CHUNYIP WONG

Seritage (NYSE:SRG) is a former REIT that owns former Sears and Kmart areas. I first checked out it when Sears spun out the REIT in 2015. Initially, SRG owned 235 Sears and Kmart areas and stakes in JV’s of 31 others. The corporate raised debt to pay Sears for a sale leaseback again of the portfolio.

Initially, all however 19 of the properties had Sears because the tenant. The unique idea was that worth may very well be extracted by repurposing or redeveloping many of those properties. On the floor, this thesis had some benefit and attracted some notable early traders corresponding to Warren Buffett, who was the third largest shareholder for a time. A way more controversial investor, Eddie Lampert, is presently the biggest shareholder. I stayed away from the title for quite a few causes. I felt the unique portfolio was too sophisticated to investigate given the size and huge variance in high quality. Furthermore, Sears was a large number on the time and my normal rule is that if I believe an organization would possibly file for chapter, do not personal something associated to it till the smoke clears.

Lastly, Lampert earned himself a questionable repute as chairman of Sears from 2005 and as CEO from 2013 till its chapter. Maybe it is unfair guilty Sears’s chapter solely on Lampert, however he undoubtedly shoulders an excellent chunk of the blame given its capital spending and capital return insurance policies through the 13 years he was Chairman and 5 years he was CEO. I consider the Sears chapter damage Lampert’s repute sufficient that many traders would not go close to any firm the place he had managerial affect. Lampert was Chairman of SRG from its spin till March of ’22.

It turned out my preliminary fears had been justified. Sears filed for chapter in October, 2018, by which era Sears was the first tenant on about half of the properties and paid rather less than half of the ABR (annual base lease). All Sears leases had been terminated about two years after that chapter submitting. In the meantime, in its years main up ending its relationship with Sears, the corporate by no means managed to create a lot worth from redeveloping/repurposing/realigning its portfolio. One can see that lack of worth creation in its money flows. Finally, money flows, notably for REITs, are the place the rubber meets the street.

all numbers in tens of millions

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Money from Operations | $110 | $60 | $55 | $58 | -$47 |

| Disposal of Fastened Property | $61 | $221 | $142 | $332 | |

| Property Enhancements | -$66 | -$243 | -$314 | -$247 | -$247 |

| Change in Investments | -$9 | -$38 | -$27 | -$63 | -$63 |

| Change in RE Curiosity | 0 | $257 | 0 | $20 | $20 |

| Whole | $36 | $97 | -$65 | -$358 | -$5 |

I finished the above desk at 2020 for a cause. Clearly, the five-plus years as a public firm weren’t resulting in main worth creation for shareholders. Due to this fact, in early 2021, the corporate scored a exceptional coup by getting Andrea Olshan to take over as CEO.

The Andrea Olshan Issue:

Andrea spent the earlier seventeen years at Olshan Properties, the actual property agency based by her legendary father. It is fairly a portfolio. From that company’s website, Olshan Properties and its affiliated corporations personal and/or handle over 13,000 multi-family residential models, 12 million sq. toes of retail and workplace house, and 1,447 resort rooms.

Andrea was CEO of Olshan, having repositioned quite a few property in that giant portfolio, when she left to take the highest job at Seritage. She in a short time pivoted the enterprise. A couple of 12 months after taking on, she modified the corporate’s tax standing from a REIT to a c-corp to achieve operational flexibility and higher use the corporate’s deferred tax property (which presently stand at $201 million). By the summer season of 2022, the corporate obtained shareholder approval to liquidate the corporate via asset gross sales after which maybe promoting the company (patrons for the entire enterprise had been solicited. None stepped ahead to purchase the corporate with the practically 200 properties.)

Promoting Properties and Paying Down Mortgage Balances:

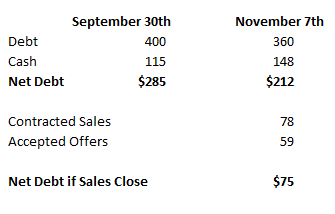

Since taking on, Andrea and her group have offered round $1.3 billion of property and paid down over 3/4’s of a $1.6 billion mortgage excellent to Berkshire Hathaway. As of quarter finish (9/30), the corporate had $400 million of debt and $115 million of money.

The corporate’s current earnings launch detailed $78 million of properties which can be in contract and $59 million of properties with accepted bids. Assuming these gross sales shut, the stability sheet development ought to appear like:

Seritage Internet Debt (Writer Utilizing Firm’s Quarterly Earnings)

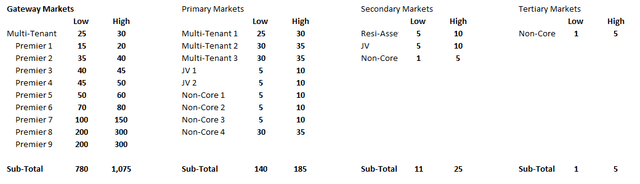

The corporate is on tempo to finish 2023 with about 25 properties (7 of that are thought-about “Premier” properties, which I will talk about under). The corporate did a fabulous job of breaking down the remaining portfolio values this previous quarterly earnings report. They laid out a spread of values by property sort and market sort.

Seritage Asset Values by Market (Writer Utilizing Firm’s Quarterly Earnings)

Clearly the primary crux of the worth lies within the premier properties in Gateway markets. That mentioned, the opposite properties supply loads of worth and would greater than cowl the remaining web debt assuming the introduced and pending asset gross sales undergo.

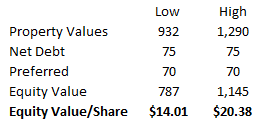

Including up the above values and utilizing the $75 million of web debt quantity leaves you with some compelling math, notably for a inventory that closed at $8.64 per share yesterday.

Seritage Worth Per Share (Writer Utilizing Firm’s Quarterly Earnings)

Given the corporate solely has $490 million ($8.72/share) of frequent fairness worth on the stability sheet, there’s a clear disconnect between even the low finish of the potential asset values right here and the market/accounting values.

I warning that there are different components at play right here. For starters, whereas the corporate has some rents coming in and is decreasing working bills, it does run at a deficit, run price of about $30-40 million per 12 months. Andrea runs a good ship and can deliver down overhead as properties are offered, however there are particular prices which can be inconceivable to flee. The longer it takes to promote properties, the larger of a headwind these prices will likely be per share. The debt and the preferreds additionally value 7% in annual curiosity bills. The corporate will pay down the debt and name the popular shares, however till they do, that is a money drag as effectively.

The excellent news is there’s a huge hidden asset too, the deferred tax property that the corporate doesn’t presently acknowledge as a result of there isn’t any sure path of profitability. Clearly, there can be accounting beneficial properties if the corporate can promote the properties on the values it estimated. These deferred tax property ought to eradicate most if not all the potential tax leakage.

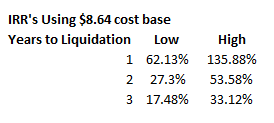

I believe zeroing out the working prices and the deferred tax property and assuming conservative sale and capital return course of (all money being returned at finish of timeframes) even issues out and leaves the high-low values per share as honest estimates of worth per share. Utilizing the above numbers and assuming the method takes one to 3 years results in extraordinarily compelling IRR’s when beginning at $8.64/share.

SRG Potential IRR’s (Writer Utilizing Firm’s Quarterly Earnings)

Clearly, the upper the gross sales costs and the shorter the sale course of, the higher the returns.

The Andrea Wrinkle:

I am clearly an Andrea Olshan fan. I believe she has a singular mind and ability set which can be an ideal match for these property. She’s the kind of government with whom I fortunately park cash for so long as she’s prepared to handle it. Those that know me know I do not say that about too many individuals.

Andrea is sensible sufficient to know that she is poised to have an organization with seven excessive convexity property, no debt, money within the financial institution, and a big deferred tax asset. That backdrop within the fingers of an excellent, proficient, and pushed government can a recipe for good issues. Andrea has demonstrated a few of her redevelopment chops with the UTC in San Diego (signing Amazon as an workplace tenant) and on the Aventura Mall. Each asset is totally different, with totally different redevelopment alternatives, however do not forget that Andrea has overseen residential, retail, and workplace properties in her earlier gig working her household’s enterprise. She is able to working in a multi-use actual property state of affairs. The backdrop I described affords Andrea a possibility to do some fairly inventive and particular issues. Personally, I might wish to see what Andrea can do.

Threat:

The principle dangers listed below are the difficulties of promoting actual property property into as we speak’s rate of interest and actual property lending atmosphere and Andrea sticking round. Rates of interest have been fairly excessive for some time now and actual property lending has been weak because the Silicon Valley debacle in March. They’ve been shifting property regardless.

Andrea is a key threat. She affords a lot right here that I believe she’d be exhausting if not inconceivable to exchange.

Lots of people will cite Eddie Lampert’s presence as a big shareholder as one thing to regulate. Lampert stays controversial for lots of people, particularly institutional traders, given his oversight of Sears because it spiraled into chapter 11. He doesn’t have a seat on the board anymore, however he holds numerous shares. His mere presence as an affect given his stake might scare quite a few traders away.

Conclusion:

I believe the danger reward right here could be very compelling. The property right here have numerous optionality and potential worth embedded in them and I believe they’re in extraordinarily succesful fingers. For my part it is extra a matter of how excessive a return on funding given sale costs and timing of gross sales than threat of loss. That mentioned, there are not any guarantees in something, and we have seen, the market has crushed up the inventory at instances. Personally, I am prepared to abdomen the volatility to put money into these property and distinctive CEO working them.