PonyWang

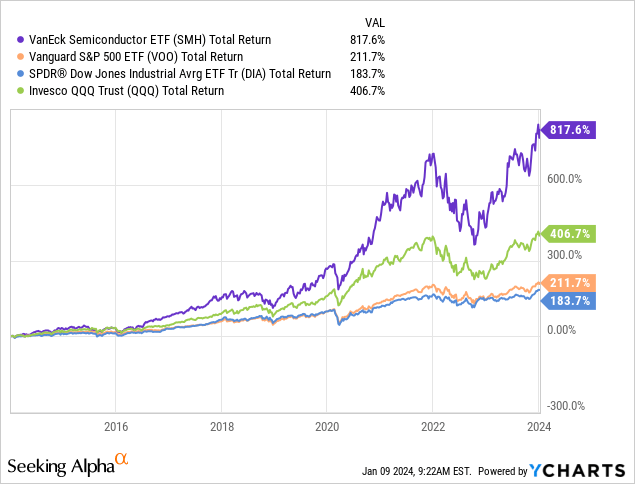

My followers know I’ve been bullish on the semiconductor sector for years. That is because of a number of highly effective catalysts. Amongst them are progress throughout quite a lot of expertise sub-sectors: high-speed networking, knowledge facilities, 5G handsets and infrastructure, EVs, clean-tech, and the on-shoring of supply-chains – simply to call a few. The VanEck Semiconductor ETF (NASDAQ:SMH) is a superb nice thematic play on these catalysts as a result of – with its 20% stake in Nvidia (NVDA) – it is usually excellently positioned to learn from what I imagine goes to be a robust multi-year stimulant for the sector: AI. Right this moment, I am going to take a more in-depth have a look at the SMH ETF and clarify why all traders ought to have direct publicity to what in my view is without doubt one of the most dynamic and necessary sectors for the twenty first Century. Certainly, the SMH ETF has been outperforming the broad market averages (as represented by the S&P500 (VOO), DJIA (DIA), and Nasdaq-100 (QQQ) ETFs) for years:

Funding Thesis

Semiconductors have grow to be ubiquitous in fashionable life: whether or not in your cellphone, TV, laptop computer, wi-fi router, or automotive (and your key-fob) – they’re actually in every single place. Trendy life would merely not be doable with out semiconductors. However, after all, some semiconductors are extra worthwhile than others. Nvidia at the moment makes a few of the most respected semiconductors on Earth, a lot in order that the U.S. authorities prohibits the sale of Nvidia’s top-end A800 and H800 AI processors from being offered to China. Nonetheless, Nvidia says it doesn’t count on “a near-term significant impression on our monetary outcomes” resulting from sturdy world demand for these chips. Certainly, the corporate has had challenges merely assembly that demand.

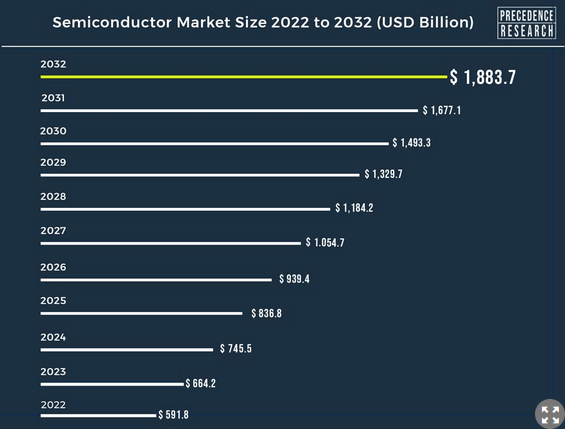

I’ve been protecting semiconductors and the SMH ETF on Searching for Alpha for fairly a while. My final article (an “Editor’s Choose”) was again in November of 2022 (see SMH: Buffett Takes Huge Stake In ETF’s #1 Holding Taiwan Semiconductor). Since that BUY-rated article was printed, SMH has outperformed the S&P500 by nearly 3x and that development could be very prone to proceed shifting ahead and for a few years to come back. Certainly, in line with Precedence Research, gross sales for the worldwide semiconductor market are anticipated to roughly triple over the approaching decade:

GlobalNewsWire.com

This is the reason traders want to ascertain a core place within the semiconductor sector and to easily maintain it. Additionally it is why I’ve persistently put a “Purchase” score on SMH and advise traders to scale right into a full-position over time in an effort to benefit from market volatility.

From a extra near-term perspective, simply this morning (Wednesday) the Semiconductor Trade Affiliation (“SIA”) reported that world chip gross sales rose in November for the primary time in additional than a yr. In accordance with the SIA, chip gross sales for November 2023 rose 5.3% yoy to $48 billion. That was a 2.9% improve as in comparison with October gross sales.

SIA president and CEO John Neuffer stated:

World semiconductor gross sales elevated on a year-to-year foundation in November for the primary time since August 2022, a sign that the worldwide chip market is constant to realize power as we enter the brand new yr. Trying forward, the worldwide semiconductor market is projected to expertise double-digit progress in 2024.

Buyers clearly have numerous selections in learn how to take part on this market: they’ll put money into single semiconductor corporations, a extra diversified ETF strategy, or each (my private alternative). Right this moment I am going to analyze the SMH ETF after which you’ll be able to resolve what technique is finest in your portfolio.

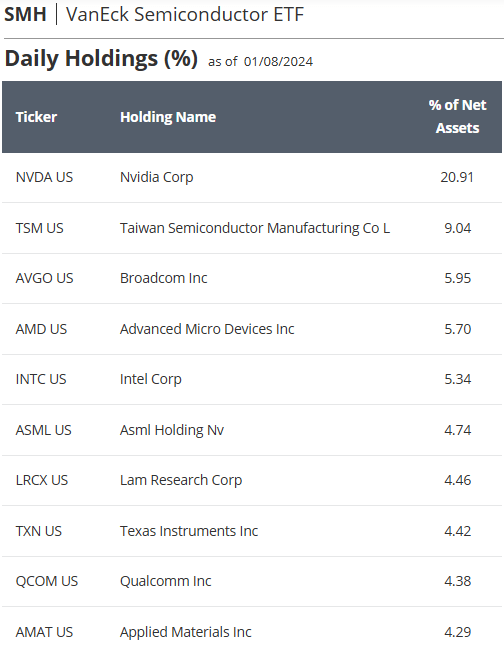

Prime-10 Holdings

The highest-10 holdings within the SMH ETF are proven beneath and have been taken instantly from the VanEck SMH ETF webpage, the place you will discover extra detailed data on the fund:

VanEck

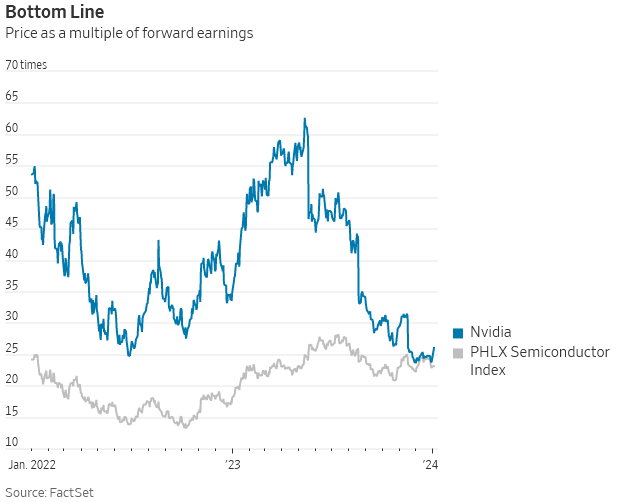

As talked about earlier, the #1 holding with a 20.9% weight is Nvidia. Regardless of all of the chatter about Nvidia’s “sky-high valuation”, a latest article within the Wall Avenue Journal at this time factors out that, on a ahead earnings foundation, the inventory is definitely not considerably over-valued as in comparison with broad semiconductor sector as measured by the Philadelphia Semiconductor Index (see What Nvidia Does For An Encore):

Wall Avenue Journal

That’s as a result of Nvidia’s data-center income is booming and, in consequence, so is its free-cash-flow. Certainly, the article factors out that over the previous 4-quarters, Nvidia has generated $17.5 billion in FCF – tying with it with Broadcom as the best within the chip sector (this in line with knowledge from S&P World Market Intelligence).

Meantime, Nvidia inventory has traded strongly this week and reached an all-time excessive after unveiling the brand new GeForce RTX 40 SUPER Collection household of GPUs. The brand new RTX 4080 SUPER be obtainable beginning on Jan seventeenth and can retail for $999 – $200 lower than the RTX 4080.

The #2 firm within the SMH ETF is arguably the #1 semiconductor producer on the planet: Taiwan Semiconductor Corp (TSM), or, extra continuously known as “TSMC”. As , TSMC is the corporate that truly manufactures the highest-end highest-performance chips that main tech corporations like Nvidia, Apple, and Broadcom design. But TSMC at the moment trades with TTM P/E of solely 18.6x, which is a moderately outstanding and vital low cost to the S&P500 (25.7x).

One in every of my favourite shares within the semiconductor sector, Broadcom (AVGO), is the #3 holding with a 6.0% weight. Broadcom is arguably the chief within the world high-speed networking market (though Nvidia actually has its eyes set on gaining vital market-share …) and has been rising organically but additionally main by M&A. It is most up-to-date acquisition was VMWare (see Broadcom: The Magnificence Inside And Why VMWare Will Add To It). You will need to perceive that Broadcom has a partnership with Nvidia that allows VMWare’s full-stack software program resolution to run Nvidia AI software program and {hardware}.

Broadcom inventory is +85% over the previous yr and at the moment trades at over $1,000/share, making it a possible candidate for a 20:1 inventory cut up this yr (ala Google and Amazon within the latest previous).

Whereas Nvidia could match Broadcom’s FCF, it is not shut by way of its dividend (Nvidia solely pays $0.16 yearly). In any case, as I’ve been reporting on Searching for Alpha, Broadcom has been the very best dividend progress firm in the complete S&P500 over the previous 5-years. AVGO’s newest quarterly improve was 14% to $5.25, or a whopping $21.00/share on an annual foundation. Regardless of AVGO’s massive inventory run, that’s nonetheless ok for a close to 2% yield.

The fund additionally has ~11% allotted to Intel (INTC) and AMD (AMD), each of whom try to carve out their very own niches within the AI area. AMD introduced the brand new Radeon RX 6700 XT graphics card on the Client Electronics Present Monday. The inventory is up ~9% over the previous 5 buying and selling days.

The semiconductor gear makers are nicely represented within the top-10 holdings with ~17.5% of the portfolio allotted to ASML Holdings (ASML), Lam Analysis (LRCX), and Utilized Supplies (AMAT). All of those semi-equip corporations have wonderful progress prospects with the diversification and on-shoring of essential supply-chains away from China in addition to the endless quest within the business for higher-performance and lower-power semiconductor processes and options.

Efficiency

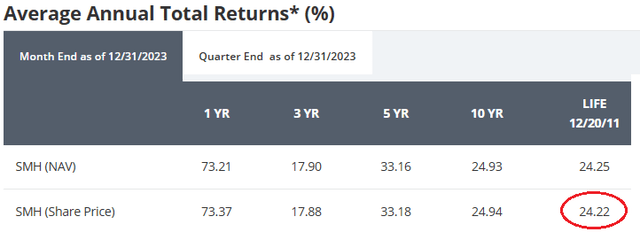

As talked about earlier, the SMH ETF has been a terrific performer for years. The typical annual returns chart beneath exhibits why the fund carries an general, 3-year & 5-year 5-Star score from Morningstar:

VanEck

As you’ll be able to see from the graphic, the fund has a mean annual return over the lifetime of the fund (since 2011) of a outstanding 24.2%.

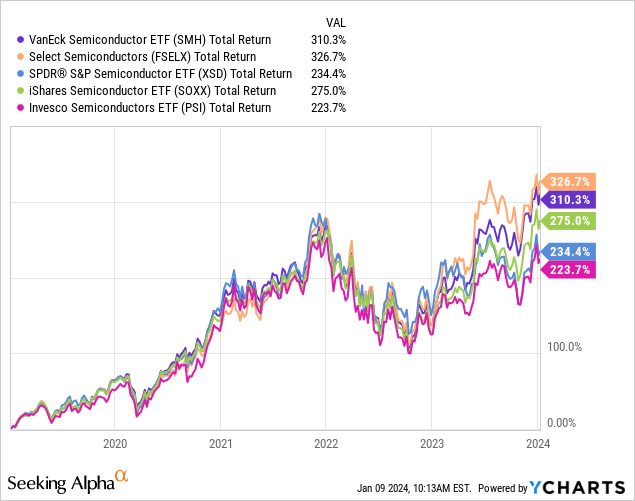

The graphic beneath compares the 5-year efficiency of the SMH ETF to a few of its friends: the Constancy Choose Semiconductors ETF (FSELX), the SPDR S&P Semiconductor ETF (XSD), the iShares Semiconductor ETF (SOXX), and the Invesco Semiconductors ETF (PSI):

As you’ll be able to see, the SMH ETF has acquitted itself fairly nicely, solely lagging the chief – FSELX – by 16% whereas considerably outperforming all the different friends proven on this comparability. Word the home semiconductor funds don’t maintain Taiwan Semiconductor inventory. Contemplating TSMC is arguably the chief in semiconductor manufacturing, that may be a main benefit of ETFs like SMH. FSELX, for instance, additionally has a place in TSMC (5.4%) and a bigger place in NVidia as in comparison with SMH (26%).

Dangers

SMH’s expense price is 0.35%, which is mostly greater than I wish to spend on funds. Nonetheless, on this case it’s nicely price it given the fund’s wonderful long-term efficiency monitor file.

Because the charts above demonstrated, semiconductor funds might be very risky. They will commerce off of geopolitical occasions, the rise/fall of the U.S. greenback (it was a rising U.S. greenback that helped sink SMH over 20% in Q2FY2022), and the well being (or perceived well being) of the general tech-sector. That being the case, I strongly advise traders who wish to set up a place within the fund to scale-in over time in order to not purchase at market tops and to benefit from market volatility. For instance, it took me ~2 years to ascertain a full-position in SMH, and I nonetheless add from time-to-time on dips.

The ETF’s 9% stake in TSMC is clearly considerably dangerous given China’s militaristic perspective towards Taiwan. That stated, an assault on Taiwan would doubtless render TMSC’s fabs completely ineffective as a result of not solely would they doubtless undergo extreme bodily injury, however the crops are additionally not price something with out the know-how of the Taiwanese engineers that handle and function it.

As latest warnings by corporations like Micron (MU) and Samsung (OTCPK:SSNLF) recommend, there’s nonetheless some weak spot and stock flushing that should happen within the reminiscence market. Samsung just isn’t at the moment held within the fund and the allocation to Micron in SMH is simply 2.07%.

SMH is a big and standard fund with $11+ billion in property below administration. That being the case, there are not any liquidity points in any way.

From a valuation perspective, Yahoo Finance reports the SMH ETF at the moment trades with a TTM P/E of solely 14.8x and a dividend of 0.60%. That stated, the first funding alternative with the SMH ETF is clearly capital appreciation, not earnings. Meantime, I do not pay an entire lot of consideration to short-term valuation metrics on an ETF like SMH as a result of, as acknowledged earlier than, I think about SMH to be the form of core long-term holding a well-diversified portfolio should purchase and maintain. And after I say “purchase”, once more, I counsel traders to scale-in over time (or “greenback price common” if you happen to choose) to benefit from market volatility – and to take action by the semiconductor cycle when valuation ranges as reported by P/E can rise and fall moderately dramatically. Right this moment the P/E is comparatively low as a result of we’re arguably popping out of considerably of a down-cycle – regardless that it didn’t impression all corporations equally.

Abstract & Conclusion

The SMH ETF is a superb means for traders to realize diversified publicity to the highest semiconductor corporations on the planet. That stated, if you have already got a place in Nvidia, and given its 20% weight in SMH, I recommend the XSD equal weight semiconductor ETF as a greater different for these wanting to construct a extra well-diversified strategy (see XSD: “Xtra” Semiconductor Diversification). No matter the way you wish to play it, I strongly advise all traders to have some direct publicity to the dynamic and really profitable semiconductor sector.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.