Solana (SOL) has attracted extra stablecoins previously day as liquidity shifts to probably the most promising markets. A shift in the direction of DeFi lending and DEX actions is driving this development.

Solana (SOL) desires to turn into one of the vital lively chains by 2024. Solana noticed a bigger influx of stablecoins within the final days of the 12 months, surpassing all different chains. Primarily based on knowledge from Lookonchain, Solana attracted greater than $454 million within the inflow of stablecoins over the previous week. Strategies for monitoring inflows range, however the normal development is a extra lively bridging of stablecoins to Solana’s apps and credit score swimming pools.

Solana additionally surpassed Base regardless of the current rush to AI agent tokens. Secure coin flows can shift relying on the obtainable revenue potential of various chains. Arbitrum, beforehand one of many main L2 chains, noticed the most important outflow of stablecoins.

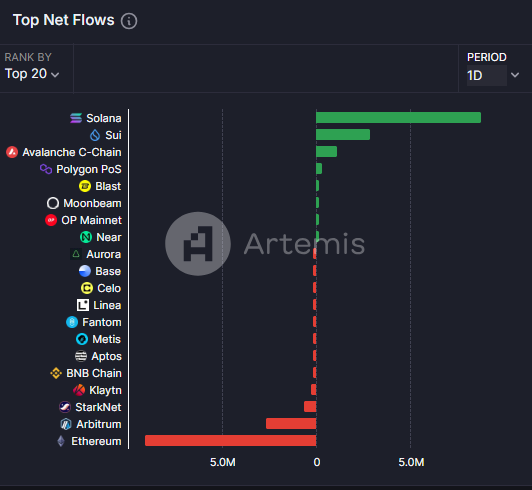

Solana led the day in stablecoin inflows, benefiting from expanded liquidity in 2024. | Supply: Artemis

Regardless of the L2 story, not all chains have succeeded in attracting worth this 12 months. Former DeFi star ZKSync Period noticed internet outflows of over $2 billion, together with Linea, Blast, and Avalanche.

On an annual foundation, stablecoins have boosted Optimisme, Base, Solana, Arbitrum and SUI. Ethereum remained probably the most lively chain in internet hosting USDT, including to the obtainable liquidity. Basic, steady cash pushed previous the $200 billion mark, pushed by Tether, alongside new cash for DAI, USDS and Ethena’s USDe.

Ethereum stays a stablecoin backer, visitors has shifted to Solana and Base

Stablecoin flows change within the brief time period and Solana reached its main place on December 30. The chain noticed $8.8 million in internet flows that day, adopted by SUI’s $2.9 million in internet flows. Solana competes with Base for fund inflows, though it has solely been in second place for the previous three months.

To this point, Base stays the principle goal for stablecoin inflows. For 2024, the chain attracted $7.8 billion in premium inflows, of which $3.5 billion was retained as internet inflows.

Solana attracted $5.3 billion in new inflows whereas retaining $2.1 billion in internet inflows 12 months so far. The chain not too long ago added greater than USD 100 million from the Sky ecosystem because it seems to be to broaden DeFi lending.

Because of this, Solana has $5.254 billion in bridged stablecoins, with a complete locked worth rising to $8.58 billion. Solana has lagged behind in gaining worth, solely peaking in December at over $9 billion throughout varied tokens and stablecoins. Jito Liquid Staking and Kamino Finance locked up a lot of the worth, however DEX, like Raydium and Jupiter, additionally raised $4.47 billion of their liquidity pairs.

Measuring stablecoin flows bridging exercisewhich different relying on the apps obtainable. Arbitrum was one of many EVM-compatible chains with very lively bridging. For Solana, bridging from Ethereum was rarer, however as soon as funds have been despatched to Solana, they have been extra more likely to keep. Arbitrum, then again, had a way more lively turnover.

The current development in stablecoin flows exhibits that merchants’ expectations have modified thus far this 12 months. The development accelerated when Solana and Base grew to become the highest chains carrying AI agent tokens. As the only real supply for these tokens, bridging stablecoins for buying and selling was key to accessing the brand new markets.

The Solana exercise has moved from memes to DeFi

Meme tokens have been one of many most important development drivers on Solana in current months, with two important units of enlargement. Regardless of this, not all visitors on Solana was of the identical high quality. The chain executed a number of low-value transactions, with as much as 35% failed transactions.

Over the previous 12 months, Solana has additionally been the chief in operating buying and selling bot actions. Routing and bot utilization have been crucial for Solana to make sure a profitable DEX transaction or token sniping.

As much as 86% of all bot merchants use Solana as their vacation spot chain. Most Solana visitors additionally comes from wallets with 0.01 SOL as balances. Nevertheless, the inflow of stablecoin exercise exhibits that worth can also be being constructed, largely tied to whale wallets utilizing the protocols.

Solana’s lending enlargement additionally relied on meme tokens. Some main memes, corresponding to DogWifHad (WIF)have been used as collateral on Kamino to borrow extra stablecoins.

A step-by-step system to launch your Web3 profession and land high-paying crypto jobs in 90 days.