SHansche

Introduction

SFL Company Ltd. (NYSE: SFL) launched its third quarter 2023 outcomes on November 14, 2023. This text updates my August 21, 2023, article.

I’ve adopted SFL’s quarterly Looking for Alpha outcomes since September 2014 and have been a shareholder for over a decade. Regardless of my long-term optimism and up to date strong earnings outcomes, I’m not as enthusiastic concerning the short-to-medium-term outlook.

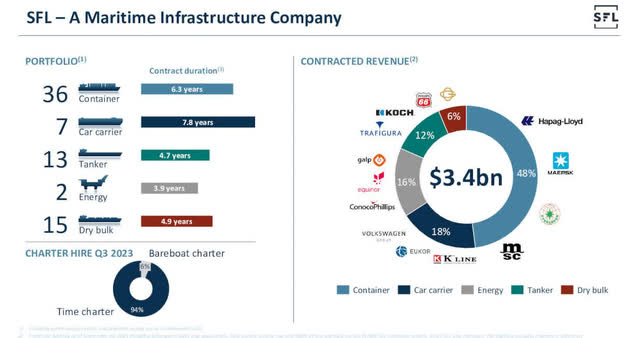

SFL is flexible and energetic in tankers, dry bulk, offshore, automotive carriers, and containers, which is a large benefit for traders. In comparison with an organization that concentrates on a selected delivery phase, SFL can reply extra rapidly, because of its numerous portfolio. Additionally, Trym Sjolie stated within the convention name:

Most of our vessels are on long-term charters that we’ve got during the last 10 years fully reworked the corporate’s working mannequin and have moved away from financing kind bareboat charters and as a substitute assume full working publicity. This makes us related for giant industrial finish customers like Volkswagen, Maersk, Hapag-Lloyd and others.

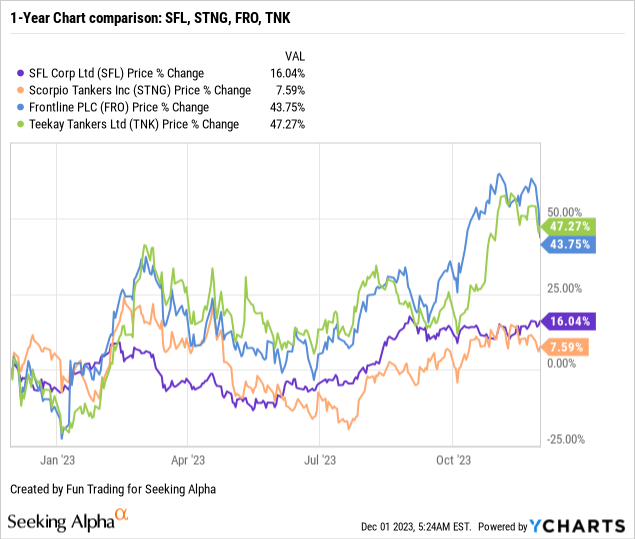

The corporate carried out properly in 2023. I examine SFL to a few different firms that I observe. Teekay Tankers (TNK), Frontline plc (FRO), and Scorpio Tankers (STNG). Since SFL isn’t a pure tanker firm, in contrast to the opposite three, this comparability isn’t foolproof, however it’s the finest I may provide you with. SFL is up 16% on a one-year foundation, providing an 8.63% dividend.

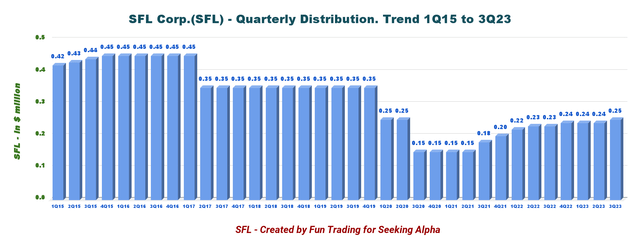

This delivery firm has usually supplied me with a excessive dividend return in good and dangerous occasions, a key part of my long-term bullish view. By the way in which, September’s distribution would be the firm’s 78th consecutive payout, yielding 8.63%.

SFL Quarterly Dividend Historical past (Enjoyable Buying and selling)

Nevertheless, if somebody assumes that this extraordinarily risky trade will result in steady stability sheet enchancment with out main setbacks alongside the way in which, it could be prudent to completely reevaluate this assumption and implement an adjusted buying and selling and investing technique.

I will not litter my article with pointless historic particulars concerning SFL, however one factor is apparent: the trade is unpredictable and inconsistent. By analyzing my graphic above, you may simply see how the speedy consequence of this uncertainty has impacted the distribution during the last 9 years.

One downside of SFL is that it belongs to the Fredricksen group. As we’ve got seen with the Seadrill cooperation, SFL is likely to be keen to put money into problematic and dangerous ventures. Some traders maintain a distinct perspective and look at Fredricksen’s engagement as helpful.

The shut connection between Frontline and Seadrill with the corporate illustrated this controversial problem just a few years in the past. Nonetheless, SFL seems extra autonomous because of the favorable short-term market, which ought to enhance earnings within the fourth quarter and remove any issues.

So, the funding thesis stays the identical as in my earlier article, and I counsel SFL as a long-term funding with a big and safe dividend fee. Nevertheless, I like to recommend buying and selling short-term SFL using a minimum of 40% of your complete place to revenue from this risky and continually shifting enterprise.

CEO Ole Hjertaker stated within the convention name:

The short-term market is pink piping scorching proper now and we’ve got secured a really enticing interim constitution from the shipyard in Asia to Europe producing round $8.5 million in EBITDA per vessel over a interval of solely two months. Within the third quarter, 94% of constitution revenues from all belongings got here from time constitution contracts and solely 6% from naked boats or dry leases.

Seadrill’s rising from chapter final yr was an essential constructive occasion for SFL.

One essential aspect that contributed to bettering the stability sheet was the ultimate decision of the corporate’s offshore phase, with Seadrill Restricted (SDRL) emerging from Chapter 11 on February 23, 2022.

After rising from chapter, there was a significant discount within the interplay between the brand new Seadrill and SFL for the reason that West Linus and the West Hercules have been reassigned from Seadrill to an SFL affiliate. The West Hercules is chartered to Seadrill and is managed by Odfjell Drilling.

SFL owns two rigs. Seadrill has chartered the tough surroundings, Semisub West Hercules, and the Harsh Setting Jackup West Linus since 2008 and 2014, respectively.

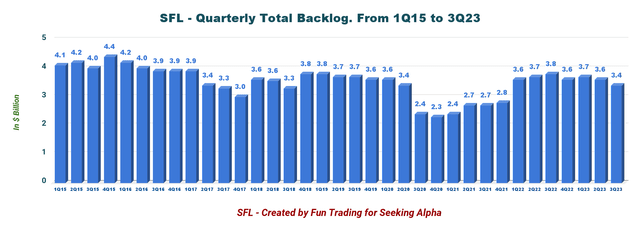

The Semisub West Hercules is contracted till 3Q24 with Exxon, and the Jackup West Hercules is contracted till 4Q28 with ConocoPhillips, providing nice visibility and a backlog of $544 million, or 16% of the full backlog of $3.4 billion in 3Q23, as proven beneath:

As of September 30, 2023, and adjusted for subsequent transactions, the estimated fastened charge constitution backlog from the Firm’s fleet of 73 wholly or partly owned vessels and newbuildings beneath building was roughly $3.4 billion with a weighted remaining constitution time period of 5.9 years (press launch).

The rigs introduced in round $64 million in contract revenues within the third quarter, up from about $19 million within the second quarter.

SFL Backlog 3Q23 (SFL Presentation)

SFL Quarterly Backlog Historical past (Enjoyable Buying and selling)

Since Seadrill’s two bankruptcies excluded the offshore drilling portion, the backlog from H2 2020 to December 31, 2021, was diminished.

Notice: Lately, West Hercules accomplished its five-year SPS, which included a radical renewal and upgrades that price round $100 million, which considerably affected H1 2023. Though Odfjell Drilling manages West Hercules on behalf of Seadrill, SFL Company assumes full accountability for all prices related to the five-year SPS. The rig is in Namibia, getting ready for its new contract with Exxon.

1–3Q23 Outcomes Snapshot and commentary

SFL Company Ltd. reported a quarterly revenue of $0.23 per diluted share, in comparison with $0.37 in the identical quarter a yr in the past.

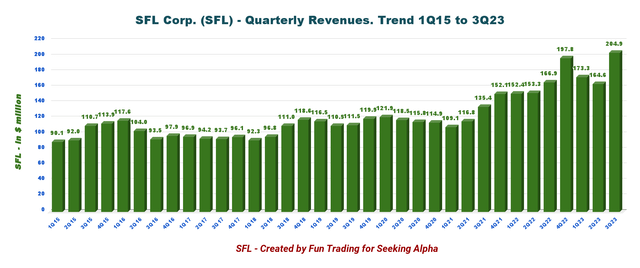

It was a report quarter for the SFL Company. The corporate’s complete consolidated U.S. GAAP Constitution Rent revenues have been $214 million in 3Q23, and the full working revenues have been $204.89 million, up from $166.89 million final yr.

SFL Quarterly Working Revenues Historical past (Enjoyable Buying and selling)

The corporate declared a quarterly dividend of $0.25 per share this quarter, or a rise of 4.2% sequentially. The dividend yield is now 8.63%.

Though SFL didn’t buy any shares in 3Q23, the corporate does have a share buyback program. In accordance with the information launch:

The Firm’s Board of Administrators licensed the repurchase of as much as an combination of $100 million of the Firm’s widespread shares, which is legitimate till June 30, 2024. So far, the Firm has repurchased an combination of roughly 1.1 million shares at a median value of roughly $9.27 per share, which leaves roughly $90 million remaining out there beneath this system.

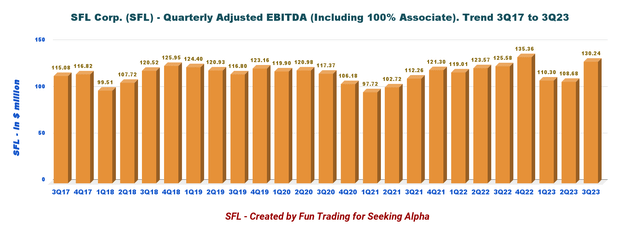

Consolidated adjusted EBITDA elevated from $125.58 million reported in the identical quarter final yr to $130.24 million (together with the 49.9% owned affiliated corporations).

SFL Quarterly Adjusted EBITDA Historical past (Enjoyable Buying and selling)

This graphic clearly reveals the progress within the offshore drilling phase, which in H1 2023 was producing little to no income.

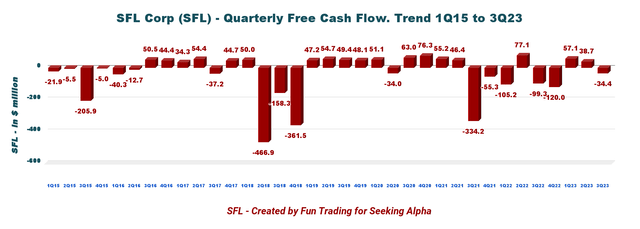

On the unfavourable aspect, the free money move was unfavourable in 3Q23. The money move from operations dropped from $149.91 million in 2Q23 to solely $31.21 million in 3Q23, regardless of a diminished CapEx of $65.62 million this quarter.

SFL Quarterly Free Money Circulation Historical past (Enjoyable Buying and selling)

The change in working belongings and liabilities was unfavourable $53.3 million this quarter from a constructive $83.5 million in 2Q23. Although the free money move could not precisely mirror the soundness of the stability sheet for an organization continually engaged in financing, like SFL, it is not very nice and is trigger for concern.

It failed at this level as a result of free money move is often used to evaluate whether or not a enterprise can afford to pay a distribution. One rationalization is that SFL paid off a 2018 bond mortgage denominated in Norwegian kroner in full in the course of the third quarter with $48 million left at maturation. This was settled out of the corporate’s out there money.

In 3Q23, the trailing 12-month free money move (“ttm”) was unfavourable $58.6 million, with a free money move of unfavourable $34.41 million for the quarter.

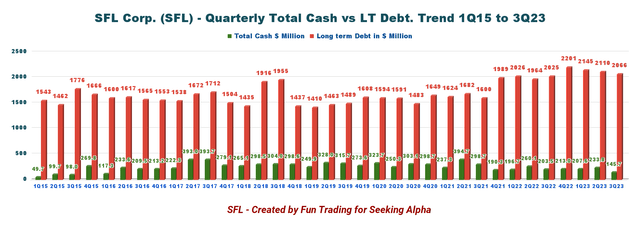

Lastly, on the debt entrance, the state of affairs is almost unchanged. Nevertheless, one other concern is the sharp decline in complete money of virtually 38% sequentially to $145.67 million, whereas complete debt was diminished a bit of from $2,110 million in 2Q23 to $2,066.4 million in 3Q23.

In 2023, the corporate signed recent finance offers value over $1 billion. Moreover, the corporate has absolutely obtained favorable long-term financing for all three new services. In consequence, we will conclude that SFL has an important debt profile.

CEO Ole Hjertaker stated within the convention name:

We’ve got just lately raised vital quantities within the new debt funding at very enticing phrases in Asia and do not see a must refinance the just lately repaid bond mortgage with new financing within the near-term.

SFL Quarterly Money versus Debt Historical past (Enjoyable Buying and selling)

* Notice: The whole money consists of funding in marketable securities and funding in sales-type, direct financing, and leaseback belongings, the present portion.

Technical Evaluation (Brief-Time period) And Commentary

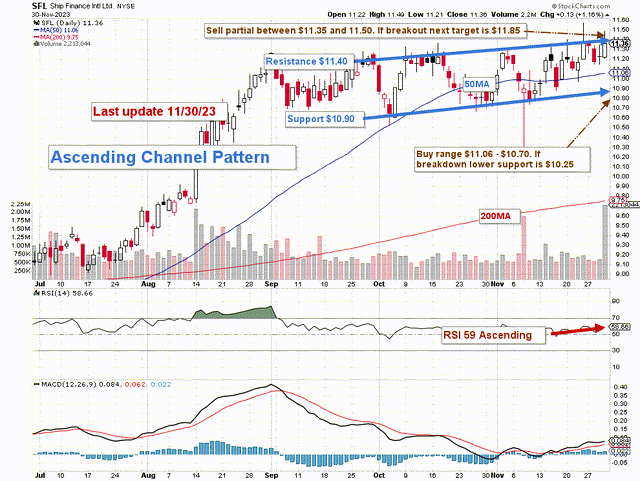

SFL TA Chart (Enjoyable Buying and selling StockCharts)

Notice: The graph has been adjusted for the dividend.

SFL develops a rising channel sample, with assist at $10.90 and resistance at $11.40. At 59, the RSI suggests a possible breakout above the primary resistance between $11.85 and $12.

An ascending channel is a typical sample with a sequence of upper highs and better lows. It suggests a bullish outlook for the market and a gradual however regular improve in value. It does, nonetheless, usually finish with a consolidation section.

The thought is to have a core long-term holding and use about 40% of your capital to commerce LIFO whilst you look ahead to the next goal closing value and benefit from a considerable payout. The buying and selling technique is to promote 40% between $11.35 and $11.50, with larger resistance round $11.85. The following motion is to attend for a retracement within the vary of $11.06 to $10.70, with a decrease assist stage at $10.25 to return again into play. Repeat after rinsing.

Warning: The TA chart have to be up to date regularly to be related. The chart above has a doable validity of a couple of week. Keep in mind, the TA chart is a instrument solely that can assist you undertake the fitting technique. It isn’t a method to foresee the long run. Nobody and nothing can.