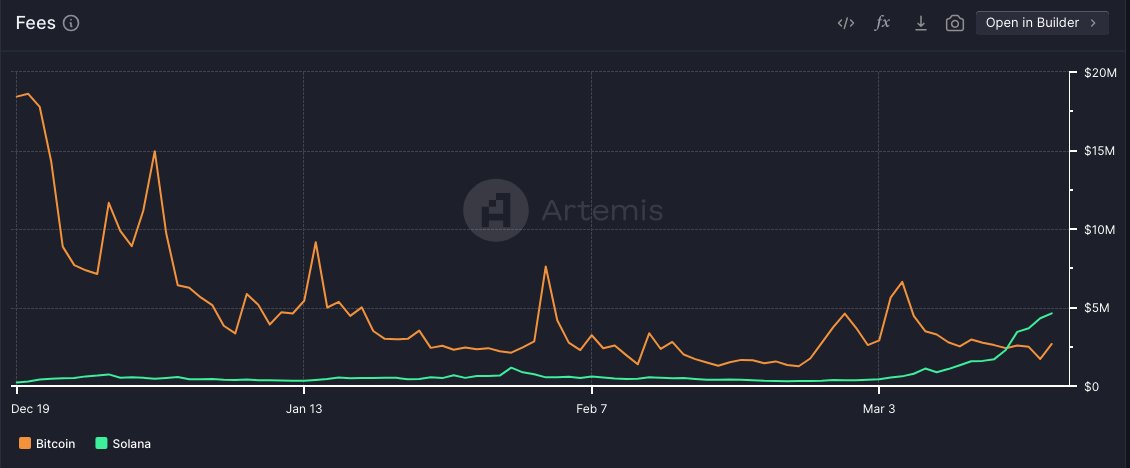

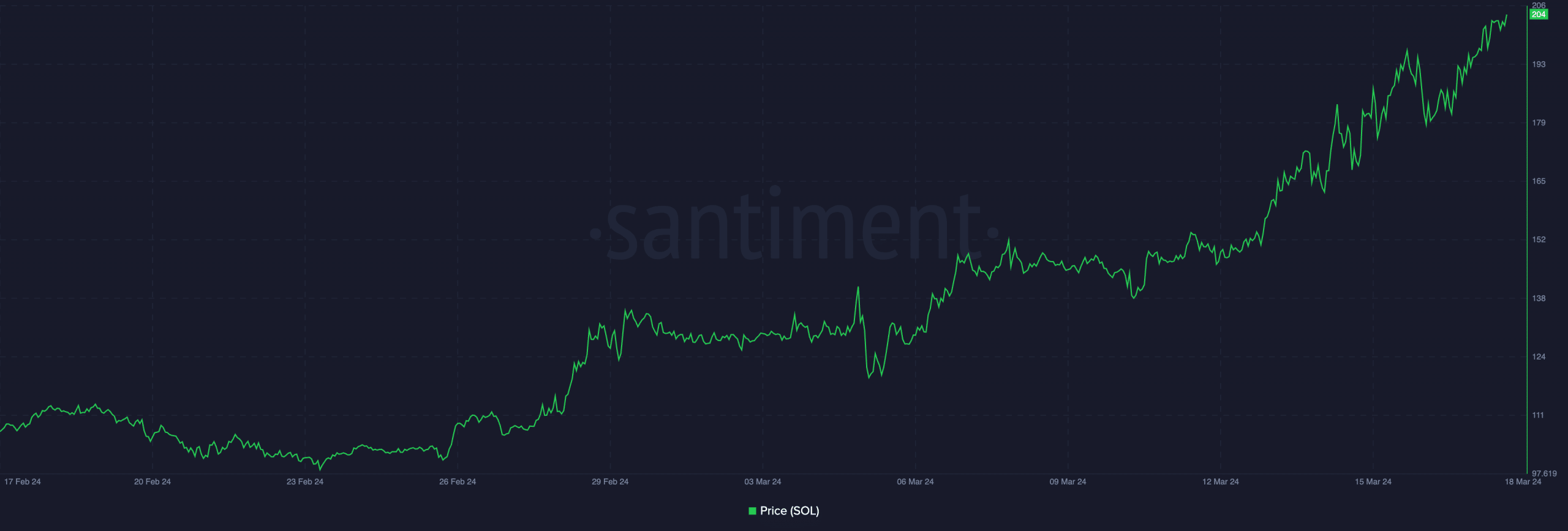

- Solana validator charges outpaced charges generated on the Bitcoin community.

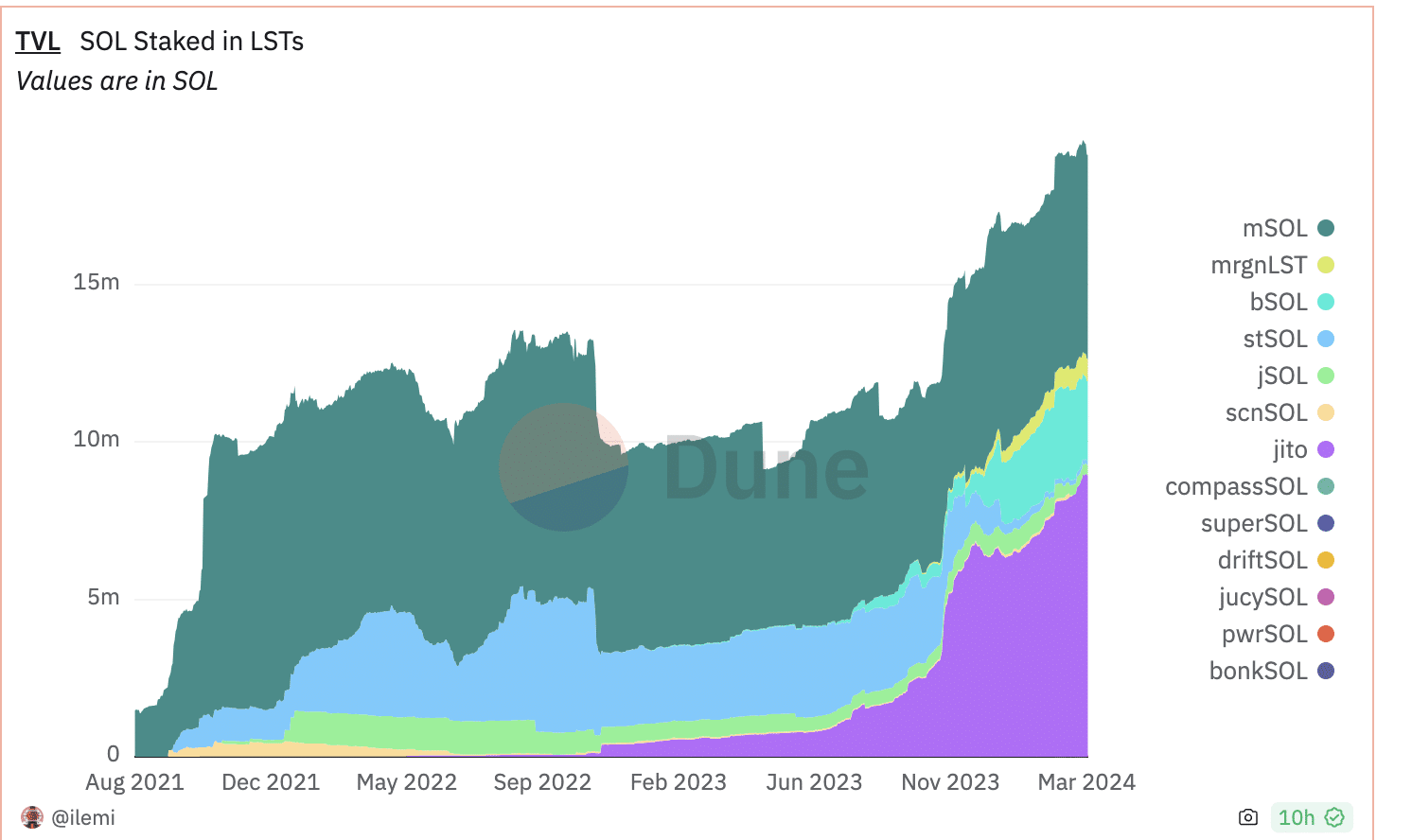

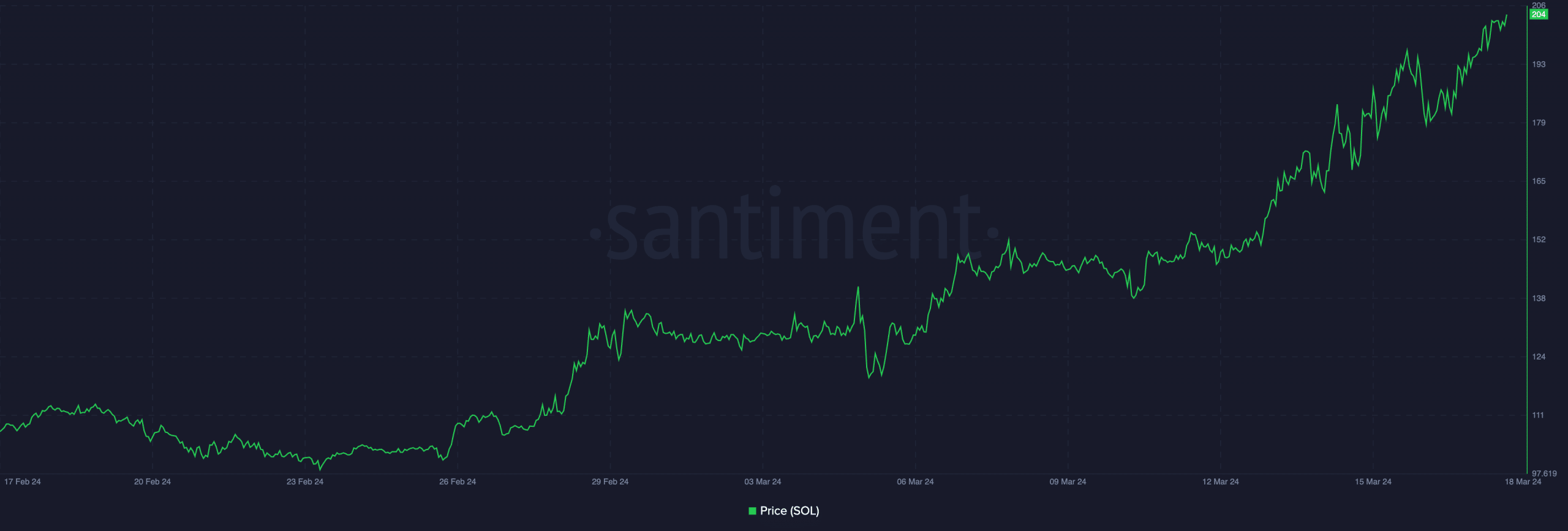

- Curiosity in staking SOL grew as worth of SOL surged.

Solana [SOL] has surpassed varied altcoins by way of exercise and transactions occurring on the community. Nonetheless, the community had began to point out development in different areas as properly. Knowledge indicated that Solana was in a position to go toe-to-toe with Bitcoin[BTC] by way of charges collected on the community.

Larger charges

In line with AMBCrypto’s evaluation of Artemis’ information, Solana was blowing previous Bitcoin by way of charges generated for validators. The upper charges earned by Solana validators point out a surge in community exercise, suggesting elevated adoption and utilization of the platform.

The heightened exercise not solely demonstrates Solana’s scalability but in addition highlights its effectivity in processing transactions and executing sensible contracts.

Furthermore, the flexibility to generate increased charges enhances the attractiveness of Solana for validators, incentivizing their participation and bolstering community safety and decentralization.

As Solana continues to outpace Bitcoin in payment technology, it solidifies its aggressive place and underscores its potential as a number one blockchain platform, attracting extra builders, tasks, and customers to its ecosystem.

Supply: Artemis

Whereas increased charges could point out elevated community exercise, some traders fear that Solana’s speedy development might be unsustainable or doubtlessly indicative of speculative habits.

There are additionally issues concerning the scalability of Solana’s community and whether or not it will probably deal with continued development with out encountering technical challenges or bottlenecks.

Solana’s historical past with downtimes doesn’t assist with the sentiment across the community both.

Curiosity in staking

Aside from validator charges, there was a surge in curiosity noticed in Solana staking as properly. Evaluation of Dune Analytics information revealed that there was a surge in TVL (Whole Worth Locked) staked by LST(Liquid Staking Tokens).

Jito was the preferred selection for many stakers because it had captured 46.1% of the general market share.

The heightened participation in staking bolsters the safety and decentralization of the community by locking up extra SOL tokens as collateral. This elevated safety helps safeguard the integrity of transactions and enhances belief within the Solana protocol.

Moreover, staking SOL tokens permits holders to earn rewards.

How a lot are 1,10,100 SOLs price right now?

This fosters a tradition of long-term funding and helps in lowering circulating provide, doubtlessly resulting in a extra secure token worth over time.

Supply: @ilemi Dune Analytics

Aside from SOL staking, curiosity was proven within the SOL token as properly. Within the final 24 hours, the value of SOL had surged by 10.46%.

Supply: Santiment