JamesBrey

Funding Rundown

REX American Sources Company (NYSE:REX) has seen its share worth enhance fairly steadily during the last 12 months and doesn’t show any of the volatility a number of the border markets have. The FWD p/e is at over 15 proper now and while it could be under the place REX has traditionally been buying and selling I do not assume any of the final report’s outcomes ought to equal such a excessive premium above the sector, which is 44% presently.

The marketplace for ethanol and different commodities that REX works with will be fairly risky which signifies that earnings stories might differ extensively every so often. What appears to be a pattern proper now for the corporate although is that common promoting costs are reducing and this limits the underside line progress of the corporate. Aside from this, the margins appear to additionally be in a fairly regular decline as REX has been nowhere close to reaching the highs it had in 2015 once more. I do not see any attraction in investing on this enterprise and with the premium it trades at it introduces pointless danger to buyers. This concludes to me score it a promote for now.

Firm Segments

REX and its subsidiaries are actively engaged within the manufacturing and sale of ethanol throughout the US. Moreover, the corporate gives a various vary of merchandise, together with corn, distiller’s grains, non-food grade corn oil, gasoline, and pure fuel. Certainly one of its key contributions to the market is the availability of dry distiller’s grains with solubles, which function a invaluable supply of protein for animal feed, additional extending the corporate’s influence throughout numerous industries. REX’s multi-faceted method to its product portfolio underscores its dedication to catering to a wide selection of market wants, contributing to its dynamic presence within the ethanol and associated sectors.

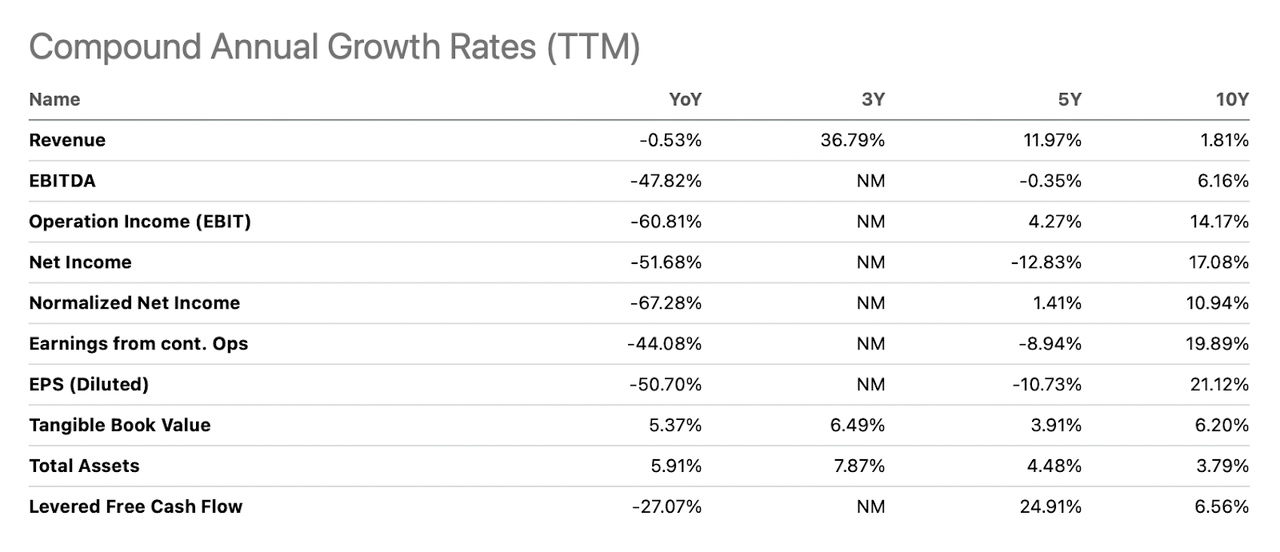

Development Charges (Looking for Alpha)

Wanting on the final decade the top-line progress has not been that spectacular for the corporate, solely averaging 1.8% CAGR. Wanting on the backside line although it has appreciated by over 17% within the final 10 years yearly. That’s improbable however as we now have seen, the web margins are reducing and I do assume it is cheap to imagine that REX might not publish YoY progress right here for a while. The web earnings is true now even decrease than it was in 2016 and definitely 2015 as properly, over 3x the final 12 months outcomes. I feel this could all equate to a decrease valuation being relevant however that does not appear to be the case but.

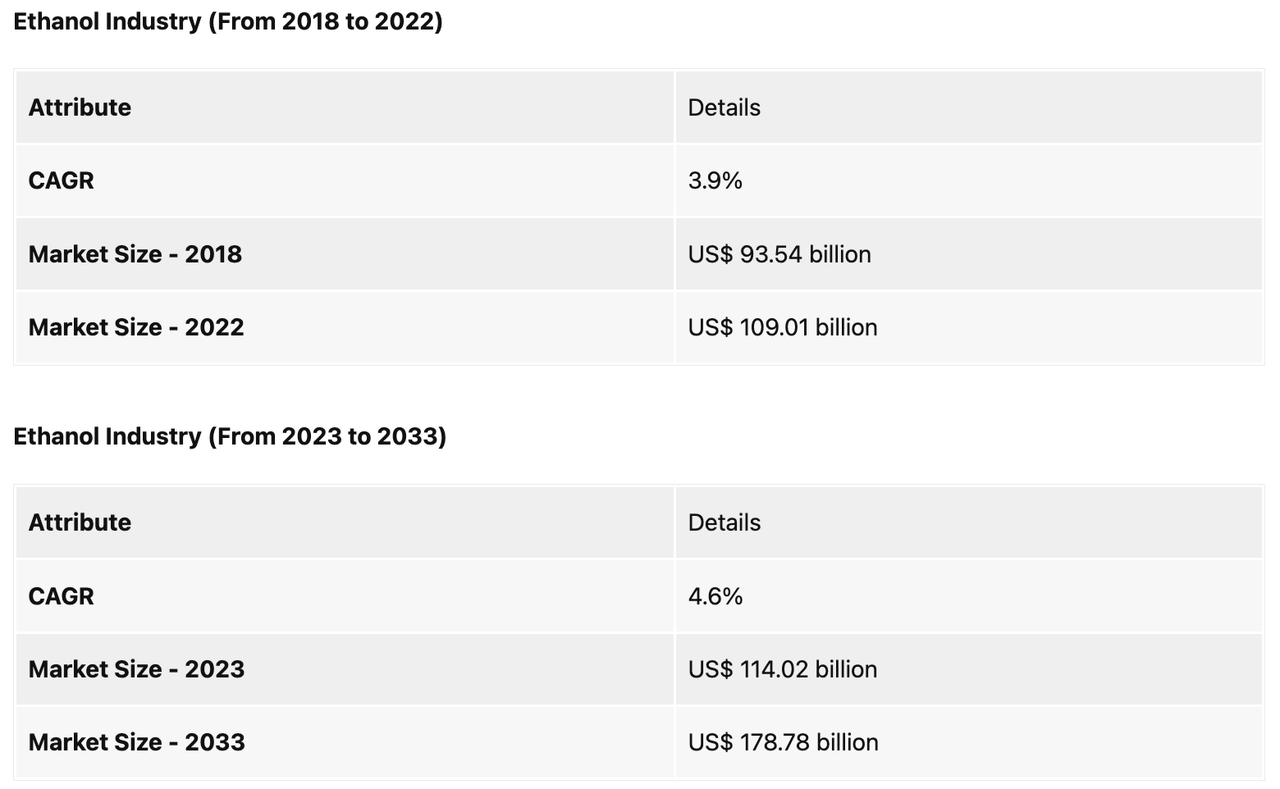

Market Dimension (Future Market Perception)

The market outlook for ethanol which REX is uncovered to is estimated to proceed rising at a low single-digit vary within the subsequent decade. REX has not been seeing the identical sort of CAGR for its high line as famous above right here, simply 1.81%. With a market cap of underneath $700 million, there must be loads of room for REX to develop one may assume. I consider a part of the explanation for the maybe muted progress is the dearth of funding incentives within the ethanol market as green energy is gaining loads of traction proper now and sure within the many years to come back as properly.

Bioethanol, a frontrunner within the renewable vitality realm, possesses the potential to revolutionize the vitality panorama as a sustainable vitality supply. Its prominence is additional accentuated by its environmentally pleasant attributes, providing a cleaner and extra environment friendly combustion course of. I feel this can be a key marketplace for REX to focus extra on and journey the inexperienced vitality wave. Capital expenditures have been rising for the corporate and are within the final 12 months at $21 million, up from $5.1 million in 2022.

Dangers

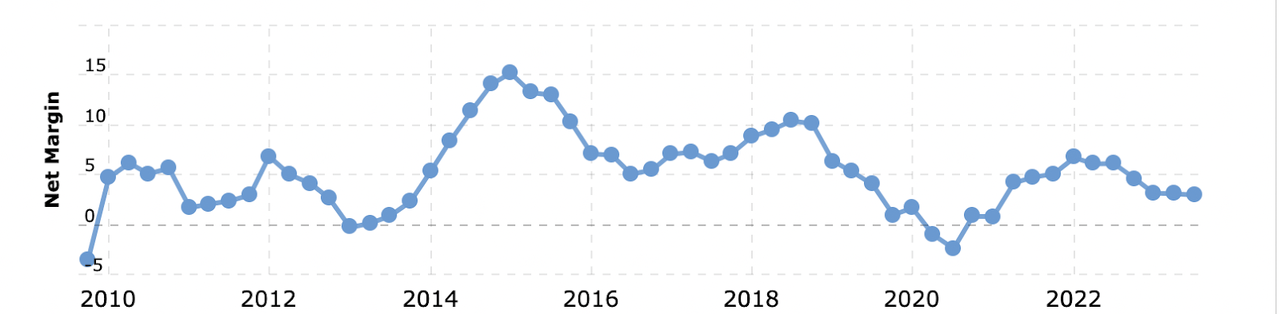

REX, as an organization, faces a major problem within the type of low-profit margins. Its present web margins hovering at simply over 3% won’t be notably spectacular. Nonetheless, it is essential to notice that REX has a commendable observe report that demonstrates its potential to attain increased margins. The prospect of reverting to the extra favorable 12-13% web margins, as seen in 2015, just isn’t solely a considerable enchancment but additionally a testomony to the corporate’s adaptability and resilience inside the trade. In 2015 the corporate had its highest web earnings however has since seen a lower of roughly 70% as commodity costs have depreciated.

Web Margins (Macrotrends)

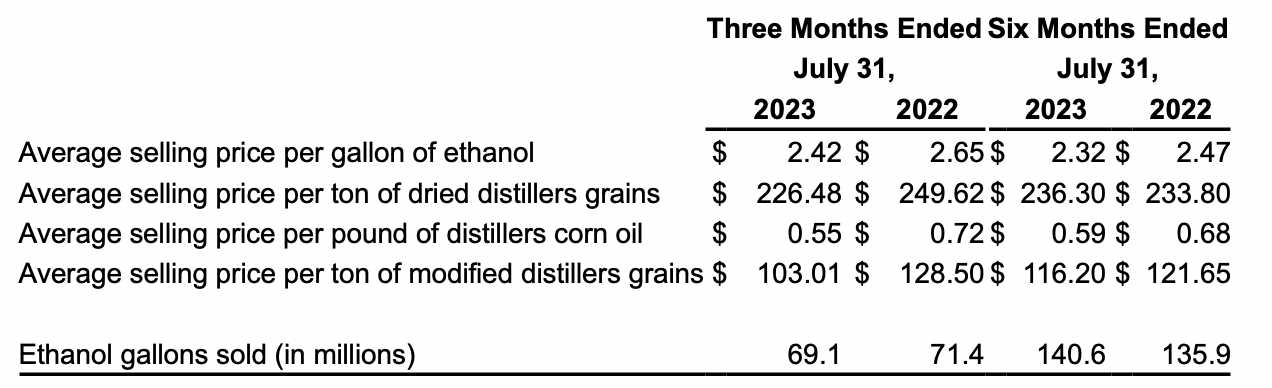

Promoting Value (Earnings Report)

What has moreover added to the depreciating web earnings and margins has been decrease promoting costs and volumes. Ethanol gallons bought decreased by over 2 million YoY however noticed a 5 million enhance YTD in comparison with 2022 YTD. This volatility is one thing to be anticipated I feel. What I nonetheless consider although is that each Q3 and This fall will show decrease promoting costs throughout the board with the assorted commodities that REX sells and this may result in a decrease web earnings and the next p/e. I say this as a result of commodity costs spiked in 2022 because the warfare in Ukraine started. Now we’re returning to a extra regular state of much less elevated costs. The worth of ethanol has been trending downwards steadily as seen here. I do not see any elementary shifting that might trigger a reversal within the pricing surroundings, and subsequently Q3 and This fall will doubtless publish decrease promoting costs for my part. I feel the markets are anticipating a turnaround right here however I do not see it. REX is likely to be debt-free however they haven’t been capable of develop margins over the past a number of years and that could be a key issue I search for in investments. Estimates level to some restoration within the backside line over the subsequent a number of years however as I see it the proof is within the pudding and till that’s proven in black and white on an earnings assertion I will not be a purchaser.

Financials

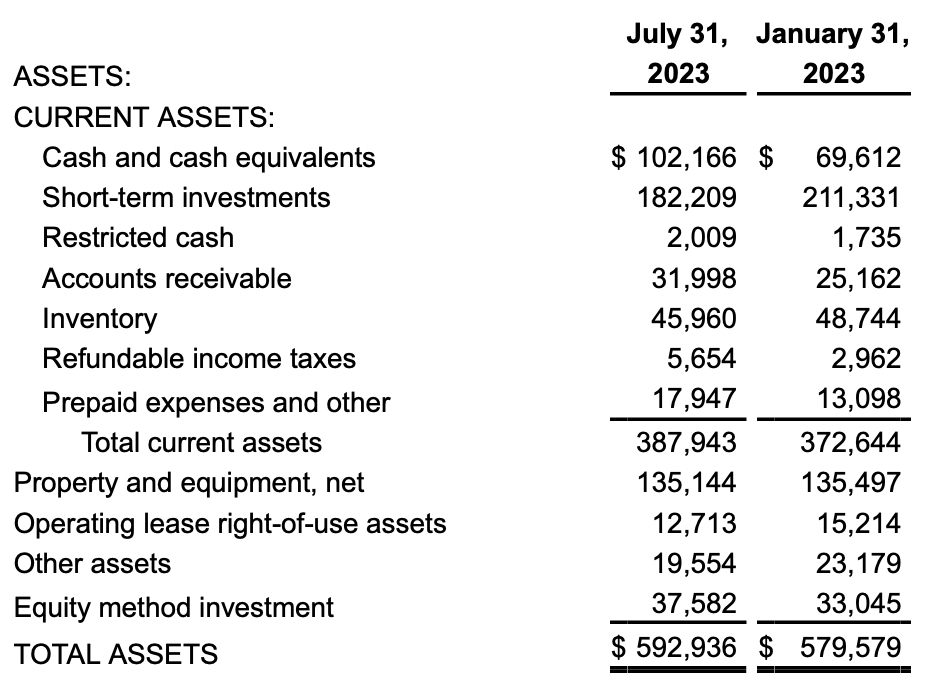

Asset Base (Earnings Report)

Wanting on the financials of the enterprise the money place has risen fairly strongly because the final of January this 12 months and is now at $102 million. This lets REX be a bit of extra versatile of their investments I feel and may very well be a cause for the slight premium the p/b has in opposition to the 5-year common for the corporate, proper now being at 1.43. There haven’t been any vital enhancements within the property and tools for the enterprise although which is the place I’d be trying. I’d hope that REX may develop its operations additional seize a number of the bioethanol market share and generate a powerful progress charge consequently. They’ve the money out there to do that in some method so I might be conserving my eyes right here within the coming couple of stories by the corporate.

Last Phrases

The share worth has grown steadily during the last 12 months for REX however I feel the deteriorating web margins are a key danger for buyers proper now. If this does not reverse we aren’t far off from REX posting a detrimental EPS. The markets they’re in are expected to proceed to develop, however maybe not at any fast charge, most underneath 5% yearly or so. When I’m taking a look at an funding alternative I would favor to see an annual anticipated CAGR between 9 – 11% indicating there may be a considerable amount of momentum and demand current. The corn market within the US has had some exhausting instances this 12 months as production is decrease doubtless attributable to softer demand. I might be score the corporate a promote due to the dangers I see introduced right here like a excessive valuation in opposition to the sector. Softer market situations are an actual trigger for a decrease valuation and bleak outlooks for promoting costs I feel additional add to a decrease valuation being relevant right here. Moreover, I feel there’s a lack of shareholder-beneficial actions right here like buybacks or a powerful dividend which suggests the next valuation could also be justified. There are a lot extra corporations in the identical sector at decrease premiums with for instance excessive dividend yields or sturdy buyback packages. I will not be extra optimistic concerning the enterprise till the web margins are reversing shortly or the p/e falls to a extra cheap stage of round 10x.