WANAN YOSSINGKUM

2023 redeemed the mess that was 2022.

I imagine 2024 will eclipse the reminiscence of 2022 by including to the positive aspects of This fall 2023.

If in case you have already forgotten (or purposely erased out of your reminiscence) the yr 2022, the S&P 500 (SP500) was down 19.4% that yr. The Nasdaq 100-Index (NDX) was down 33%!

In 2023, the S&P was up 23.4%. Most individuals would assume which means a revenue over these two years. Nevertheless, our members know higher. They perceive this math.

2022: $10,000 – $1,940 (19.4%) = $8,060.

2023: $8,060 + $2,420 (24.2%) = $10,480.

Over these two years, an funding within the S&P 500 would have earned a complete of $480, lower than the speed of inflation — and that is solely due to the bull-roaring positive aspects of the 7 AI shares which might be the biggest by market cap holdings of the S&P!

The information on the Nasdaq 100 entrance is a smidge higher, because of the wild enthusiasm generated by generative AI:

2022: $10,000 – $3,300 (33%) = $6,700

2023: $6,700 + $3893 (58.1%) = $10,593.

On this case, an investor who held the Naz 100 over 2022 and 2023 can be up $593. Hardly price it financially, however many market individuals are in it for the adrenaline rush. They definitely acquired one in every of those years! “To all the pieces there’s a season…”

The Good Information

The excellent news is that each indicator I exploit to contemplate the extent of money/MMF to maintain versus safety/ETF funding to make appears higher now than it did initially of 2023.

I attempt to keep forward of investor sentiment, the place we stand within the financial cycle, the valuation of obtainable choices, and the technical scenario (significantly useful when reviewing development firms).

* Sentiment

* Financial Cycle

* Worth

* Technical.

Sentiment is true the place I wish to see it, which is to say: it isn’t very robust. Many traders are nonetheless cautious of the market. That is evidenced by the frenzy to earnings (not a nasty choice if you may make 2-3%+ over the speed of coming-down inflation for an prolonged interval.) It is usually seen by the upper quantity on down days than up, and on the instant concern seen within the first gingerly step of 2024, because the Naz took a long-overdue dive.

The financial cycle appears simply tremendous. Even the Fed has lastly capitulated to the truth that inflation was declining a lot sooner than their *trailing* indicators had been exhibiting. With intermediate ups and downs, the pattern to decrease charges is prone to proceed.

This could unfreeze all these of us who refinanced our properties or purchased anew and acquired as little as 2 & 3/8 p.c mortgage loans. We’d now need to downsize or be part of these owners fleeing from sanctuary cities or high-tax states like California, New York, and Illinois, however are unwilling to lose that whole lot with out a increased dwelling worth. As charges come down, the brand new housing market ought to choose up and current housing will take part.

Wage inflation has two clear causes. If there are extra job openings than there are keen employees, employers have to lift wages to draw extra employees. That’s the way it works in most states that also imagine in capitalism for all. In states that arbitrarily elevate the minimal wage to the extent the place a robotic arm can do the identical job as a human and do it twice as quick for half the last word “wage” earlier than it should be changed, we’ll see many layoffs. These robotic arms give Adam Smith’s “invisible hand” a complete new that means — and can imply much less wage inflation.

Valuation stays the largest fly within the ointment. There’s a motive the Nasdaq is plunging proper now. Investor enthusiasm merely acquired forward of itself. I had trailing stops in any 2x or 3x leveraged ETFs that traded Nasdaq firms. Poof!! They’re gone. However I’m fairly all proper holding the unleveraged lengthy ETFs on the Naz. Our most revolutionary firms are among the many giant caps traded there. In what I see as a tremendous 2024, these are good holds.

Sure, the markets will appropriate occasionally. Hold your eye on the prize. I imagine there can be a rolling correction by business and sector the place a number of the least fashionable sectors and industries, people who missed a lot of the 2023 fireworks, will quietly rise within the shadows whereas people who acquired forward of themselves will nonetheless get 99% of the media consideration.

The technical outlook will, I imagine, rely upon how temporary or lengthy the large-cap darlings take to settle again a bit.

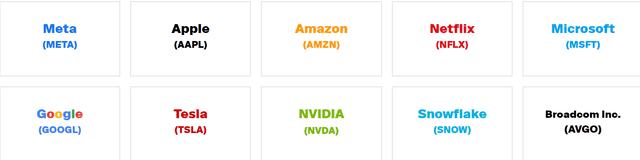

We are able to all the time rely upon the truth that companies that create indexes will stress people who enchantment essentially the most to these traders who’re most prone to animal spirits. One such, not content material with simply FANG, FAANG, or Magnificent 7, is ICE’s “NYSE® FANG+® Index” (“NYFANG”). This index consists of simply 10 shares, every of which includes 10% of this portfolio of 10. It’s reconstituted quarterly, however my guess is there can be no interloper that unseats any of those until Apple (AAPL) or Tesla (TSLA) take it on the chin in a really large manner this yr.

ICE

This space of technical evaluation — no charts, no difficult knowledge, simply it with recent eyes — tells me that too many individuals are overlooking the subsequent tier down of very profitable firms that can do fairly effectively in what I’ve dubbed a journeyman yr of positive aspects.

I say the subsequent tier down as a result of I don’t see the Nasdaq 100 fulfilling the extra aggressive prognostications of development. Working our manner down a bit into the Nasdaq Composite may supply some good surprises from still-growing firms. Numerous these companies had been down for the yr 2023.

I evaluation each day a mannequin portfolio for our household of subscribers. In our Development & Worth Portfolio, I’m fairly completely satisfied to personal the S&P 100 and Nasdaq 100 *equal-weighted* ETFs in addition to the S&P 500 equal-weighted index that has executed so very effectively for us previously. However I don’t want to personal solely the highest-current-momentum already highly-priced High 7 or High 10 of something.

My long-time choice to personal the Invesco S&P 500® Equal Weight ETF (NYSEARCA:RSP) for some purchasers and for myself has meant a greater worth proposition. Our P/E ratio of securities held declined from a P/E of 23.78 for typical S&P 500 market-cap-weighted ETFs like SPY, IVV, and VOO to a closer-to-normal 20.1 for RSP. (“Regular” being, in latest many years, 18-22.)

The Invesco S&P 500® Equal Weight ETF (RSP)

I imagine 2024 can be a much more egalitarian yr, with significantly broader participation. Our Development & Worth Portfolio at the moment holds a lot of methods to play this theme. One among them is our renewed possession of RSP, which was my first purchase of 2024.

Given my evaluation of the first indicators I analysis and comply with, I need to dig down into the subsequent 400 largest firms (by market cap) within the USA. One of the best ways to try this is to purchase our previous favourite as soon as once more within the Development & Worth Portfolio.

Listed here are the High 10 holdings of a typical S&P 500 index fund:

Searching for Alpha

All tremendous firms for the long run. Simply, in my evaluation, having gotten forward of themselves of late — as mirrored of their elevated P/E ratios and excessive quantity of buying and selling.

Listed here are the High 10 holdings of RSP:

Searching for Alpha

These “high 10” will fluctuate, in fact, since they’re so shut to one another at every quarterly rebalancing. As some draw back through the subsequent 3-month interval after rebalancing again to “equal weighting” it may appear to some that it might solely make sense to wager on these “winners.” However the entire thought of equal weighting is that, simply as usually, people who pull forward in such a short while achieve this due to some single issue: a superb one-quarter earnings report, a tout from some large financial institution, and many others.

Higher to belief that these 500 firms symbolize an outsized contribution to the overall capital invested in all firms and that every one — not only a cherished (and generally overbought!) few — will do effectively in a superb market surroundings.

I ought to make one closing level as to why I’m a bit involved about lacking out on a single high-flyer which may maintain flying or may crash to earth. Each one in all these 500 firms is a well-established agency with actual earnings and actual weight within the economic system of the USA.

Even the smallest firm by market capitalization within the S&P 500 index is fairly large. Underneath Armour (UA), the sports activities attire and footwear firm that competes with the likes of Nike and Adidas, and has a market cap of $3.5 billion.

Good investing to all, and don’t decide this yr by a single day or a single week!

Analyst

Except you’re a shopper of my portfolio administration agency, Stanford Wealth Administration, I have no idea your private monetary scenario. Due to this fact, I supply my opinions above on your due diligence, not as recommendation to purchase or promote particular securities.