- Solana’s worth elevated by greater than 20% within the final seven days.

- If the bull rally resumes, then SOL may go above $180.

Solana [SOL] managed to reclaim $175 on the 18th of Could, nevertheless it quickly witnessed a worth correction, pushing the token’s worth down. Does this imply SOL is sure to go down additional within the coming days?

Let’s check out SOL’s present state to seek out out.

Solana again to $175

Final week was an amazing success for Solana, because the token’s worth rallied considerably. In keeping with CoinMarketCap, SOL’s worth surged by greater than 20% within the final seven days, permitting it to the touch $175.

Nevertheless, SOL couldn’t maintain that spot because it dipped.

On the time of writing, SOL was buying and selling at $174.39 with a market capitalization of over $78.2 billion.

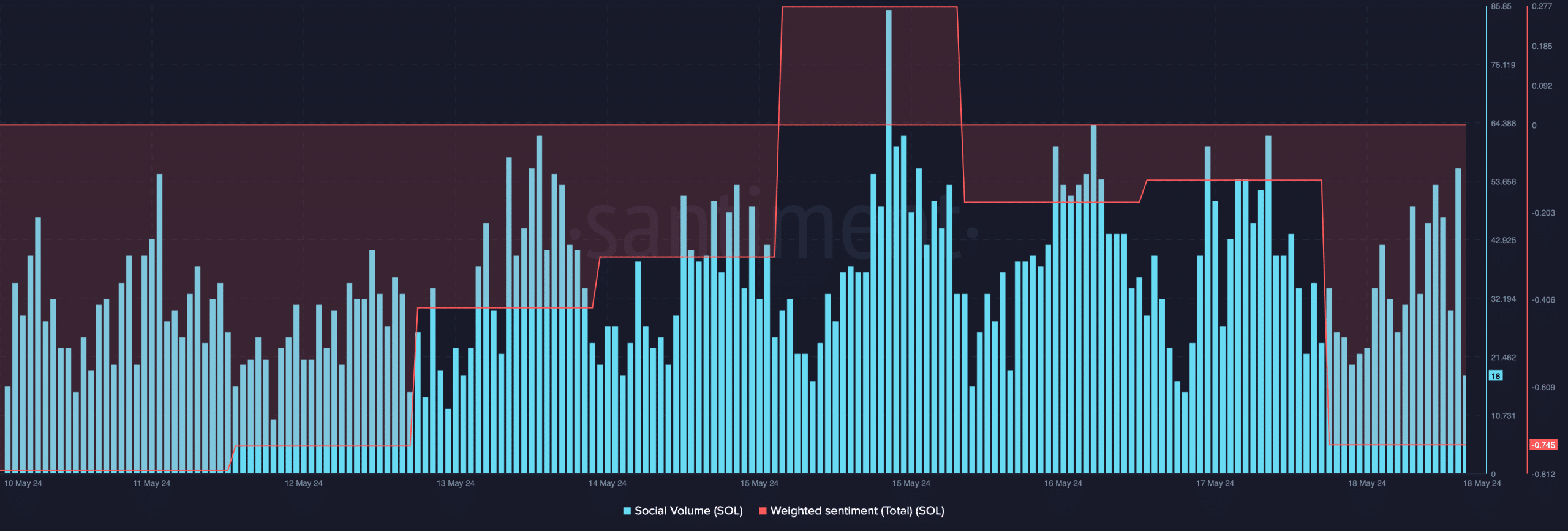

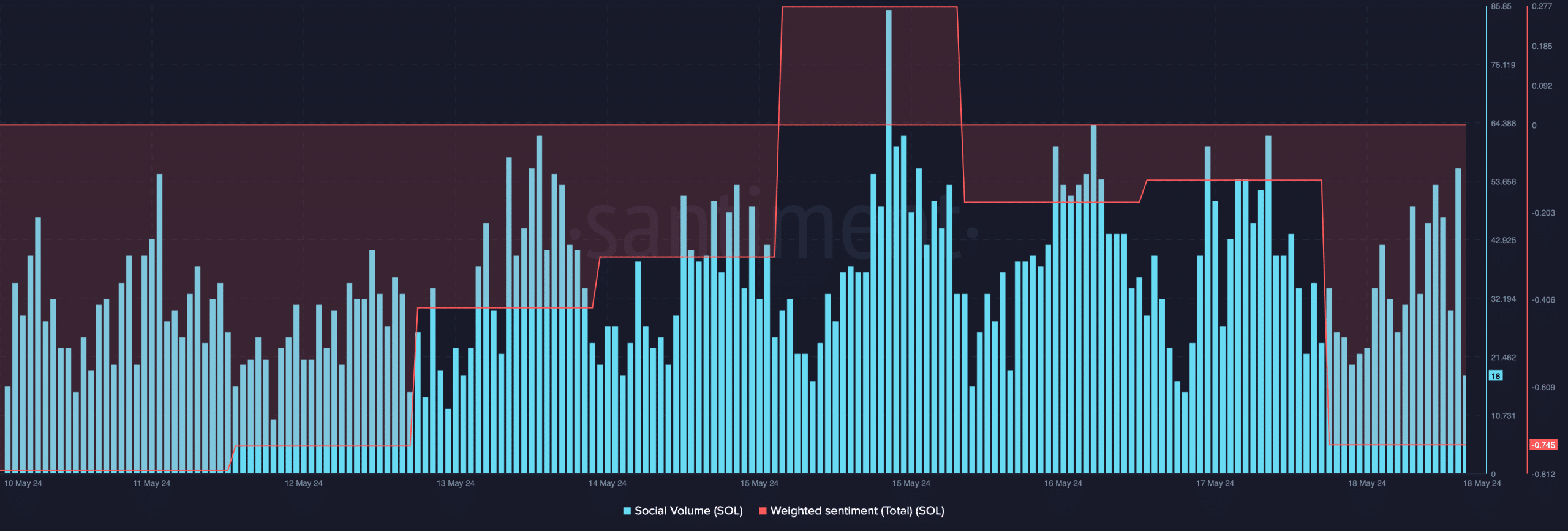

The decline from $175 additionally had a unfavourable influence on the token’s social metrics. Its Weighted Sentiment dropped sharply, which means that bearish sentiment round it was dominant out there.

Nonetheless, its Social Quantity remained secure.

Supply: Santiment

Buyers shouldn’t get disheartened, as a current evaluation steered that SOL’s worth may skyrocket. Alex Clay, a preferred crypto analyst, just lately posted a tweet highlighting an attention-grabbing growth.

In a month-to-month timeframe, SOL displayed a rounding backside sample. If this sample assessments out, then traders may quickly witness SOL attain new highs.

What to anticipate within the quick time period

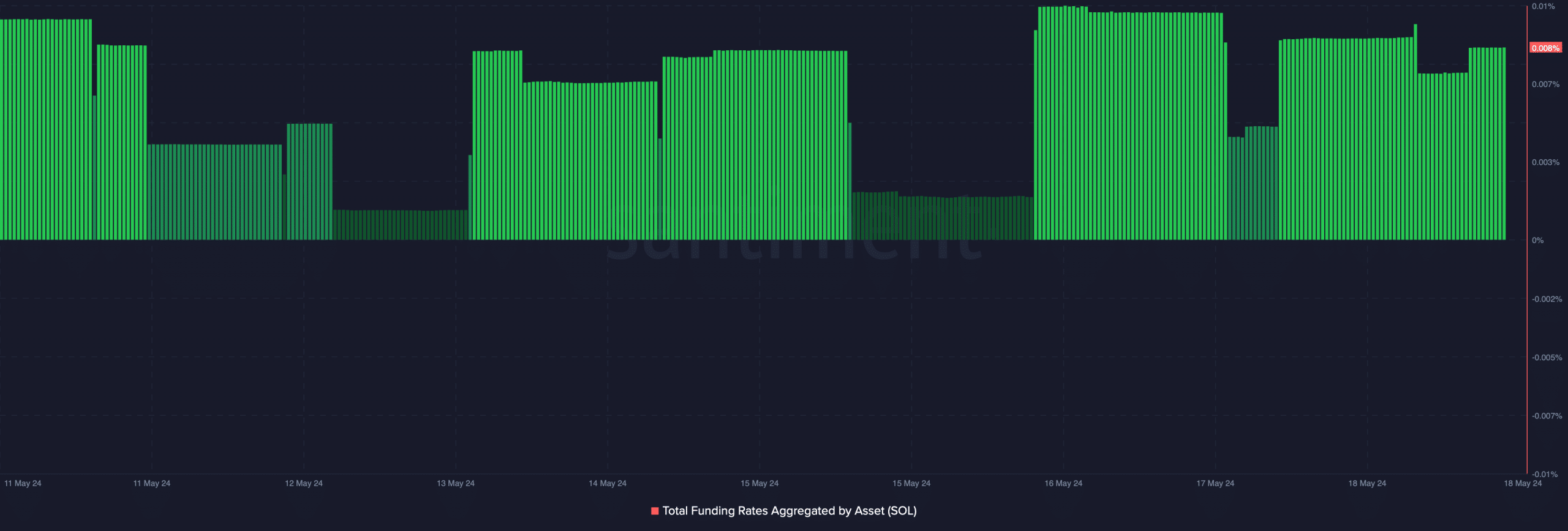

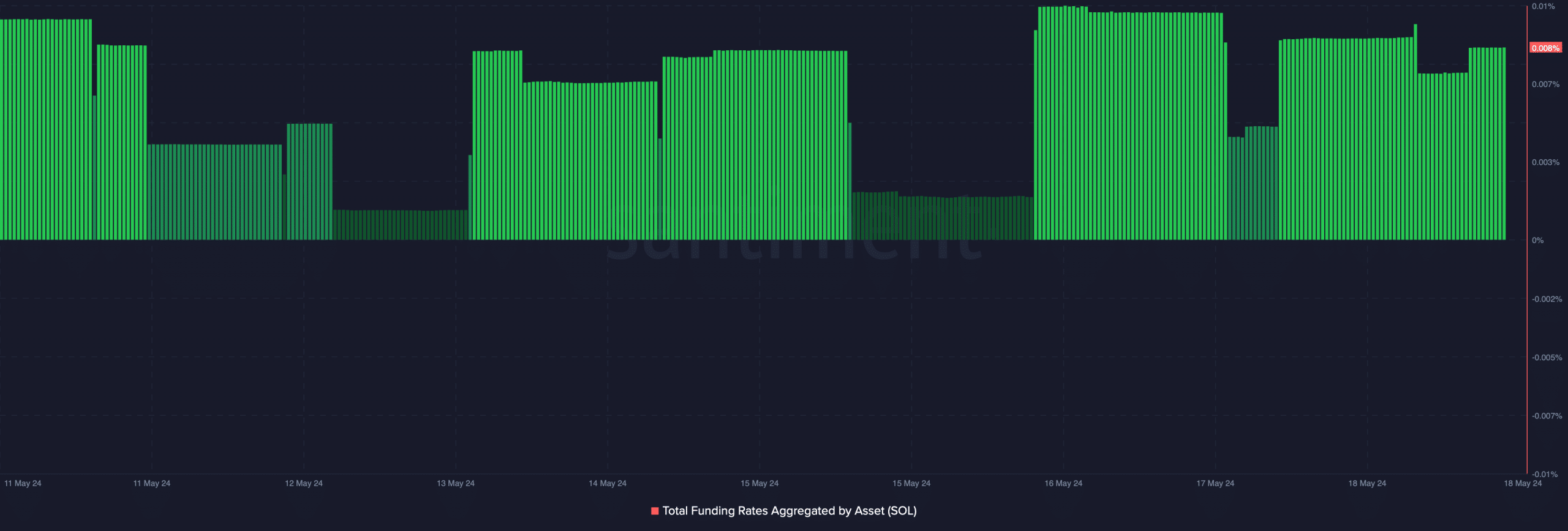

AMBCrypto then analyzed SOL’s on-chain metrics to see whether or not traders ought to anticipate a large surge within the close to time period. As per our evaluation, SOL’s Funding Price had elevated sharply.

An increase within the metric meant that derivatives traders had been shopping for SOL. In keeping with Coinglass’ data, SOL’s Open Curiosity additionally elevated, which could function a push for the coin’s weekly rally.

Supply: Santiment

Nevertheless, considerations nonetheless stay. The coin’s fear and greed index had a worth of 75% at press time, which means that the market was in an excessive greed section. Such numbers typically lead to worth drops.

We then analyzed SOL’s each day chart to see which means it was headed.

The Relative Power Index (RSI) seemed fairly bullish, because it had a worth of 64. Nevertheless, the Chaikin Cash Circulation (CMF) moved within the different path. ‘

Moreover, Solana’s worth had touched the higher restrict of the Bollinger Bands, indicating a attainable worth correction.

Supply: TradingView

Is your portfolio inexperienced? Try the SOL Revenue Calculator

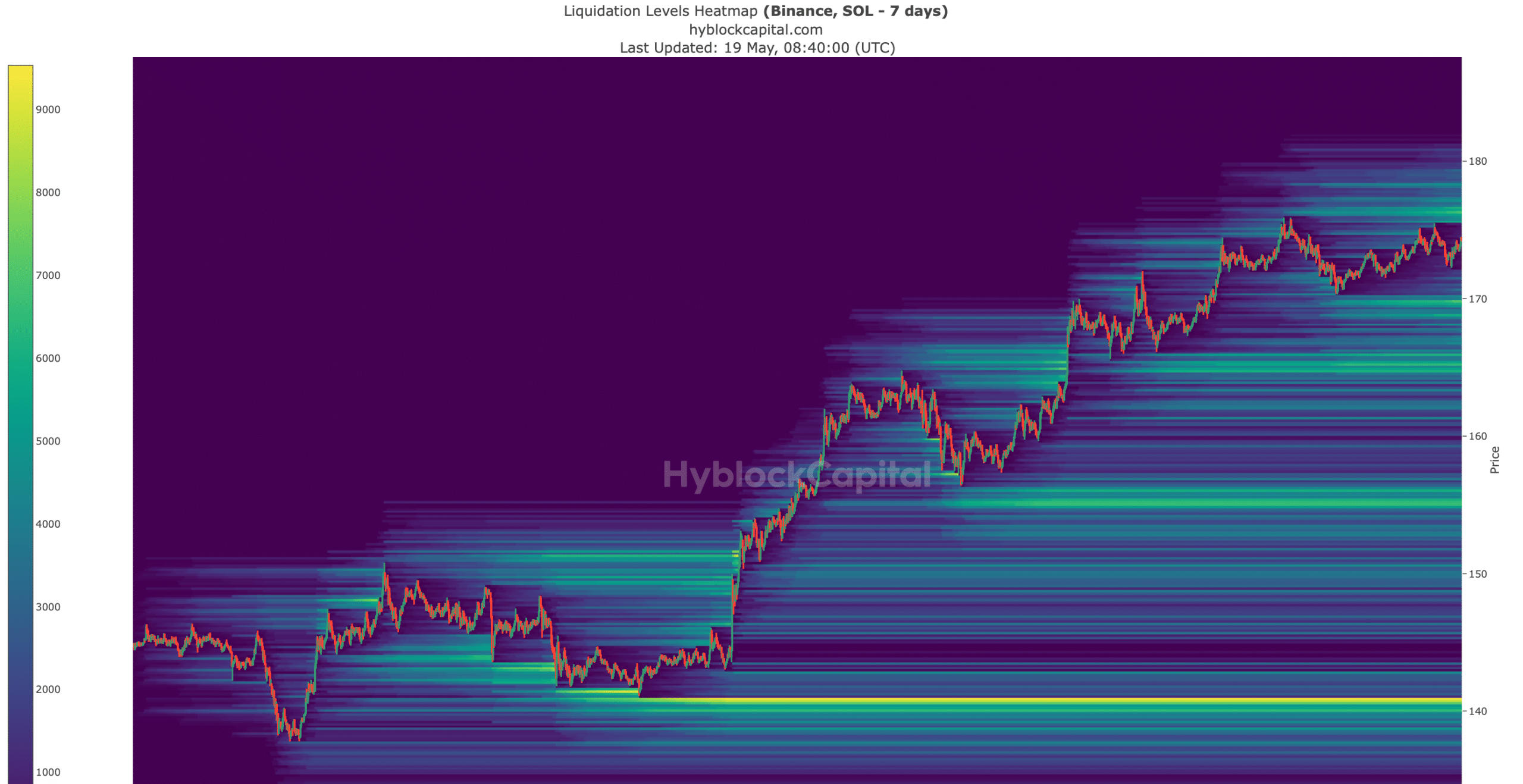

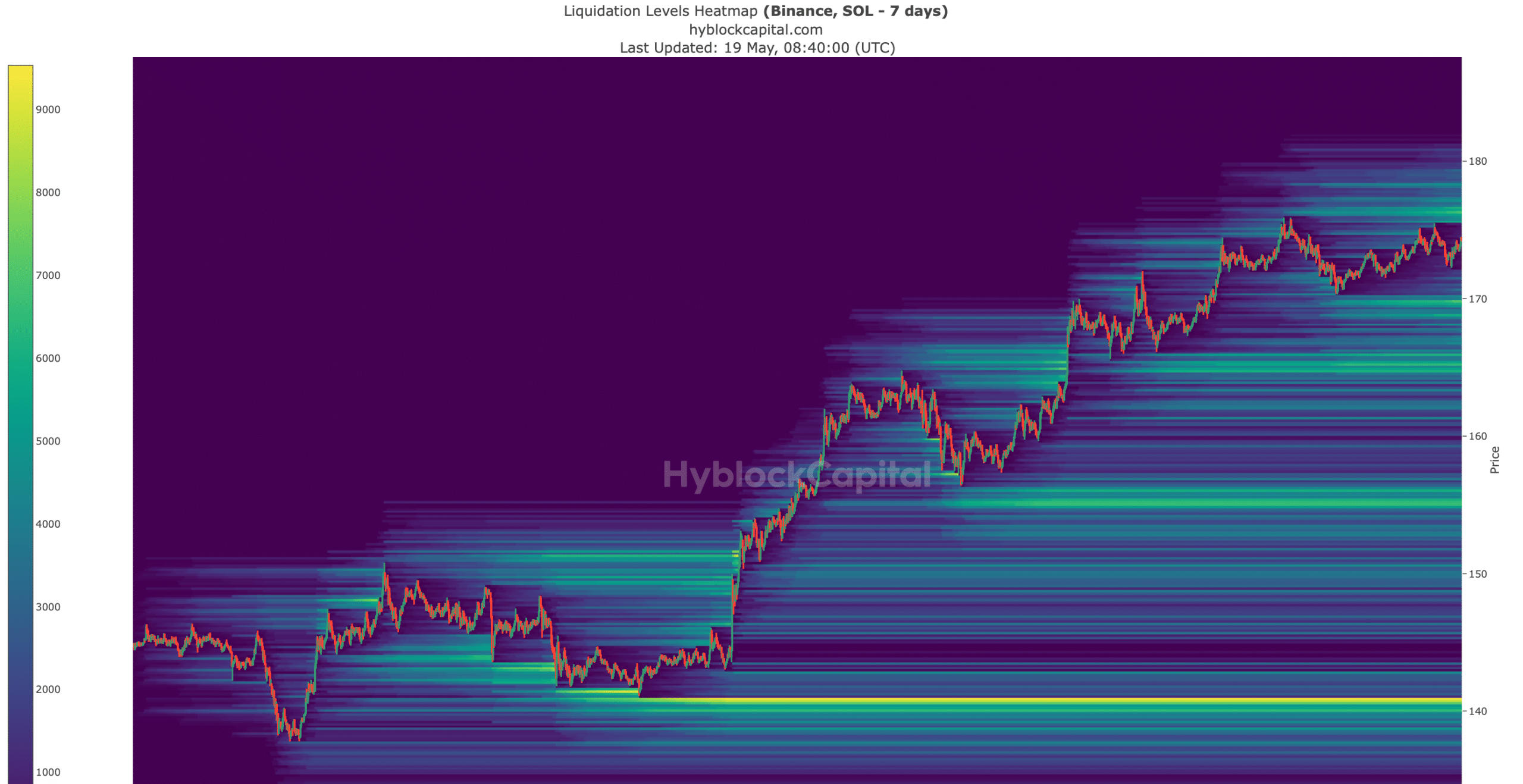

If a worth correction occurs, SOL’s worth may fall to $173.5 as liquidation would rise sharply, which could act as a help. An additional downfall might push SOL’s worth to $165. ‘

Nevertheless, if SOL manages to proceed its weekly bull run, then the token may have the ability to go above $180.

Supply: Hyblock Capital