Torsten Asmus

Earlier this month I wrote that there was nonetheless room for debating if a broad-based risk-off sign was brewing. Three weeks later, the area is narrowing for protecting an open thoughts, primarily based on a number of units of ETF pairs for markets by yesterday’s shut (Sep. 26).

To be truthful, there’s no smoking gun through a worldwide asset allocation profile. The downturn within the ratio for aggressive (AOA) vs. conservative (AOK) asset allocation ETFs remains to be modest and has but to sign a draw back regime change. In different phrases, this pairing nonetheless implies that the latest market turbulence is noise.

The technical profile for the US inventory market, in contrast, paints a considerably darker setting. The ratio for US shares (SPY) vs. low-volatility shares (USMV) – a proxy for gauging the danger urge for food for American shares – has clearly peaked, though it’s not but fallen to a degree that decisively marks a bearish reversal.

An analogous story in favor of warning applies to shares for semiconductor corporations (SMH) vs. the broad US equities market (SPY). Semi shares are thought-about a proxy for the danger urge for food and the enterprise cycle and on this entrance there’s been a comparatively clear change in sentiment following an exuberant run of risk-on.

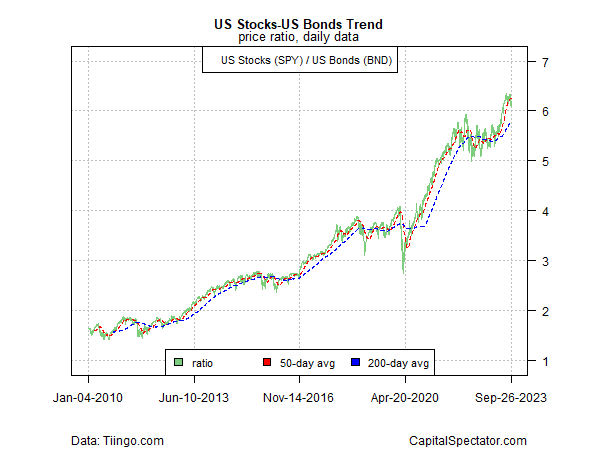

In an indication of attainable distortion of the same old indicators, the US inventory market/US bond market ratio (SPY vs. BND) nonetheless displays energy. However that is deceptive as a result of equities and stuck revenue are each struggling. Consequently, the usual diversification good thing about holding each asset lessons has pale as each markets break with historical past and transfer in keeping with one another recently.

Lastly, a probably troubling reversal for markets could also be brewing through the renewed rise within the relative value of inflation-indexed US Treasuries (TIP) vs. their nominal counterparts (IEF). In latest months, the reflation commerce gave the impression to be peaking — a bullish sign. However latest historical past means that the urge for food for inflation hedging is reviving. That’s a worrisome signal if it persists as a result of it means that markets understand that inflation threat poses a brand new headwind for threat property… once more. Accordingly, watching this pairing deserves shut consideration as a attainable early warning for what occurs subsequent.

Editor’s Notice: The abstract bullets for this text have been chosen by Searching for Alpha editors.