- Buyers’ sentiment round SOL turned bearish within the final 24 hours.

- Just a few metrics prompt that SOL’s value would possibly improve within the coming days.

Solana’s [SOL] value tumbled prior to now day, sparking worry a couple of additional dip. Nevertheless, there have been probabilities of a pattern reversal. If that occurs, then buyers would possibly witness SOL reclaim $200 quickly.

Solana’s newest fall

The final 24 hours weren’t in buyers’ favor, as Solana’s worth fell by greater than 6%.

Based on CoinMarketCap, on the time of writing, SOL was buying and selling at $134.70 with a market capitalization of over $60.2 billion. The appreciable value drop had an influence on SOL’s social metrics.

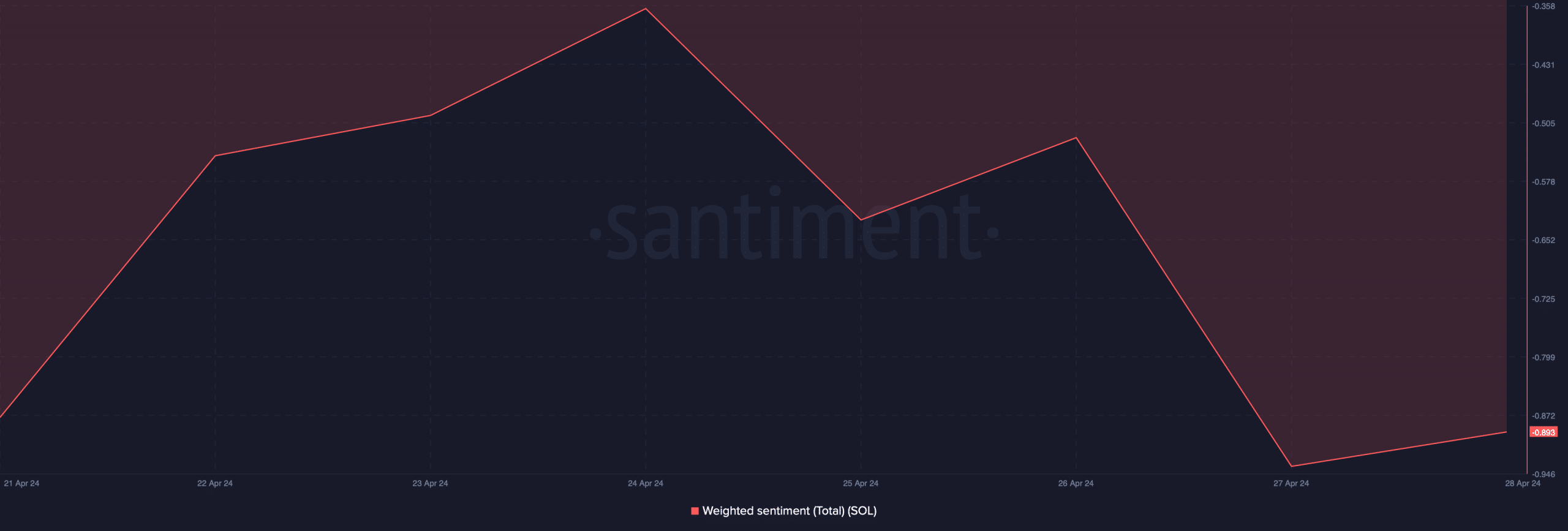

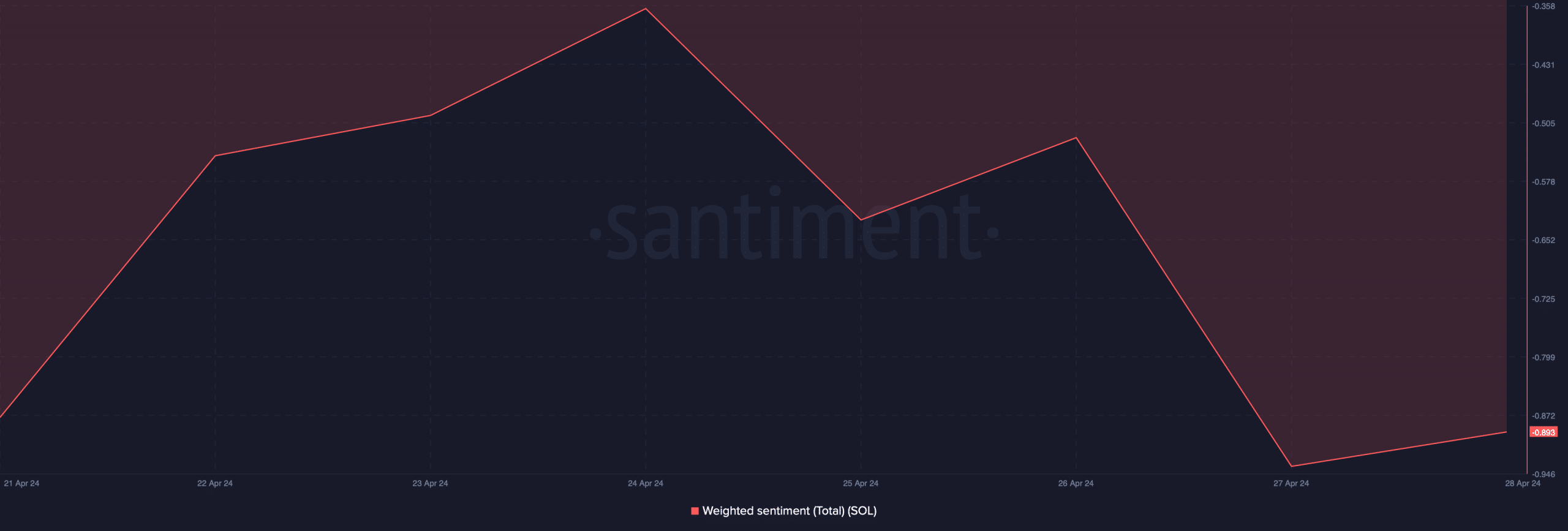

Its Weighted Sentiment dipped sharply, that means that bearish sentiment across the token turned dominant available in the market.

Supply: Santiment

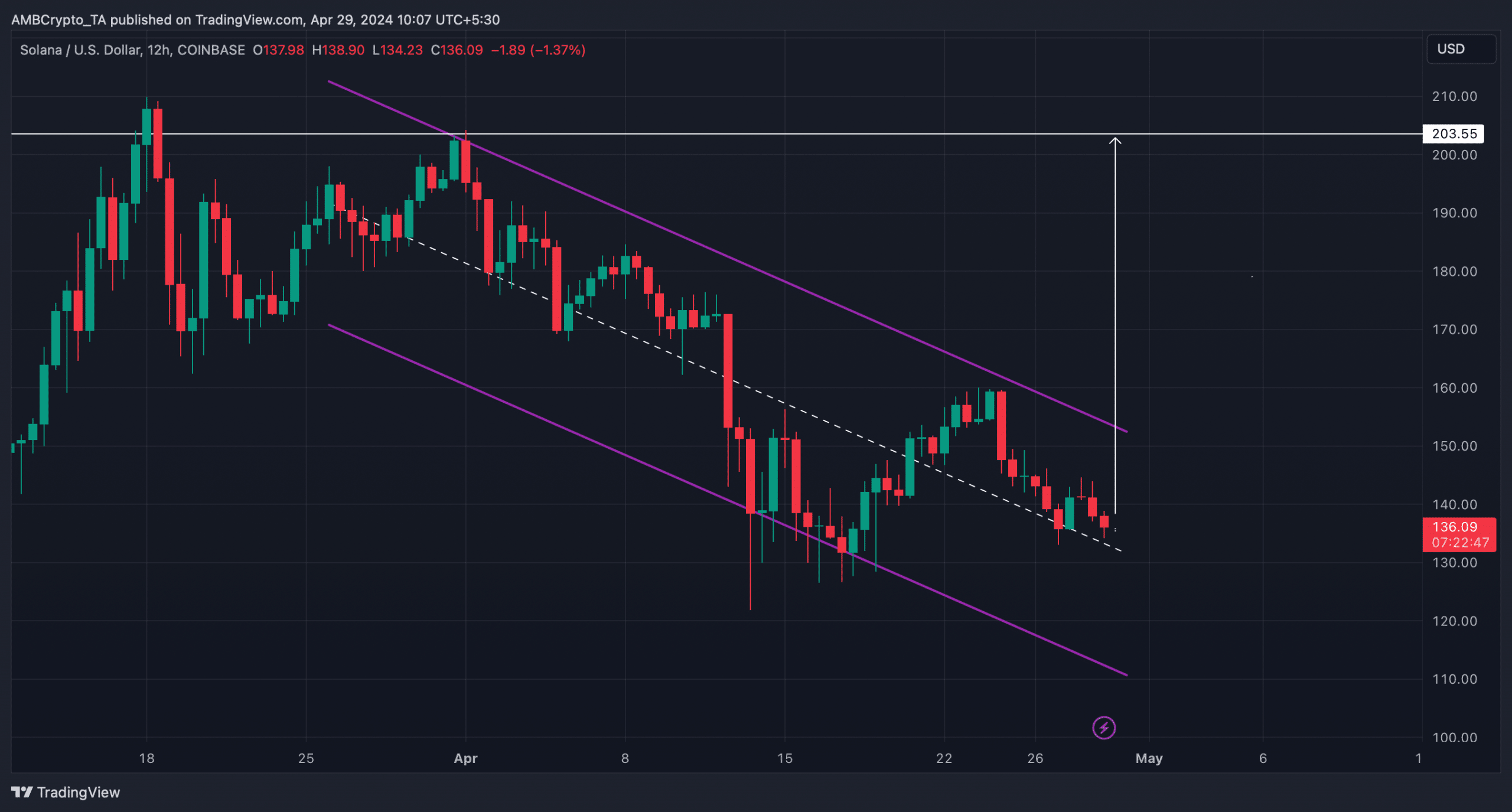

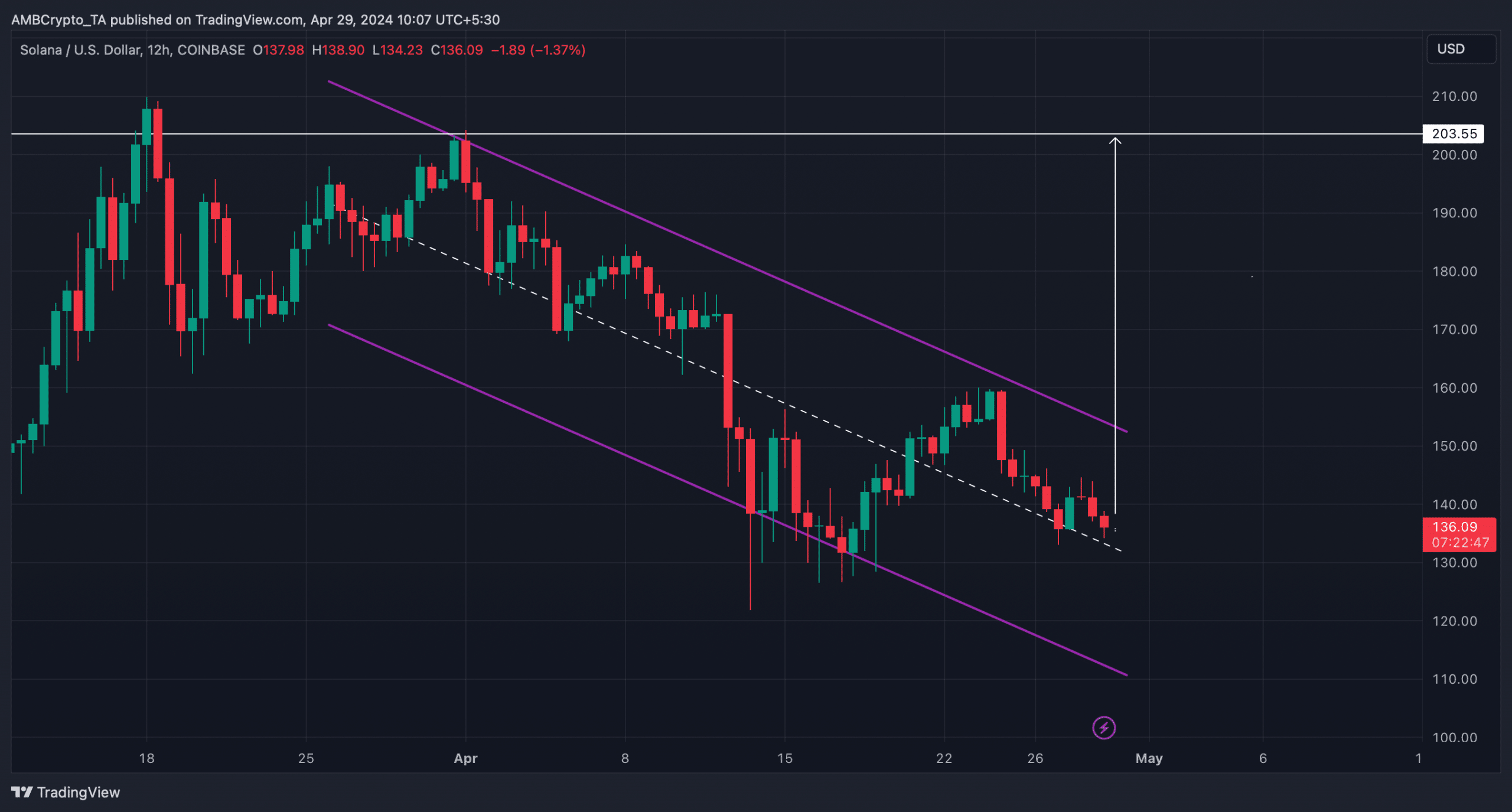

Nevertheless, there was extra to the story than simply this. AMBCrypto discovered that SOL’s value was transferring in a descending channel on its 12-hour chart.

If Solana manages to check that sample and register a breakout, then issues would possibly get bullish within the coming days or even weeks. In actual fact, it would as properly permit SOL to get better and reclaim the $200 mark too.

Supply: TradingView

Odds of SOL touching $200

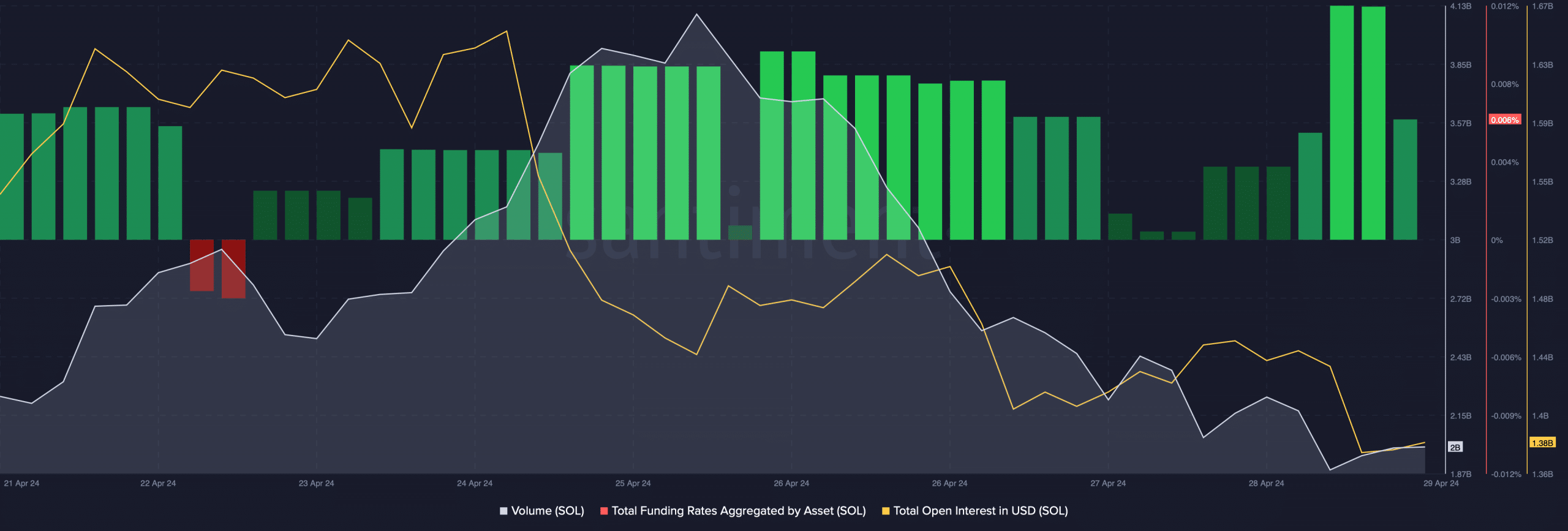

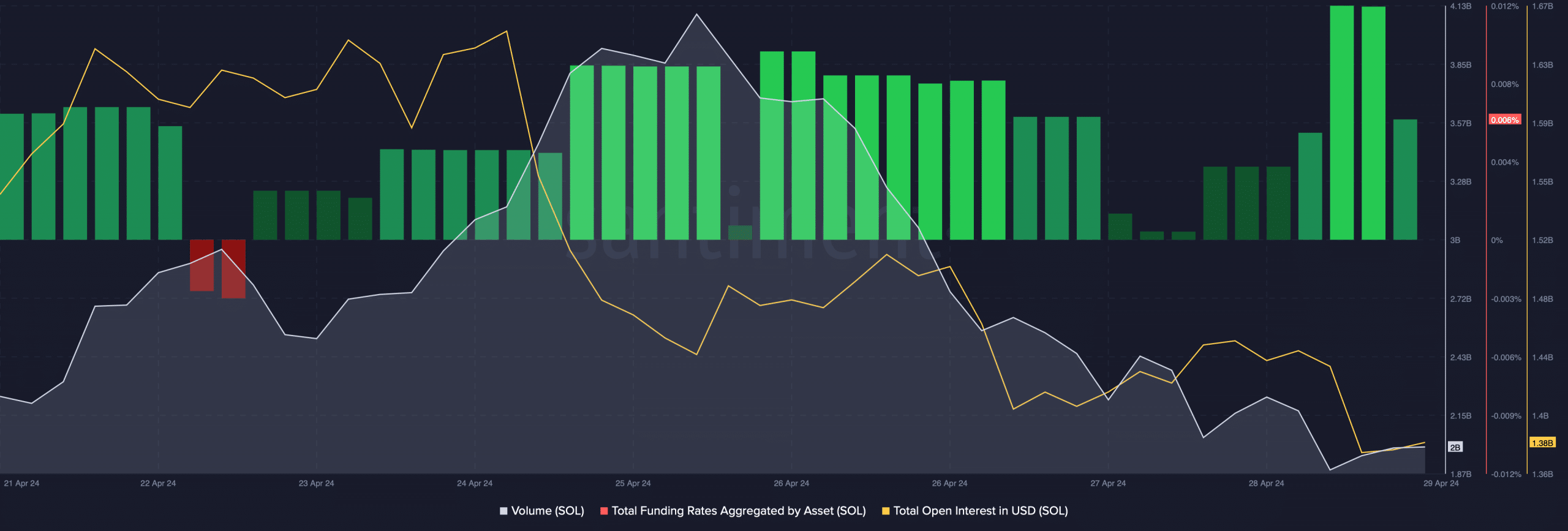

AMBCrypto then analyzed SOL’s on-chain knowledge to search out out whether or not the token would handle to interrupt out of the sample. As per our evaluation of Santiment’s knowledge, SOL’s quantity plummeted sharply together with its value.

This prompt that the bearish value pattern may not final lengthy.

Its Open Curiosity additionally adopted an analogous declining pattern, additional hinting at a pattern reversal quickly. Nevertheless, its Funding Fee remained excessive, which could be inferred as a bearish sign.

Supply: Santiment

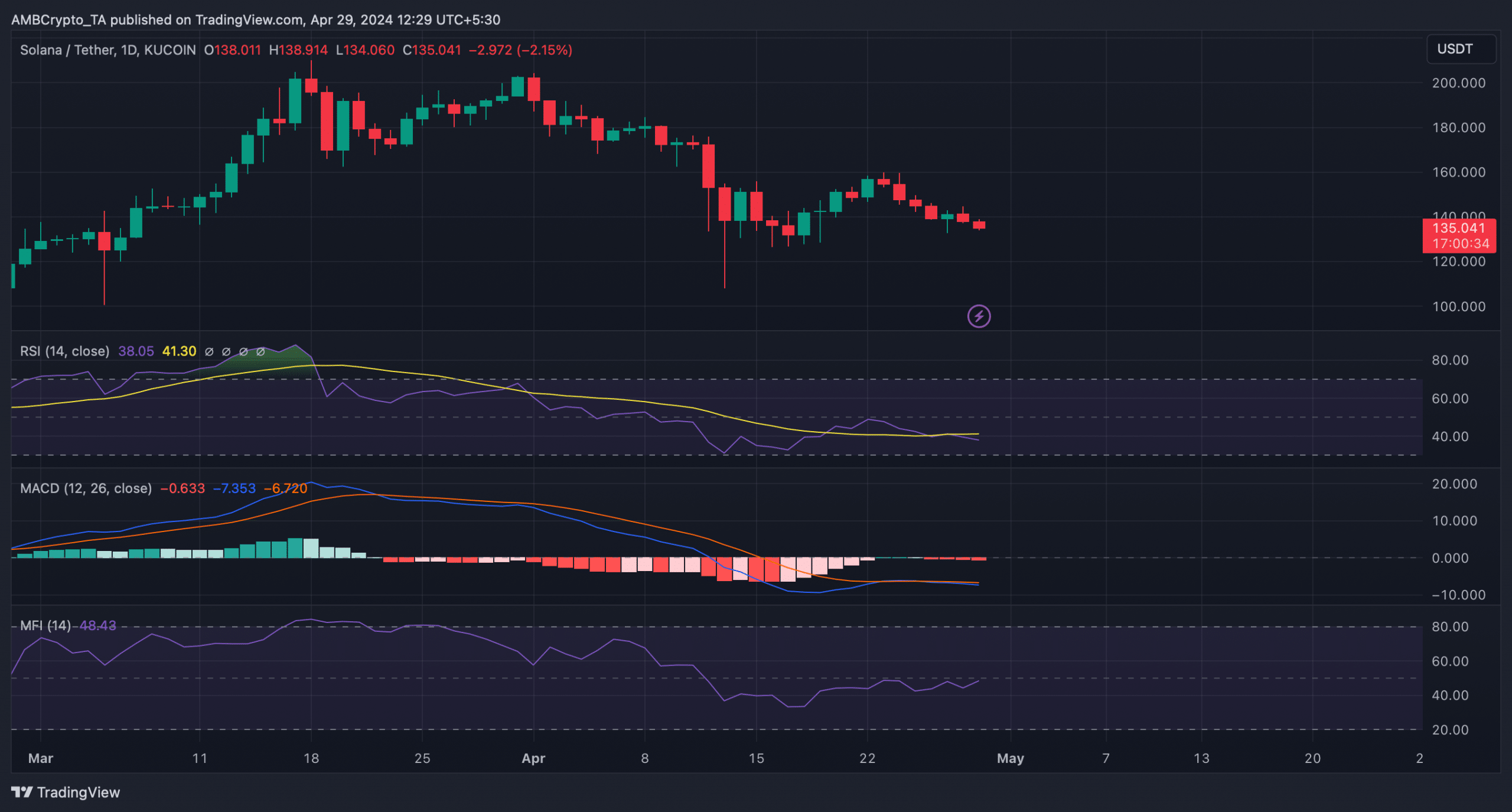

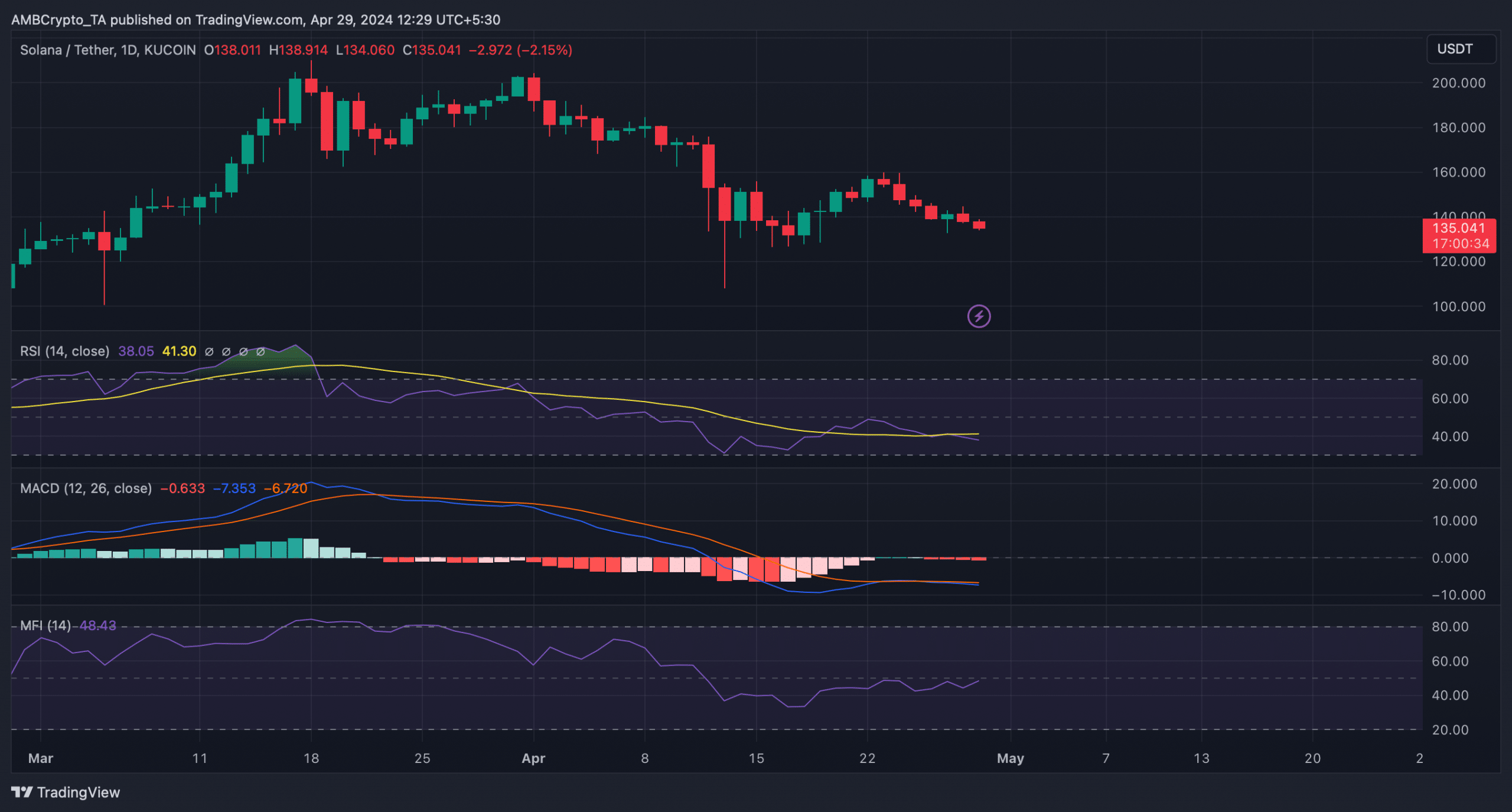

The technical indicator MACD supported the sellers because it displayed a bearish crossover. SOL’s Relative Energy Index (RSI) additionally registered a downtick, signaling that the worth decline would possibly proceed.

As per the Bollinger Bands, SOL’s value was in a much less unstable zone, which prompt that the probabilities of an unprecedented value uptick have been low.

Nonetheless, the Cash Stream Index (MFI) remained bullish because it moved northward.

Supply: TradingView

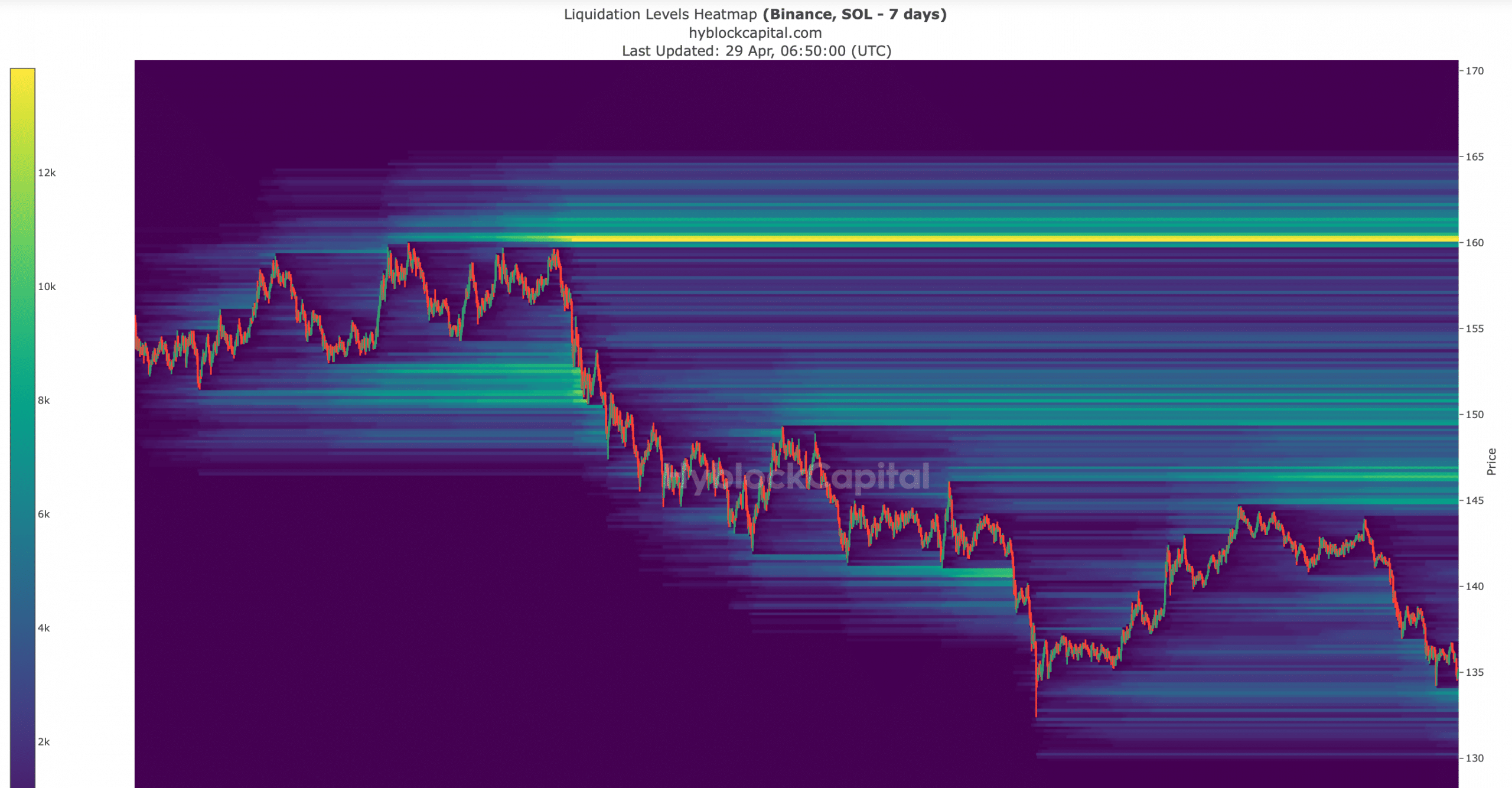

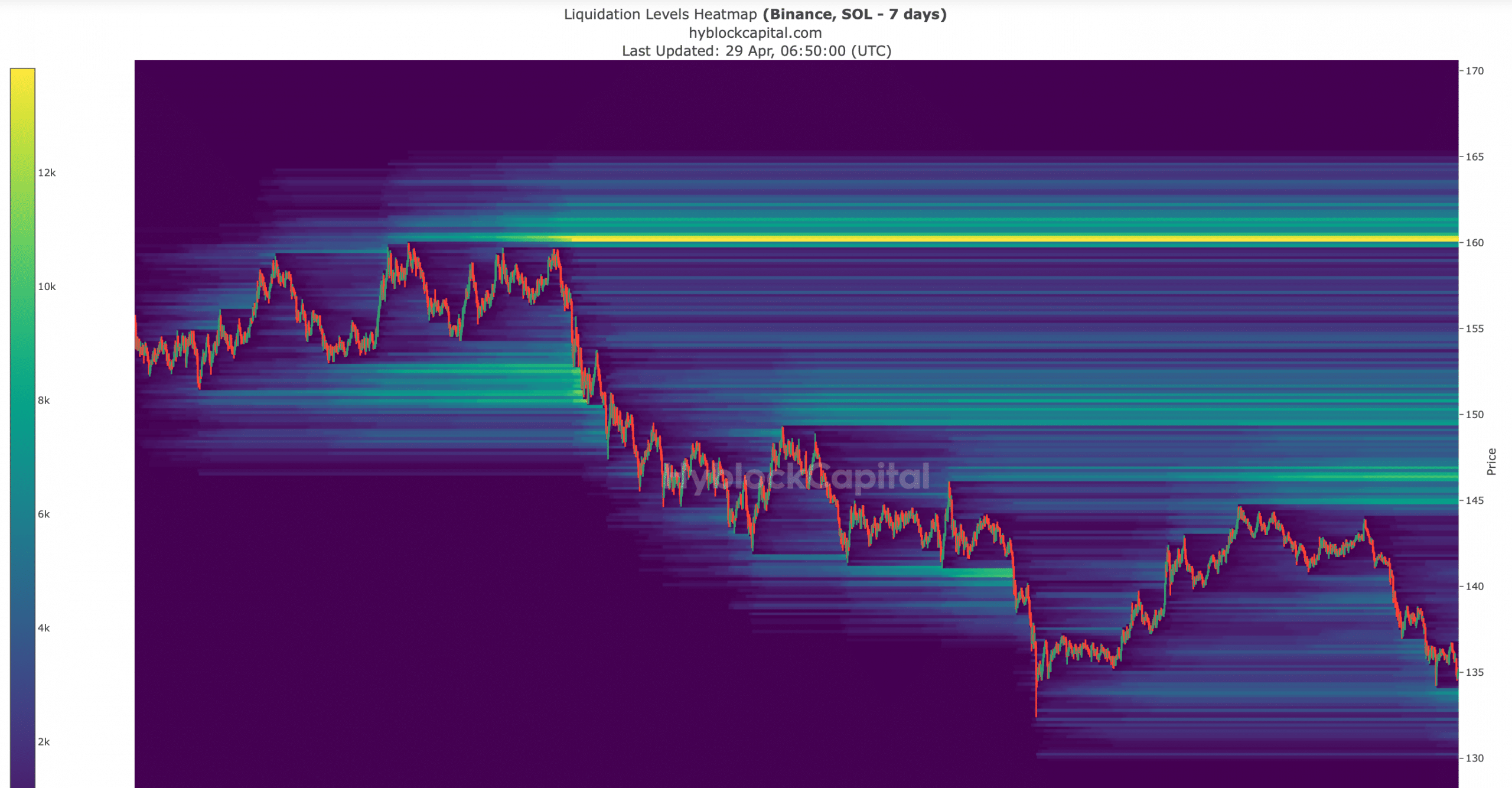

Although there was a chance for the bearish pattern to persist, AMBCrypto checked Hyblock Capital’s knowledge to search out potential near-term resistance ranges if a bull rally occurs.

Learn Solana’s [SOL] Worth Prediction 2024-25

We discovered that SOL’s liquidation would rise close to $146. Subsequently, it’s essential for SOL to go above that mark to maintain its bull rally. Going additional north, the $160 can be an important stage, as liquidation would rise sharply.

A profitable breakout above that might clear SOL’s path in direction of $200.

Supply: Hyblock Capital