- SHIB led the newest memecoin rally amid general altcoin market optimism

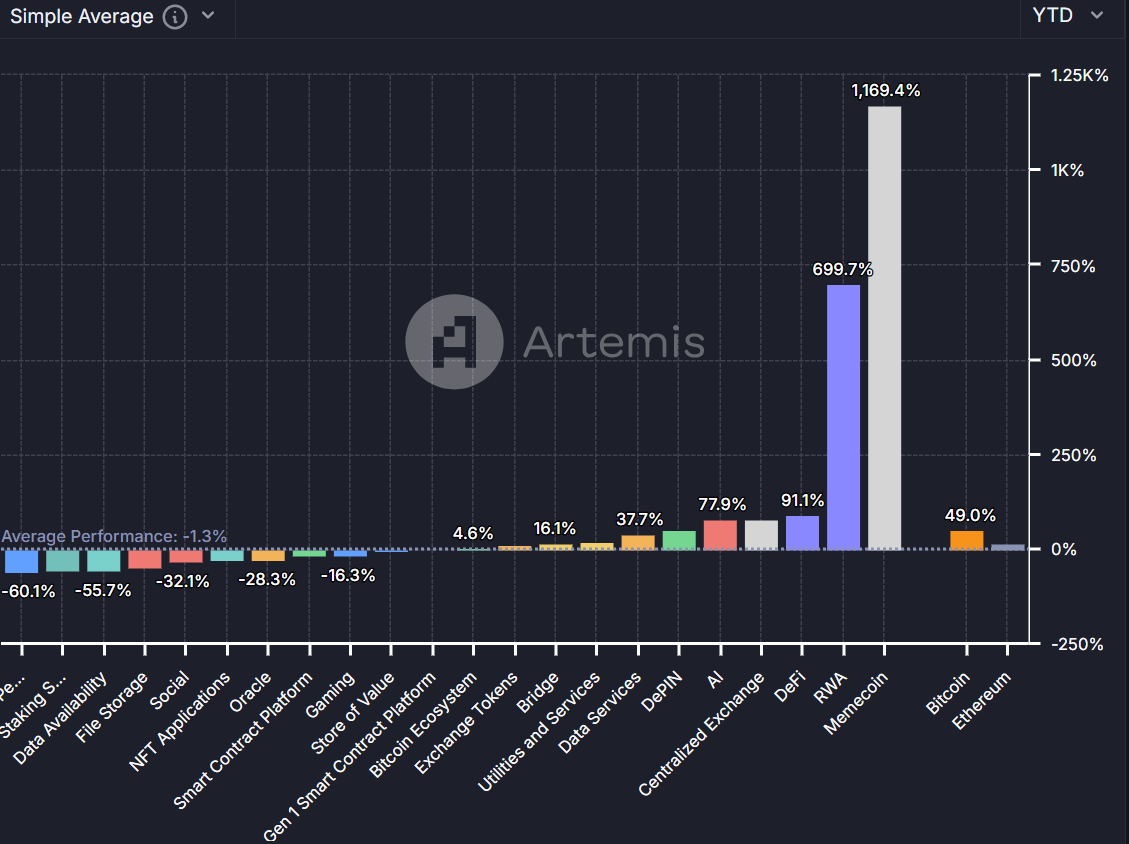

- Memecoins was the top-performing phase on a YTD foundation

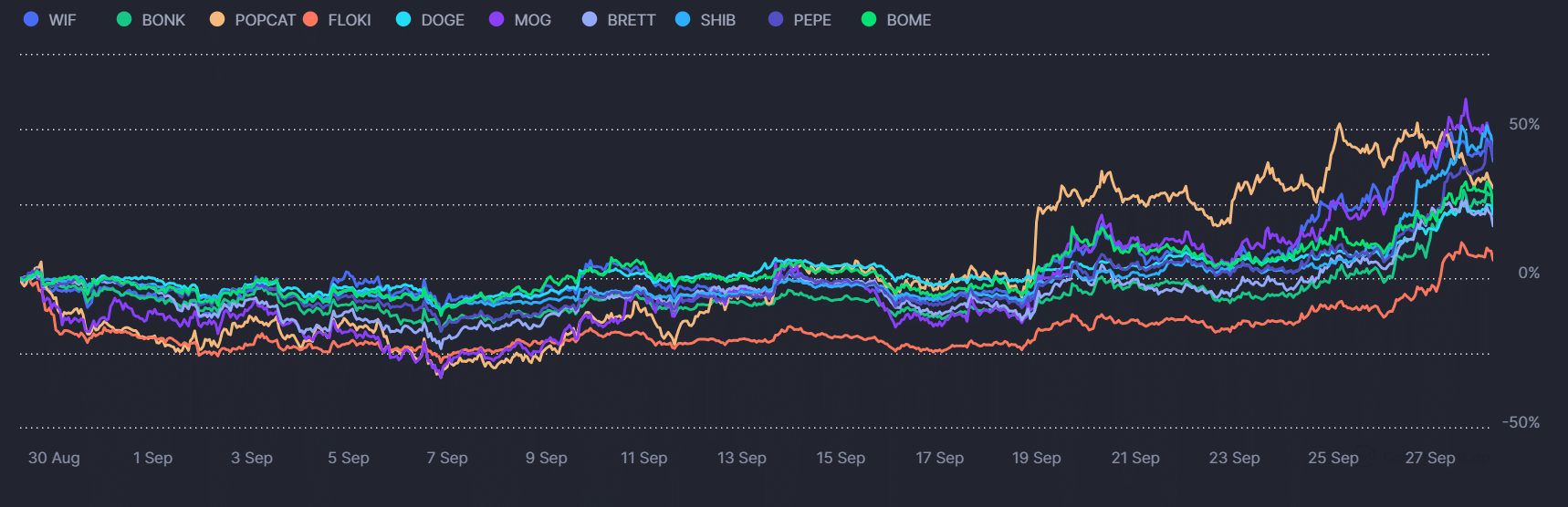

The altcoin sector has seen robust good points for the reason that Fed pivot in mid-September, reinforcing the market’s conviction of an early innings into the much-awaited alt season. Nonetheless, a well-known development gave the impression to be transpiring at press time — Memecoin dominance.

Glassnode’s founders noted the identical, claiming that memecoins took the lead within the early alt season. In doing so, they highlighted dogwifhat [WIF], Shiba Inu [SHIB], and Pepe [PEPE] exhibiting robust momentum.

“We simply entered Altcoin Season 5 days in the past, and we’re already selecting up robust momentum on #memecoins.”

SHIB leads memecoin rally

Supply: CoinMarketCap

As of 27 September, 8 of the highest 10 memecoins, together with SHIB, WIF and MOG, had double-digit good points between 25% and 50% over the previous 30 days of buying and selling. SHIB was an outlier throughout this week’s rally too, with the identical climbing by 40%.

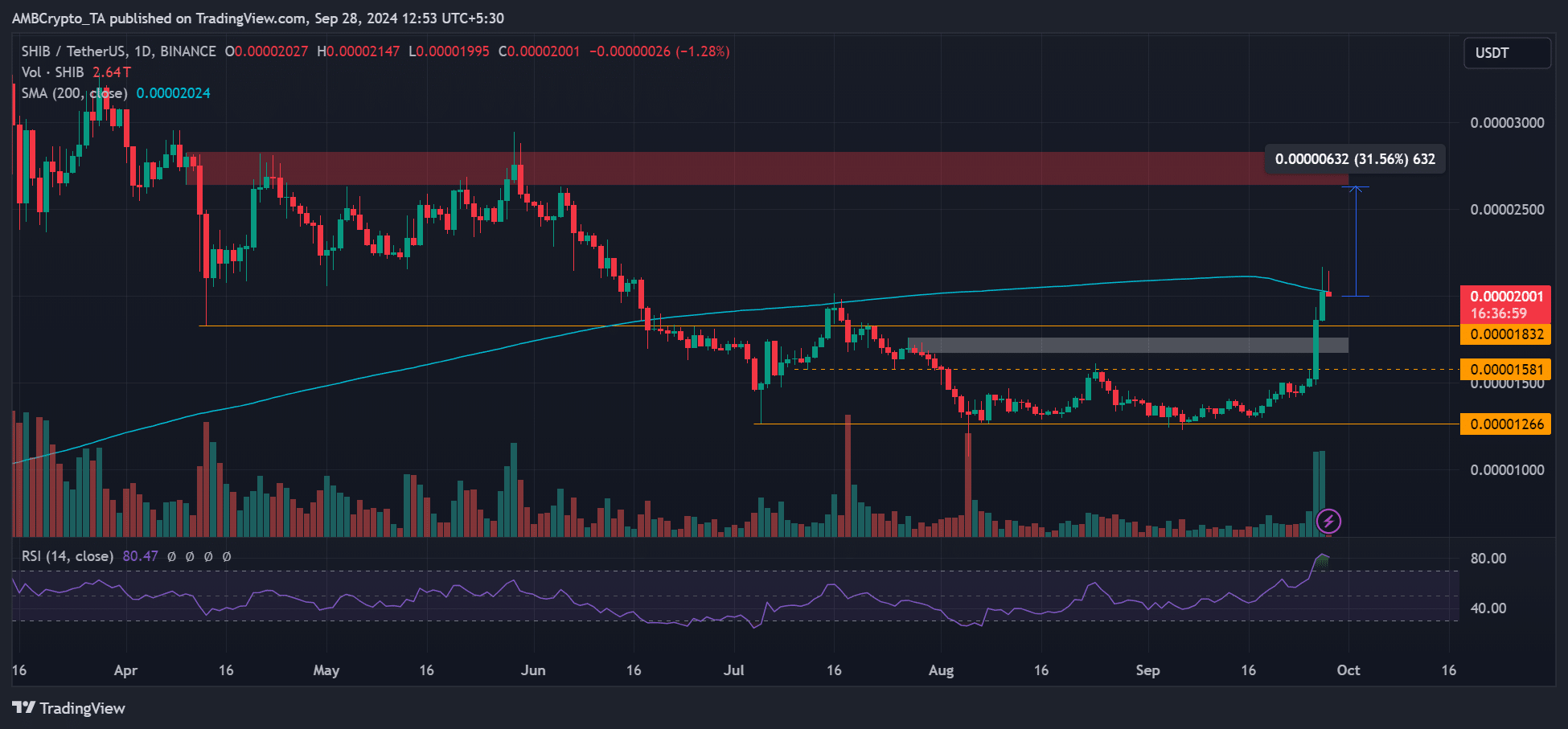

At press time, SHIB’s rally had cooled off barely across the 200-day MA (Transferring Common). Additionally, the RSI flashed overbought situations.

Supply: SHIB/USDT, TradingView

Nonetheless, relative to different classes, there was stronger speculative market curiosity in memecoins, which may enhance the sector.

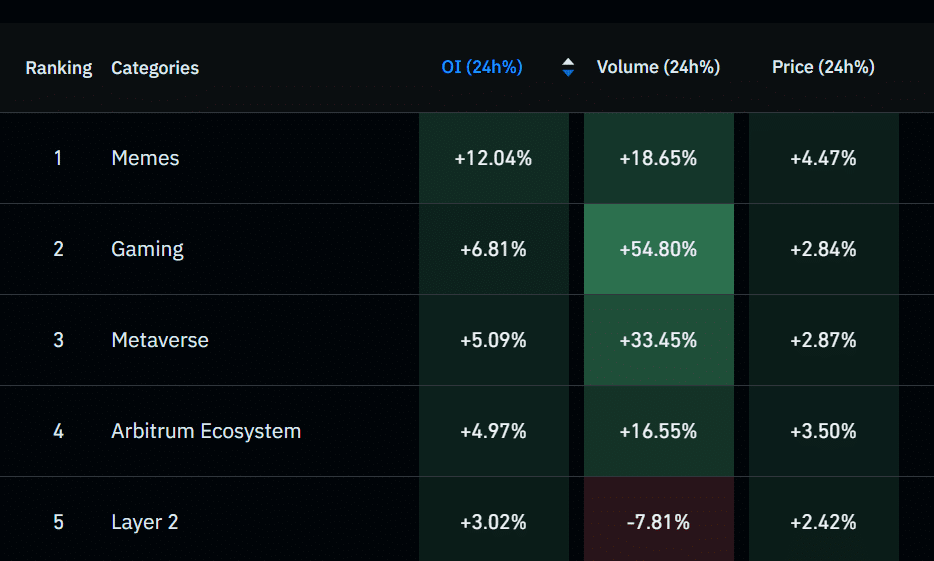

Based on Coinglass, memecoins had been ranked first (12%) in Open Curiosity (OI) previously 24 hours. That was about double the market curiosity within the second-ranking sector – Gaming – with a determine of 6.8%.

Memecoins additionally ranked third in quantity over the identical interval. This underscored robust liquidity injection and speculators within the phase over the weekend.

Supply: Coinglass

This large speculative fervor in memecoins may reinforce its market dominance once more in Q3. In H1 2024, the sector was a high performer, eclipsing even Bitcoin [BTC] in good points.

On the time of writing, the phase had the best good points on a YTD (year-to-date) foundation, with whopping 1160% returns.

Supply: Artemis