PM Pictures

Sarepta Therapeutics (NASDAQ:SRPT) not too long ago reported sturdy Q3 performance together with key milestones that fortify their place as a number one drive in precision gene therapies for uncommon illnesses, together with Duchenne muscular dystrophy (DMD). Not solely did their earnings reveal spectacular income figures, however additionally essential developments of their efforts to fight this debilitating situation. Sarepta was capable of internet product revenues of $309.3M, marking a exceptional 49% improve year-over-year. Notably, ELEVIDYS, the corporate’s fourth DMD remedy pulled in internet product revenues totaling $69.1M within the first quarter available on the market. In consequence, Sarepta recorded a powerful beat on EPS and income, which brought on the share worth to spike roughly 15% within the following buying and selling session. Sadly, Sarepta reported disappointing outcomes from their topline knowledge from its Part III EMBARK trial, evaluating ELEVIDYS in DMD the day previous to their earnings report. The knowledge confirmed ELEVIDYS didn’t hit its major endpoint within the examine, which practically lower the share worth in half. Nevertheless, ELEVIDYS was capable of obtain statistical significance for all secondary endpoints and will nonetheless have the ability to safe its label enlargement, in addition to full approval. Contemplating the FDA’s regulatory strategy to gene therapies, I’m wanting so as to add to my SRPT place if the market desires to convey the ticker under my Purchase Threshold.

I intend to supply a short background on Sarepta Therapeutics and their current earnings. As well as, I focus on the ELEVIDYS knowledge and why I’m not overly involved right now. As well as, I’ll focus on some draw back dangers that traders ought to pay attention to. Lastly, I reveal my plans for my SRPT place as we head into 2024.

Background On Sarepta Therapeutics

Sarepta Therapeutics is a number one biopharmaceutical firm devoted to discovering, growing, and commercializing modern medicines for uncommon, genetic-based illnesses.

Sarepta Therapeutics boasts a sturdy portfolio of RNA-targeted therapies, gene remedy, and gene modifying. These applied sciences deal with the foundation causes of genetic illnesses, thus, rising the chance of discovering efficient remedies. With over 40 packages and late-stage initiatives in Duchenne and limb-girdle muscular dystrophy sort 2E, Sarepta’s pipeline is a pacesetter in gene remedy and uncommon illnesses.

Sarepta is finest recognized for his or her efforts in DMD, a uncommon and devastating genetic illness affecting roughly 1 in 3,500 – 5,000 new child males worldwide. Characterised by progressive muscle weak spot, DMD usually results in critical problems, making Sarepta’s therapies cherished each by sufferers and suppliers. In actual fact, Sarepta’s RNA-based therapies have been permitted for particular genetic mutations, serving roughly 30% of the DMD neighborhood.

Sarepta’s Q3 Efficiency

Sarepta’s Q3 performance advised the corporate has made a considerable leap ahead on the business entrance. The corporate reported $331.8M in complete income for the quarter. Nevertheless, their internet product revenues of $309.3M, up from $207.8M in Q3 of final yr. Equally noteworthy is the corporate’s attainment of profitability on a non-GAAP foundation, with $37.7M in internet earnings, or $0.37 per diluted share. This was in stark distinction to a non-GAAP internet lack of $70M, or $0.80 per diluted share, for Q3 of 2022.

Notably, Sarepta’s latest remedy, ELEVIDYS, has made a convincing entry into the market, producing internet product revenues of $69.1M in its inaugural quarter. As well as, Sarepta continues to impress with their strategic collaborations and recorded $22.5M from their collaboration with Roche (OTCQX:RHHBY).

Moreover, Sarepta’s monetary state is robust, with the corporate boasting roughly $1.8B in money, money equivalents, investments, and long-term restricted money.

ELEVIDYS Concern?

Sarepta’s latest therapeutic breakthrough, ELEVIDYS, is the unique gene remedy granted accelerated approval by the FDA and represents a big milestone for the corporate of their efforts to be the chief within the remedy of DMD. Nevertheless, the corporate reported topline outcomes from their international Part III EMBARK confirmatory trial for ELEVIDYS, which fell in need of assembly its major goal. This improvement led to a pointy decline in Sarepta’s inventory worth by roughly 42%.

In June, the FDA granted ELEVIDYS approval by way of its accelerated pathway for youngsters between the ages of 4 and 5 with DMD. This indication of a narrower age vary than initially anticipated could have contributed to the market’s response to the current trial outcomes.

Nevertheless, the corporate believes they’ve supplied compelling proof that ELEVIDYS can alter the trajectory of the illness. Whereas the examine’s major endpoint was not met, ELEVIDYS-treated sufferers exhibited marked enhancements in motor perform as assessed by the North Star Ambulatory Evaluation. Moreover, statistically important outcomes on key practical pre-specified secondary endpoints, like time to rise and the 10-meter stroll take a look at, revealed a big remedy benefit that utilized no matter age. It is value noting that no new security issues emerged. The first findings of the examine clearly supported using ELEVIDYS for all measured outcomes. Remarkably, the examine attained statistical significance on all predetermined essential secondary endpoints, signaling a helpful therapeutic influence.

My Take

Sure, ELEVIDYS failed hit to hit the first endpoint, nevertheless, the FDA has been prepared to approve gene therapies with lower than stellar efficacy. What’s extra, the FDA has needed to rely on surrogate endpoints for quite a lot of approvals. So, it’s attainable that the FDA permits ELEVIDYS to stay available on the market with conventional approval… and possibly even greenlight a label enlargement to doubtlessly deal with “all DMD sufferers”. Clearly, if the FDA does approve a label enlargement, Sarepta ought to see a big increase of their long-term prospects as practically all DMD sufferers could be eligible for ELEVIDYS. Contemplating ELEVIDYS prices $3.2M per remedy, and roughly 20,000 boys are born every year with DMD, Sarepta might see upwards of $64B in income. Sure, not each DMD affected person will have the ability to get entry to ELEVIDYS for quite a lot of causes, and we don’t know the corporate’s capability to serve the DMD inhabitants every year. Nevertheless, even when the corporate performs 1,000 remedies continues to be going to get them $3.2B in gross sales.

Contemplating SRPT’s market cap is round $7.5B, we will say that the ticker nonetheless has some potential upside if ELEVIDYS hits its full potential.

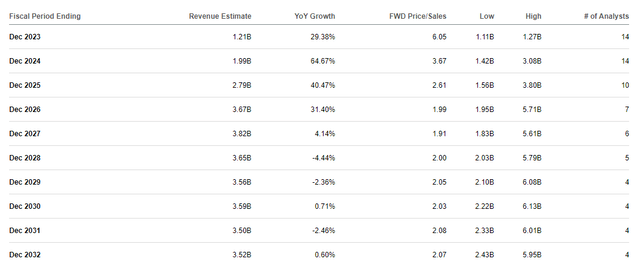

The Road expects Sarepta to report strong double-digit progress for the subsequent few years and probably clear $3.6B by 2026, which might be about 2x ahead price-to-sales.

Sarepta Therapeutics Income Estimates (Searching for Alpha)

The trade’s common worth to gross sales is roughly 4x, so SRPT is at the moment buying and selling at a reduction for its potential future efficiency.

Notable Draw back Threat

Clearly, Sarepta does have a big draw back threat if the FDA doesn’t approve the label enlargement. Though the corporate has a number of different business merchandise, Sarepta is de facto relying on ELEVIDYS to see a giant progress spurt and persistently report a optimistic EPS. I have to level out that Sarepta has amassed $681.9M in R&D bills within the first 9 months of 2023, and over $350M in SG&A in the identical time interval. So, we would see the market transfer SRPT again to a extra speculative ticker as traders would possibly start to query when the corporate can definitively publish a optimistic annual EPS.

We’ve already seen how the market reacted to the info launch, so a ultimate choice to disclaim the label enlargement might actually damage the share worth and forestall a restoration for a chronic time frame. In consequence, I keep my present conviction ranking of three out of 5 and can keep within the Compounding Healthcare “Bio Growth” portfolio.

My Plan

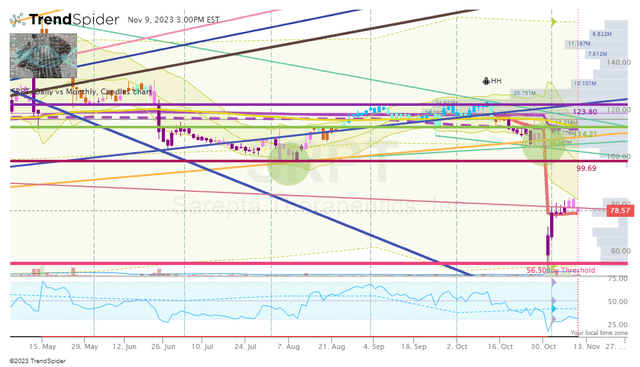

For essentially the most half, my SRPT place has been dormant over the previous couple of years as a consequence of ticker buying and selling above my near-term Promote Targets. As well as, I’ve been apprehensive about including to positions which can be above my Purchase Threshold in a market that has been punishing speculative healthcare tickers. Nevertheless, the market’s response to the info readout plunged SRPT proper all the way down to my Purchase Goal 2 of $56.25, the place I had a small standing purchase order positioned simply in case the market wished to overreact to a destructive headline. Effectively, it labored… I’m not again within the accumulation section for SRPT to construct on my “Home Cash” place. Nevertheless, I’m not trying to amass a large SRPT place right now and will probably be trying to e-book earnings as soon as the ticker hits my Promote Targets. As talked about above, I’m not overly eager on constructing heavyweight positions in my speculative portfolio on this market atmosphere. I’ll fortunately settle for the market’s alternative to derisk the place and hold some on the desk for long-term funding and hopefully graduate to the “Bioreactor” progress portfolio.

SRPT Day by day Chart (Trendspider)

Nevertheless, I’ll think about altering my place if we see a drastic change within the ticker’s technical grades or a optimistic replace on ELEVIDYS.

Long run, I count on to take care of an SRPT place for the foreseeable future with the objective of buying and selling the ticker within the “Bio Growth” portfolio till it doubtlessly graduates to the “Bioreactor” progress portfolio.