The DeFi ecosystem is on edge as Uniswap, a number one decentralized finance platform, is beneath scrutiny by the US Securities and Change Fee (SEC).

The issuance of a Wells Discover to Uniswap CEO Hayden Adams alerts a possible regulatory storm for the DeFi market sector.

A battle that might decide the destiny of DeFi

Based on Nicola Massella, authorized accomplice at STORM Companions, this new lawsuit has brought about quite a lot of unrest within the DeFi sector, underscoring the seriousness of the scenario. The SEC’s allegations that Uniswap operated as an unregistered securities dealer and trade have raised considerations.

“This motion towards Uniswap marks the SEC’s first aggressive step in direction of a number one entity within the DeFi sector,” Massella instructed BeInCrypto.

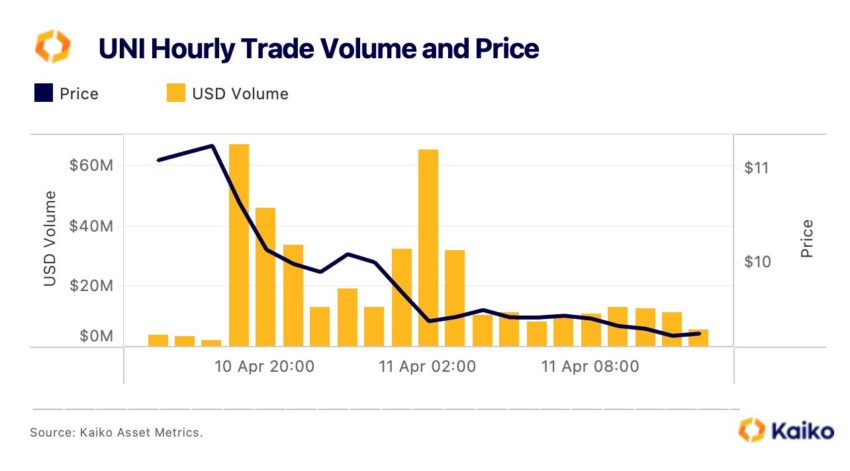

Moreover, the standing of Uniswap’s native token, UNI, as a possible safety provides an additional layer of complexity. Analysts at Kaiko famous that UNI’s value fell 15% and buying and selling volumes soared after the announcement. In the meantime, Santiment reported a “important quantity of FUD” from merchants round Uniswap.

Uniswap (UNI) Worth Efficiency. Supply: Kaiko

Given the significance of this dispute, Massella expects it to additional outline the authorized boundaries of DeFi actions within the US. On the coronary heart of this authorized dispute is the classification of DeFi platforms.

Operators declare to be expertise service suppliers, facilitating impartial crypto asset transactions with out exercising management. This mannequin, they argue, is essentially totally different from conventional buying and selling platforms, that means that current monetary laws don’t apply.

Conversely, the SEC is anticipated to advocate that DeFi platforms adjust to the identical regulatory frameworks that apply to inventory brokers and different monetary entities.

The SEC v. Uniswap decision is poised to develop into a milestone for the US DeFi sector. It is going to make clear the authorized standing of DeFi platforms and set a precedent that might both encourage innovation and progress inside the sector or impose important restrictions beneath the pretext of client safety and market integrity.