asbe

A Purchase Ranking for Silvercorp Metals Inventory

To learn from the rise in silver costs from the present $23.11 per ounce to $25.52/oz., which Trading Economics analysts predict inside 12 months, retail traders might wish to contemplate shares of the Canadian mining producer in China, Silvercorp Metals (NYSE:SVM) quite than a direct funding within the bodily metallic because the latter generally requires funds past the aptitude of retail traders.

To this finish, the fast-growing, long-life, and intensely low-cost manufacturing in China’s big adopter on the earth of silver-based photo voltaic panel know-how to facilitate the power transition defines a major upside potential for the funding in SVM, as earnings, that are the principle driver of the inventory value, will almost certainly be revised upward in anticipation of the following anticipated silver bull market.

The Outlook for Silver Costs

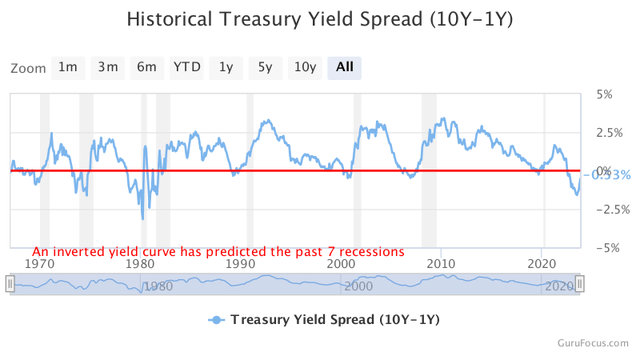

Silver costs are anticipated to expertise a bull market: fearing devaluation results on their portfolios as a result of financial recession predicted to happen as early as 2024 by economists and the U.S. Treasury bond’s inverted yield curve, traders will flock to silver to make the most of its secure haven properties towards the headwinds. It’s no coincidence that silver is taken into account the poor man’s gold. The situation will create upward strain on silver costs.

Outstanding economists supporting the thesis of an financial recession on account of essentially the most aggressive rate of interest hikes for the reason that 2007-2008 monetary disaster to curb the best inflation in additional than 40 years embody Michael Pearce, the lead U.S. economist at Oxford Economics, Chryssa Halley, the CFO of the US Federal Nationwide Mortgage Affiliation (Fannie Mae), and David Rosenberg, economist of Rosenberg Analysis. The previous US Treasury Secretary’s voice was just lately added to the choir. In accordance with Larry Summers, a mushy touchdown is unlikely, however a recession will happen in 2024.

The inverted US Treasury yield curve, with the one-year US Treasury yield presently exceeding the 10-year US Treasury yield (5.416% vs. 4.845%), continues to counsel a deterioration within the US financial cycle. Underneath regular circumstances, the one-year yield needs to be decrease as a result of a shorter time period carries much less threat of default and is subsequently compensated by a decrease yield. So, if, as GuruFocus.com’s chart exhibits, the 1-year yield is as an alternative increased than the 10-year yield, then the brief time period is seen as riskier by traders, which might be an indication that dangerous climate is simply across the nook.

Supply: GuruFocus.com

Silvercorp Metals and Its Relationship to the Market Value of Silver

The corporate additionally produces gold, albeit in small portions, and different base metals which might be important in lots of sectors of the financial system, reminiscent of the development business, which is a mainstay of the Chinese language financial system.

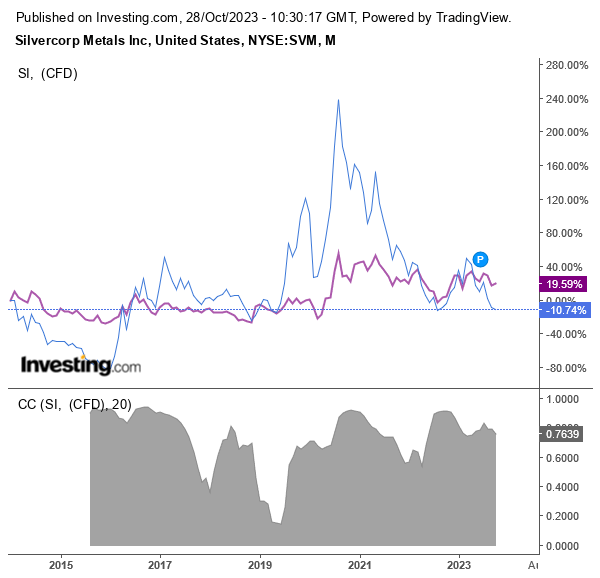

Nevertheless, main manufacturing consists of portions of silver ounces, the worth of which is measured within the under chart from Investing.com utilizing silver futures (purple line).

So, a rising silver value ought to possible be adopted by a rise in SVM’s share value, and the sturdy constructive correlation that has existed between the 2 previously, which is illustrated within the Investing.com chart within the part under with a totally grey space and above zero, permits this evaluation to find out that the dynamics have a really excessive likelihood of manufacturing the specified impact.

Supply: Investing.com

Based mostly on a linear mannequin the place the SVM inventory return over the previous 52 weeks represents the output and the silver futures return over the previous 52 weeks represents the enter, the evaluation concluded that the SVM inventory will rise on common as a lot because the silver value.

The mannequin has a coefficient of willpower of roughly 40%, which is suitable as a measure of the representativeness of the hypothesized relationship between silver and SVM. It signifies that the change in silver value determines 40% of SVM’s share value. The previous 52 weeks have been thought-about a enough interval to review the cause-and-effect relationship, as markets are more likely to look the identical for the foreseeable future as a result of impression of roughly the identical geopolitical and macroeconomic circumstances.

Silvercorp Metals’ Operations Are Positioned in China

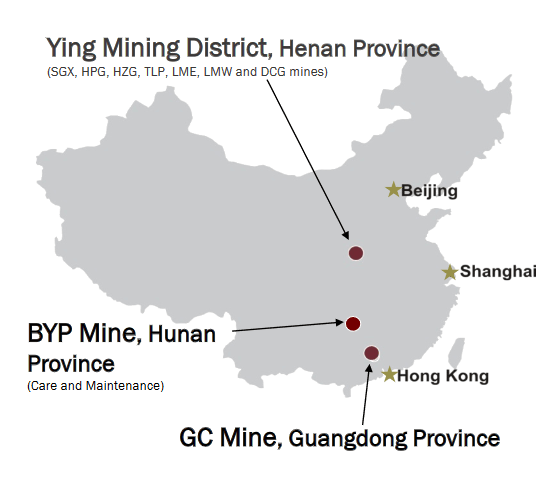

Silvercorp Metals Inc. presently produces the metals from two underground mines within the Individuals’s Republic of China:

- The Ying Undertaking is positioned within the Ying Mining District of Henan Province.

Throughout H1 of fiscal 2024 (ended September 30, 2023), the mine produced 3.103 million ounces of silver (down 7.5% YoY), 4,010 ounces of gold (up 74.3% YoY), 30.4 million kilos of lead (down 7.7% YoY), and 4.31 million kilos of zinc (up 10.4% YoY).

In the course of the first quarter of fiscal 2024 (ended June 30, 2023), the mine produced 1.597 million ounces of silver, 1,552 ounces of gold, 15.382 million kilos of lead, and a pair of.113 million kilos of zinc.

Silver manufacturing elevated 60.2% for the reason that fourth quarter of fiscal 2023 (ended March 31, 2023) and was barely decrease in comparison with prior-year quarter when the miner produced virtually 1.7 million ounces.

On a sequential foundation, lead, zinc, and gold rose 59%, 81.5%, and 55.2% respectively. On a year-over-year foundation, lead fell barely by 8%, whereas zinc rose by 9.6% and gold rose by 41.1%.

Silver and lead manufacturing within the Ying Mining District was anticipated to be decrease than final 12 months attributable to briefly decrease grades within the producing deposit, in keeping with the mining sequence and mineral reserves.

All-in sustaining value per ounce of silver (AISC/oz.), internet of by-product credit, was $7.14 in Q1-fiscal 2024, a major enchancment in comparison with the prior quarter when AISC/ounce was $11.33 and in comparison with the prior 12 months quarter when AISC was $8.60.

- The Gaocheng (GC) mine is positioned in Guangdong Province.

Throughout H1 of fiscal 2024 (ended September 30, 2023), the mine produced 267k ounces of silver (down 12.5% YoY), 3.481 million kilos of lead (down 16.2% YoY), and seven.112 million kilos of zinc (down 21% YoY).

The decrease manufacturing was brought on by disruptions because the native provincial authorities has been busy enhancing the native energy grid infrastructure and subsequently a number of corporations in the identical space, not simply Silvercorp Metals, have been affected by the non permanent shutdown.

In the course of the first quarter of fiscal 2024 (ended June 30, 2023), the mine produced 183k ounces of silver, 2.434 million kilos of lead, and 4.708 million kilos of zinc.

Silver manufacturing elevated 68% for the reason that fourth quarter of fiscal 2023 (ended March 31, 2023) and elevated by 11.6% over the prior-year quarter when the miner produced 164k ounces.

On a sequential foundation, lead and zinc rose 94.7%, and 95.1% respectively. On a year-over-year foundation, lead rose barely by 2.7%, whereas zinc declined barely by 5.8%.

All-in sustaining value per ounce of silver (AISC/oz.), internet of by-product credit, was $9.51 in Q1-fiscal 2024, a deterioration in comparison with the prior quarter when AISC/ounce was $5.93 and in comparison with the prior 12 months quarter when AISC was unfavorable $7.48.

Supported by pleasant Chinese language laws, significantly for the mining of power transition metals, and aided by the presence of infrastructure and communications hyperlinks, these mines have been capable of deliver over 90 million ounces of silver and greater than 1.3 billion kilos of result in the native market over the previous 17 years, serving to the corporate generate complete earnings of greater than $520 million.

Supply: Firm’s October 2023 Presentation

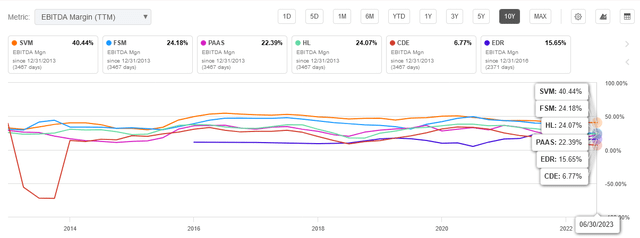

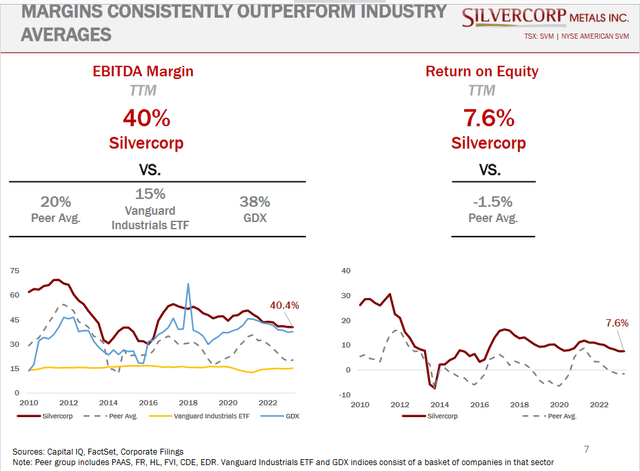

Greater than 2,605 km of profitable drilling and greater than 835 km of tunneling accomplished at Ying and GC since 2004 have outlined a portfolio of operations that has outperformed each Silvercorp Metals Inc.’s most direct opponents and the general silver mining business for a number of years when it comes to profitability.

Supply: Searching for Alpha

The screenshot from the corporate’s October 2023 presentation exhibits that Silvercorp Metals Inc. has virtually all the time been a winner in comparison with a whole company sector represented by Vanguard Industrials Index Fund (VIS) and VanEck Gold Miners ETF (GDX).

Supply: Firm’s October 2023 Presentation

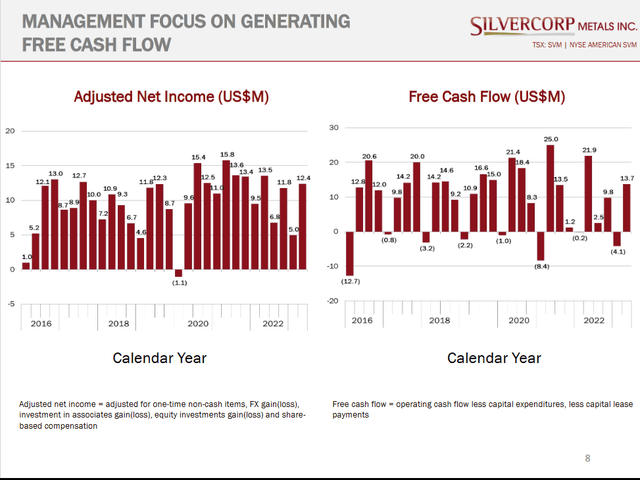

Excessive returns from low-cost, debt-free silver equal and lead manufacturing generated constant free money circulation over time, which Silvercorp Metals Inc. used to fund annual manufacturing development, now focusing on roughly 8 million equal ounces per 12 months by fiscal 2026 (calendar 12 months 2025) in comparison with the 6.6 million ounces produced in fiscal 2023.

Supply: Firm’s October 2023 Presentation

The Monetary Situation and the Fairness Investments Portfolio

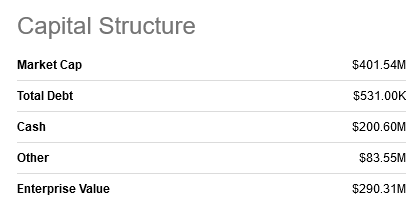

As of June 30, 2023, Silvercorp Metals Inc.’s steadiness sheet regarded sturdy, with $200.6 million in money and short-term investments, whereas there was no debt.

The Altman Z Rating of 4.51 (scroll down this Searching for Alpha web page to the “Threat” part of this web site) means that Silvercorp Metals Inc. has no likelihood of going bankrupt inside a number of years.

The Altman Z Rating predicts the likelihood that an organization will go bankrupt inside a number of years. A price under 1.8 signifies that the corporate is in monetary misery and is probably going going through chapter. Firms with a rating between 1.8 and three are grayed out and the chance of chapter varies from reasonably excessive to reasonably low, whereas corporations with scores above 3 are unlikely to go bankrupt.

The corporate additionally has shares in different corporations, with the most important holding being a 27.5 % stake in New Pacific Metals Corp. (NEWP) (NUAG:CA) fairness value about $75.83 million as of this writing. New Pacific Metals Corp is a Canadian exploration firm in Bolivia whose initiatives, significantly the wholly-owned flagship Silver Sand mission, which is focusing on 14 years of mid-level manufacturing, have very attention-grabbing development prospects as sturdy fundamentals are anticipated to maintain silver costs above the historic common value of $21/oz.

The portfolio of fairness investments additionally consists of 15% of OreCorp Restricted’s issued shares, however Silvercorp Metals Inc. desires to amass 100% possession of the Australian mineral explorer and the plan requires Silvercorp Metals to pay A$0.15 in money along with A$0.45 in Silvercorp share for every OreCorp share.

OreCorp. is the developer of the Nyanzaga gold mission within the Lake Victoria goldfields of Tanzania. The goal is to provide gold at a charge of 213,000 ounces per 12 months and an AISC of roughly $954 per ounce. Or a complete of two.56 million ounces of gold over all the operational lifetime of the longer term gold deposit, which is estimated to be 12 years.

The Inventory Valuation

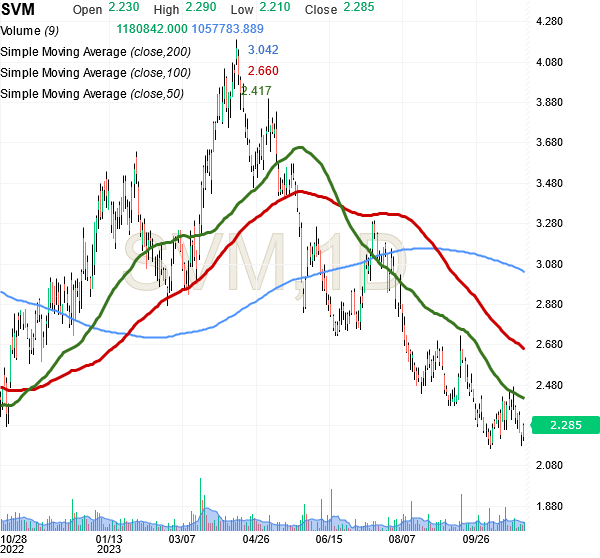

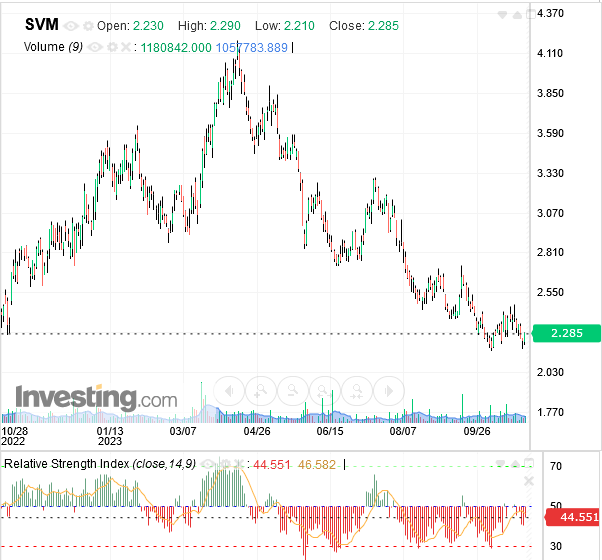

As of this writing, Silvercorp Metals shares, $2.285 apiece, are buying and selling:

- 25% under the 200-day easy shifting common of $3.042.

- 14.1% under the 100-day easy shifting common of $2.660.

- 5.5% under the 50-day easy shifting common of $2.417,

Because the chart under from Investing.com signifies.

Supply: Investing.com

Shares have additionally fluctuated between a low value of $2.17 and a excessive value of $4.20 over the previous 52 weeks, and presently, they’re additionally considerably under the center level of $3.185 of the 52-week vary.

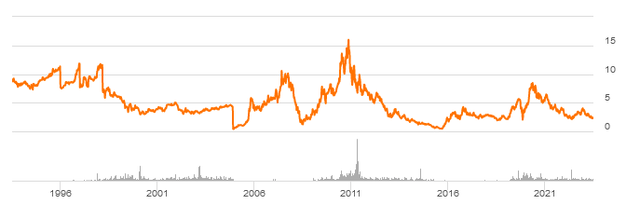

These costs are even traditionally low, whereas the corporate’s development prospects are based mostly on strong foundations.

Supply: Searching for Alpha

In comparison with the expansion prospects analyzed on this article, shares are objectively cheaper, so retail traders might wish to buy inventory in SVM from these value ranges given the estimated bullish sentiment for the silver value.

Nevertheless, shares might be getting cheaper as the next chart of the 14-day Relative Power Indicator at 44.55 (versus the oversold stage of 30) exhibits that there’s nonetheless loads of room for additional draw back.

Supply: Investing.com

Though SVM shares have declined considerably since early April 2023 attributable to sturdy headwinds from China’s actual property sector, the Fed’s “increased for longer” rate of interest stance might quickly additional tighten the atmosphere for US-listed shares and trigger SVM shares to go down a bit bit extra. There’s a sturdy likelihood of this situation.

The annual “core” PCE ex. Meals and Power – the Federal Reserve’s most well-liked inflation indicator – stays strong and above the two % goal. Due to this fact, further Fed charge hikes, as hinted at within the Fed Chair’s October 19 speech, are gaining momentum quite than truly fizzling out.

Pending recessionary headwinds to behave as a catalyst for increased silver costs, one other charge hike, which doesn’t bode nicely for US-listed shares, may put sturdy downward strain on SVM shares as nicely within the mild of a 24-m beta market of 1.6x (scroll down this Searching for Alpha web page to the “Threat” part of this web site).

Retail traders might wish to watch for a decrease share value earlier than implementing a purchase ranking.

Aswath Damodaran, professor of enterprise economics and fairness valuation at New York College’s Stern Faculty of Enterprise, says non-gold valuable metals and minerals shares ought to have an EBITDA a number of no increased than 6.97x to be thought-about pretty valued on the inventory market.

Silvercorp Metals Inc. has the next Enterprise Worth (EV) equation: The EV of $290.31 million is the same as the market cap of $401.54 million plus complete debt of $531k, plus different of $83.55 million, minus money of $200.60 million.

Supply: Searching for Alpha

Silvercorp Metals Inc. has a TTM EBITDA of about $82.7 million resulting in an EV/12-M EBITDA ratio of three.5x, which is under Aswath Damodaran‘s threshold of honest worth.

These market value ranges may already present an attention-grabbing entry level for SVM shares, however because the shares may get even cheaper, the retail investor might wish to wait till extra engaging entry factors emerge.

There’s a threat that shares is not going to get cheaper from present ranges, however the Fed’s unfriendly angle in direction of US-listed shares makes that threat bearable for now.

The inventory pays a dividend, however it’s small, about $0.01 semi-annually per frequent share, which interprets to an annualized dividend yield of 0.87% as of this writing.

The identical issues apply to shares of the inventory in Silvercorp Metals Inc. traded on the Toronto Inventory Trade.

On the Toronto Inventory Trade, beneath the [TSX:SVM:CA] image, shares have been buying and selling at CA$3.15 per unit as of this writing for a market cap of CA$556.98 million. Shares are buying and selling considerably under the 200-day easy shifting common of CA$ 4.10 and under the 50-day easy shifting common of CA$ 3.30.

Shares are additionally under the center level of CA$ 4.285 within the 52-week vary of CA$ 2.98 to CA$ 5.59. On prime of this, the 14-day RSI’s pattern of 46.4 means that shares have loads of room for draw back in a high-interest charge atmosphere so there’s a good likelihood they are going to be extra compellingly appraised by the marketplace for a Purchase ranking.

Conclusion

Shares of Silvercorp Metals Inc. have a “Purchase” ranking. however traders might wish to maintain off on implementing the ranking for a short while as shares may grow to be cheaper (relative to development prospects) beneath the Fed’s “increased for longer” rate of interest coverage.

However this inventory is unquestionably a purchase, as its very sturdy portfolio of long-life, high-margin metals mining operations has laid a strong basis to profit dramatically from the anticipated bull market in silver costs.

The catalyst of the bull market would be the recession.