Mikko Lemola

As we carry September and the second quarter to an in depth, it appears like traders are in a sell-everything temper. Shares and bonds fell yesterday for no particular motive aside from that each one information is being interpreted as dangerous information. JPMorgan Chase CEO Jamie Dimon warned that the U.S. is “not ready” for 7% rates of interest. Fed President Neel Kashkari asserted that there’s a 40% likelihood that rates of interest might want to rise “meaningfully greater” to defeat inflation. The juvenile gamesmanship in a scandal-ridden Washington is operating the chance of one other authorities shutdown, which may additional injury the nation’s credit standing. The checklist goes on…

Finviz

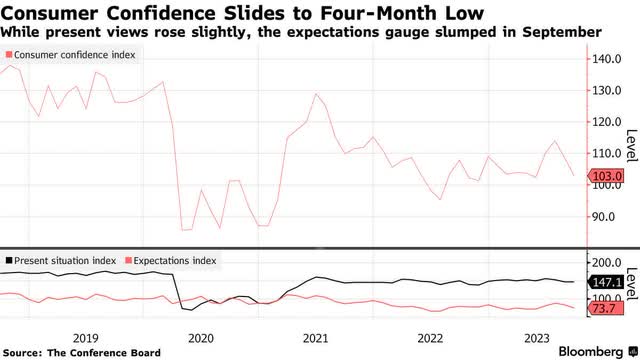

No surprise, confidence amongst customers fell for a second month in a row, alongside the slide in inventory costs. Scrolling by the headlines has been downright miserable in current days. But the deterioration in confidence is targeting the outlook and never the current scenario, which has been getting higher. In line with the Convention Board, the Current Scenario Index, which relies on what is occurring to present enterprise and labor market situations, improved! The Expectations Index fell again beneath a degree that has traditionally been according to the onset of a recession. Think about that?

Bloomberg

The warnings about an impending recession over the previous yr have been fixed, they usually have intensified the longer we go with out one. Customers have been inundated with these warnings, which regardless of being inconsistent with present situations, make them understandably leery in regards to the outlook. Nonetheless, survey outcomes present that plans to purchase autos stay at an elevated degree and plans to purchase home equipment are trending up. This seems like the beginning of the shift from providers to items spending that I’ve been anticipating this fall.

As the following election approaches and the poisonous political divide on this nation intensifies, I think that client sentiment could deteriorate additional. That mentioned, I’m going to remain targeted on what customers are doing reasonably than what they’re saying, which is what dictates the state of the economic system.

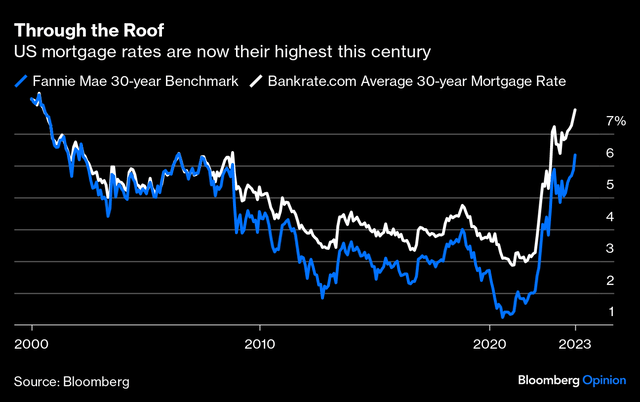

Yesterday’s new house gross sales quantity, which fell sharply beneath estimates, additionally raised issues in regards to the well being of the housing market. With mortgage charges surpassing 7%, this could not have been a shock. Shelter prices have been the stickiest part of the inflation gauge that everybody is complaining about, and better borrowing prices are the answer. Present mortgage charges are killing demand, which ought to stall value will increase and ultimately result in decreases, which is able to then lead to decrease mortgage charges as lenders compete for debtors once more. This can be a cycle. The answer to excessive and rising costs is excessive and rising costs.

Bloomberg

The constructive side of all this dangerous information is that its lessening ought to begin to assist threat asset costs as we start the fourth quarter, setting the stage for a year-end rally. The foremost market averages are at or approaching oversold ranges. If we now have a authorities shutdown, it’s not prone to final lengthy. I anticipate softer financial knowledge to begin to reverse the rise in 2- and 10-year yields, weaken the greenback, and finish the rally in crude oil costs.

When it looks like traders are promoting the whole lot, that’s normally the very best time to begin shopping for, and as I’ve talked about earlier than there are $5.6 trillion causes to take action. As traders acknowledge that the Fed’s rate-hike cycle concluded in July and that short-term rates of interest have peaked, I anticipate traders will begin to reposition cash market fund belongings which are incomes a variable fee of greater than 5% into shares and bonds which are extra prone to exceed that fleeting fee or return over the long run.