As TVL rises, trade insiders say DeFi is as soon as once more seeing elevated curiosity. DeFi is powerful and can proceed to develop, specialists say, including that 2024 might be an thrilling 12 months for this rising sector.

DeFi is resilient, TVL on the rise

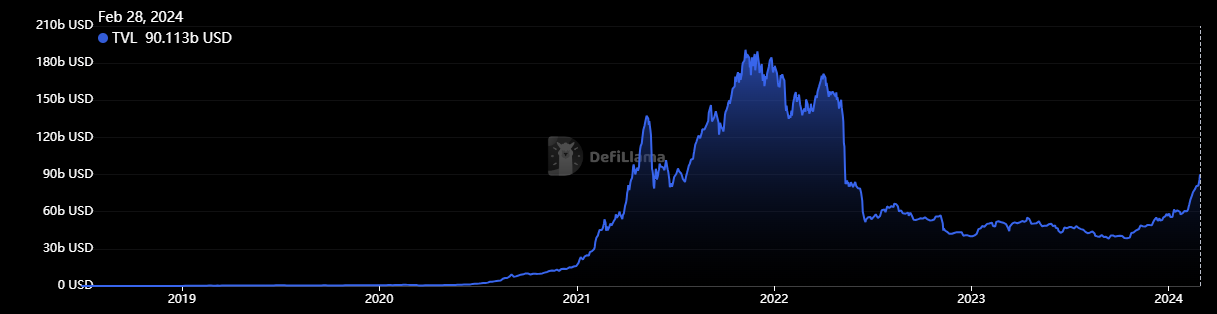

The entire worth dedicated to decentralized finance (DeFi) has surpassed $80 billion. It’s the first time it has crossed this threshold because the notorious fall of the Terra stablecoin nearly two years in the past.

In keeping with DefiLlamaTVL at the moment stands at $90.113 billion. The final time it was at this stage was Could 2022.

A rise could be seen from October 2023, which can speed up in January 2024.

Between October 28, 2023 and February 28, 2024, TVL elevated by 108.3%.

Supply: defillama.com

Supply: defillama.comBlockchain platform Swarm markets’ co-founder Timo Lehes famous that,

“The top of the Crypto Winter has led to a rise in investor confidence, which has permeated the DeFi market. We anticipate this development to proceed, particularly if the costs of well-known crypto property proceed to rise.”

He famous that the DeFi sector is inclined to “the whims” of the broader market, like most different sectors.

Nonetheless, the above-mentioned enhance proves that the DeFi sector can be resilient.

Furthermore, DeFi initiatives have added greater than $42 billion in property in latest months. This truth “proves the doubters unsuitable,” Lehes argued.

Due to this fact, DeFi will solely develop in quantity and measurement within the coming years, he concluded.

Loads to be enthusiastic about

Barney Mannerings, DeFi professional and founding father of Vega protocola decentralized change for futures and perpetuals, mentioned that we’re as soon as once more witnessing a rising curiosity in DeFi.

In a remark shared with Crypto informationhe argued {that a} new wave of experimentation and innovation is underway within the sector.

That is the results of the introduction of recent primitives into the community, Mannerings explains. They’re primarily primarily based on Ethereums staking and yield functionalities.

Additionally, latest good points within the crypto market look like “being channeled again into protocols.” We frequently see this when a bear market turns bullish, Mannerings mentioned, including:

“The truth that ETH, which many speculate could possibly be packaged into a brand new spot exchange-traded fund (ETF), is rising so dramatically solely reinforces this development. However the spectacular displaying of Ethereum Layer-2’s (like Coat And Gnosis) of the previous week exhibits that progress can be happening in attention-grabbing locations.”

As reported earlier this month, asset administration firm Bernstein urged that Ethereum is perhaps the one digital asset subsequent Bitcoin to acquire approval of a spot ETF.

Moreover, the actions of US buyers have led to cost will increase for ETH in latest weeks. A significant motive is investor expectations for the adoption of spot Ethereum ETFs.

In the meantime, “vital progress” of recent DeFi primitives is occurring Shuttle supply extra causes to be excited, the founder argued.

Mixed with the appearance of recent derivatives exchanges reminiscent of Vega, “it seems like a really thrilling time for DeFi, and will probably be attention-grabbing to see what 2024 brings.”