Crypto information: Final week the crypto world skilled exuberance and shock in equal measure. On-chain metrics revealed Bitcoin (BTC) whales are rising more and more bullish in mild of the latest US Federal Reserve (Fed) charge pauses, whereas the conviction of former crypto mogul Sam Bankman-Fried (SBF) marked a surprising fall from grace for one among crypto’s early champions and refocused scrutiny on crypto.

Fed Chair Jerome Powell affirmed on Wednesday the central financial institution will maintain rates of interest unchanged at 5.25-5.5%, marking the third consecutive charge pause on this cycle. On-chain knowledge revealed patterns that the Fed’s coverage is popping buyers bullish towards Bitcoin, whilst former crypto champion Sam Bankman-Fried withered below the responsible verdict of 9 jury members in Manhattan.

Bitcoin Upside From Fed Determination

The Federal Open Markets Committee (FOMC) introduced on Nov. 1 that the central financial institution would preserve rates of interest fastened. Powell admitted the transfer would sluggish financial development because the Fed however was essential to battle inflation.

The choice to maintain charges fixed noticed Treasury yields fall from 4.73% from 5% earlier this week. This discount implies that markets imagine that the Fed could also be executed mountain climbing charges.

A pause might be bullish for Bitcoin and cryptocurrencies, since charge will increase have traditionally coincided with large declines within the worth of Bitcoin. Between March and December 2022, when the Fed’s charge hikes had been at their most aggressive, Bitcoin fell 66% from $47,000.

Bullish Bitcoin Whale Transactions

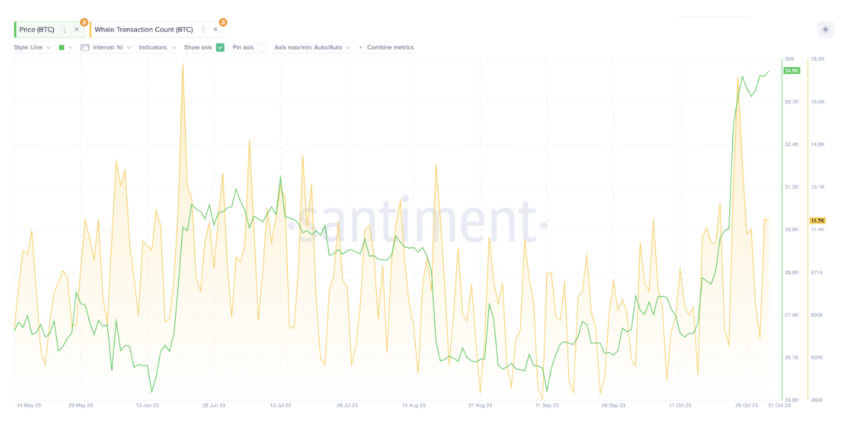

Earlier than the FOMC announcement, BeInCrypto’s on-chain analyst Ibrahim Ajibade mentioned on-chain exercise confirmed crypto buyers had already penciled in a charge pause. Between Oct. 22 and Nov 1, Bitcoin attracted 7,000 each day transactions by giant crypto holders, known as whales.

On Oct. 24 alone, there have been 17,520 giant transactions, the most important since BlackRock introduced its intention to file for a Bitcoin exchange-traded fund. Intuitively, an increase in whale transaction depend is bullish as a result of it factors to a better demand for Bitcoin from institutional and excessive net-worth people.

Learn extra: Top 11 Public Companies Investing in Cryptocurrency

One other metric, known as the World In/Out of the Cash knowledge, which tracks historic shopping for developments, revealed that the $35,100 resistance degree is essentially the most pressing hurdle Bitcoin should overcome earlier than reaching $40,000.

Learn extra: 8 Best On-Chain Analysis Tools in 2023

VanEck Predicts Solana Surge by 2030

However Bitcoin just isn’t the one beneficiary of the latest charge pause. Crypto asset supervisor VanEck believes that Solana may rise greater than 10,000% by 2030 if its consumer base rises to 100 million.

A bull market, broadly believed to be not too far-off, may see the asset surge to $3,211. The community, criticized for its downtime and centralization, just lately struck partnerships with Visa and Shopify that might assist enhance its consumer base.

Following the FOMC announcement, the worth of Solana surged 16% to $39.36 on Nov. 1. The Fed information noticed it get away from its $28 horizontal resistance space established after it collapsed in November final yr.

Crypto Belongings Have been Not SAFU After All

Staying on-chain, crypto sleuth ZachXBT revealed that customers of a password supervisor known as LastPass misplaced roughly $4 billion in crypto belongings on Oct. 25. A hack that began in December affected 80 entities who saved their crypto belongings on LastPass.

ZachXBT suggested individuals who saved keys or seed phrases on LastPass to maneuver their belongings. Tayvano, a Twitter consumer who additionally labored on the investigation, suggested these affected to file a criticism with the Web Crime Criticism Heart (IC3).

Learn extra: Top 10 Must Have Cryptocurrency Security Tips

Musk’s X Experiment So Far

Off-chain, BeInCrypto just lately mirrored on how profitable billionaire entrepreneur Elon Musk has been in turning X, previously Twitter, into an “every little thing app.” After Musk acquired Twitter, he rebranded the platform to X as he charted a brand new course for the platform.

Musk’s hyperlinks with Dogecoin advised he may combine a local “X” token into the social media app. Whereas the billionaire dismissed the concept, new CEO Linda Yaccarino affirmed that X is working with companions to combine video, audio, messaging, and banking companies.

To this point, Musk has been unable to fully remove bots, one thing he vowed to do as a part of an effort to show the platform round. Subscription tiers, together with the aptly-named “not-a-bot” trial in New Zealand and the Philippines, have had restricted success.

Whereas consumer numbers declined since Musk took over, the platform stays a preferred hub for crypto lovers, influencers, politicians, and CEOs. Tweets by Musk additionally proceed to maneuver crypto markets.

Hasta La Vista, SBF

Talking of CEOs, former FTX CEO Sam Bankman-Fried was convicted on a number of counts of fraud and money-laundering in a Manhattan Federal Court docket on Thursday. The decision got here after prosecutors urged jurors to imagine courtroom proof over Bankman-Fried’s “storytelling.”

As soon as a titan of the crypto trade, Bankman-Fried’s fall from grace has been nothing wanting gorgeous. It’s laborious to imagine that the particular person behind one of many largest frauds in US historical past was as soon as in comparison with banking godfather John Pierpont Morgan.

Bankman-Fried’s legal professionals mentioned the previous crypto boss nonetheless maintained his innocence and can battle the judgment. Bankman-Fried’s sentencing trial is about to happen on March 10, 2024.

Every week in the past, hedge fund supervisor Travis Kling tweeted that FTX collectors could also be totally compensated after Google invested $2 billion in Anthropic. The funding values the unreal intelligence agency at $4 billion, making it probably the chapter property will be capable to get better everything of FTX’s funding.

Learn extra: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

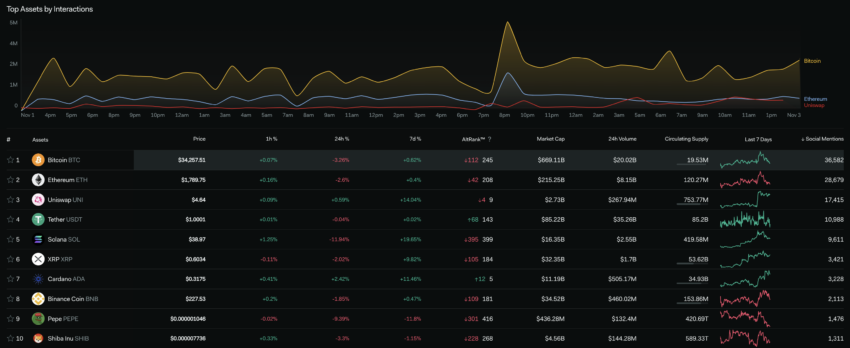

Crypto – Socially Talking

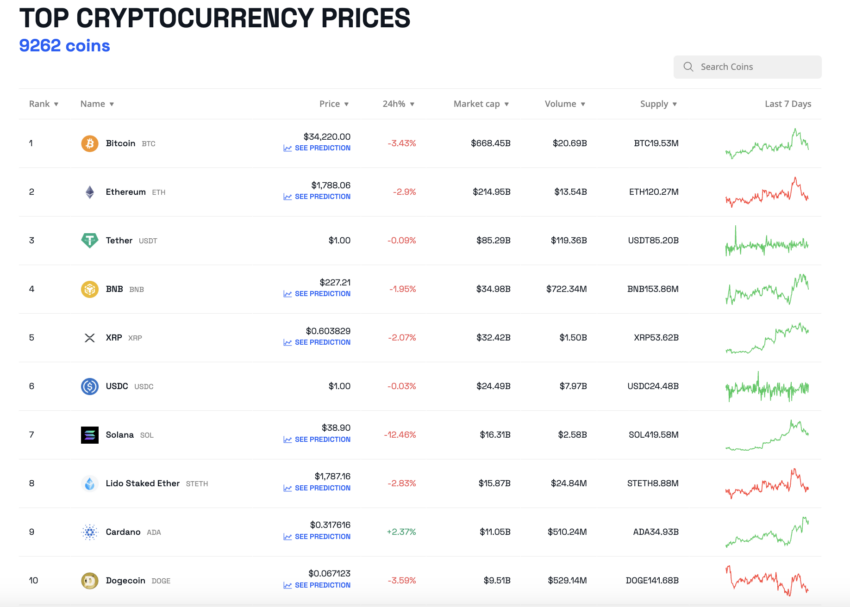

Prime 10 Crypto Costs This Week

Do you will have one thing to say concerning the impression of the Fed charge pause resolution coverage on Bitcoin, Sam Bankman-Fried, or any of the highest tales this week? Please write to us or be a part of the dialogue on our Telegram channel. You may as well catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

All the knowledge contained on our web site is printed in good religion and for normal data functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own danger.