Man celebrating anticipated FFO progress after 5 years of declines.

lucigerma/iStock by way of Getty Photos

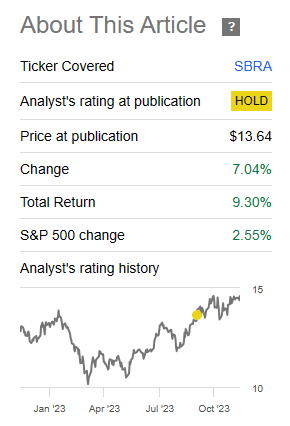

On our final protection of Sabra Well being Care REIT Inc. (NASDAQ:SBRA), we identified the problems with the corporate, and informed you why we weren’t shopping for the 9% yielder.

We see the corporate as one of many weaker gamers within the house and do not assume the present worth presents a compelling entry level. Sure the big dividend yield seems tempting, however it’s actually about contemplating the whole returns buyers have gotten from the corporate. Extra importantly, the majority of the value loss over this timeframe was on account of FFO declines and never on account of a a number of compression. We charge this a maintain whereas giving it a 6 on our potential ache scale at this worth.

Supply: A 9% Yielding Healthcare REIT

The inventory proved to be one of many extra resilient ones within the REIT sector and buyers are in all probability sad at lacking out on the up transfer.

Looking for Alpha

After all, we have now maintained this destructive stance for a very long time and over the previous few years, SBRA has not given buyers a lot cheer. However issues are certainly wanting up for the sector. There are some good tailwinds for the REIT and as we speak we’ll go over what the bull case might like for 2024. We will even inform you the place the higher risk-reward lies if you wish to play the rebound.

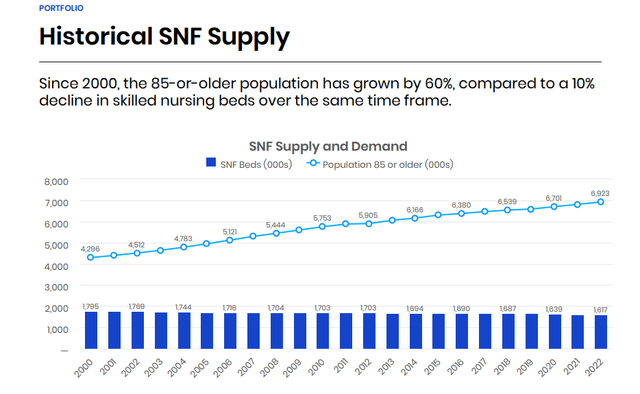

Q3-2023 & Outlook

Senior housing and expert nursing sectors took it on the chin throughout COVID-19 and it created an ideal storm for the sector. The three years had been stuffed with disaster on a number of fronts together with a excessive stage of mortality within the aged inhabitants, excessive provide from earlier building begins and a really excessive stage of inflation in wages. However we have now begun to see all three recede and transfer in the wrong way. COVID-19 associated mortality is now a previous problem and the variety of boomers retiring is rapidly filling the demand hole. New constructions have fallen off and provide is slowly coming to a crawl in senior housing. On the expert nursing aspect, out there beds have been declining for a while and the REIT’s tenants will doubtless get pleasure from higher pricing energy on the non-public aspect.

SBRA Q3-2023 Data

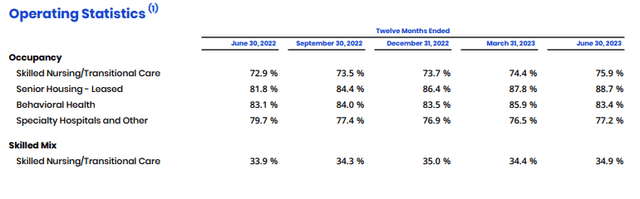

Wages have moderated. On SBRA’s portfolio we will see the small inexperienced shoots within the occupancy ranges which have trended increased.

SBRA Q3-2023 Data

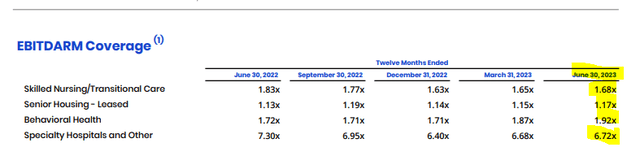

Skeptics might level to the EBITDARM (earnings earlier than curiosity, taxes, depreciation, amortization and administration charges) protection of tenants nonetheless wanting weak.

SBRA Q3-2023 Data

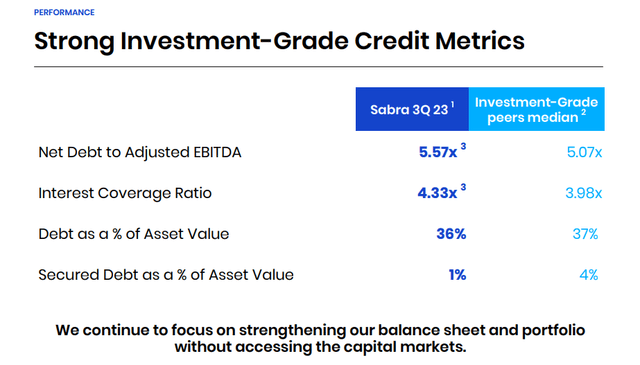

That’s actually true, however these enhance with a lag and since this can be a trailing 12-month measure, you will not see it right here till effectively into 2024. Extra importantly for SBRA, it’s truly in an excellent place to benefit from it. In contrast to some REITs that performed quick and free with their credit score, SBRA has truly maintained a moderately clear steadiness sheet.

SBRA Q3-2023 Data

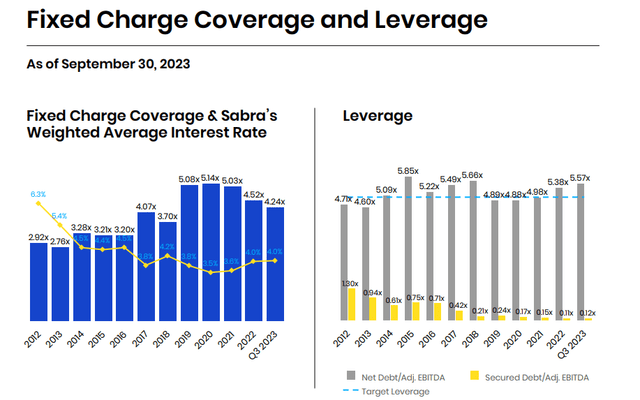

Mounted cost protection did development down from 2020, however stays moderately sturdy at 4.24X.

SBRA Q3-2023 Data

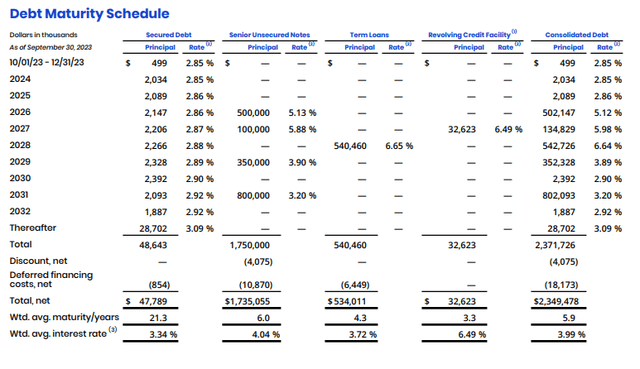

The debt maturity profile is superlative and there’s no massive refinancing till 2026. The 2026 and 2027 maturities are additionally at comparatively excessive rates of interest so refinancing is not going to be an enormous burden on funds from operations (FFO).

SBRA Q3-2023 Data

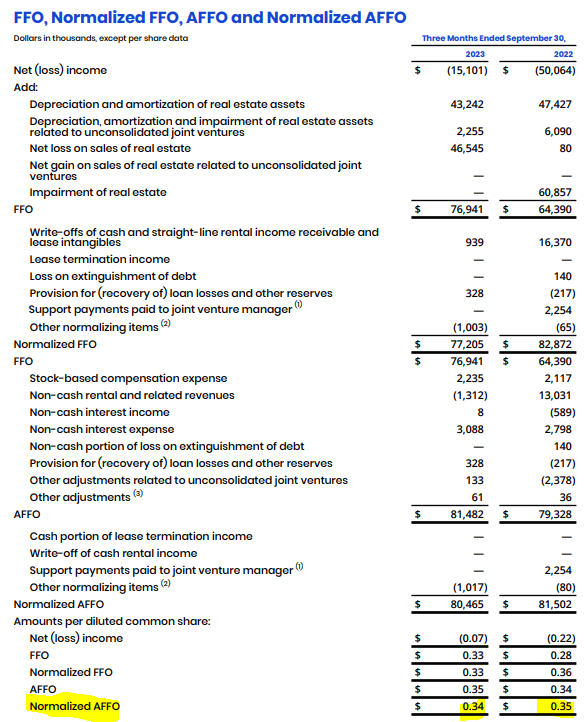

Talking about FFO and adjusted FFO (AFFO), the REIT confirmed yet one more quarter of declining normalized AFFO yr over yr.

SBRA Q3-2023 Data

This has been a thorn within the aspect of the bull case and SBRA’s AFFO has declined from over $2.00 a share (2018) all the way down to $1.36 now (anticipated 2023). However because it stands, FFO ought to develop in 2024, albeit off a low base. Analysts have at all times been predicting progress each single yr after which have needed to backtrack round mid yr. So in that sense, 2024 doesn’t sound any completely different than the previous few years. However we consider that the approaching yr truly has an excellent probability of proving the analysts right for as soon as. So you’re looking at a couple of 3-4% progress and you then add the 8.22% dividend yield, and all of the sudden you’re excited in regards to the inventory.

Look For Worth

Whereas there’s a reputable case for some upside right here, we might nonetheless be skeptical that the long run tendencies right here have been firmly reversed. What bothers us most about this sector is that the underlying tenant well being has been extraordinarily poor. Having EBITDARM coverages close to 1.2X is actually what we’re referring to. That poor stage of lease protection (after you exclude each single related expense) shouldn’t be discovered wherever else within the REIT house. Even in the event you “purchase” the bull case, allow us to inform you why we expect Nationwide Well being Traders, Inc. (NHI) is a superior choose right here.

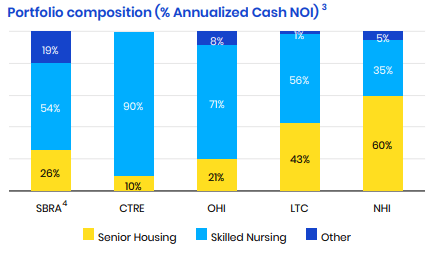

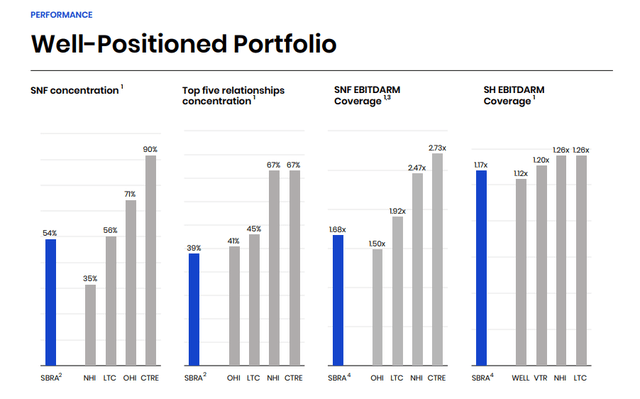

NHI does bear a variety of similarity to SBRA and even SBRA throws on this one as a comparative in displays.

SBRA Q3-2023 Data

We truly just like the NHI leaning on senior housing versus expert nursing because the latter continues to be fighting Medicare reimbursement points. For the expert nursing that each have, NHI has much better lease protection from its tenants (2.47X vs 1.68X). Senior housing lease protection is comparable.

SBRA Q3-2023 Data

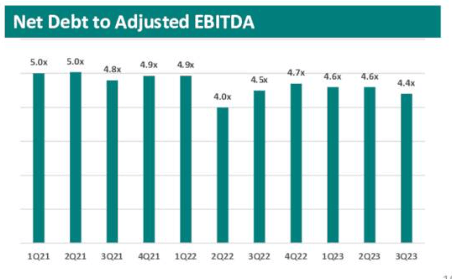

NHI has held up its FFO much better within the 2018 to 2023 timeframe (20% decline versus over 35% for SBRA). NHI can be operating leverage at 4.4X EBITDA versus 5.57X for SBRA.

NHI Q3-2023 Presentation

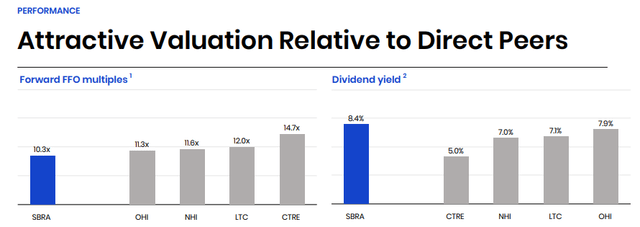

On a worth to NAV foundation, each shares are buying and selling at about 10% over consensus NAV. So neither aspect will get a bonus there. SBRA does sport a better dividend yield and likewise a barely decrease FFO a number of.

SBRA Q3-2023 Data

We predict this is not going to sway the general final result a lot by way of returns. We might proceed avoiding SBRA and contemplate NHI as a play on the sector.