Andrii Yalanskyi

Rithm Capital (NYSE:RITM) gives a high-dividend yield that appears to be sustainable within the medium time period, plus its latest acquisitions ought to result in extra recurring income and improved earnings profile, being optimistic for its enterprise mannequin and valuation over the long run.

As I’ve coated in a earlier article, Rithm Capital gives a high-dividend yield, however the belief was in the course of an acquisition dispute to purchase Sculptor Capital Administration, and there was some threat it might finally pay an excessive amount of for this goal, a situation that might be destructive for its shares. Whereas Rithm did enhance its providing, this acquisition was accomplished at an affordable worth, and its share worth has carried out fairly nicely in latest months.

On this article, I do an replace on Rithm’s latest earnings and replace its funding case, to see if it has now a greater earnings enchantment or not.

Latest Occasions

Rithm Capital’s strategy has been to diversify its enterprise past mortgage servicing rights (MSRs) right into a diversified funding platform, together with different areas of the credit score phase. Regardless of that, its enterprise mannequin continues to be fairly uncovered to MSRs, which account for some 55% of its income.

Because of this enterprise profile, Rithm advantages from a rising rate of interest setting, whereas different mortgage REITs (mREITs), akin to Annaly Capital Administration (NLY) or AGNC Funding Corp. (AGNC), undergo from this development as a result of they make investments closely in company mortgage-backed securities.

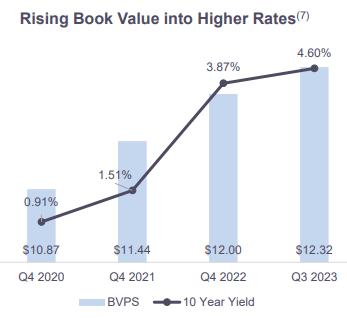

Whereas company MBSs decline in worth when rates of interest enhance, placing strain on the ebook values of mREITs, MSRs enhance in worth as a result of greater charges result in decrease prepayments and better common lifetime of servicing rights. As proven within the subsequent graph, Rithm’s ebook worth has elevated by greater than 13% because the finish of 2020, to $12.32 per share on the finish of Q3 2023.

Guide worth (Rithm Capital)

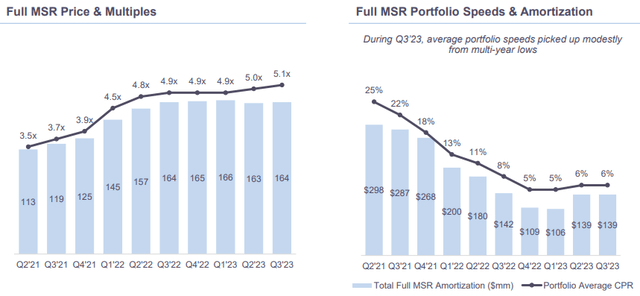

Whereas long-term rates of interest have declined significantly since peaking final October (at shut to five% for the 10-year Treasury yield), most of Rithm’s MSRs portfolio has decrease charges than present new mortgage manufacturing, which suggests mortgage amortizations and pre-payments are anticipated to stay fairly low, boding nicely for its MSR valuations and money stream profile within the coming quarters.

MSRs (Rithm Capital)

In Q3 2023, income associated to MSRs amounted to $463 million, a slight lower from the earlier quarter attributable to some gross sales of extra MSRs. Alternatively, curiosity earnings elevated by shut to twenty% on a quarterly foundation, attributable to its acquisition of part of Goldman Sachs (GS) Marcus loans, wherein Rithm invested some $145 million to buy a $1.45 billion unsecured shopper mortgage portfolio. These loans have a comparatively quick length and excessive yield, boosting Rithm’s curiosity earnings, and are not anticipated to result in a lot in the best way of mortgage losses within the quick time period.

This shopper mortgage portfolio acquisition was the principle cause why its revenues elevated in Q3 to $1.09 billion, up by 4.8% in comparison with the earlier quarter. Bills additionally elevated within the quarter and the belief booked some unrealized losses from investments, resulting in a internet earnings of $193 million within the quarter, whereas its non-GAAP measure of Earnings Accessible for Distribution amounted to $280 million, or $0.58 per share.

That is a lot greater than its present quarterly dividend of $0.25 per share, thus Rithm appears to have a dividend that’s nicely coated by its earnings stream, which is kind of optimistic for a sustainable dividend over the long run.

Past its optimistic working momentum in latest quarters, the corporate continues to take some vital steps to develop its enterprise and in addition concerning its strategic pivot to change into a world asset administration firm, shifting step by step its enterprise focus from actual property right into a diversified funding platform throughout actual property and personal credit score.

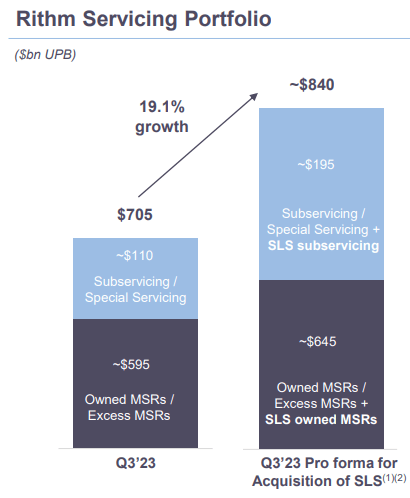

Concerning enterprise progress, Rithm introduced firstly of final October the acquisition of Computershare Mortgage Providers, together with its affiliated firm Specialised Loans Servicing, for round $720 million, rising its Newrez subservicing and particular servicing companies in a major approach. This acquisition is predicted to shut in Q1 2024 and is predicted to extend its servicing income, particularly from third-party servicing.

Servicing (Rithm Capital)

In relation to its objective to shift its enterprise into a world asset administration firm, Rithm completed the acquisition of Sculptor Asset Administration in November, for a complete quantity of $720 million. This was greater than its preliminary provide of $639 million, as Rithm needed to elevate its provide worth attributable to competing gives on the desk.

Whereas this acquisition was costlier than initially anticipated, it makes strategic match into Rithm’s strategic pivot into turning into a diversified funding platform, accelerating its enterprise progress within the non-public credit score phase.

Sculptor is an alternate asset administration laid out in opportunistic credit score, actual property, and multi-strategy, having some $34 billion of property below administration. This will increase Rithm’s property below administration to greater than $50 billion within the asset administration enterprise on the finish of 2023 and will increase Rithm’s long-term progress prospects because the overlap to its present enterprise is slightly low. From a monetary standpoint, Rithm funded this acquisition by means of its money place and expects to be impartial to 2024 earnings and be accretive for its backside line thereafter.

Going ahead, Rithm is predicted to take care of a optimistic working momentum, because the rate of interest setting is supportive for the corporate’s MSRs enterprise. Whereas inflation has moderated in latest months and there’s some hypothesis about potential rate of interest cuts throughout 2024, I feel it is possible that the Fed will reduce charges step by step slightly than aggressively shift its financial coverage, thus mortgage pre-payments are more likely to stay at traditionally low ranges in the course of the subsequent few quarters.

Concerning different progress sources, the belief has good potential in non-public credit score the place it is rising its enterprise organically and now additionally by means of the acquisition of Sculptor, plus it additionally sees alternatives within the industrial actual property market, the place it may use its sturdy pool of liquidity to purchase attention-grabbing property from struggling homeowners.

This implies the corporate appears to be in place to develop its enterprise within the close to future from a number of initiatives, which ought to result in a extra diversified enterprise mannequin and being much less uncovered to rates of interest in comparison with its previous.

Concerning its dividend, its present quarterly dividend has been maintained at $0.25 per share, unchanged since October 2021, which at its present share worth results in a dividend yield of about 9.5%. This high-dividend yield is kind of engaging to earnings traders and is roofed by the belief’s earnings, plus Rithm has liquidity place, thus the dividend appears to be sustainable within the quick to medium time period.

Conclusion

Rithm Capital continues to be thought-about a mortgage REIT attributable to its sizable publicity to MSRs, however its latest acquisitions led to a extra diversified enterprise profile over the long run, making it more and more akin to different monetary providers corporations slightly than REITs.

I feel its technique of step by step shifting its enterprise mannequin from an mREIT to a diversified funding platform is smart to create extra worth for shareholders over the long run, making a extra recurring earnings profile which is supportive of its dividend and a better valuation going ahead.

Whereas a enterprise overhaul takes a while to realize, Rithm is taking the correct steps to change into an asset administration firm, which might result in greater valuation multiples sooner or later. This implies its present valuation of 6.5x ahead earnings and 0.9x ebook worth might be thought-about low cost, plus its high-dividend yield can also be fairly engaging for earnings traders.

Whereas I used to be fearful some months in the past that Rithm might overpay for Sculptor, now that the acquisition is accomplished and the value paid appears cheap, I now see Rithm as earnings play attributable to its mixture of high-dividend yield and engaging valuation.