PhonlamaiPhoto

To be of fine high quality, it’s a must to excuse your self from the presence of shallow and callow minded people.”― Michael Bassey Johnson.

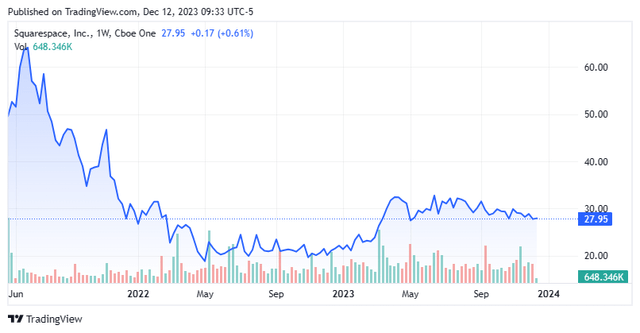

At this time, we put Squarespace, Inc. (NYSE:SQSP) within the highlight. The inventory has not but lived as much as the hyperbole that accompanied its public debut on the markets within the spring of 2021. Nevertheless, the corporate is delivering gross sales progress within the mid-teens and shifting shortly to profitability. Are the shares now within the “purchase zone”? An evaluation follows beneath.

In search of Alpha

Firm Overview:

Squarespace is headquartered in New York Metropolis and got here public in the course of the 2020/2021 IPO/SPAC craze, largely fueled by the straightforward cash insurance policies of the Federal Reserve on the time. The corporate has developed and operates a platform for companies and impartial creators to construct on-line presence, develop their manufacturers, and handle their companies throughout the Web. Squarespace permits clients to construct web sites and different capabilities to promote merchandise in addition to offering hosting providers. The corporate’s imaginative and prescient is to offer entrepreneurs with a single on-line hub for all their web-based wants. The inventory presently trades simply over $27.00 a share and sports activities an approximate market capitalization of $3.8 billion.

Third Quarter Outcomes:

Squarespace posted its Q3 numbers on November seventh. The corporate delivered a GAAP lack of 12 cents a share. Revenues rose simply over 18% on a year-over-year foundation to $257.1 million, some $5 million above expectations. $12 million of income was the results of value will increase. Annual run price income or ARRR additionally elevated 18% yr over yr to $1,013.5 million in 2023. It was the primary time ARRR exceeded the $1 billion mark. Adjusted EBITDA got here in at $66.5 million, considerably above the $43.7 million from the identical interval a yr. Distinctive subscriptions rose 5 % to 4.4 million, whereas the corporate’s common income per person or ARPU was up 10% to $226.05.

Administration raised FY2023 gross sales steerage barely to Income of $1,002 million to $1,006 million. Management additionally sees unlevered free money circulate of $232 million to $236 million on a non-GAAP foundation.

Analyst Commentary & Stability Sheet:

The analyst neighborhood is presently not sanguine about Squarespace’s present prospects in the intervening time. Since third quarter outcomes hit the wires, 5 analyst corporations together with Barclays and Oppenheimer have reissued Maintain/Impartial rankings on the inventory. Worth targets proffered vary from $32 to $34 a share. William Blair, Financial institution of America ($35 value goal), Citigroup ($40 value goal) and D.A. Davidson have maintained their Purchase rankings on Squarespace.

Roughly six % of the excellent float within the shares are presently held quick. A number of insiders have been frequent, constant and enormous sellers of the inventory in 2023 thus far. Thus far simply within the fourth quarter they’ve disposed of slightly below $9 million price of fairness collectively. As well as, a promoting stockholder supplied up six million shares in mid-November by way of a secondary providing. An identical occasion occurred in September as properly.

Squarespace ended the third quarter with simply over $215 million price of money and marketable securities on its stability towards some $580 million of debt. Administration has guided that it sees internet curiosity expense on this internet debt (after tax advantages) of between $26 million and $27 million. Squarespace delivered $53 million price of working money circulate within the third quarter, up 29% from 3Q2022.

Verdict:

The corporate misplaced a $1.80 a share in FY2022 on $867 million price of revenues. The present analyst agency consensus has Squarespace delivering a small revenue of seven cents a share in FY2022 on gross sales rise 15% to $1.01 billion. They undertaking comparable gross sales progress in FY2024 leading to earnings of 43 cents a share.

Squarespace, Inc. is delivering stable income progress. Nevertheless, the shares commerce at 3.8 instances 2023’s projected gross sales and 65 instances FY2024E earnings per share. The inventory is appreciable cheaper on an operational money circulate yield foundation, it ought to be famous.

Competitor Wix.com Ltd. (WIX) is seeing income progress within the low teenagers. Nevertheless, that firm is already very worthwhile, and the inventory trades at underneath 23 instances FY2024E earnings per share and with an identical value to gross sales ratio as Squarespace, in method of comparability. Wix’s stability sheet can be in a lot better form. Add within the appreciable insider promoting within the shares in SQSP, the advice is to move on any funding at the moment.

Few delights can equal the mere presence of 1 whom we belief totally.”― George MacDonald.