Kwarkot

REITs outperformed broader markets this week, helped by macro components and robust quarterly earnings.

The Federal Reserve saved its coverage charge at 5.25%-5.50% for the second straight assembly and the third time this 12 months, with a rising sentiment that the Federal Open Market Committee has ended, or ought to finish, its rate-hiking marketing campaign.

Main REITs similar to AGNC Funding (AGNC) and Simon Property Group (SPG) beat Wall Avenue expectations, serving to the sector’s general weekly returns.

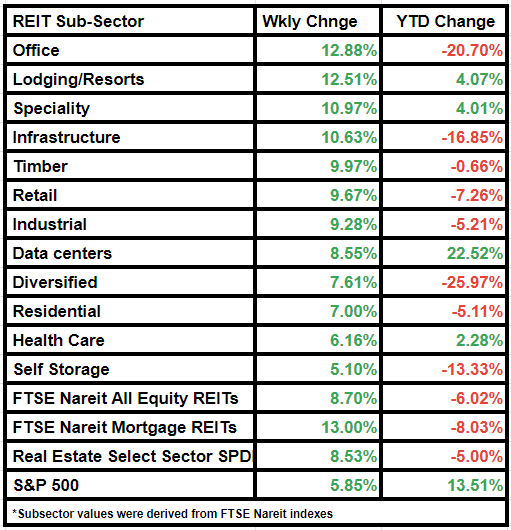

The FTSE Nareit All Fairness REITs index elevated by 8.70%, whereas the Dow Jones Fairness All REIT Complete Return Index gained by 8.74%.

Comparatively, S&P 500 was up 5.85% on a weekly foundation.

The Actual Property Choose Sector SPDR ETF rose by 8.53% and the FTSE NAREIT Mortgage REITs index by 13.00%.

Workplace was the most important gainer amongst subsectors, having gained 12.88% on a weekly foundation. Fairness Commonwealth (EQC) and Piedmont Workplace Realty Belief (PDM) had been notable movers within the subsector.

Resort REITs adopted with a rise of 12.51%. Park Inns & Resorts (PK), RLJ Lodging Belief (RLJ), Xenia Inns & Resorts (XHR) and Host Inns & Resorts (HST) had been the notable movers on this subsector.

Here’s a take a look at the general subsector efficiency: