Douglas Rissing

The Schwab Brief-Time period U.S. Treasury ETF (NYSEARCA:SCHO) is one among many funds that buyers flocked to the final a number of years because the Fed went by the quickest fee hike cycle in historical past. These days might now be over. SCHO is an effective fund, however from an asset allocation perspective, I am not satisfied it is value positioning right here now.

SCHO was launched in 2010 and has amassed a complete internet asset worth of over $12 billion. It provides a simple, low-cost technique of gaining publicity to U.S. Treasury securities, notably these with a remaining maturity of between 1 and three years. This deal with short-term bonds permits the fund to reduce each credit score and rate of interest danger, making it a sexy addition to a diversified portfolio.

SCHO’s Fund Particulars

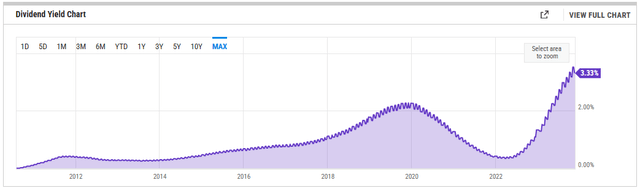

SCHO has a complete expense ratio of 0.03%, which is relatively low for an ETF of its type. This low expense ratio interprets into greater returns for buyers. The fund distributes yields month-to-month and has 98 holdings in whole. No shock – the yield is the very best it has been in a decade.

YCharts

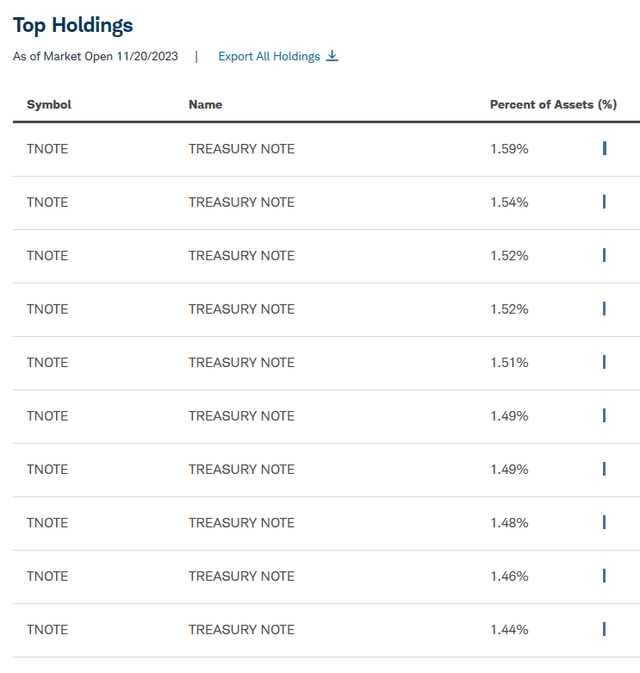

As famous, SCHO invests solely in U.S. Treasury bonds with maturities starting from 1 to three years. All Treasury notes, with small percentages. This can be a very clear pure-play means of accessing Notes with out having to go to Treasury Direct.

Schwab Asset Administration

Sector Composition

SCHO’s sector composition is simple: 99.9% of the fund’s belongings are invested in U.S. Authorities Securities, with the remaining 0.1% allotted to Different Funding Corporations. The latter class represents the fund’s place in cash market mutual funds registered underneath the Funding Firm Act of 1940 and should embrace money pending settlement.

Peer Comparability

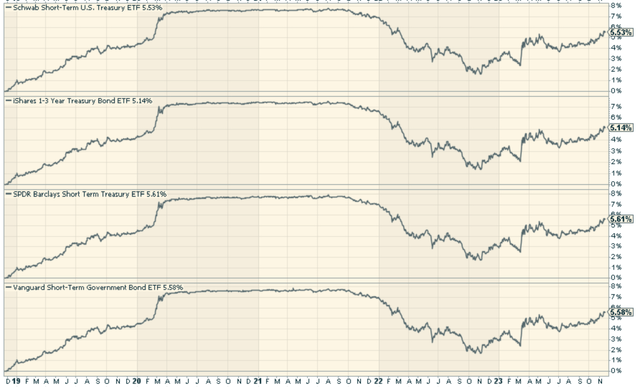

SCHO’s most direct opponents embrace the iShares 1-3 12 months Treasury Bond ETF (SHY), the SPDR Portfolio Brief Time period Treasury ETF (SPTS), and the Vanguard Brief-Time period Treasury Index Fund ETF Shares (VGSH).

Whereas all these ETFs goal to attain related funding targets, there are notable variations associated to their expense ratios, whole asset measurement, common quantity traded, and yields. For example, VGSH, with a complete asset measurement of over $22 billion, has an expense ratio of 0.04% and a mean quantity traded of two.5 million. Compared, SCHO’s expense ratio is decrease at 0.03%, however its whole asset measurement is smaller, at $12 billion.

The efficiency of all has been roughly the identical.

StockCharts.com

Execs and Cons of Investing in SCHO

One of many major benefits of investing in SCHO is its deal with short-term U.S. Treasury bonds. This focus helps to mitigate each credit score and rate of interest danger, making it a doubtlessly engaging possibility within the present financial setting.

One other profit is its low expense ratio of 0.03%, which implies greater returns for buyers. The fund can be extremely liquid, making it straightforward for buyers to purchase and promote shares within the inventory market.

On the flip aspect, the fund’s efficiency is intently tied to the efficiency of the U.S. Treasury bond market, that means that antagonistic financial situations or adjustments in U.S. financial coverage might negatively influence the fund’s returns.

Conclusion

In conclusion, the Schwab Brief-Time period U.S. Treasury ETF represents a viable possibility for buyers searching for publicity to short-term U.S. Treasury bonds. Its low expense ratio, excessive liquidity, and deal with danger mitigation make it a sexy addition to a diversified portfolio. I might moderately favor length now given the place the Fed is within the rate of interest cycle, so whereas this can be a good fund and conservative, there may be extra potential to make elsewhere in my opinion.