- Constancy eclipsed Grayscale in BTC ETF outflows on the first of Might.

- BlackRock’s IBIT noticed its first outflow as BTC struggled to reclaim $60K.

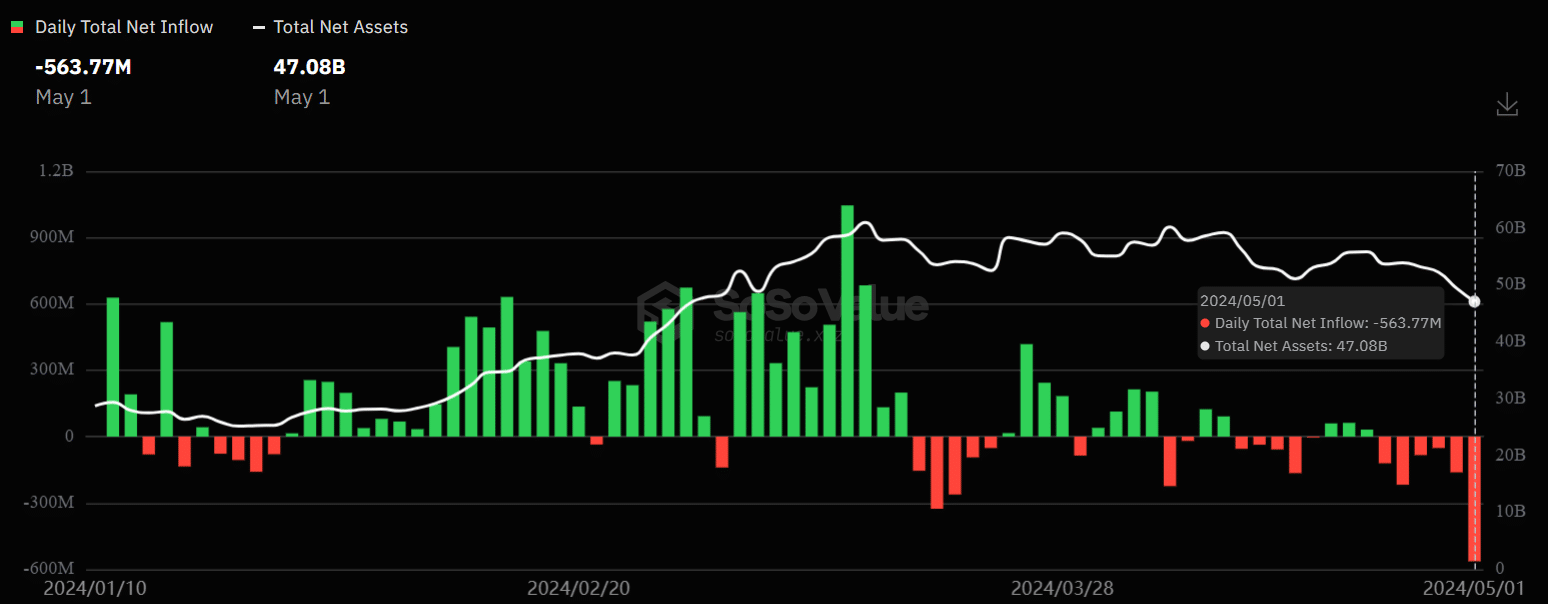

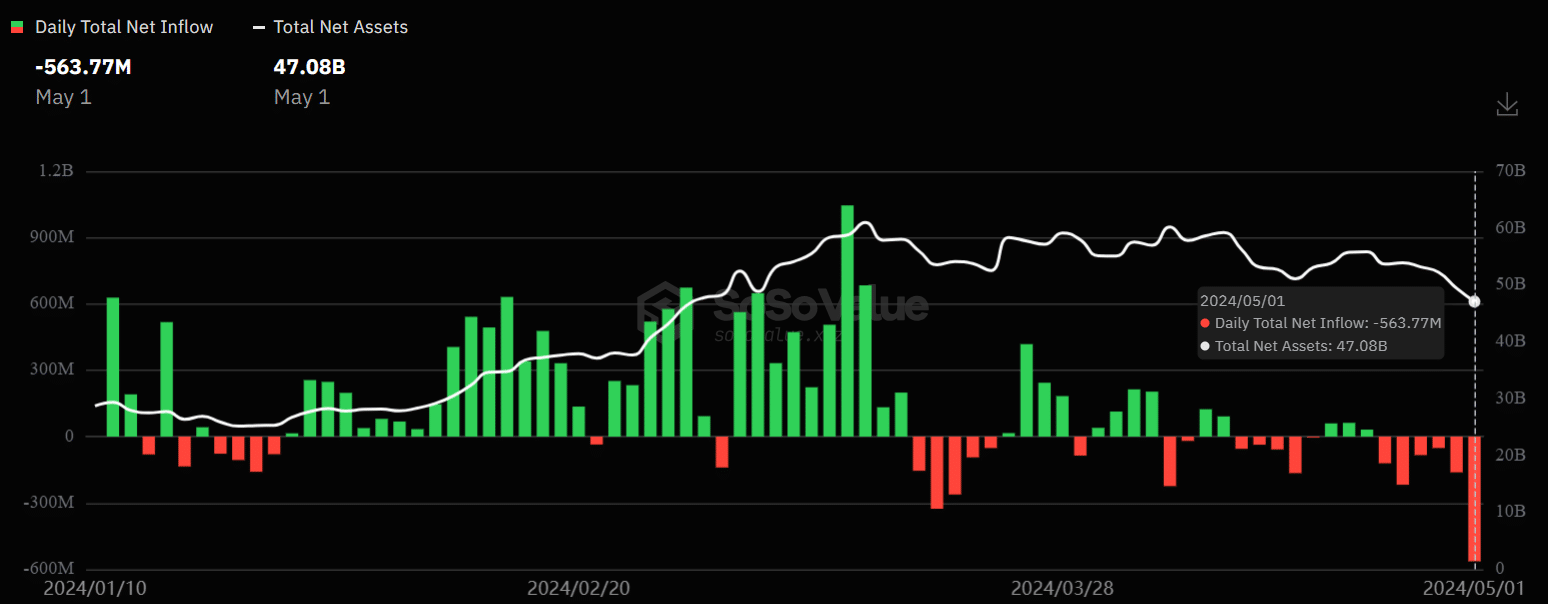

Bitcoin’s [BTC] tough Q2 appears removed from over. In keeping with Soso Worth data, US BTC ETFs recorded extra outflows on the first of Might, price $563.7 million.

Surprisingly, Grayscale’s GBTC dominated outflows beforehand, however didn’t lead the outflows as Constancy’s FBTC took middle stage.

Supply: SoSo Worth

BlackRock’s first outflow as Constancy loses 2% of its BTC ETF belongings

Out of the whole outflows of $563.7 million, Constancy’s FBTC led the outflows with $191.1 million, Farside data confirmed.

Grayscale’s GBTC recorded the second-largest day by day outflow on 1 Might, price $167.4 million.

Bloomberg ETF analysts noted that Constancy’s huge day by day outflows have been “big” and virtually price 2% of its ETF belongings,

“Rattling.. whereas it’s like 2% of the ETF’s belongings, however a) it’s large for Constancy and b) all of them getting hit in the present day seems like.”

Moreover, BlackRock’s IBIT, after hitting pause and going zero inflows for 5 days, noticed its first outflow price $36.9 million yesterday.

Reacting to IBIT’s first outflow, Bloomberg analyst James Seyffart famous,

“Ruff day to be a #bitcoin ETF.”

The Fed charge resolution didn’t assist a lot with the sentiment both. BTC remained firmly beneath $60K after the Fed saved the rate of interest unchanged.

In keeping with monetary commentator Peter Schiff, BTC may drop to $54K after shedding the $60K assist. Schiff said,

“Discover on this shorter-term #Bitcoin chart that $60K, which was assist, has grow to be resistance.”

Supply: X/Peter Schiff