- Miners continued to be worthwhile after the halving, because of Runes.

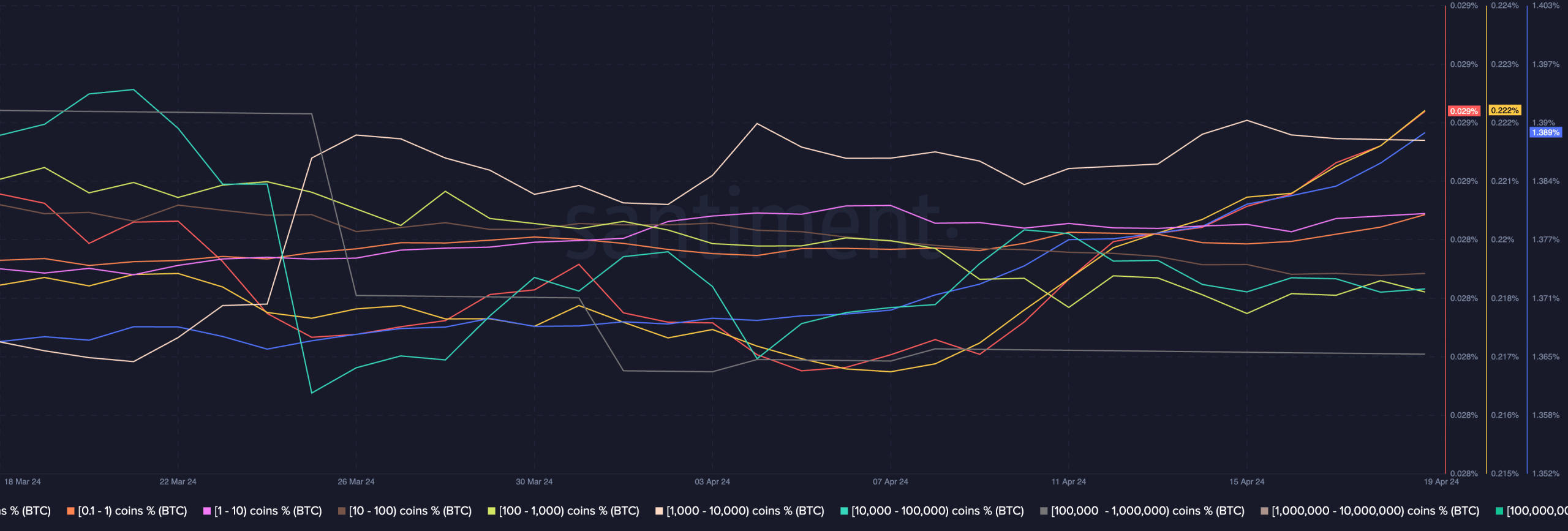

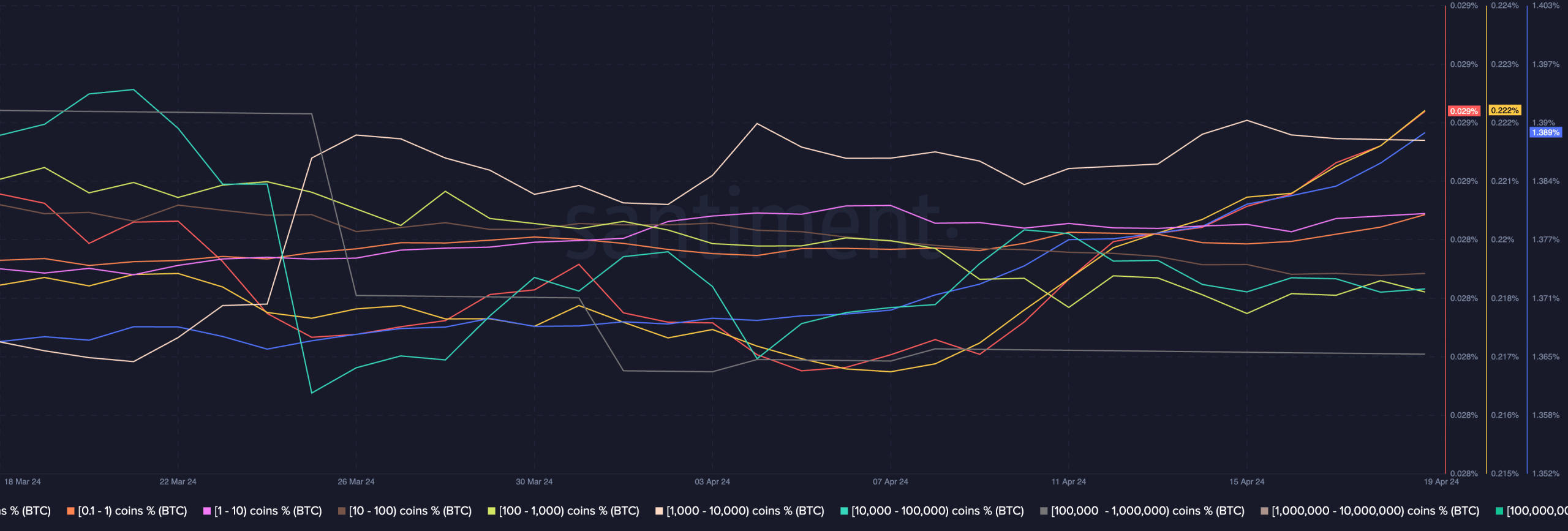

- Retail curiosity in BTC grew, nevertheless, whale curiosity remained stagnant.

Usually, after a Bitcoin [BTC] halving, there’s a discount in revenues collected by miners as a result of diminished block rewards.

Nonetheless, current developments within the cryptocurrency mining panorama have painted a unique image, with miners seeing inexperienced and record-breaking revenues.

Miners profit from Runes

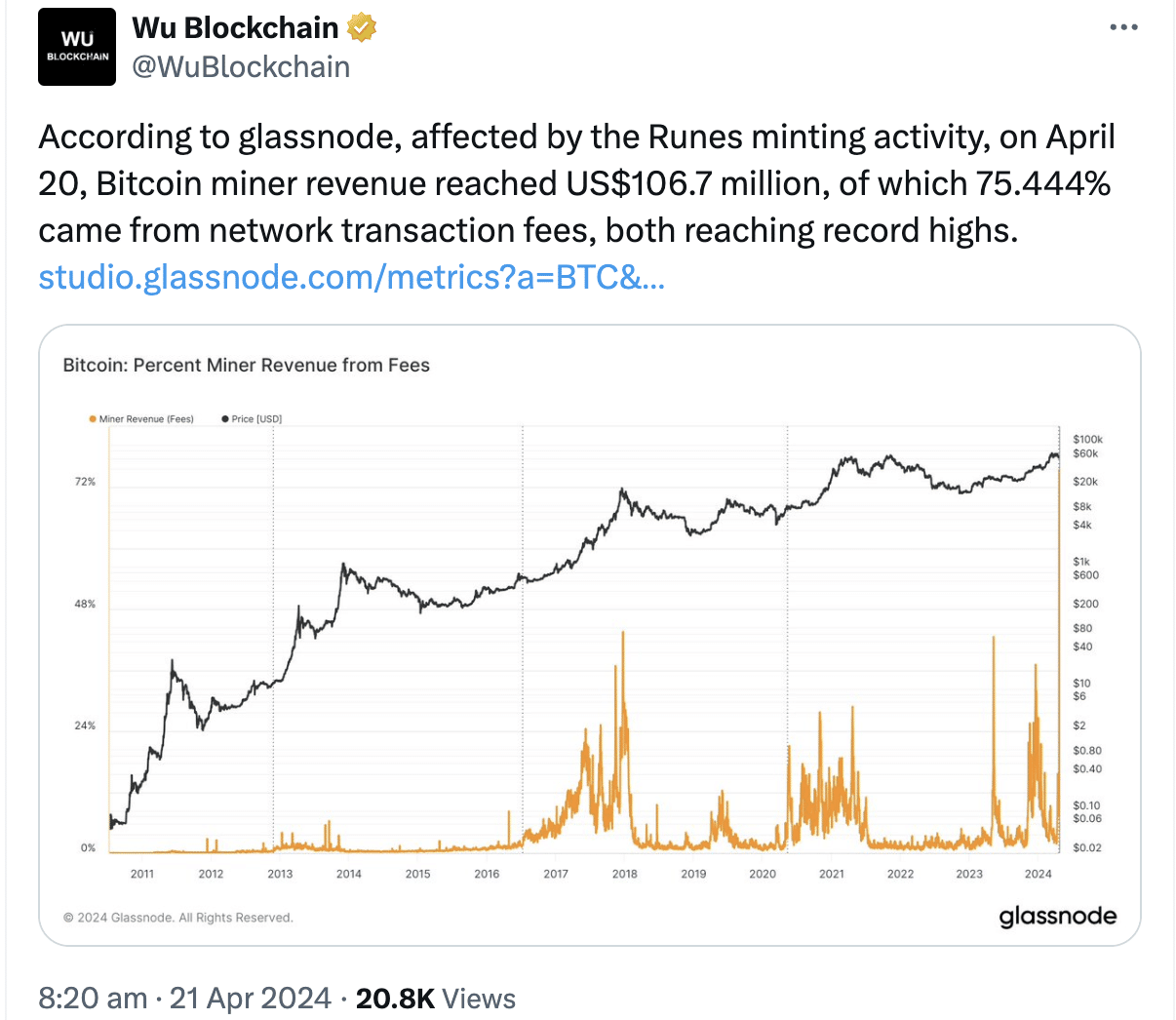

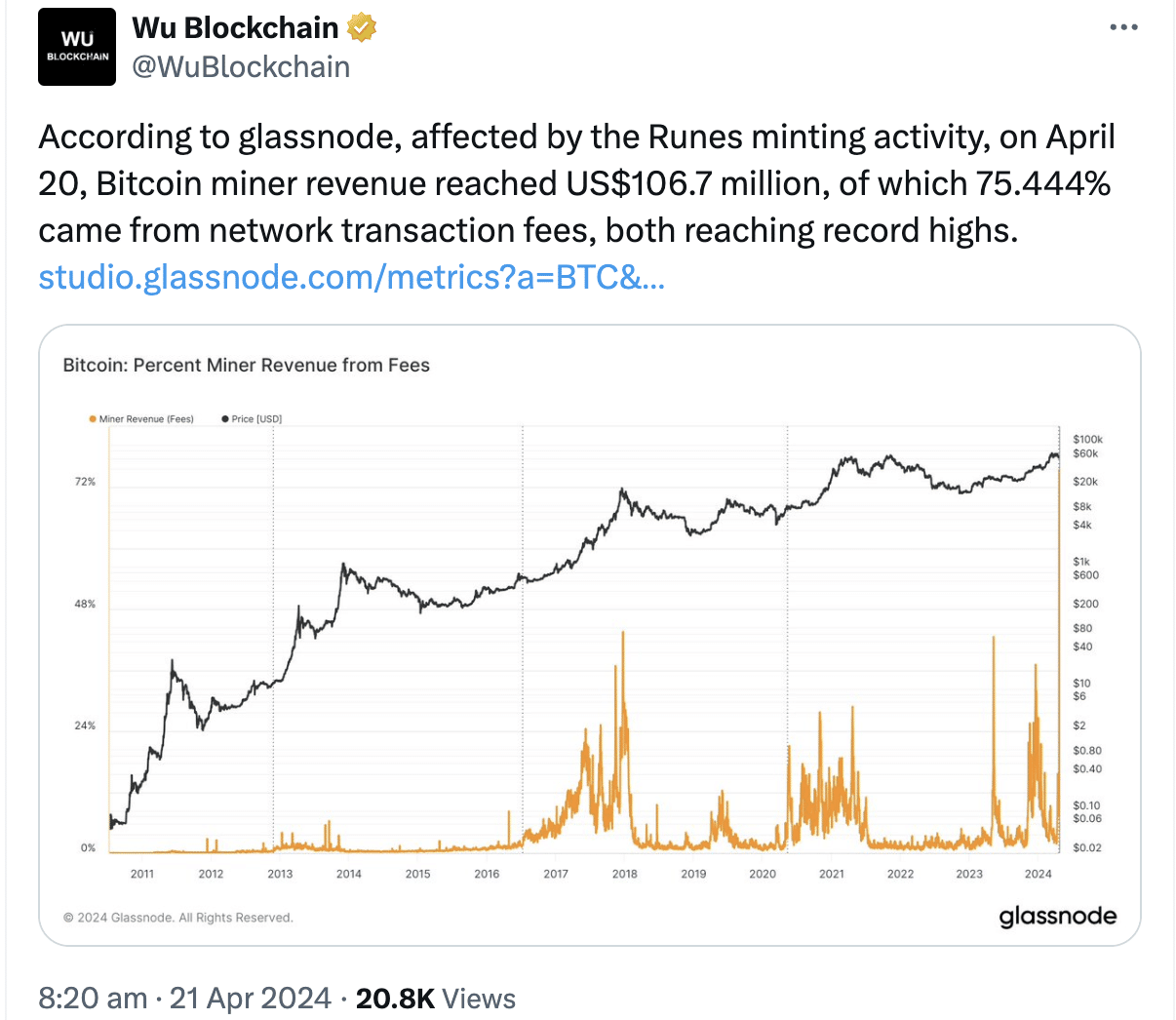

In accordance with Glassnode, Bitcoin miner income surged to a formidable $106.7 million on the twentieth of April.

A good portion, 75.444%, of this income got here from community transaction charges, marking a brand new excessive for Bitcoin miners.

Supply: X

This surge in miner income could be attributed to the rise of Bitcoin runes, a protocol enabling the creation of fungible tokens on the Bitcoin blockchain.

This innovation permits for the creation of recent cryptocurrencies or tokens that function on the identical community as Bitcoin, contributing to elevated mining profitability.

The profitability of Bitcoin mining is important for miners because it immediately impacts their backside line.

Increased profitability means miners can cowl their operational prices extra effectively and probably reinvest in mining gear or infrastructure upgrades.

This, in flip, strengthens the general safety and resilience of the Bitcoin community.

Furthermore, the excessive profitability of Bitcoin mining may have constructive implications for the broader BTC market.

With miners incomes extra income, there may be diminished promoting strain on BTC as miners could also be much less inclined to promote their newly minted cash.

This dynamic may contribute to cost stability and probably even upward worth actions for BTC.

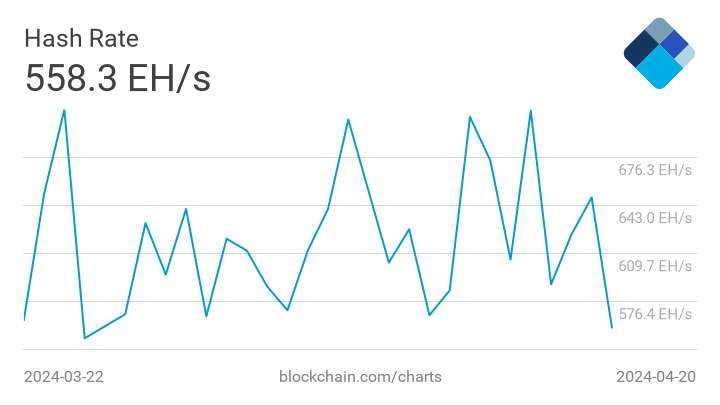

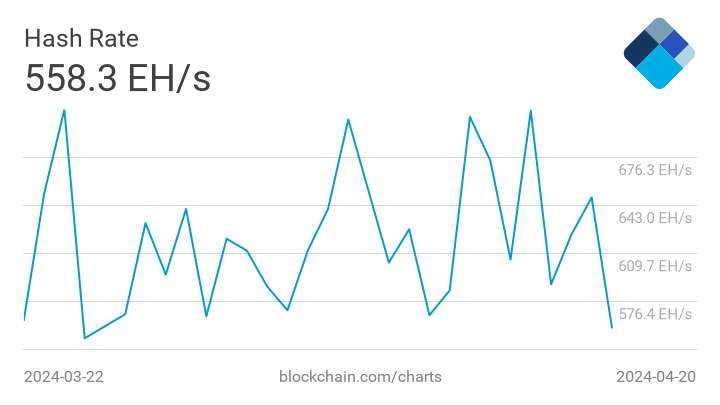

Nonetheless, the hashrate round BTC declined considerably in the previous couple of days, which may influence miners negatively sooner or later.

Supply: Blockchain

How is BTC doing?

Talking of worth actions, BTC was buying and selling at $64,883.09 at press time, reflecting a 2.10% enhance within the final 24 hours.

This uptick in worth, coupled with the rising profitability of mining, bodes effectively for the general sentiment surrounding BTC.

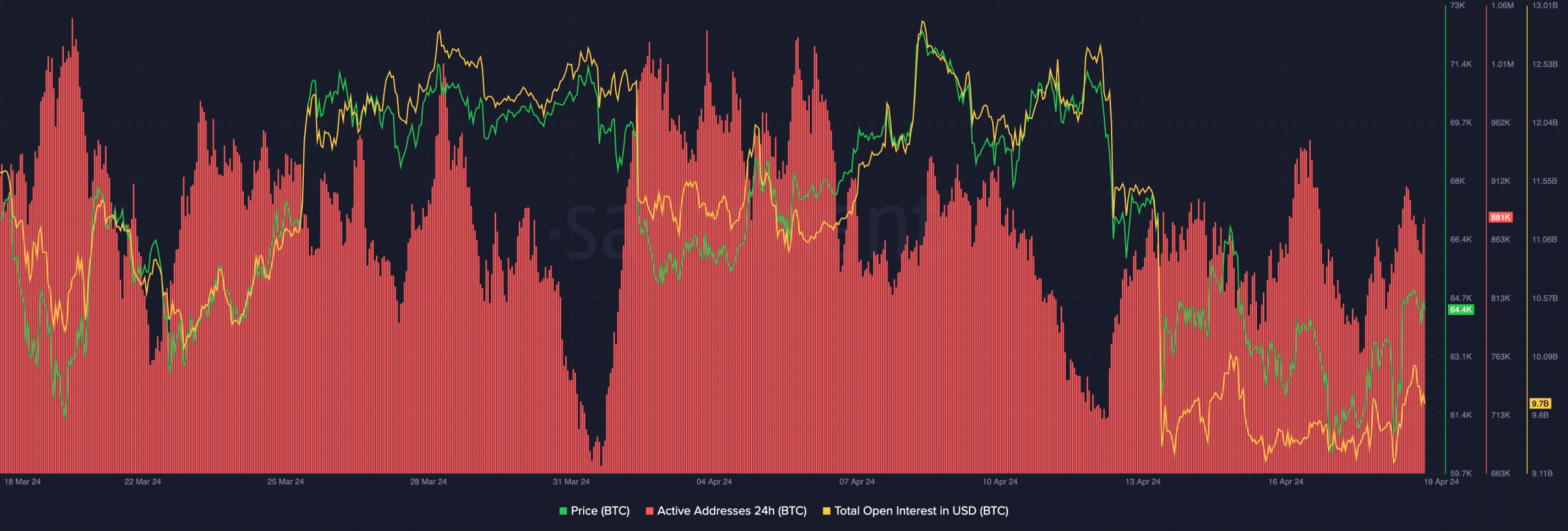

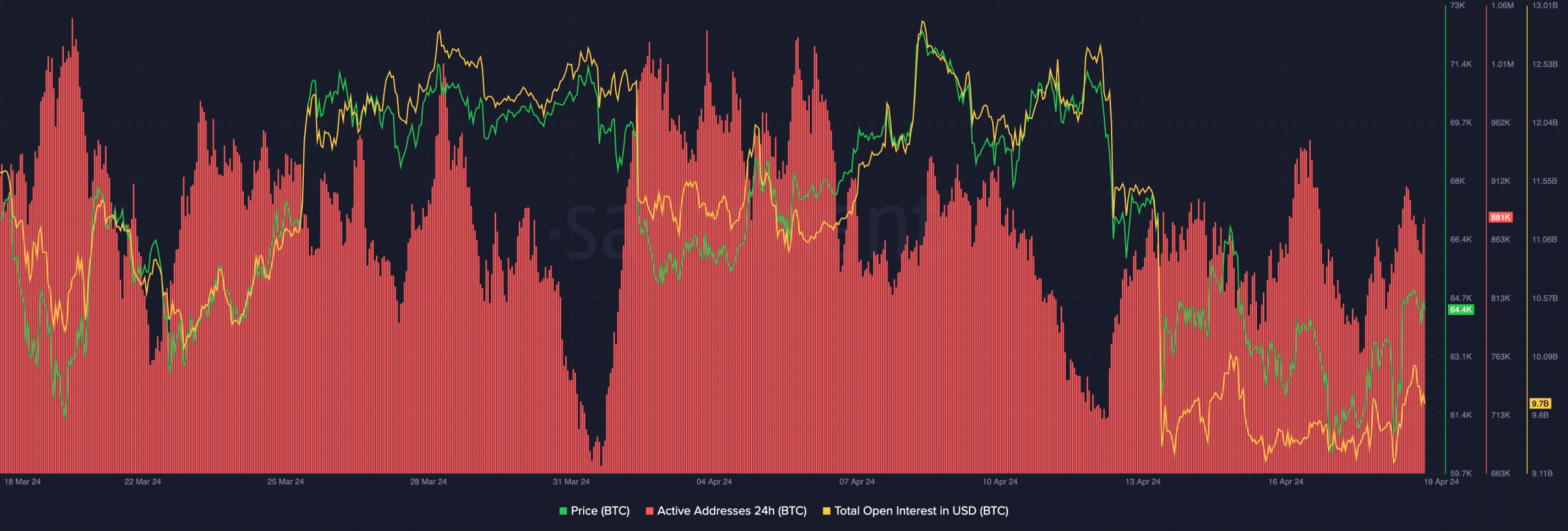

Moreover, lively addresses on the BTC community have seen vital development in current days.

This uptick in exercise suggests rising curiosity and engagement with the Bitcoin blockchain, additional supporting constructive worth momentum.

Supply: Santiment

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Whereas retail curiosity in BTC has been on the rise, whale curiosity seems to have stagnated, indicating a possible shift in market dynamics.

Nonetheless, Open Curiosity, a measure of market exercise and liquidity, has witnessed a slight uptick, steered continued curiosity from merchants and traders in BTC futures markets.

Supply: Santiment