Just_Super

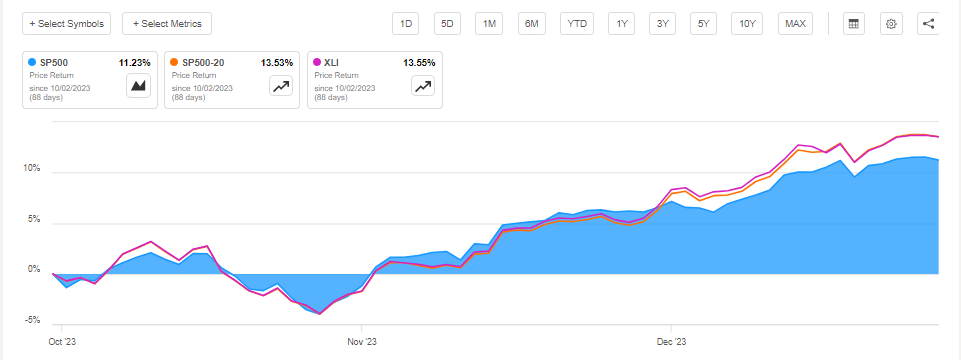

The S&P 500’s Industrial sector (SP500-20) gained about 13% within the fourth quarter, after weakening within the earlier one. Its accompanying ETF, Industrial Choose Sector SPDR Fund (NYSEARCA:XLI), additionally rose about 13.5% between October and December, in comparison with the S&P 500’s 11.23% rally.

With earnings for the fourth quarter proper across the nook, In search of Alpha’s Quant scores gave the Industrial sector, which makes about 9% weightage, an total well being rating of three.31 out of 5, in comparison with 3.39 in the course of the begin of Q3 earnings.

Quant scores marked about 11 shares as a Purchase or greater, whereas the remainder 60 have been rated as Impartial. This compares with 13 Buys and 58 Neutrals simply earlier than Q3 earnings. Scores underneath the Quant system are based mostly on quantitative indicators like valuation, earnings development, and previous inventory efficiency.

Moreover, the sector scored 4.45 out of 5 on dividend safety with, 46 corporations rated as “Extremely Protected” and one other 12 marked “Very Protected”.

Main the pack, service American Airways (AAL), building tools maker Caterpillar (CAT), and electrical tools firm Emerson Electrical (EMR) have been rated Robust Purchase, carrying quant scores within the vary of 4.63–4.86 out of 5.

American Airways was graded an A+ on valuation and development prospects, together with one other A on profitability. Nonetheless, the corporate acquired a C for its momentum.

In the meantime, swimming pool tools provider Pool Corp. (POOL), energy tools maker Generac Holdings (GNRC), and consulting companies firm Jacobs Options (J) have been SA Quant’s least favourite picks. The three corporations have been marked Maintain and carried quant scores within the vary of two.63–2.67.

Pool was graded a D on its development prospects however a B- on momentum and an A on profitability.

Behemoths like Boeing (BA), Lockheed Martin (LMT), Honeywell (HON), United Parcel Service (UPS), 3M (MMM) and Automated Knowledge Procession (ADP), RTX (RTX) have been all rated Maintain and had quant scores ranging between 2.95–3.45.

Trying forward, analysts at Goldman estimated that the economic sector will not be anticipated to see EPS development, solely its median inventory EPS development is predicted to be 5%.