LaylaBird/E+ through Getty Pictures

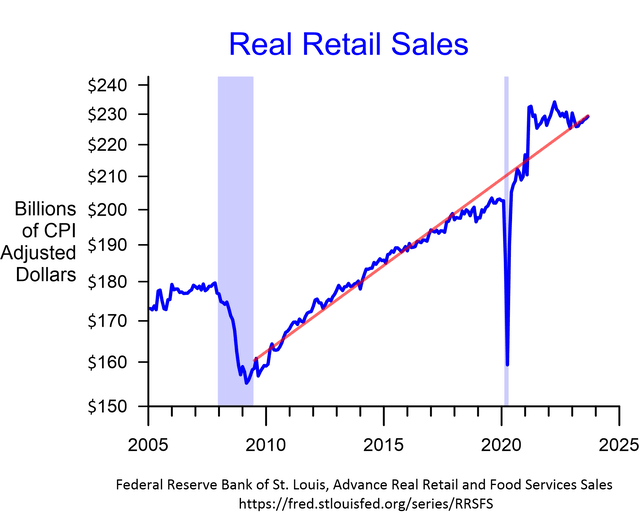

Actual Retail Gross sales Resume Progress

Simply launched September actual retail gross sales present six straight months of progress and the 12 months over 12 months price turned optimistic. Gross sales are again on the expansion pattern of the earlier financial growth (pink line in chart). This completes a two and a half 12 months digestion of the historic surge from Might 2020 to April 2021.

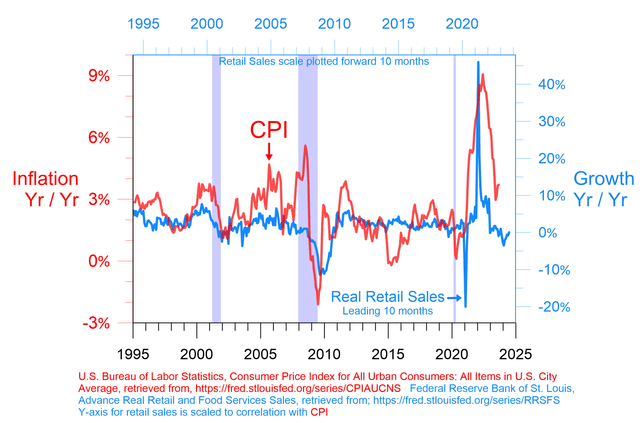

Financial Leads

That report breaking surge helped push inflation to 40 12 months highs. The digestion the place actual gross sales have been flat to down for 2 and a half years and the 12 months over 12 months price was unfavorable for ten out of 11 months started the downtrend of inflation that may doubtless take the speed to 2% or under.

Financial Leads

Revenue maximizing companies usually discover it worthwhile to boost costs when demand is robust. They are going to resist elevating costs if vital to guard market share or if a decline in gross sales harms earnings greater than decrease costs. This dynamic seems to play out with adjustments within the progress price of gross sales main adjustments within the price of inflation by about ten months. Current weak spot in gross sales counsel inflation might drop under 2% within the subsequent 10 months. Nevertheless, primarily based on the weak CPI numbers that may drop out of the 12 months over 12 months CPI price within the subsequent three months the headline CPI price might pattern greater earlier than dropping sharply in 2024.

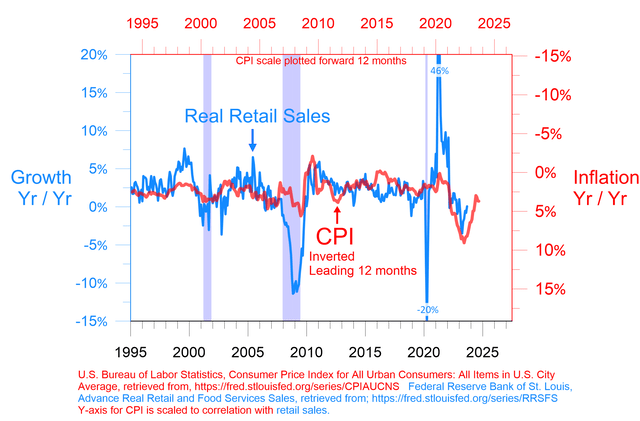

Inflation Tailwind

The affect between inflation and gross sales isn’t just a method. Above we present a optimistic correlation with retail gross sales main the best way; there’s additionally an inverse correlation the place inflation leads. The inverse relationship has a 12 month lead time.

Financial Leads

The chart exhibits the surge of inflation in 2021 helped crash retail gross sales in 2022. The autumn again of inflation in 2022 traces up with enhancing gross sales in 2023. Be aware the pink line for inflation within the chart above is plotted with utilizing an inverted axis so the pink line going up means inflation is falling and vice versa.

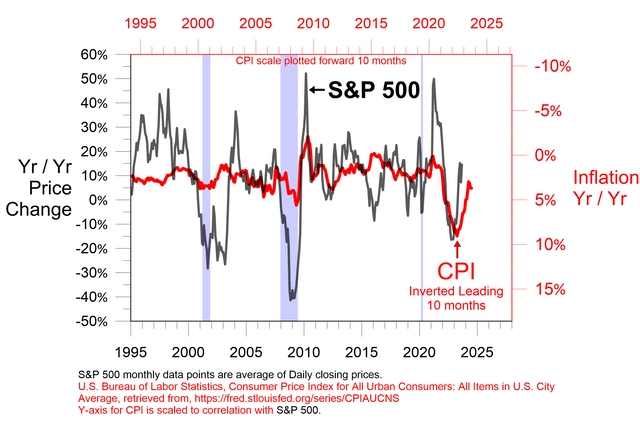

Inflation additionally provides a tailwind to shares.

Financial Leads

The surge of inflation in 2021 corresponds with the bear market in 2022. Inflation dropping in 2022 corresponds with the inventory market uptrend since October 2022. This correlation within the chart suggests the three.7% inflation price in September can be in keeping with a +5% change within the S&P500 for the 12 months ending July 2024.

Tailwind Not Trigger

Inflation is certainly one of many influences available on the market. The inventory market run since October 2022 has had much more behind it than simply falling inflation. Inflation influences the inventory market and retail gross sales, however actually doesn’t management them. When the recession comes (we anticipate late in 2024) inflation might have a powerful tailwind with a 2% price or under, however it received’t matter shares and retail gross sales will plummet within the recession.

Enterprise Cycle and Shares

For now, we’re most likely within the second friendliest a part of the enterprise cycle for shares. We’re doubtless within the closing a part of the financial growth the place financial progress is modest, however persists. That is the a part of the cycle the place shares are inclined to turn out to be essentially the most overvalued. Typically the bull market runs proper up until the recession begins. Typically it’s a bit sooner; in 2007 the bull peaked in October and the recession began in December. Typically it’s as a lot as a 12 months earlier as with the 2001 recession.

The early a part of a recession in fact is the worst a part of the cycle for shares. The collapse in shares within the early a part of a recession units up the subsequent interval the place shares have their greatest efficiency. That is what occurred following the Covid pandemic. One of the best efficiency a part of the cycle usually ends because the financial progress hits a powerful price within the early a part of the growth. Within the present cycle this robust inventory part resulted in December 2021 because the 12 months 2021 was changing into the strongest 12 months of financial progress since 1984 or by some measures since 1950. As financial progress is often hitting its strongest price of the enterprise cycle shares usually enter a weak part which within the present cycle included a few 25% decline in equities. If I’m studying the cycle appropriately we are actually within the inventory pleasant closing a part of the growth.

If the growth ends late in 2024 as I anticipate it is going to be the shortest financial growth for the reason that one lasting 13 month between the again to again recessions within the early Eighties.

My final article reviewed the inventory cycles I’m following. These cycles are nonetheless pointing upward though within the shortest cycle the 12.5 trading-day value achieve raced forward of the cycle and suggests the opportunity of a number of days of weak spot slightly than the uptrend persevering with straight from right here.

If we do get a number of days of weak spot deal with it as a shopping for alternative.