Sundry Pictures

Again in July, I previewed ServiceNow’s (NYSE:NOW) earnings, saying that the corporate would probably must publish some extraordinary outcomes given its excessive valuation. The inventory in down about -10% since that write-up. Let’s catch-up on the title.

Firm Profile

As a reminder, NOW is a software-as-a-service (SaaS) firm that manages workflows throughout programs by connecting siloed programs and bringing them to a single platform. The corporate’s product started as an IT Service Administration (ITSM) answer to assist IT departments higher handle their networks, optimize prices, and shortly determine and repair any safety vulnerabilities. Since then, it has expanded its use circumstances to different departments as nicely.

Its choices now embrace options for customer support, human assets, and the areas of automation, procurement, and low code. The platform additionally has options for authorized providers and well being & security. Its choices are bought as a subscription primarily via a direct salesforce.

Robust Q2 Outcomes Don’t Transfer the Needle

In my earnings preview, I famous that historical past and analyst channel checks pointed to NOW probably topping analyst expectations, and on that entrance the corporate did ship. Nonetheless, additionally as anticipated, that by itself was not sufficient to elevate the inventory, with it falling -3.9% the following session after its report.

For the quarter, the corporate grew income 23% (and 23% ex-FX as nicely) to $2.15 billion. That edged previous the consensus of $2.13 billion. Subscription income jumped 25% to $2.075 billion. Skilled service income fell -20% to $75 million.

Adjusted EPS of $2.37, in the meantime, simply topped analyst estimates of $2.02.

The corporate had 70 transactions over $1 million in new web ACV within the quarter, representing 30% development.

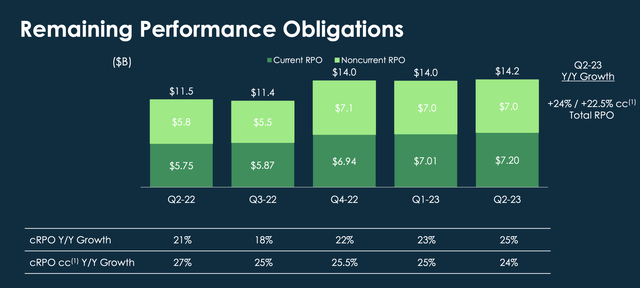

One space I stated buyers ought to take note of for the quarter was its RPO (deferred income + backlog) development. On that entrance, NOW noticed RPO develop 24% to $14.2 billion, and present RPO (cRPO) leap 25% to $7.2 billion, or 24% on a continuing forex foundation.

Firm Presentation

Whereas these numbers had been strong, you actually wanted to see an acceleration in development from these numbers to get the inventory shifting. Whereas cRPO did speed up on an absolute foundation, development slowed barely on a continuing forex foundation. This is superb development, however NOW’s inventory valuation is fairly dear, so it actually wanted to a giant quantity to get buyers excited.

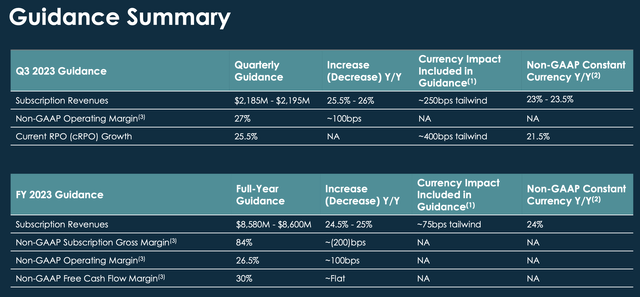

Wanting forward, the corporate projected Q3 income to develop 25.5%-26.0% to $2.185-2.195 billion. On a continuing forex foundation, it was taking a look at development of 23.0%-23.5%

It additionally projected cRPO to be develop 25%, or 21.5% on a continuing forex foundation. That may proceed a pattern of modest cRPO development deceleration on a continuing forex foundation.

Firm Presentation

General, NOW as soon as once more put collectively very robust quarterly outcomes. As I famous in my authentic write-up, NOW is a superb firm, and I feel it has been persevering with to show that each earnings report. Whereas some SaaS corporations have complain a couple of robust macro setting and company price range points, it has simply continued to ship strong development, which speaks to the ability of its options.

AI Hype

Following earnings, administration has hit the funding convention circuit, with a giant concentrate on generative AI. Administration famous that over the previous six years, it’s completed a variety of acquisitions within the house to assist add expertise within the areas of machine studying, automation, and different areas. The corporate additionally famous that each time it meets with clients, generative AI is at all times a subject of dialogue.

At a Deutsche Bank Conference on the finish of August, SVP & GM of Know-how Workflows Pable Stern stated:

“All these conversations we have now with clients at all times begins with the voice of the shopper, telling us about the place they’re, what are their prime priorities and what they should resolve for. After which we may have a dialog based mostly on what they wish to discuss. And generative AI is in each a kind of discussions. And so the demand is there, the curiosity, the potential. And we not solely see it from the executives. So once I speak to love a CIO or a CTO, we hear it. However then additionally from a practitioner perspective, and we have now over 100 clients who’ve already signed up with us on design companion packages for our generative AI options, customer-facing use circumstances, employee-facing use circumstances, that sort of demand is actually unseen when it comes to like how shortly we have seen, for what’s a brand new product, demand coming in from the market. Now you requested about a number of the dangers. Properly, one of many issues that we actually satisfaction ourselves on is, if you concentrate on a variety of the acquisitions we have completed previously, so corporations within the AI house, like Factor AI. We have not solely centered on getting IP on the expertise and with the ability to transfer machine studying ahead, we’re additionally actually centered on trustworthiness. And what can occur with that AI? And the way do you — how will you belief what Gen AI is doing to not solely ship insights, however ensure that your knowledge is your knowledge and issues are protected? And so I feel like one of many issues that does come up in a variety of the conversations with our clients is that they belief ServiceNow.”

In the meantime, at a Goldman Sachs conference earlier this month, CEO William McDermott famous that the Professional Model of its answer that was launched just a few years in the past comes with a 25% uplift in pricing. Given all the eye round AI, this must be a pleasant enhance sooner or later for NOW. There may be probably nonetheless some hesitancy about AI, and corporations wish to watch out with it, however because it turns into extra prevalent, NOW ought to see some good upsell alternatives.

Valuation

SaaS corporations are typically valued based mostly on a gross sales a number of given their excessive gross margins and the businesses desirous to pump a refund into gross sales and advertising to develop.

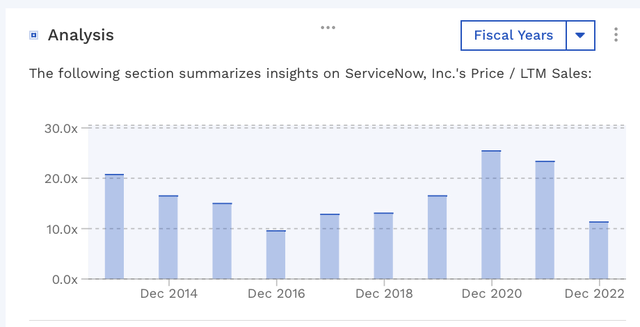

On this regard, NOW is valued at a P/S ratio of about 12.6x based mostly on the 2023 consensus for income of $8.91 billion. Primarily based on the 2024 income consensus of $10.86 billion, it trades at a P/S a number of of 10.3x and an EV/S a number of of 9.9x.

Prior to now, the corporate has usually traded at over 13x LTM gross sales generally over 20x. Nonetheless, development is slowing from over 30% to the low 20% vary. It’s projected to be 23% this yr and 21.8% subsequent yr.

NOW P/S Historic Valuation (FinBox)

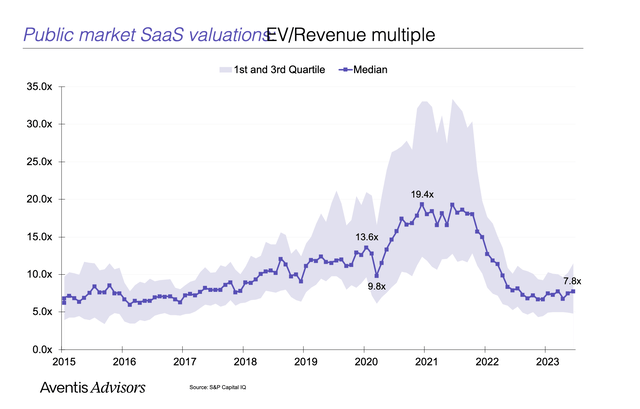

For a SaaS firm with gross margins north of 75%, no debt, and rising income within the low to mid 20% vary spending an affordable quantity of gross sales & advertising, I typically view a valuation of 10x P/S as in the direction of the high-end of being an affordable valuation. That is proper round the place NOW presently sits based mostly on 2024 estimates. The trade has round an 8x a number of with related 20% development. I do not suppose the massive multiples that had been seen between 2020-2022 made sense.

Aventis Advisors and Capital IQ

Conclusion

NOW continues to show it’s an incredible firm, with continued strong outcomes. In the meantime, the corporate is approach forward of the AI curve, having constructed out and bought its expertise during the last a number of years. It has additionally formed a partnership with chip chief NVIDIA (NVDA) to assist develop enterprise-grade generative AI options. Given the pricing uplift it sees with its already established Professional product with AI capabilities, the long run ought to stay shiny for NOW, particularly in relation to serving to main the pack with AI.

That stated, NOW’s inventory remains to be not low-cost. Given its development, I feel it’s a number of seems fairly acceptable. When you personal the inventory I’d proceed to take action, however I’m not a brand new cash purchaser at present ranges. As such, I charge the inventory a “Maintain.”