This can be a section from the Empire e-newsletter. To learn the complete editions, subscribe.

It is actually exhausting to summarize the largest tales of 2024 just because there have been so many, but when I had been to undertake that train I would must say that tokenization – and BlackRock’s grand entry into crypto – ranks excessive the checklist can be.

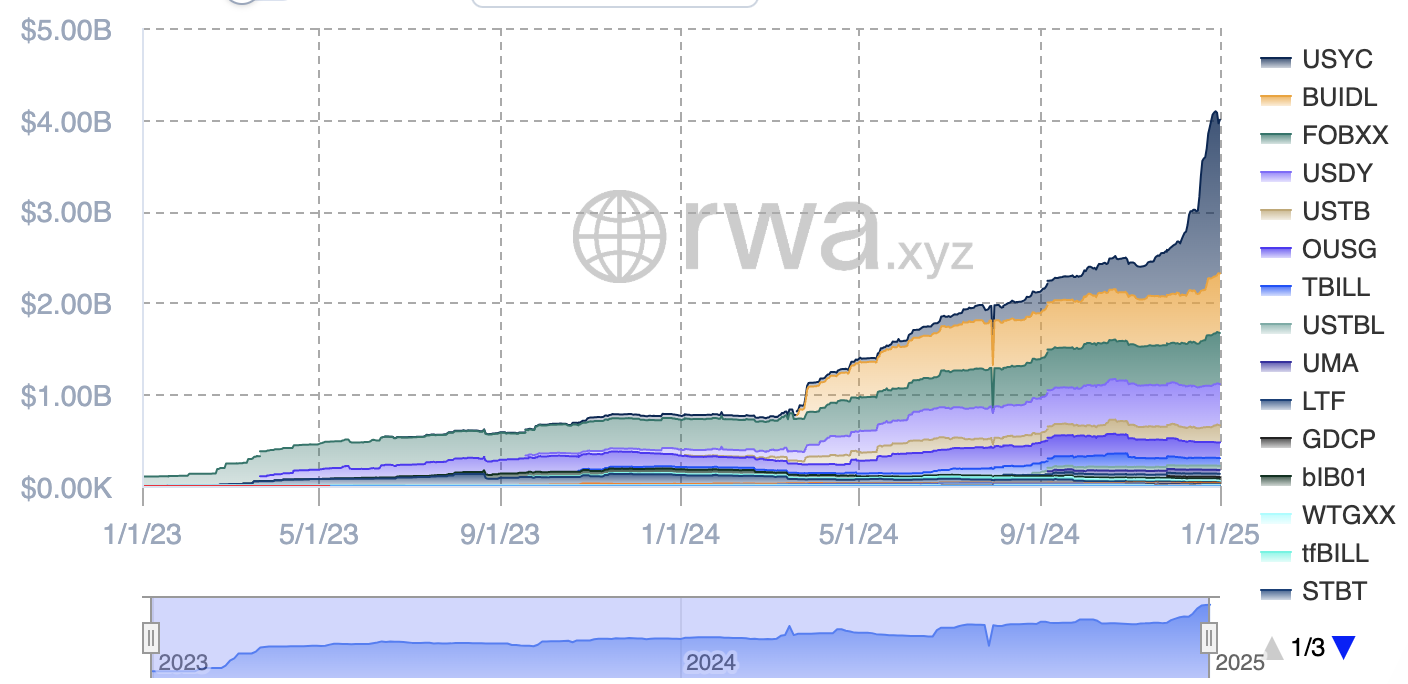

In response to RWA.xyz, tokenized treasuries presently sit at round $4 billion, which is a small slice of the RWA pie. Presently, the entire RWA onchain (excluding stablecoins) is $15.2 billion.

Nevertheless, Securitize CEO Carlos Domingo thinks you would realistically minimize out a number of the tokenization efforts that happened on personal chains that nobody makes use of, which may carry the entire worth right down to round $5 billion.

Each VanEck and Bitwise consider the RWA area may develop to $50 billion – a quantity Domingo believes is inside attain.

“When you take a look at the speed at which we’ll develop, the Treasury area itself ought to develop to a number of billion {dollars} subsequent 12 months, as a result of stablecoins are actually price $200 billion. In order that must be $10 to $20 billion in authorities bonds. And then you definitely begin including in a number of the new merchandise that we’ll roll out… ongoing integrations with DeFi, and many others. I feel merging the business… ought to attain $50 billion inside the subsequent twelve to eighteen months, and hopefully we are going to we our 20% [to] 25% market share because the business chief,” stated Domingo.

A take a look at the most important tokenized treasurySure

As for achievement this 12 months, Domingo thinks that tokenization has reached the mainstream not solely as a result of large figures are coming into the area, but in addition as a result of there was “usefulness of the tokens.”

“We began with easy options like peer-to-peer portability, so quicker portability that makes the asset extra usable within the chain, just like the use circumstances we have been engaged on – with BUIDL as collateral – and so forth. That is all based mostly on with the ability to transfer safety effectively within the chain [and] the liquidity via single redemptions with stablecoins, and many others.,” he defined.

Clearly, Domingo would not assume that tokenization’s second within the highlight is a one-time affair. He feels fairly strongly that we are going to proceed to adapt and evolve the RWA area over the approaching 12 months.

For Domingo, the large catch is the aforementioned integration with DeFi, which Securitize is exploring as its subsequent enterprise.

“That can make the business ten occasions larger. That is my private opinion,” he informed me. However it is going to be good for each RWA and DeFi, which might profit from one another’s success.

Relating to the challenges of the approaching 12 months, it is going to be twofold for Securitize.

First Domingo half-jokingly informed me to cease being a bottleneck (which, he added, was why Securitize was thrilled to usher in Michael Sonnenshein late final 12 months) after which it is all about buying expertise.

Domingo stated hiring in a bull market could be very “difficult” as a result of quantity of competitors within the business, however it’s not a nasty drawback to have as regulatory overhang will now not be a serious drawback as soon as we transition to this subsequent administration.

Overlook the 12 months of the snake – that is the 12 months of tokenization.