Overview

With the explosive development of the electrical car market and the worldwide push for sustainability, demand for battery metals is skyrocketing. This has created important upside potential for exploration, notably the place copper and nickel are involved.

Miramar Sources (ASX:M2R) intends to leverage that potential to the fullest. Led by an skilled board with a confirmed observe report of profitable exploration, discovery, improvement and manufacturing, the corporate has acquired a number of tasks with the potential to host world-class mineral deposits. These discovery alternatives lie in Western Australia’s Jap Goldfields and Gascoyne areas, together with the Capricorn Orogen, a quickly rising but largely underexplored mineral province.

Proterozoic orogens are well-established as internet hosting main mineral deposits. Capricorn is not any exception. It is extremely potential for a number of commodities and deposit sorts.

Recognizing this chance, Miramar has acquired two giant and extremely potential landholdings throughout the Capricorn Orogen: the Whaleshark copper-gold venture and the Bangemall nickel-copper-PGE tasks. Along with these, Miramar maintains two gold tasks within the Jap Goldfields, one in all which — Gidji JV — has the potential to develop into a brand new gold camp within the area.

Miramar’s technique is straightforward — to create shareholder worth by means of the invention of world-class mineral deposits. It is well-positioned to do precisely that, with energetic exploration packages, a good share register and low enterprise worth.

Firm Highlights

- Australian exploration firm Miramar Sources is well-positioned to reap the benefits of the battery metals alternative.

- The present concentrate on battery metals creates important upside alternatives for exploration, notably on copper and nickel.

- Led by an skilled board with a observe report of profitable discovery, improvement and manufacturing, Miramar has acquired a number of tasks with the potential to host world-class deposits, together with:

- Massive, shallow copper-gold targets at Whaleshark

- A number of nickel-copper-PGE targets at Bangemall

- A number of strategic Jap Goldfields tasks, together with one with the potential to develop into a brand new gold camp

- Miramar is an energetic explorer with common information circulation, a good share register and low enterprise worth.

Key Property

Whaleshark (Ashburton)

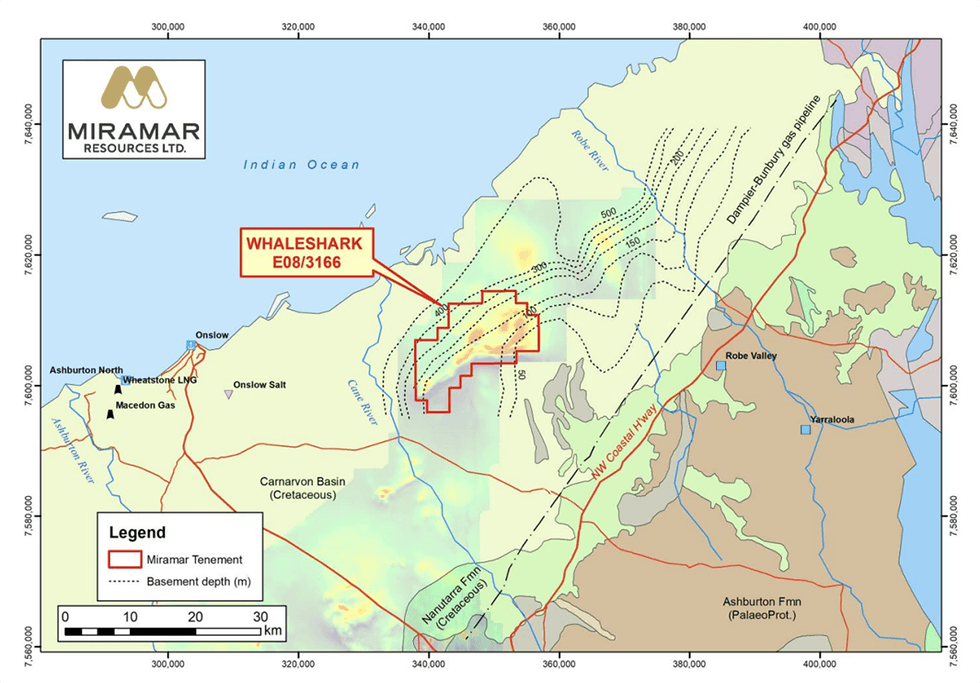

Situated roughly 40 kilometres east of Onslow within the Ashburton area of Western Australia, Whaleshark. It was acquired by Miramar as a part of its preliminary public providing in 2020.

Miramar secured $180,000 below the Exploration Incentive Scheme (EIS) funding program from the Western Australia Authorities to fund diamond drilling and venture improvement at Whaleshark. Assay outcomes from the diamond drilling confirmed the presence of bedrock copper sulphide mineralisation at Whaleshark and the corporate additionally recognized the potential for very giant magnetite iron deposits close to current infrastructure.

Undertaking Highlights:

- Prospectivity: Whaleshark shows all the required traits for the presence of a giant copper-gold deposit, together with:

- Proterozoic granite with close by iron-rich rocks

- Overlapping magnetic anomalism and gravity

- Robust anomalous “interface” geochemistry

- Sodic and potassic alteration

- Excessive-priority Drilling: Miramar has recognized a number of high-priority bedrock drill targets which comprise overlapping:

- Cell metallic iron (MMI) floor geochemical anomalism over roughly 1.2 sq. kilometers

- Gravity anomalism crosscut by a northwest-trending construction

- Strongly elevated copper, cobalt, gold and silver outcomes gathered from “interface” aircore drilling

- Advantageous Geology: Whaleshark’s geology is much like the massive Ernest Henry IOCG deposit in Queensland, together with the size, suite and magnitude of components. Nonetheless, Whaleshark additionally shows shallower cowl in comparison with Ernest Henry.

- Bedrock copper sulphide confirmed: Outcomes from the finished diamond drill program confirmed the presence of bedrock copper sulphide mineralisation throughout the venture. Multi-element assays subsequently additionally confirmed the presence of anomalous copper, gold, silver, molybdenum and tungsten all through the Whaleshark granodiorite.

- Massive Magnetite Iron Alternatives: The drill program, coupled with evaluation and comparisons to historic information and magnetic anomalies additionally point out potential for a big shallow magnetite iron deposit at Whaleshark in shut proximity to important infrastructure.

Bangemall/Mount Vernon (Gascoyne)

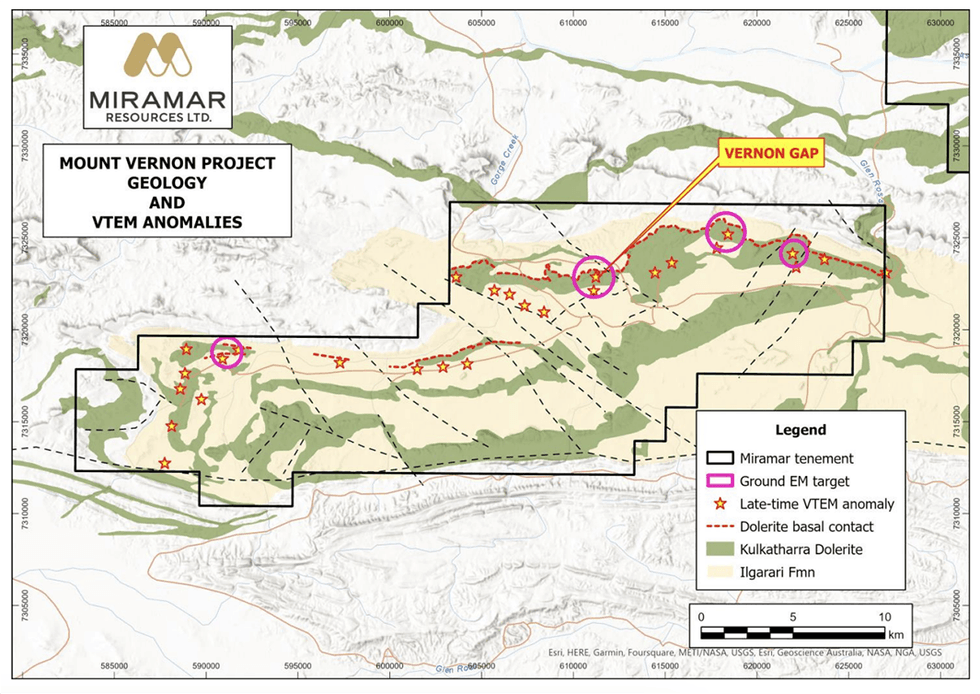

Miramar has a number of granted and pending exploration licences in its district-scale Bangemall venture that are potential for Proterozoic magmatic Ni-Cu-PGE mineralisation related to 1070Ma Kulkatharra Dolerite sills that are the identical age because the Giles Complicated, host to the massive Nebo and Babel Ni-Cu deposits within the West Musgraves of WA.

Each the Geological Survey of Western Australia and Geoscience Australia have recognized the realm as being extremely potential for quite a few sorts of mineral deposits.

Since 2020, Miramar has constructed a strategic land place within the Bangemall area, specializing in areas containing key elements and/or regional-scale indicators for Norilsk-style Ni-Cu-PGE mineralisation:

- Kulkatharra Dolerite sills – supply of Ni, Cu +/- PGE’s

- Proximity to main crustal-scale faults (+/- cross faults) – potential plumbing methods +/- traps

- Sulphidic sediments – potential sulphur supply

- Regional-scale geochemical anomalism (GSWA regional geochemistry)

- Regional-scale EM anomalism (2013 Capricorn AEM Survey)

The corporate’s Mount Vernon venture is a excessive precedence. In early 2022, Miramar flew an in depth magnetic and electromagnetic survey over the Mount Vernon venture, figuring out a number of late-time anomalies probably associated to nickel-copper-PGE sulphide mineralisation. A floor EM is underway and RC drilling is deliberate for Mount Vernon targets.

Undertaking Highlights:

- Mount Vernon potential: Miramar’s VTEM survey at Mount Vernon confirms historic exploration on the venture, which recognized:

- Nickel, copper and platinum group components soil anomalies

- Vital nickel-copper in rock chips

- Drilling intersected elevated nickel-copper-PGEs in dolerite

- 50 rock chip samples taken, with a number of containing course-grained pyrite in effective grained chill margin and coarser grained gabbro within the centre of the sill

- Present Work: Geophysical contractors have commenced a set loop electromagnetic survey to refine targets for future drill testing

- Enlargement of Bangemall Undertaking: In early 2024, Miramar introduced the grant of the Bother Bore Exploration Licence, adjoining to Mount Vernon, the place historic EM surveys had recognized a robust late-time EM anomaly that might be consultant of buried Ni-Cu-PGE mineralisation.

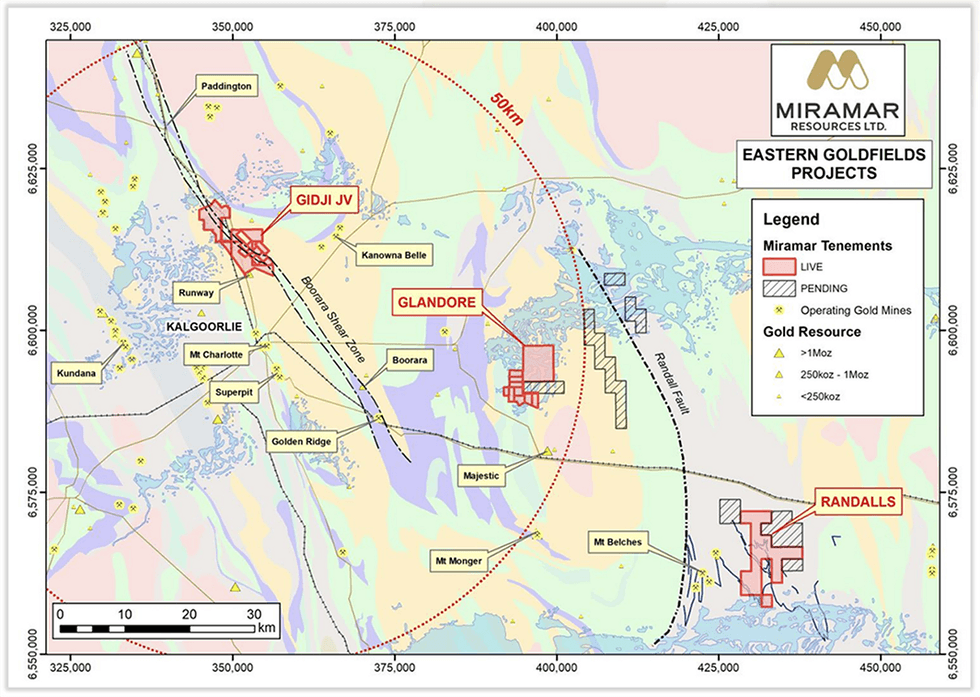

Gidji JV Undertaking (Jap Goldfields)

Situated roughly 15 kilometres north of Kalgoorlie, Gidji is a extremely potential but underexplored gold venture with potential nickel mineralisation. Miramar has been actively exploring the venture since October 2020, ensuing within the identification of a number of new targets and outlining giant aircore gold anomalies at Marylebone, Blackfriars and Freeway/Piccadilly, every of which might host a major gold discovery. The Marylebone goal is the very best precedence goal because it has the identical geology, structural setting and scale because the 4-Moz Paddington gold deposit which can also be situated within the ‘Boorara Shear Zone’ to the north and the place Miramar found high-grade gold in a quartz vein. On the Marylebone goal alone, Miramar has outlined a big shallow gold “exploration goal” of 1.4 to three.2 million tons (Mt) @ 1.2 to 1.5 grams per ton (g/t) gold. The corporate believes Gidji has the potential to develop into a brand new gold camp.

Highlights:

- A number of Excessive-potential Gold Targets: Potential mineralisation at Marylebone ranges from 1.4 to three.2 Mt @ 1.2 to 1.5 g/t gold. Different gold anomaly targets embrace Blackfriars, Freeway-Piccadilly and Railway. Miramar is at the moment refining bedrock targets for additional deep drilling.

- Potential Nickel Sulphide Mineralisation: Via re-analysis of a number of aircore holes, Miramar has produced important platinum and palladium assays generally related to excessive nickel and copper outcomes.

Glandore (Jap Goldfields)

Located 40 kilometres east of the Kalgoorlie Gold Discipline, Miramar’s 100-percent-owned Glandore venture shows the potential for important high-grade gold mineralisation. Earlier exploration of the venture space recognized a big aircore gold footprint together with important gold anomalism. Diamond drilling in 2005 returned outcomes that included 4 metres @ 44.3 g/t gold.

In 2022, Miramar accomplished a diamond drilling program on the high-grade “Glandore East’ goal, on the fringe of the salt lake, with outcomes returning high-grade gold mineralisation and visual gold. A number of parallel mineralised buildings have been outlined beneath a really giant aircore gold footprint and bedrock gold mineralisation is current over 600 metres of strike and open. A UAV magnetic survey recognized a number of northeast-trending buildings. Extra surveys are deliberate to additional refine and help in concentrating on.

Administration Workforce

Allan Kelly – Govt Chair

Allan Kelly is a geologist and supervisor with over 30 years’ expertise in mineral exploration, improvement and manufacturing all through Australia and the Americas. Kelly graduated in 1994 with a Bachelor of Science (with honors) in utilized geology from Curtin College. He has been concerned in concentrating on early-stage exploration of gold, nickel and copper deposits in Australia, Alaska and Canada, and has beforehand held senior exploration positions at Western Mining Company and Avoca Sources.

In 2009, he based Doray Minerals, which was listed on the ASX in early 2010. Beneath Kelly’s administration, Doray found the high-grade Wilber Lode gold deposit throughout the Andy Properly Undertaking within the Murchison Area of Western Australia, which moved from discovery to manufacturing inside three and a half years. He subsequently funded, constructed and commissioned the Deflector gold-copper venture inside 14 months of finishing the takeover of Mutiny Gold in 2014.

In 2014, Kelly was awarded the Affiliation of Mining and Exploration Corporations (AMEC) ‘Prospector Award’, together with Doray’s co-founder Heath Hellewell, for the invention of the Wilber Lode and Andy Properly gold deposits. He’s a fellow and former councilor of the Affiliation of Utilized Geochemistry (AAG), a member of the Australian Institute of Geoscientists (AIG), and a member of the Institute of Brewing and Distilling (IBD).

Marion Bush – Technical Director

Marion Bush is a geologist with over 25 years’ expertise in senior administration, directorship, industrial administration, analyst and advertising and marketing roles throughout the UK, Australia, Africa and South America. She was the previous CEO of TSX-V listed Cassidy Gold and a former mining analyst.

Bush holds a Bachelor of Science (geology) from Curtin College, a Grasp of Science (mineral venture appraisal) from the College of London (Imperial School) and is a member of the AIG.

Terry Gadenne – Non-executive Director

Terry Gadenne has over 30 years’ expertise in army and civilian aviation, agriculture and mining administration. He was the chief pilot of Mackay Helicopters and managing director of Mining Logic, situated in Queensland. All through his profession, Gadenne has had numerous board positions in not-for-profit organisations.

He holds a Bachelor of Aviation Research (administration) from the College of Western Sydney, accomplished the Firm Administrators Course with AICD and was a former military and navy pilot.

Mindy Ku – Firm Secretary

Mindy Ku has over 15 years’ worldwide expertise in monetary evaluation, monetary reporting, administration accounting, compliance reporting, board reporting, firm secretarial companies and workplace administration throughout a number of jurisdictions (Australia, Malaysia, UK, Sweden and Norway) together with ASX-listed private and non-private firms.

Ku holds a Bachelor of Science in computing from the College of Greenwich, United Kingdom, is a member of Licensed Practising Accountant Australia and a fellow member of the Governance Institute of Australia.