BalkansCat/iStock Editorial through Getty Photographs

Funding Thesis

In final week’s article, I defined the explanations behind having included Philip Morris into The Dividend Revenue Accelerator Portfolio. Thus far, The Dividend Revenue Accelerator Portfolio consisted of 1 ETF (SCHD (SCHD)) and two particular person positions (Realty Revenue (O) and Philip Morris (PM)).

The purpose of right this moment’s article is to clarify the explanations behind having included Royal Financial institution of Canada (NYSE:RY) into The Dividend Revenue Accelerator Portfolio. On this evaluation, I’ll examine Royal Financial institution of Canada to a few of its rivals corresponding to The Toronto-Dominion Financial institution (TD), Financial institution of Montreal (BMO), and The Financial institution of Nova Scotia (BNS).

Royal Financial institution of Canada has a 60M Beta Issue of 0.79, which signifies that we are able to cut back the chance stage of The Dividend Revenue Accelerator Portfolio with its inclusion. It’s also price mentioning that Royal Financial institution of Canada combines dividend earnings with dividend development, aligning with the portfolio’s funding method.

With the acquisition of Royal Financial institution of Canada, The Dividend Revenue Accelerator Portfolio now offers a Weighted Common Dividend Yield [TTM] of three.89% and a Weighted Common Dividend Development Fee [CAGR] of 11.76%, indicating that it helps buyers to generate further earnings whereas rising this further earnings to a major quantity from yr to yr. On the similar time, the portfolio offers its buyers with a lowered threat stage (a number of positions have a 60M Beta Issue under 1).

The Dividend Revenue Accelerator Portfolio

The Dividend Revenue Accelerator Portfolio’s goal is the era of earnings through dividend funds, and to yearly increase this sum. Along with that, its purpose is to realize an interesting Whole Return when investing with a lowered threat stage over the long-term.

The Dividend Revenue Accelerator Portfolio’s lowered threat stage can be reached because of the portfolio’s broad diversification over sectors and industries and the inclusion of firms with a low Beta Issue.

Under you’ll find the traits of The Dividend Revenue Accelerator Portfolio:

- Engaging Weighted Common Dividend Yield [TTM]

- Engaging Weighted Common Dividend Development Fee [CAGR] 5 Yr

- Comparatively low Volatility

- Comparatively low Threat-Degree

- Engaging anticipated reward within the type of the anticipated compound annual price of return

- Diversification over asset courses

- Diversification over sectors

- Diversification over industries

- Diversification over nations

- Purchase-and-Maintain suitability

Royal Financial institution of Canada’s Aggressive Benefits

Robust Model Picture and Repute

Royal Financial institution of Canada is the most important financial institution in Canada by way of Market Capitalization (with a present Market Capitalization of $123.69B) and it’s among the many most dear manufacturers on the earth. In line with the newest model rating from Brand Finance, the Canadian financial institution is ranked one hundred and thirty fifth among the many most dear manufacturers on the earth.

Robust Monetary Well being

Completely different metrics underline Royal Financial institution of Canada’s monetary power: the Canadian financial institution has an Aa1 credit standing from Moody’s and a Web Revenue Margin [TTM] of 27.28%. On the similar time, it reveals a Return on Fairness of 14.26%. All these metrics underline the financial institution’s monetary well being, representing an extra aggressive benefit.

Expertise in Managing Dangers

The Canadian financial institution was based again in 1864 and it has an extended observe report of a sturdy threat administration that has helped it to navigate by all types of market situations, offering the financial institution with an extra aggressive edge over rivals.

Broad and Diversified Product Portfolio

Royal Financial institution of Canada has a broad and diversified product portfolio, which helps it to mitigate dangers. The financial institution distinguishes between the following segments:

- Private & Industrial Banking

- Wealth Administration

- Insurance coverage

- Investor & Treasury Providers

- Capital Markets

- Company Help

Every of the above aggressive benefits of Royal Financial institution of Canada contributes to the financial moat the financial institution has over its rivals. Because of these sturdy aggressive benefits, I consider the financial institution is a perfect match for The Dividend Revenue Accelerator Portfolio.

Royal Financial institution of Canada’s Dividend and Dividend Development and the Projection of its Yield on Value

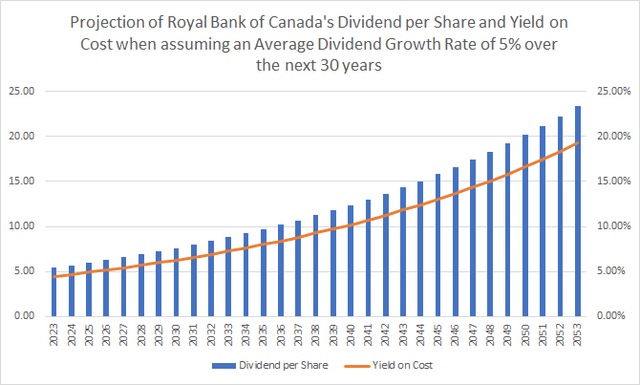

At this second in time, Royal Financial institution of Canada pays its shareholders a Dividend Yield [FWD] of 4.49%. The Canadian financial institution has proven a ten Yr Dividend Development Fee [CAGR] of seven.92%. Each metrics point out that the financial institution is a superb choose for buyers who want to mix dividend earnings and dividend development.

The graphic under illustrates the belief that the Canadian financial institution would be capable to increase its Dividend by 5% per yr throughout the next 30 years. This assumption implies that you possibly can be capable to attain a Yield on Value of seven.26% by 2033, 11.82% by 2043, and 19.25% by 2053.

Supply: The Writer

Royal Financial institution of Canada In comparison with its Peer Group

When in comparison with rivals corresponding to The Toronto-Dominion Financial institution, Financial institution of Montreal, or The Financial institution of Nova Scotia, it may be highlighted that Royal Financial institution of Canada has the marginally decrease Dividend Yield [FWD]: whereas Royal Financial institution of Canada’s Dividend Yield [FWD] stands at 4.49%, The Toronto-Dominion Financial institution’s lies at 4.69%, Financial institution of Montreal’s at 5.08%, and The Financial institution of Nova Scotia’s is at 6.64%.

When it comes to Dividend Development, nevertheless, it may be highlighted that Royal Financial institution of Canada is forward of most of its rivals: the financial institution’s 3 Yr Dividend Development Fee [CAGR] of seven.36% stands above the one in all The Toronto-Dominion Financial institution (7.20%) and The Financial institution of Nova Scotia (4.78%). Solely the one in all Financial institution of Montreal is increased (10.70%).

When it comes to Valuation, I additionally consider that Royal Financial institution of Canada is enticing. Its P/E [FWD] Ratio stands at 11.76, which is considerably decrease than the P/E [FWD] Ratio of The Toronto-Dominion Financial institution (13.73) or Financial institution of Montreal (18.08). Solely the Valuation of The Financial institution of Nova Scotia is decrease (9.72).

It’s additional price mentioning that Royal Financial institution of Canada’s Payout Ratio of 47.90% lies under the one in all Financial institution of Montreal (49.14%) and The Financial institution of Nova Scotia (58.31%), indicating that Royal Financial institution of Canada has extra room for future dividend enhancements when in comparison with these rivals.

It’s also price mentioning that Royal Financial institution of Canada’s is a superb selection with regards to Profitability. Proof of that is the financial institution’s Web Revenue Margin (which is at 27.28%) and its excessive Return on Fairness of 13.51%. Royal Financial institution of Canada’s Return on Fairness stands considerably above the one in all Financial institution of Montreal (10.26%) and The Financial institution of Nova Scotia (10.89%).

|

RY |

TD |

BMO |

BNS |

|

|

Firm Title |

Royal Financial institution of Canada |

The Toronto-Dominion Financial institution |

Financial institution of Montreal |

The Financial institution of Nova Scotia |

|

Sector |

Financials |

Financials |

Financials |

Financials |

|

Trade |

Diversified Banks |

Diversified Banks |

Diversified Banks |

Diversified Banks |

|

Market Cap |

123.69B |

109.61B |

61.01B |

56.73B |

|

Dividend Yield [FWD] |

4.49% |

4.69% |

5.08% |

6.64% |

|

Payout Ratio |

47.90% |

46.48% |

49.14% |

58.31% |

|

Dividend Development 3 Yr [CAGR] |

7.36% |

7.20% |

10.70% |

4.78% |

|

Dividend Development 5 Yr [CAGR] |

6.24% |

6.91% |

7.84% |

4.07% |

|

P/E GAAP [FWD] |

11.76 |

13.73 |

18.08 |

9.72 |

|

Worth to Ebook [TTM] |

1.55 |

1.36 |

1.13 |

0.99 |

|

Income Development [YoY] |

9.45% |

14.60% |

5.74% |

-5.75% |

|

EPS Diluted 3 Yr [CAGR] |

9.97% |

14.34% |

12.60% |

4.37% |

|

Web Revenue Margin |

27.28% |

28.98% |

23.03% |

28.26% |

|

Return on Fairness |

13.51% |

13.53% |

10.26% |

10.89% |

|

60M Beta |

0.79 |

0.87 |

1.16 |

0.93 |

Supply: Looking for Alpha

Why Royal Financial institution of Canada is an Engaging Threat/Reward Alternative and Aligns with the Funding Strategy of The Dividend Revenue Accelerator Portfolio

- Royal Financial institution of Canada’s Dividend Yield [FWD] of 4.49% lets you earn an essential quantity of additional earnings, which is likely one of the targets of The Dividend Revenue Accelerator Portfolio.

- On the similar time, it contributes to lift the Weighted Common Dividend Yield [TTM] of The Dividend Revenue Accelerator Portfolio.

- The financial institution’s 3 Yr Dividend Development Fee [CAGR] of seven.36% reveals that it may contribute to elevating dividend funds to a major quantity yr over yr, aligning with the method of The Dividend Revenue Accelerator Portfolio.

- Royal Financial institution of Canada offers buyers with a beautiful combine between dividend earnings and dividend development, matching with one of many major targets of The Dividend Revenue Accelerator Portfolio.

- The Canadian financial institution’s 60M Beta Issue of 0.79 signifies you can cut back the volatility of your portfolio by together with it. This matches with the funding method of The Dividend Revenue Accelerator Portfolio to supply a lowered threat stage and to function a portfolio for all types of market situations.

- I consider that the chance components are comparatively low and that the reward may be enticing for buyers, implying that the financial institution is an interesting choose by way of threat and reward, as soon as once more aligning with The Dividend Revenue Accelerator’s funding method.

- I consider that Royal Financial institution of Canada can function a buy-and-hold funding from which you’ll profit enormously when investing over the long run and from the steadily rising dividend funds.

- Subsequently, I consider that Royal Financial institution of Canada might help you to steadily improve your wealth, aligning with one other goal of The Dividend Revenue Accelerator Portfolio.

Investor Advantages of The Dividend Revenue Accelerator Portfolio after Investing $100 in Royal Financial institution of Canada

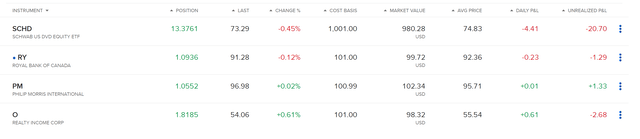

After the acquisition of shares to the quantity of $100 in Royal Financial institution of Canada, the portfolio’s diversification has been elevated.

Supply: Interactive Brokers

At this second in time, it may be highlighted that SCHD accounts for 76.92% of the general funding portfolio.

The remaining positions (Realty Revenue, Philip Morris and Royal Financial institution of Canada) every account for 7.69% of the general portfolio.

By way of the acquisition of Royal Financial institution of Canada for The Dividend Revenue Accelerator Portfolio, the portfolio’s Weighted Common Dividend Yield [TTM] has been raised to three.89%. Its Weighted Common Dividend Development Fee [CAGR] over the previous 5 years now stands at 11.76%.

These numbers replicate the portfolio’s enticing combine between dividend earnings and dividend development from which buyers can profit enormously when investing over the long run.

It’s also price mentioning, that the chance stage of The Dividend Revenue Accelerator Portfolio has been additional decreased. That is the case, since Royal Financial institution of Canada has a 60M Beta Issue of 0.79, indicating that it has a decrease threat stage than the broader inventory market (which has a Beta Issue of 1).

Subsequently, it may be highlighted that The Dividend Revenue Accelerator Portfolio, which right this moment consists of 1 ETF (SCHD) and three particular person firms (Realty Revenue, Philip Morris and Royal Financial institution of Canada) offers buyers with a Weighted Common Dividend Yield [TTM] of three.89%, with a 5 Yr Weighted Common Dividend Development Fee [CAGR] of 11.76% and with a lowered threat stage (all particular person firms which have been added to the portfolio to this point, have a 60M Beta Issue under 1).

Threat Elements

Because of Royal Financial institution of Canada’s important aggressive benefits and its sturdy monetary well being (underlined by its Aa1 credit standing by Moody’s and its Web Revenue Margin of 27.28%), I consider that the chance components that come connected to an funding within the Canadian financial institution are comparatively low, notably when in comparison with its peer group.

This concept can be underlined by Royal Financial institution of Canada’s 60M Beta Issue of 0.79, which is under the one in all rivals corresponding to The Toronto-Dominion Financial institution (60M Beta Issue of 0.87), Financial institution of Montreal (1.16), or The Financial institution of Nova Scotia (0.93).

The truth that the Canadian financial institution is ranked one hundred and thirty fifth within the rating of essentially the most priceless manufacturers on the earth serves as an extra indicator that the chance stage is comparatively low, because it’s sturdy model helps to ascertain an financial moat over current or doubtlessly new rivals.

Nevertheless, there are completely different threat components that come connected to an funding in Royal Financial institution of Canada, corresponding to Market Threat Elements and Credit score Threat Elements, which buyers ought to take into account earlier than taking the choice to put money into the Canadian financial institution.

Market Threat

For instance, market dangers can come up from movements in trade charges, commodity costs or rates of interest, which might have important impacts on the financial institution’s monetary efficiency. Nonetheless, I consider that these sorts of dangers would notably affect the financial institution’s short-term monetary efficiency. Subsequently, I counsel that buyers see an funding in Royal Financial institution of Canada as a long-term funding, benefiting from the financial institution’s steadily rising dividend funds.

Credit score Threat

Credit score threat is the obligor’s potential incapability to fulfill contractual obligations on a well timed foundation. Royal Financial institution of Canada makes use of completely different threat measurement methodologies with a purpose to mitigate credit score dangers. Nonetheless, buyers of Royal Financial institution of Canada want to pay attention to the truth that potential defaults can have important damaging results on the financial institution’s monetary efficiency (notably within the brief time period).

With the intention to mitigate the chance stage for buyers, I want to repeat that I counsel investing over the long run, benefiting from steadily rising dividend funds and from the lowered threat stage.

The truth that I consider Royal Financial institution of Canada’s threat stage is decrease when in comparison with its rivals aligns with the funding method of The Dividend Revenue Accelerator Portfolio, reiterating that the portfolio goals to give you a lowered threat stage, serving to you to extend the likelihood of reaching enticing funding outcomes over the long run.

Conclusion

I consider that Royal Financial institution of Canada is an interesting choose for The Dividend Revenue Accelerator Portfolio. The corporate combines dividend earnings and dividend development, affords buyers a lowered threat stage, and is enticing by way of threat and reward.

All of those traits point out that Royal Financial institution of Canada strongly aligns with the funding method of The Dividend Revenue Accelerator portfolio.

Because of the inclusion of Royal Financial institution of Canada, we’ve managed to additional improve the portfolio’s Weighted Common Dividend Yield [TTM] to three.89%. Along with that, the portfolio offers buyers with a Weighted Common Dividend Development Fee [CAGR] of 11.76% over the previous 5 years.

One of many causes for which I’ve chosen Royal Financial institution of Canada over its Canadian rivals is the truth that it comes connected to a lowered threat stage.

Royal Financial institution of Canada’s 60M Beta Issue of 0.79 signifies that we are able to cut back portfolio volatility by its inclusion, thus contributing to lowering the chance stage and getting ready our portfolio for various market situations. Compared to Royal Financial institution of Canada, The Toronto-Dominion Financial institution (60M Beta Issue of 0.87), Financial institution of Montreal (1.16), and The Financial institution of Nova Scotia (0.93) come connected to a barely increased threat stage.

Because of its enticing Weighted Common Dividend Yield [TTM] of three.89% together with its 5 Yr Weighted Common Dividend Development Fee [CAGR] of 11.76%, The Dividend Revenue Accelerator Portfolio can already provide help to to generate a major quantity of additional earnings through dividend funds. It could possibly additional provide help to to lift this quantity on an annual foundation whereas offering you with a lowered threat stage. On the similar time, the portfolio aspires to achieve a beautiful Whole Return.

Writer’s Word: Thanks for studying! I’d respect listening to your opinion on my collection of Royal Financial institution of Canada because the fourth acquisition for The Dividend Revenue Accelerator Portfolio. I additionally respect any ideas about The Dividend Revenue Accelerator Portfolio or any suggestion of firms that will match into the portfolio’s funding method!