FG Commerce

Thesis

Within the subsequent six months, life insurer Vericity, Inc. (NASDAQ:VERY) will merge and change into half of a bigger entity. Shareholders want to find out whether or not it’s worthwhile ready for the closing or to promote now (or sooner). By my calculations, many will come out barely forward by holding and ready for the closing.

About Vericity

This life insurance coverage firm differentiates itself partially by focusing on middle-income Individuals, which it characterizes as home households with annual incomes ranging between $50,000 and $125,000.

In accordance with the third-quarter 2023 10-Q, it operates by way of two subsidiaries, Constancy Life, an insurance coverage provider, and eFinancial, a name center-based company. The latter sells Constancy life merchandise, in addition to the insurance policies of unaffiliated carriers.

The present iteration of Vericity was created in 2019, when it went by way of a demutualization and have become publicly traded. On the time of the IPO, the inventory was valued at $10.00.

Merger

On October 3, 2023, the corporate introduced that it will merge with iA American Holdings, Inc., a subsidiary of the Canadian insurer, iA Monetary Company (IAG:CA). The mother or father firm historically has been generally known as Industrial Alliance, therefore the iA identify.

A press release saying the merger reported that the all-cash deal was value $170 million and was anticipated to shut someday within the first half of 2024. The transaction had been accepted by a majority of shareholders and the board of Vericity.

Assuming the merger closes as anticipated, every share might be transformed into $11.43 in money; the closing worth on Thursday, December 21 was $11.14. When closure happens, Vericity might be delisted and deregistered.

iA famous within the 10-Q that closing circumstances included a ready interval as dictated by laws, receipt of regulatory approvals, and compliance by Vericity to its covenants.

The corporate going ahead might be iA American, which isn’t any shock given the distinction in measurement. The mother or father iA firm has a market cap of $9.05 billion, whereas Vericity has a cap of $165.86 million.

Vericity financials

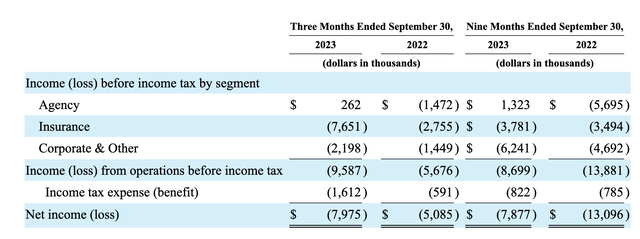

This consolidated returns earnings assertion from the 10-Q signifies why Vericity may need wished or wanted the merger:

VERY Consolidated Outcomes (VERY 10-Q)

Getting extra granular, Vericity had complete revenues of $175 million on a TTM foundation, up from $163.9 million in 2022 and down from $176.6 million in 2021.

Whole working bills had been $190.6 million, leaving a $15.6 million TTM loss in working earnings. That compares to losses of $22.6 million in 2022, $17.0 million in 2021

EPS is equally disappointing, with a TTM diluted EIPS of minus $1.03 (fundamental EPS was -$1.02). And, EPS has been unfavorable for the earlier 4 years, starting from $1.68 in 2020 to $1.30 in 2019.

There may be little on the monetary facet that may appeal to traders.

Operations

Vericity’s distinguishing technique is to focus on what it calls the center American market. In its 10-K for 2022, the corporate wrote,

“We attempt to ship to this market reasonably priced, simple to grasp time period and entire life insurance coverage merchandise by way of a consumer-friendly and environment friendly gross sales course of. Via innovation in product design and distribution that gives entry to the Center Market, together with name middle and web-enabled gross sales and underwriting processes, fast issuance of insurance policies and an emphasis on merchandise not medically underwritten on the time of sale, we consider we’re properly positioned to make life insurance coverage extra reasonably priced and accessible to the Center Market.”

Word that the ways concerned on this technique are, or may be, inherently contradictory. That’s, the corporate goals to supply reasonably priced merchandise, whereas ’emphasizing’ merchandise that aren’t medically underwritten. The purpose is that non-medically underwritten insureds are more likely to die sooner, thus producing fewer premiums earlier than loss of life happens. Within the long-run, that makes insurance policies much less reasonably priced.

Whereas I am undecided if that’s strictly the case at Vericity, I see in its Q3-2023 earnings assertion that internet insurance coverage premiums had been $23.43 million, whereas declare advantages totaled $22.58 million. Claims wolfed up greater than 96% of the online premiums.

Many corporations with low-price methods do properly; high-profile operators similar to Walmart Inc. (WMT) and Costco Wholesale Company (COST) have change into legends. However what they’ve achieved, and Vericity has not, is to construct quantity. Skinny margins require excessive volumes.

Vericity’s complete premium and annuity revenues had been $100.6 million in 2019-on a TTM foundation, they had been $101.8 million. Statistically, that is a meaningless distinction after practically 4 years. Much more regarding, although, is that premium and annuity revenues rose to $113 million in 2020 and $114.3 million in 2021 earlier than slumping to $104.5 million in 2022.

Primarily, the corporate is shedding quantity, reasonably than gaining it, and a few type of change is required. Promoting to an organization with higher assets and maybe administration experience is one, and maybe the one, possible answer.

Valuation

Usually, the problem is to find out what could be a good worth for a inventory. On this case, that is not a problem as a result of we all know that there’s a excessive chance stockholders will obtain $11.43 a share someday within the first half of 2024.

That is assuming the deal goes by way of, which I anticipate it can. Vericity is a comparatively small firm in an enormous, fragmented business, so this merger is not going to have an effect on competitors or business stability. There are different wildcard prospects, together with Vericity not assembly its covenants, however none that appear more likely to block the deal.

Since we all know what worth stockholders will obtain within the subsequent six months and the present worth, this turns into an arbitrage case. If the merger closes in January, then traders might want to maintain to choose up an additional 30 or 40 cents. However, if the merger would not shut till the tip of June, then traders could also be higher off promoting now.

For the long run, there could possibly be a possibility price for holding. Staying for X months ties up funds that could possibly be invested elsewhere, for higher returns (in precept, not less than).

To some extent, it will contain the scale of every particular person’s holding. For those who personal 100 shares, then your upside for holding is just $30 or $40. For 1,000 shares, the upside is $300 to $400.

Engaged on the idea of 1,000 shares and three months till closing, we will quantify that chance price or its reverse.

Maintain till closing:

- 1,000 shares @ $11.14 = $11,140.00

- Maintain shares till closing @ $11.43 = $11,430.00

- Achieve = $290.00

Promote now:

- Obtain $11,140.00 in money (transaction prices not included)

- Purchase shares yielding a 7.00% annual return

- $11,140.00 x 7% = $779.80 / 4 = $194.95 for 3 months

On 1,000 shares and three months, traders can be $95.05 higher off by holding than by promoting now, assuming they put money into a conservative different. However, having purchased right into a micro-cap, maybe you are on the lookout for one thing extra aggressive. In that case, your danger/reward profile would shift, and the calculations may favor promoting reasonably than holding.

Conclusion

In Vericity’s considerably distinctive case, the long run worth of shares is thought, whereas the time till that worth is realized is unknown.

Every investor should develop their very own alternative evaluation, one which displays the variety of shares she or he owns and once they anticipate the merger to shut.

For the instance proven above, the very best technique can be to carry, however given the modest quantities concerned, some traders will logically attain different conclusions.