and 135%, whereas Orca rose 48% and 87% over the previous week and month, respectively.

All issues thought of, a layer 1 blockchain like Solana has the worth of its native token tied to its DeFi ecosystem. A richer ecosystem might improve demand for SOL as a commodity, rewarding Solana’s stakeholders in the long term.

Nonetheless, you will need to contemplate that a part of the measured whole worth comes from liquid staking and lending. This creates a leveraged ecosystem as Solana’s stakers use IOU tokens for his or her beforehand illiquid funding. The extra leverage a monetary ecosystem has, the larger the dangers for each entity concerned.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.