CoffeeAndMilk/E+ through Getty Photographs

The VanEck Mortgage REIT Revenue ETF (NYSEARCA:MORT) is likely one of the worst-performing revenue ETFs available in the market, with sky-high threat, constant losses and distribution cuts. The fund is a horrible long-term maintain, and infrequently a great short-term funding.

Aggressive buyers on the lookout for the very best yields have a lot stronger choices than MORT. These embrace the VanEck BDC Revenue ETF (BIZD), the Saba Closed-Finish Funds ETF (CEFS), and the Panagram BBB-B CLO ETF (CLOZ). These three funds supply buyers sturdy, double-digit distribution yields, and have a a lot stronger efficiency and dividend progress track-record than MORT. As such, I might not spend money on MORT, and strongly want BIZD, CEFS, or CLOZ.

MORT – Fundamentals

- Funding Supervisor: VanEck

- Underlying Index: MVIS US Mortgage REITs Index

- Dividend Yield: 12.18%

- Expense Ratio: 0.43%

- Whole Returns CAGR 10Y: 2.18%

MORT – Overview and Evaluation

Index and Holdings

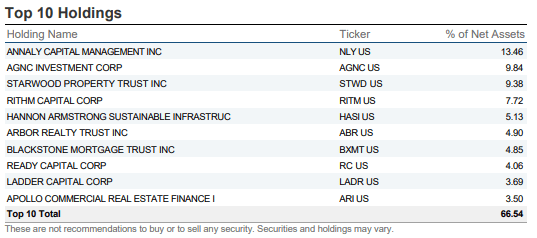

MORT invests in mREITs, monetary establishments specializing in leveraged mortgage investments. It tracks a broad-based mREIT index, with investments in most related securities of its variety. It at present holds 27 totally different mREITs, with a big, double-digit funding within the well-known Annaly Capital Administration (NLY). The biggest holdings are as follows:

MORT

Focus/Lack of Diversification

MORT is an extremely concentrated, undiversified fund, because it focuses on an extremely area of interest funding asset class: mREITs. Focus is kind of excessive too, with the fund investing in solely 27 totally different securities, and with the highest ten of those accounting for over 60% of its portfolio.

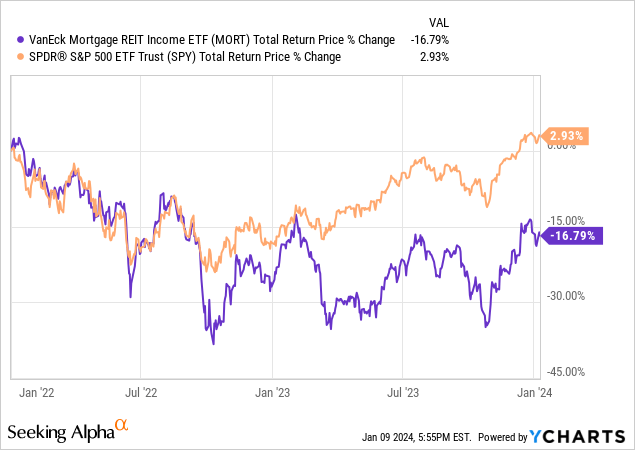

MORT’s focus will increase portfolio threat and volatility, and signifies that the fund’s efficiency would possibly materially differ from that of the broader market. For instance, the fund has considerably underperformed since early 2022, as increased charges hammer actual property trade valuations and earnings. This was the case for extra REIT funds, nevertheless.

In my view, MORT is concentrated sufficient that giant place sizes are unwise.

Leveraged Investments

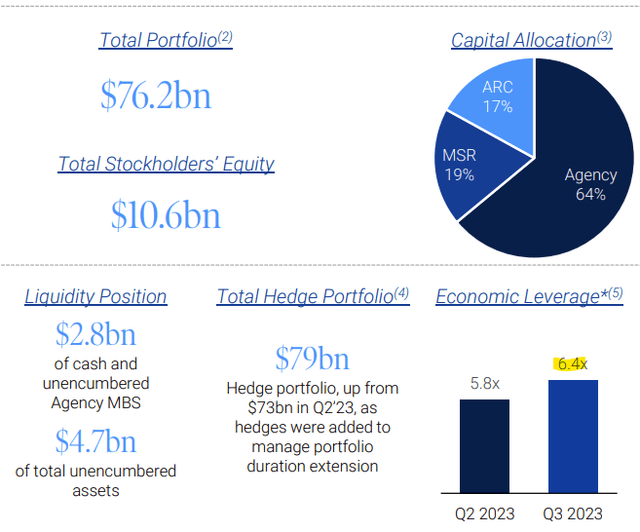

MORT’s mREITs investments are extremely leveraged investments. Excessively leveraged in lots of instances. For instance, Annaly Capital Administration manages an funding portfolio value $76.2 billion with solely $10.6 billion in shareholder fairness. In different phrases, for each greenback of fairness the corporate has round six {dollars} of debt (6.4, to be actual).

Annaly Capital Administration

Annaly’s debt load considerably will increase firm earnings, turbocharging investor dividends. The logic is, I believe, fairly easy: extra debt means extra belongings, which suggests extra revenue, earnings, and dividends. A better take a look at how this works could be illuminating.

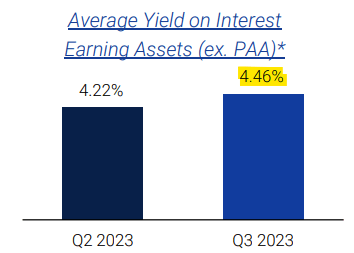

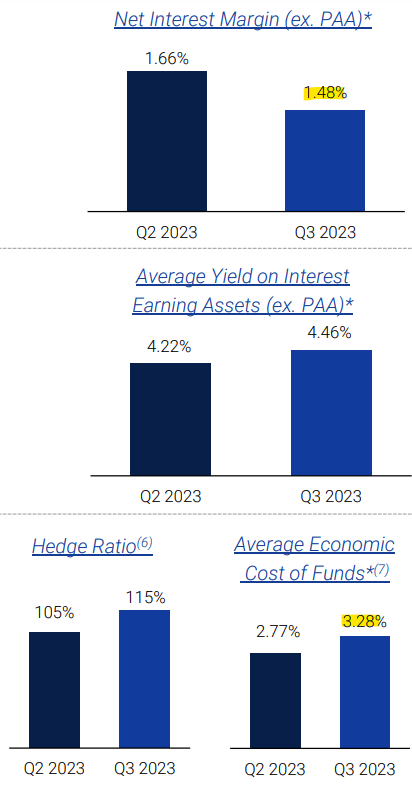

Unleveraged mortgage investments yield round 4.5% proper now:

Annaly Capital Administration

Annaly earns 4.5% on these investments, these purchased with fairness.

Annaly could make much more investments with debt. Debt could be financed at a 3.3% charge (appears unsustainably low). Margins ought to equal 1.2%, however truly equal 1.5%. Unclear have been the 0.3% got here from.

Annaly Capital Administration

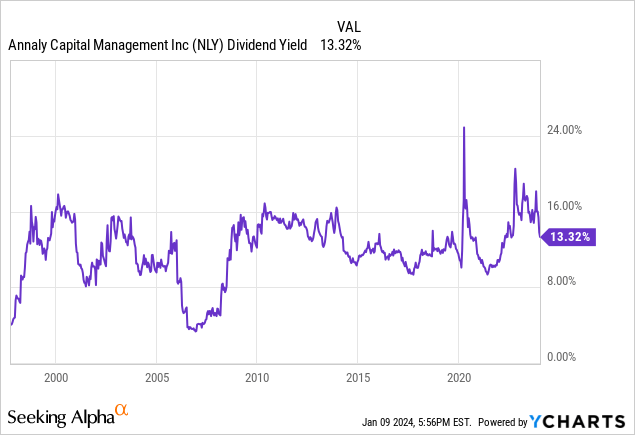

So, Annaly earns 4.5% on their equity-financed investments, and one other 1.5% on these funded with debt. With a 6.4x financial leverage ratio, that provides as much as 14.1%. Annaly itself yields 13.3%, a bit decrease as a result of firm buying and selling at a slight premium to its belongings (PB above 1.0x).

Annaly’s debt load considerably will increase firm earnings and dividends, simple advantages for buyers. The debt load additionally has a number of important negatives and dangers.

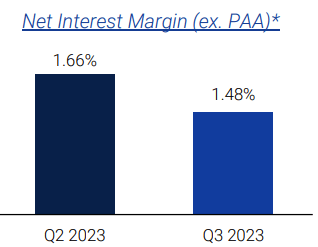

First, debt is pricey, extreme debt masses doubly so. Generally, the curiosity earned on productive belongings is increased than the prices incurred by the debt, however this isn’t all the time true, and margins or spreads fluctuate. Some monetary establishments have seen a lot decrease margins these previous few years, as Federal Reserve hikes improve rates of interest on debt. For instance, web curiosity margins for Annaly have decreased by round 0.15% this previous quarter:

Annaly Capital Administration

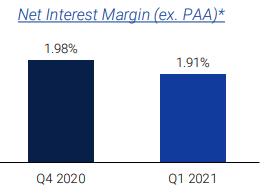

Margins are down 0.50% since late 2020, earlier than charges began rising:

Annaly Capital Administration

mREITs earnings and dividends are depending on fats margins and low value of debt, neither of which is definite, each of which have worsened these previous few years.

The second subject with excessive debt masses is that these typically need to be rolled over, which could not essentially happen at affordable phrases, if in any respect. Liquidity typically dries up, particularly throughout extreme recessions and monetary disaster, which may spell bother for mREITs like Annaly, with tens of billions of debt.

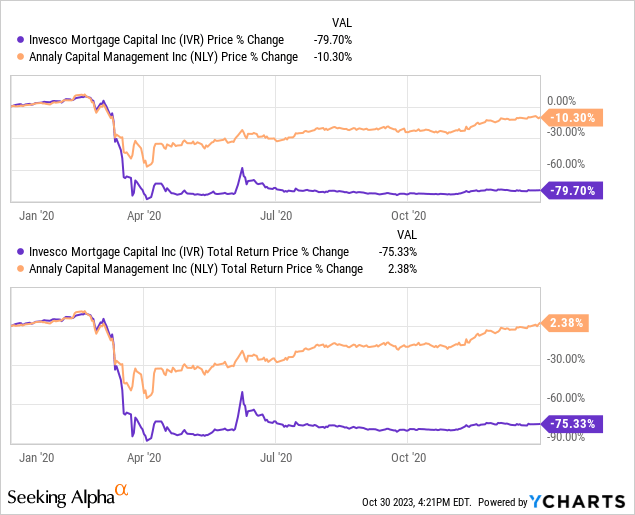

The third subject with excessive debt masses is that these serve to amplify any capital losses skilled. Keep in mind, extra debt means extra belongings, which suggests extra losses when asset costs decline. Vital reductions in worth may result in mREIT bankruptcies. Sizable reductions may result in pressured asset gross sales, as debt covenants typically compel firms to satisfy affordable capital and leverage ratios. I am conversant in the case of the Invesco Mortgage Capital (IVR), which noticed important losses in early 2020, was pressured to dump belongings at rock-bottom costs, after which by no means recovered (you possibly can’t get well for those who promote).

Information by YCharts

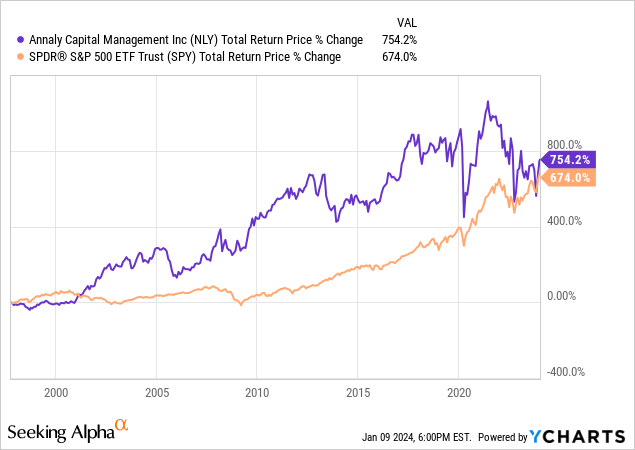

In my view, many mREITs are excessively leveraged investments, so important investments in these, particularly as an asset class, are unwise. Smaller, focused investments in the most effective of those would possibly make extra sense. Annaly appears to do fairly effectively, current weak point however.

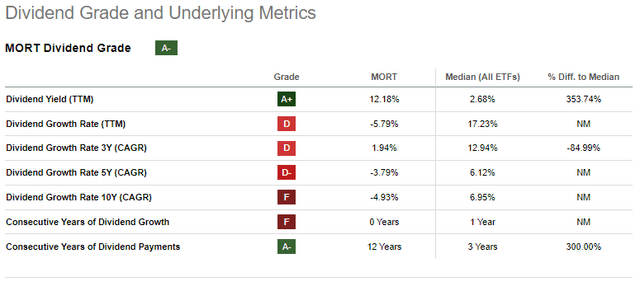

Dividend Evaluation

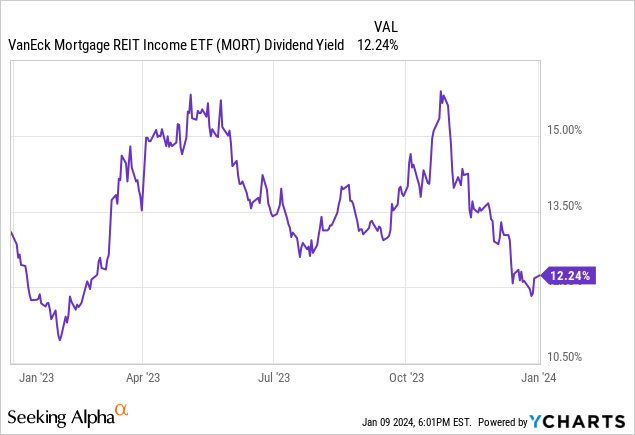

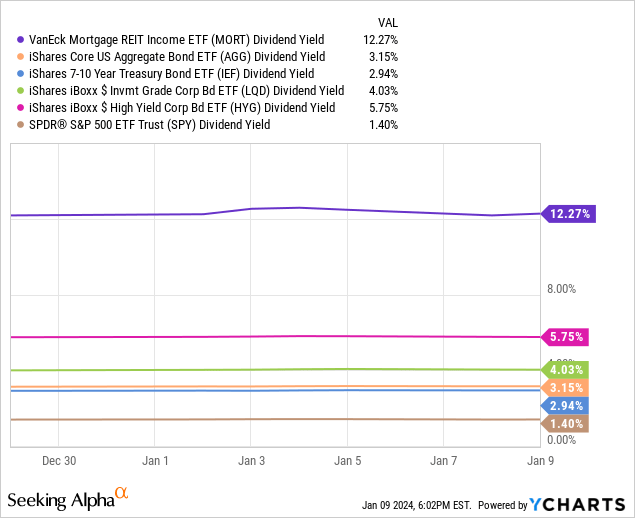

The excessive debt masses on mREITs do have one necessary profit: increased dividends. MORT itself yields a whopping 12.2%, virtually 5 occasions as a lot as mortgage-backed securities, or MBS, themselves.

Charges on each MBS and MORT look considerably low, as benchmark 30Y mortgage charges are at round 7.0%. MBS ought to yield round that, MORT a lot increased. Yields are decrease than anticipated because it takes time for increased rates of interest to influence funding markets, and for older, lower-yielding mortgages to mature and funds transferred into newer, higher-yielding mortgages.

MORT’s dividends are extremely excessive on an absolute foundation, and far increased than that of most asset courses.

Then again, the fund’s dividend progress track-record is decisively detrimental, with dividends seeing constant cuts since inception. Cuts have been attributable to sporadic mREIT implosions (IVR in early 2020), decrease rates of interest in previous years, and narrowing margins in recent times.

In search of Alpha

In my view, the consistency of those dividend cuts signifies important points with the methods and enterprise fashions of most mREITs. Corporations ought to see increased earnings and dividends long-term, and the truth that mREITs have been unable to efficiently leverage increased charges these previous few years is a really detrimental sign.

Constant dividend cuts means long-term buyers are likely to see weak, declining revenue long-term. Yield on prices common 6.5% earlier than the pandemic, 7.5%-8.5% within the years instantly after. MORT’s 15.8% in dividends are fairly sturdy, however they do not appear to final lengthy.

In search of Alpha

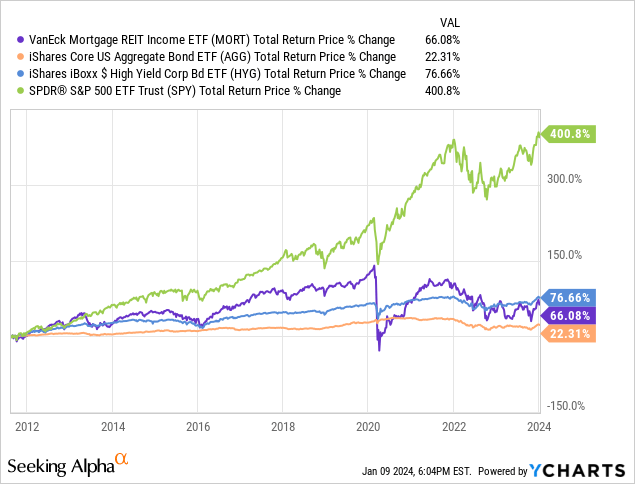

Efficiency Evaluation

MORT’s total efficiency track-record appears about common, at finest. Returns are typically decrease than these of high-yield bonds, at a lot increased threat. Returns are typically increased than these of bonds typically, however at a lot increased threat. The fund’s total risk-return profile seems to be extraordinarily weak.

MORT – Some Alternate options

Traders on the lookout for sturdy, double-digit dividend yields have a number of sturdy options to MORT.

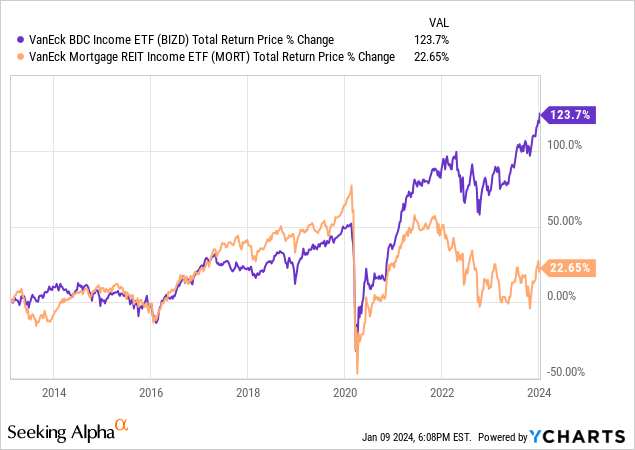

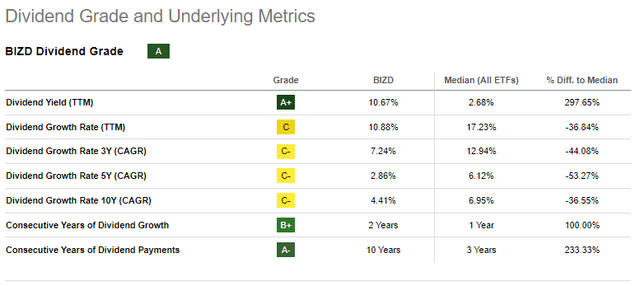

BIZD is the apparent alternative. The fund focuses on BDCs, leveraged monetary establishments specializing in riskier small and medium-sized enterprises. In apply, BDCs have a a lot stronger track-record than mREITs, with BIZD considerably outperforming since inception, and with decrease threat and drawdowns.

BIZD sports activities a ten.7% dividend yield, fairly a bit decrease than MORT’s 12.2% determine. BIZD’s dividend progress track-record is far stronger, nevertheless, so long-term buyers ought to see increased revenue from BIZD than MORT.

In search of Alpha

I final coated BIZD right here.

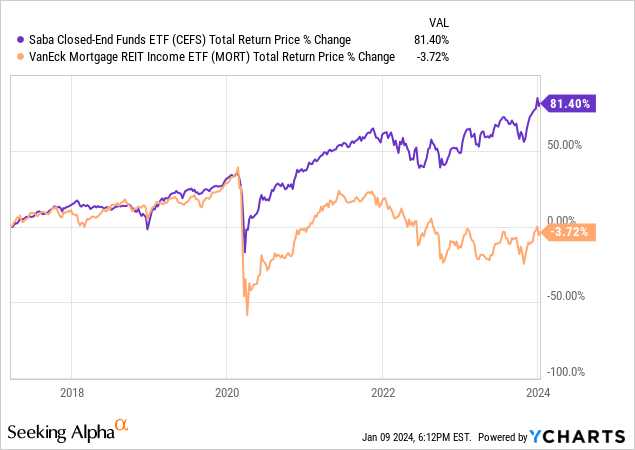

The Saba Closed-Finish Funds ETF (CEFS) is an actively-managed ETF investing in a diversified portfolio of CEFs. CEFs are likely to sport sturdy distribution yields, as does CEFS, with an 8.8% yield (excluding a particular distribution late final yr). Though dividends are decrease, dividends have been steady since inception, and the fund typically pays a particular distribution on the finish of the yr. CEFS typically engages in activist campaigns, and is usually aggressively positioned. Each are usually profitable, with the fund performing fairly effectively since inception.

I final coated CEFS right here.

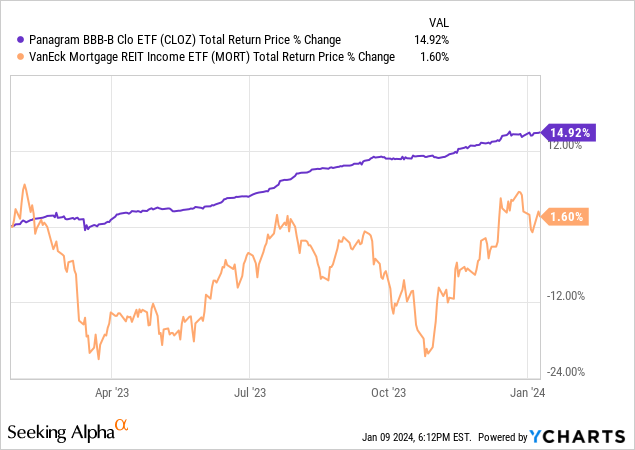

Lastly, CLOZ invests in BBB-BB CLO debt tranches. Proper now, and for my part, CLO debt tranches supply very compelling risk-return profiles, with CLOZ sporting a ten.3% SEC yield at low credit score and rate of interest threat. CLOZ’s efficiency track-record is excellent, but in addition fairly brief.

I final coated CLOZ right here.

Conclusion

MORT is likely one of the worst-performing revenue ETFs available in the market, with sky-high threat, constant losses and distribution cuts. As there are a number of stronger revenue ETFs available in the market, I might not be investing in MORT.