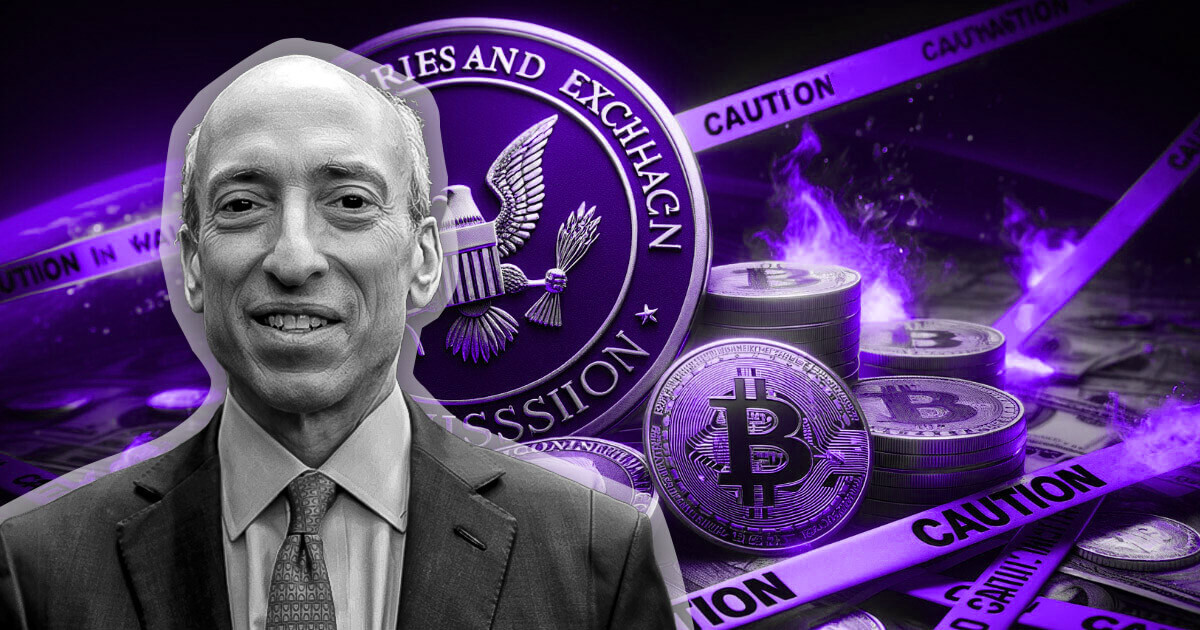

US Securities and Alternate Fee (SEC) Chair Gary Gensler reiterated that Bitcoin will not be labeled as a safety, offering a crucial clarification amid ongoing regulatory scrutiny of the cryptocurrency trade.

Talking in an interview on CNBC’s Squawk Field on Sept. 26, Gensler bolstered the SEC’s place that Bitcoin stays a commodity beneath US legislation. He stated:

“Because it pertains to Bitcoin, my predecessor and I’ve stated that’s not a safety.”

The assertion follows the SEC’s approval of a number of spot Bitcoin exchange-traded funds (ETFs), permitting the digital asset to be traded on distinguished US exchanges, together with the Nasdaq.

Disregard for laws

Whereas Bitcoin’s regulatory standing is evident, Gensler criticized the broader crypto trade for its widespread disregard for current laws. He accused many market members of ignoring guidelines and in search of exemptions from compliance.

Based on Gensler:

“There are guidelines in place, however many have chosen to disregard them.”

He added that this non-compliance has contributed to instability and confusion inside the market.

In distinction, Ethereum, the second-largest crypto, has confronted a extra ambiguous regulatory setting. The SEC has but to categorise Ethereum as both a safety or a non-security, leaving tasks constructed on its blockchain beneath ongoing scrutiny.

Regardless of this uncertainty, the SEC has authorised Ethereum-based ETFs however concurrently initiated investigations into corporations related to the Ethereum ecosystem, corresponding to Consensys and Uniswap.

Lawmakers’ considerations

Gensler’s strategy to regulating Ethereum has drawn criticism from members of Congress. US policymakers, significantly within the Home of Representatives, have accused Gensler of making confusion by coining phrases like “crypto asset safety” in authorized actions.

Throughout a latest congressional listening to, lawmakers expressed frustration over the SEC’s dealing with of crypto laws, with some arguing that the company has stifled innovation. Different SEC Commissioners, together with Hester Peirce and Mark Uyeda, endorsed the critique, saying the regulator has failed to supply readability regardless of having the instruments to take action.

Regardless of the criticism, Gensler maintained that the way forward for the crypto trade is dependent upon stronger regulatory frameworks to guard buyers and construct belief.

The SEC chair said:

“This discipline is not going to lengthy persist should you can’t construct that investor belief within the markets.”

Gensler in contrast the evolution of cryptocurrencies to the event of different industries, noting that laws, like “visitors lights and cease indicators,” are important for progress.

The SEC’s clear stance on Bitcoin contrasts with its ongoing scrutiny of different digital belongings, leaving the regulatory way forward for the broader crypto market unsure.