Andrii Yalanskyi

REITs continued to achieve as Thanksgiving gross sales and powerful macroeconomic information helped the broader markets and the sector’s Q3 figures turned out optimistic.

Notably, shoppers spent $5.6B on-line on Thanksgiving Day, a rise of 5.5% from final 12 months, according to a report by Adobe Analytics.

In the meantime, preliminary jobless claims decreased through the week, whereas mortgage functions rose to highest degree in 6 weeks as long-term mortgage charges fell to the bottom charge in two months.

However, the sector’s steadiness sheet remained robust, with about 75% of the business gamers reporting Y/Y will increase in internet working earnings in Q3. Similar retailer NOI skilled 4.6% Y/Y beneficial properties. Almost, two-thirds of REITs reported Y/Y will increase in FFO.

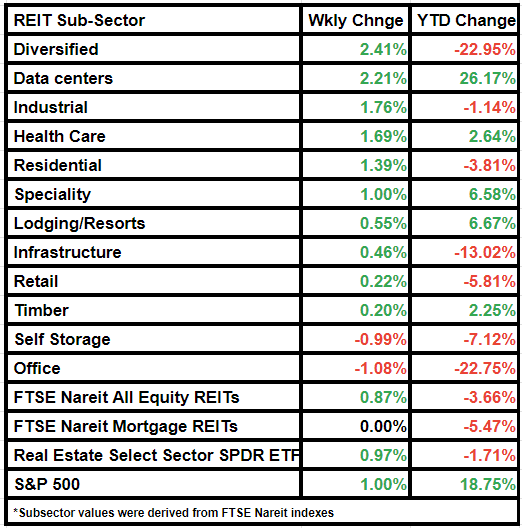

The FTSE Nareit All Fairness REITs index rose by 0.87%, whereas the Dow Jones Fairness All REIT Whole Return Index was up 0.88%.

The Actual Property Choose Sector SPDR ETF elevated by 0.97%, and FTSE Nareit Mortgage REITs index remained unchanged from final week.

In the meantime, S&P 500 gained by 1% on a weekly foundation.

Diversified was the most important gainer of the week, having elevated by 2.41%.

Information facilities adopted with a 2.21% improve from final week.

Workplace was the most important loser of the week, having misplaced 1.08% of worth.

Here’s a take a look at the subsector efficiency for the week ended Nov. 24: