- Solana’s DEX buying and selling quantity rose to an all-time excessive in March.

- Key momentum indicators confirmed that demand for SOL continued to rise.

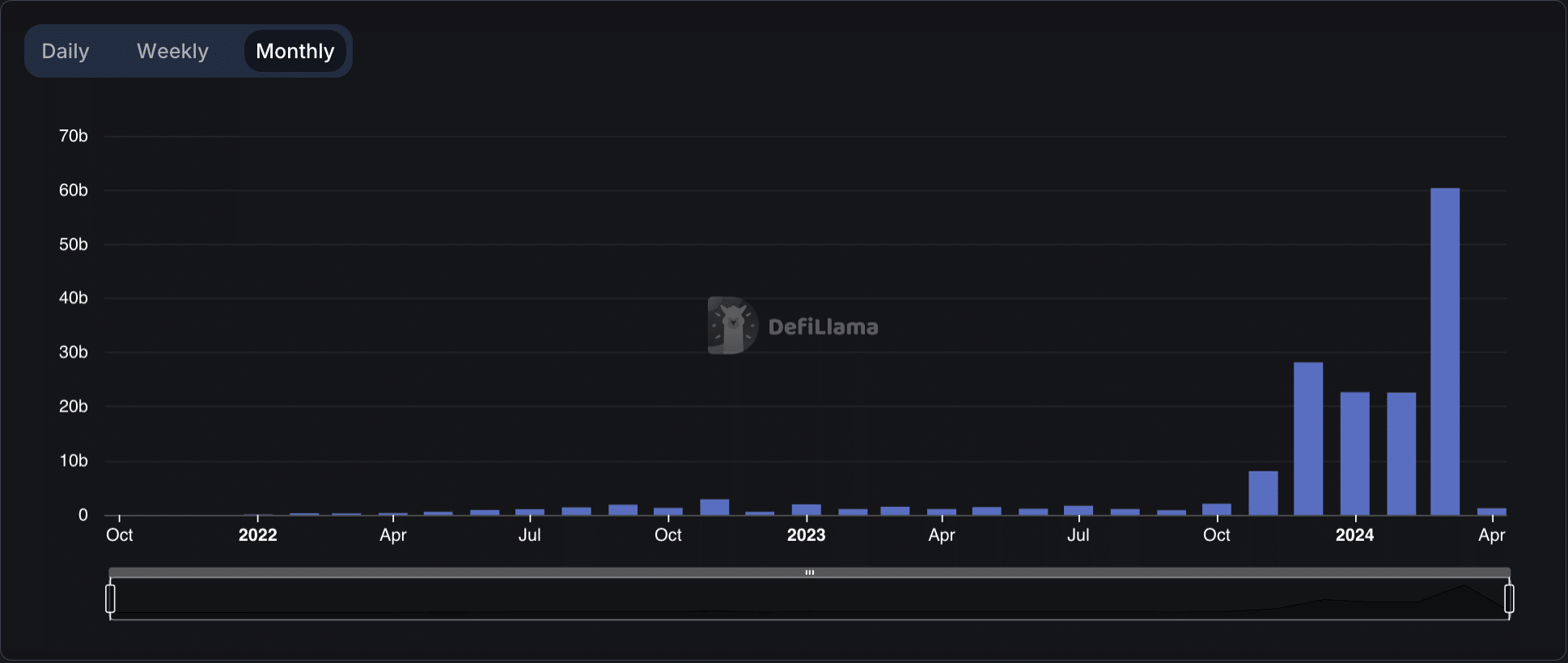

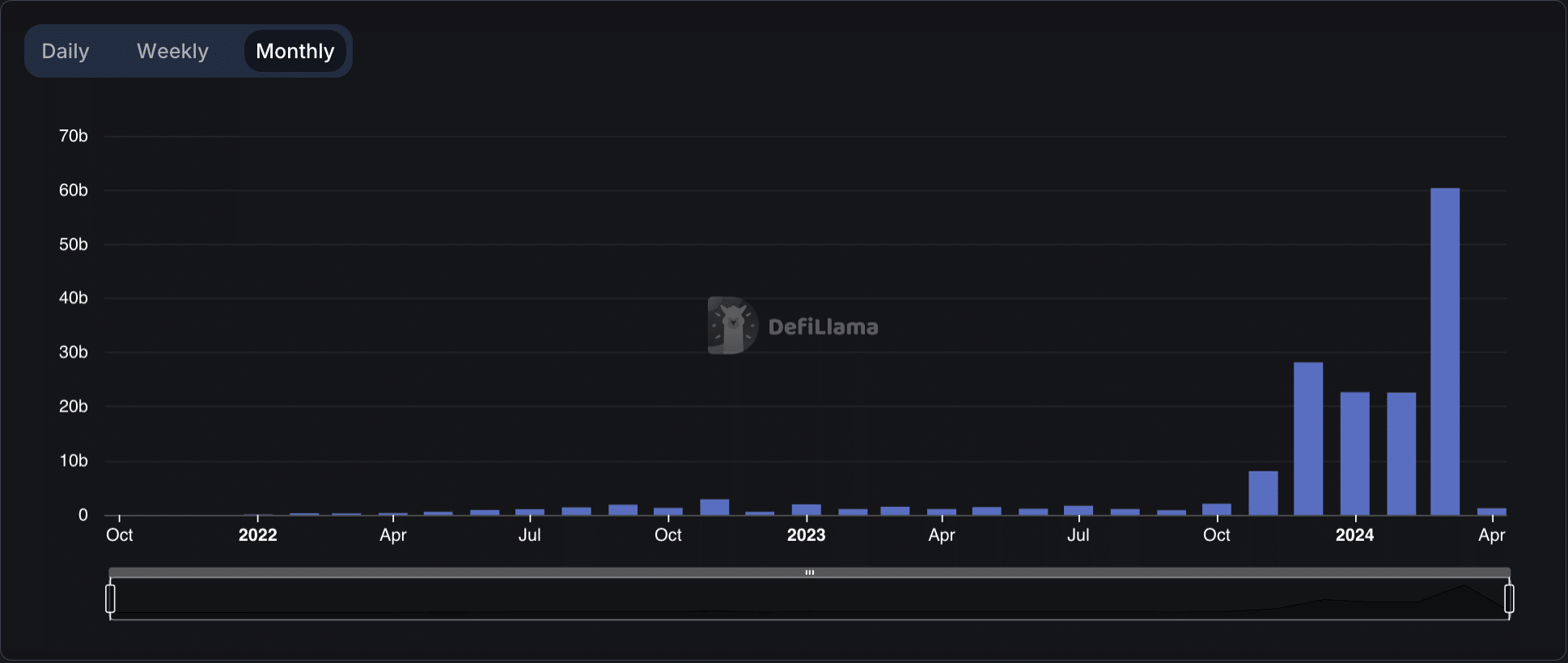

The month-to-month buying and selling quantity of decentralized exchanges (DEXes) housed inside the Solana [SOL] community surpassed $60 billion in March, setting a brand new excessive, AMBCrypto famous through DefiLlama’s knowledge.

Supply: DefiLlama

This marked a 172% spike from the $22 billion recorded in DEX quantity in February.

The surge in buying and selling quantity on Solana’s DEXes in March was because of the important curiosity in meme cash on the community throughout that interval.

This spike in meme coin exercise led to a rally within the costs of those belongings. For instance, the values of meme belongings, equivalent to Dogwifhat [WIF], rose by 140% within the final month.

Newer tokens, like Guide of Meme [BOME], noticed their costs rise 1773% throughout the identical interval, per CoinMarketCap’s knowledge.

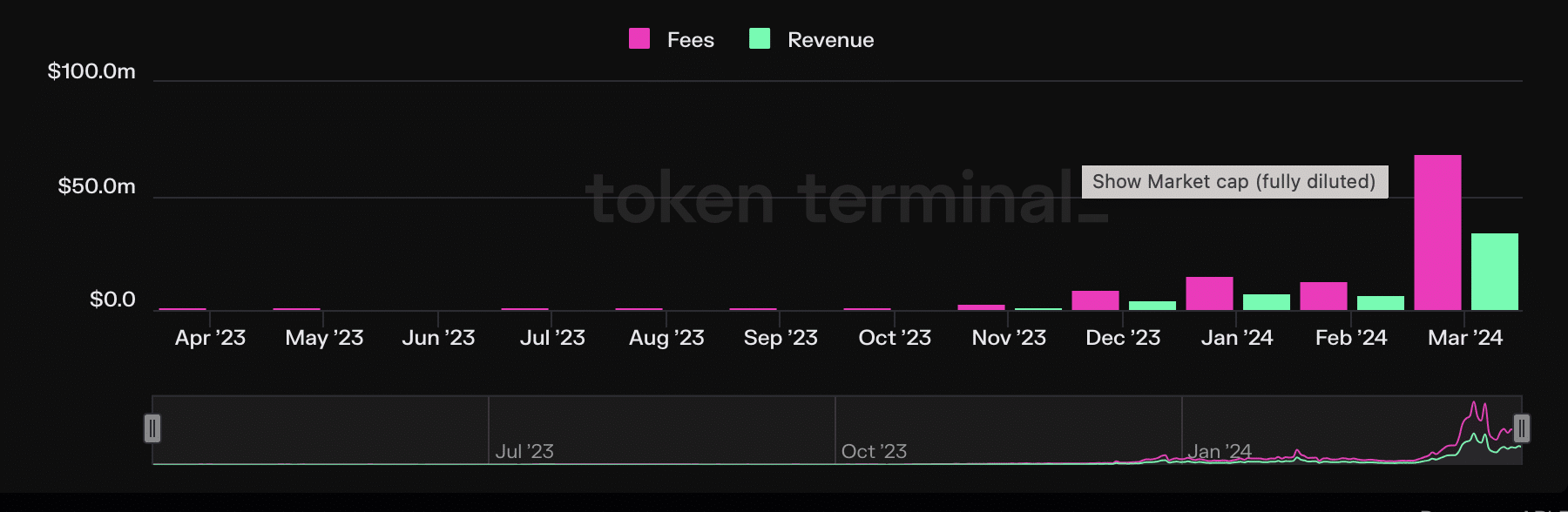

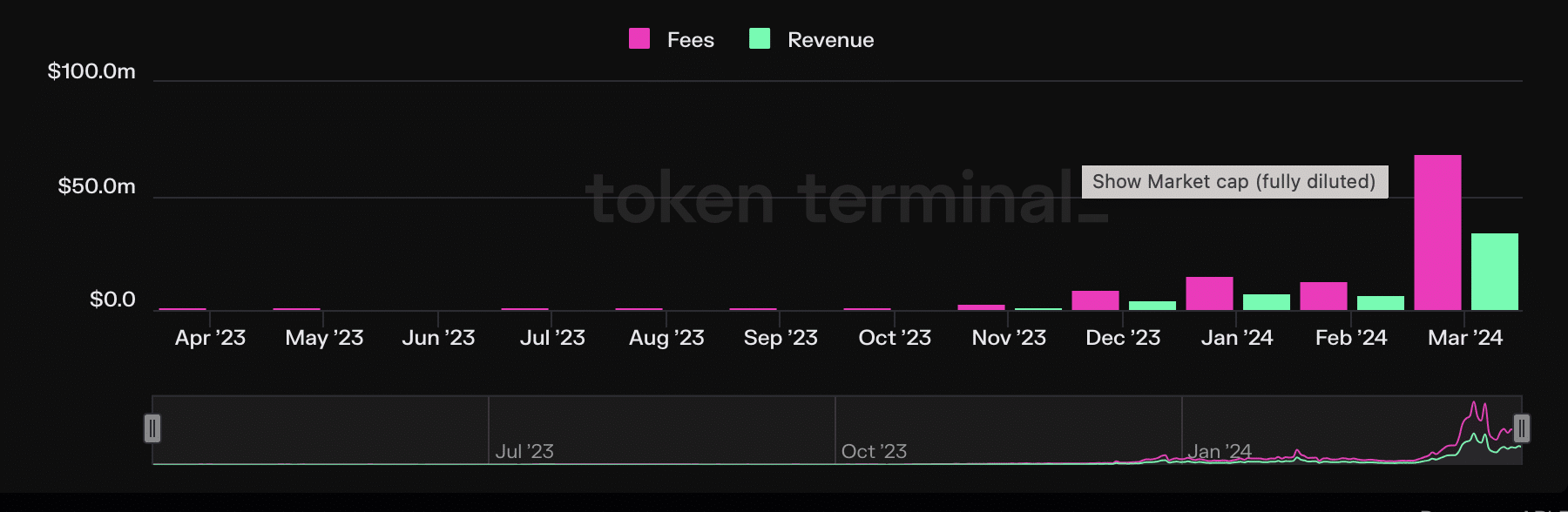

As buying and selling exercise on Solana DEXes climbed in the course of the 31-day interval, complete transaction charges and the income derived from the identical rallied to new highs.

AMBCrypto discovered that in March, transaction charges acquired by Solana totaled $69 million. This represented a 431% uptick from the $13 million the community noticed in charges in February and a 360% progress year-to-date.

Likewise, in keeping with AMBCrypto’s evaluation of Token Terminal’s knowledge, the income derived from March’s charges totaled $35 million. This represented a 483% month-over-month (MoM) progress in Solana’s income.

Supply: Token Terminal

The market continues to demand extra SOL

At press time, the community’s native coin SOL exchanged palms at $185. In keeping with CoinMarketCap’s knowledge, the altcoin’s worth has grown by 43% within the final month.

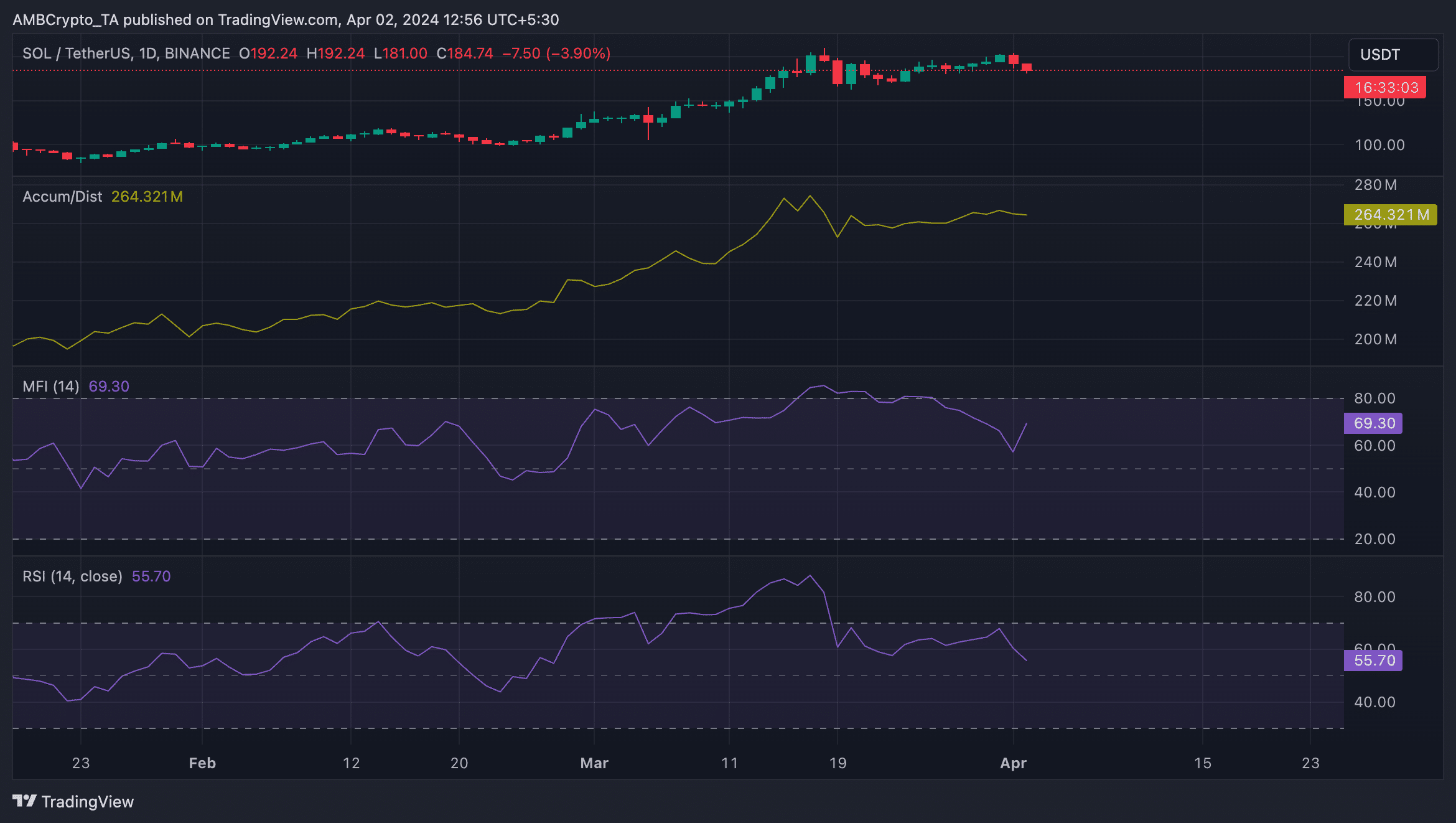

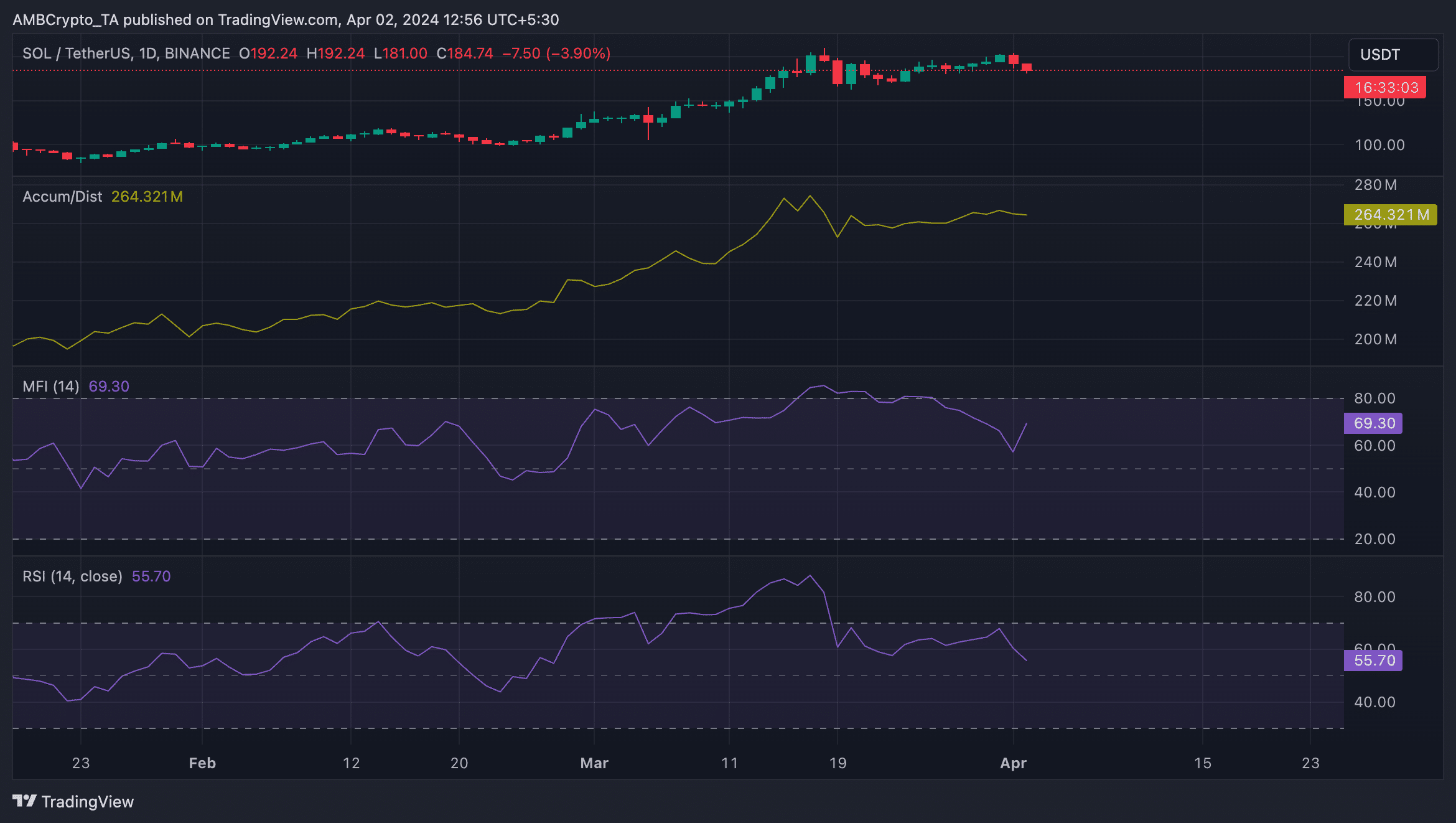

Trying to prolong its positive factors, an evaluation of key momentum indicators on a 1-day chart revealed an uptick in demand for SOL.

For instance, the coin’s Accumulation/Distribution (A/D) Line — which measures the stream of cash into or out of an asset over a selected time period — has trended upward with its worth previously two weeks.

Learn Solana’s [SOL] Worth Prediction 2024-2025

When an asset’s A/D Line strikes in the identical course as its worth, it confirms the energy of the value development. Due to this fact, when an asset’s worth and its A/D Line climb, it indicators that purchasing stress is growing.

Supply: SOL/USDT on TradingView

Additionally, SOL’s Cash Movement Index (MFI) and Relative Energy Index (RSI) rested above their middle strains, confirming the market’s desire for coin accumulation over distribution.