Dikuch

A couple of days in the past, Worldwide Seaways (NYSE:INSW) introduced its Q3-2023 earnings. Outcomes have been fairly in step with analysts’ expectations and there have been no large surprises. Outcomes have been stable and the administration introduced a $1.25/share dividend for This autumn-2023. On this article, I will present an evaluation of the Q3-2023 earnings and I’ll clarify why I imagine Worldwide Seaways continues to be a purchase regardless of the lengthy upward rally it has proven for the reason that starting of the 12 months.

If you’re fascinated with different funding alternatives within the oil tanker enterprise, you’ll be able to take a look at my final article about Teekay Tankers’ Q3-2023 outcomes.

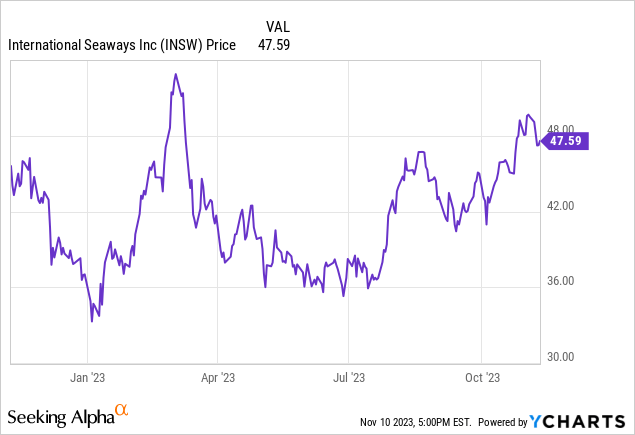

Inventory efficiency

Worldwide Seaways is at present buying and selling at $47.25/share, equal to a market cap of $2.3 bn. Because the starting of the 12 months, the inventory has gained 28% whereas, within the final 52 weeks, the rise is about 7%. The 52-week minimal is $33.3/share (January 4th, 2023), whereas the 52-week most was reached on Aprile 3rd, 2023, at $52.9/share. Subsequently, the inventory is at present buying and selling at an 11% low cost to its yearly most worth.

Q3-2023 outcomes

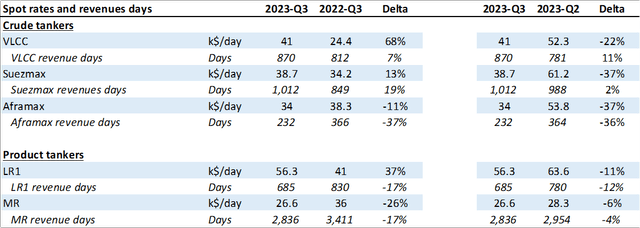

In Q3-2023, whole revenues have been $236 M, precisely in step with the earlier 12 months (+0.4%), nevertheless, the breakdown between gross sales generated by crude tankers and product tankers modified. Certainly, crude tankers’ revenues ($111 M) elevated by 48% year-on-year and now characterize 47% of whole gross sales (vs 32% on 12 months earlier than). However, product tankers generated 53% (vs 68% on the 12 months earlier than) of whole gross sales ($125 M), down 22% year-on-year. The explanation behind this alteration in income breakdown could be defined by specializing in day charges and income days:

- Crude tankers: throughout the crude tankers phase, day charges elevated by 68% y-o-y for VLCC and by 13% y-o-y for Suezmax vessels. The 2 courses additionally noticed a rise within the variety of income days (+7% and +19% respectively). Quite the opposite, the Aframax vessels recorded a decrease quantity of income days (-37%) and decrease charges (-11%). Nevertheless, since Aframax vessels are far lower than Suezmax and VLCC ones, whole crude revenues elevated.

- Product tankers: on this phase, income days decreased each for LR1 (-17%) and MR vessels (-26%) whereas day charges confirmed an inverted development. LR1 charges elevated by 37% to $56k/day whereas MR charges decreased by 26% to $26.6k/day.

Worldwide Seaways

The income state of affairs is a bit totally different if we examine Q3-2023 to the earlier quarter, Q2-2022. On this case, one can discover that revenues have dropped by 18%, from $288 M to $236 M with the principle motive being a generalized decline in day charges throughout all vessel courses.

Wanting on the working bills, whole prices elevated by 18% from $108 M to $127 M with a $9 M enhance principally on account of larger vessel bills (from $58 M to $65 M, +12%), larger D&A (from $28 M to $33 M, +18%). The online earnings was optimistic at $98 M, 13% lower than Q3-2022.

Free money flows

FCF generated in Q3-2023 was $104 M and it was the results of a beginning adjusted EBITDA of $151 M to which $54 M of debt service and $13 M of capex have been eliminated whereas $20 M of internet working capital variation was added again.

Specializing in the primary 9 months of the 12 months, money circulate from operations was optimistic at $563 M, principally pushed by the excessive internet earnings. Money circulate from investing actions was unfavorable at -$170 on account of expenditures for vessels beneath building and vessel enhancements. Money circulate from financing actions was unfavorable as effectively at -$498 M, since Worldwide Seaways, amongst different actions, paid again $323 M of debt and $247 M have been paid out in dividends.

Debt place and liquidity

On the finish of Q3-2023, the money and money equivalents plus short-term investments quantity to $214 M whereas the full debt stability is $771 M. Consequently, internet debt quantities to $557 M, equal to 24% of the market capitalization. The typical price of the debt is 6% and the earliest maturity shall be in 2027. On the time being, Worldwide Seaways has $417 M of undrawn credit score capability which additional will increase the corporate’s liquidity.

Oil tanker market dynamics

An important worth driver behind an oil tanker firm valuation is represented by the oil tanker day charges, since it’s the most impacting variable on revenues and, consequently, on FCF era. As an oil tanker investor already is aware of, the final quarters have been characterised by very excessive oil tanker charges which have enabled oil tanker shares to soar to valuation by no means seen earlier than. Nevertheless, I imagine that the upward rally is much from over for the reason that oil tanker market continues to be affected by some forces which are retaining the day charges beneath stress and at very worthwhile ranges.

The principle motive inflicting this dislocation in day charges is represented by the imbalance between oil tanker demand and provide.

From my perspective, demand for oil tankers will stay excessive a minimum of for all of 2024 for a collection of causes. To begin with, oil demand is forecast to extend in 2024 (by million barrels per day) resulting in extra oil that may have to be moved and, in fact, larger demand for oil tankers. As well as, the EU continues to be banning crude (and oil merchandise) imports from Russia with the resultant want for European nations to get a provide of oil through tanker from additional nations. This, as soon as once more, is an element that’s placing stress on the oil tanker demand.

If, on one facet, demand for oil tankers is predicted to develop, we can not say the identical for oil tanker provide. Shipyards are nonetheless working to cut back the backlogs collected through the Covid interval and have a really restricted bandwidth for brand new oil tanker orders. To present an concept, since November 2022, the worldwide oil tanker fleet has elevated by solely 3%. As well as, oil tanker corporations are pondering twice earlier than inserting new orders for 2 principal causes: inflation has elevated the price of new builds and potential new laws are creating uncertainty on the technical specs that new vessels want to fulfill.

General, the result’s that the demand for oil tankers is larger than the availability, thus retaining day charges at excessive ranges. From my perspective, the demand/provide mismatch will stay a key development for all of 2024 and possibly even past for the reason that earliest new constructing slots are in 2027.

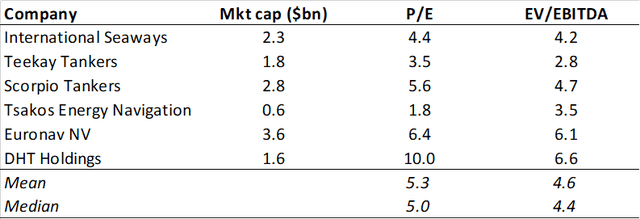

Peer comparability

To develop a greater understanding of Worldwide Seaways market valuation, I in contrast it with some friends. I chosen oil tanker corporations and I checked out their price-to-earnings and EV/EBITDA ratio. From the chart under, one can discover that Worldwide Seaways is buying and selling at 4.4x P/E and 4.2x EV/EBITDA and, subsequently, it’s buying and selling at a reduction each to the common imply and common median of friends. In different phrases, my conclusion is that Worldwide Seaways is barely cheaper than different oil tanker corporations.

In search of Alpha

Analysts’ view

Worldwide Seaways is at present lined by 7 analysts of fairness analysis corporations. All of them have a optimistic view of the corporate with six suggesting a powerful purchase suggestion. The typical goal worth is $61.2/share, which might characterize a possible 28% upside versus the present inventory worth.

Dangers

Being an oil tanker firm, Worldwide Seaways is uncovered to some dangers. Specializing in the trade itself, it’s price mentioning that the oil trade is cyclical and a discount in oil demand will for certain trigger a discount in oil tanker demand with a subsequent day fee decline and decrease FCFs. On the similar time, day-rates might decline if the availability of oil tankers have been to extend with new vessels being constructed at a sooner tempo than what’s now taking place: nevertheless, I imagine that this example could be very unlikely to materialize. Different potential dangers are associated to the regulatory side with potential new laws relating to GHG emissions that would result in extra capital expenditure for vessel modernization than anticipated.

Conclusion

General, having analyzed the Q3-2023 outcomes, I imagine that Worldwide Seaways is a stable firm and is correctly working to cut back its debt publicity. The present oil tanker demand/provide dynamics are creating a positive surroundings the place oil tanker corporations can thrive because of excessive day charges that guarantee robust FCF and income.