Chainlink Labs’ director of capital markets stated conventional finance isn’t the perfect use case for tokenization, real-world knowledge is.

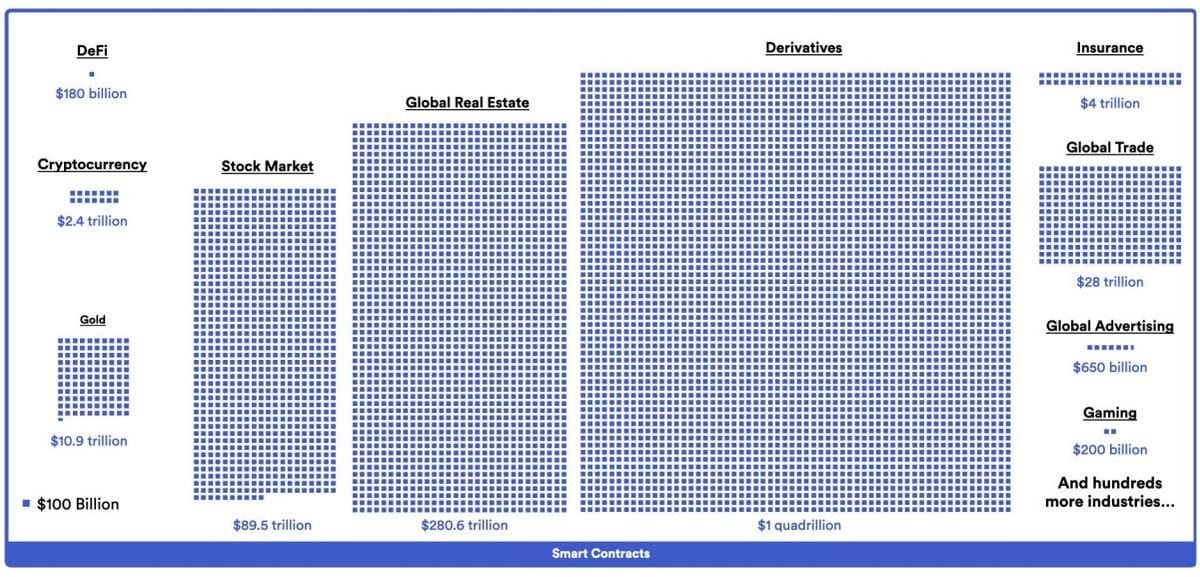

Actual-world asset (RWA) tokenization is without doubt one of the largest market alternatives within the blockchain business, with a possible market measurement within the a whole bunch of trillions of {dollars}.

1/ The tokenized RWA alternative is measured in trillions of {dollars}.

By tokenizing an asset, blockchain-enabled superpowers are unlocked, from near-instant settlement to enhanced liquidity, fractional possession, DeFi integration, & extra.

Breaking down the RWA megatrend 🧵👇 pic.twitter.com/e4WYSB8iAo

— Chainlink (@chainlink) April 23, 2024

There are an growing variety of tasks trying to tokenize all kinds of property, together with money, commodities, actual property, and extra.

Nevertheless, Researchers from the blockchain oracle platform Chainlink imagine the largest alternative is being neglected in favor of conventional finance

They declare that as monetary asset infrastructures develop into extra digital, asset managers may have a “sizable” alternative to enter the tokenization market.

In an business report titled “Past Token Issuance,” Chainlink defined the place the chance lies and the way interoperability and real-world knowledge may unlock the worth of tokenized property.

The report outlined a necessity for interoperability and real-world knowledge in tokenization to permit asset managers to adapt to the rising demand for tokenized property.

“Many asset managers discover themselves unable to assemble or provide complete digital asset funding merchandise involving tokenized property. With shoppers more and more in search of publicity to tokenized property, asset managers who’re unable to securely incorporate these property into their product choices danger falling behind their rivals.”

Chainlink Believes the Advantages of Tokenization Outweigh Conventional Finance

On condition that this was achieved, asset managers would unlock dormant capital with increased returns by enabling them to faucet into beforehand inaccessible markets or asset courses and entry international, liquid, 24/7 markets.

This would offer higher availability to asset courses that had been beforehand inaccessible or difficult to enter.

With this, asset managers may create novel income fashions with new income sources as a result of distinctive alternatives unlocked. They might differentiate their service choices with novel and bespoke monetary merchandise for his or her shoppers.

Bridging the hole would unify consumer portfolios, incorporating each conventional monetary property and digital property right into a single providing.

And eventually, it will cut back the back-office operational prices for asset managers since they must make use of fewer intermediaries, exploiting decentralization.

Chainlink argues that blockchain expertise is evolving into an “integral part of the present monetary ecosystem.” The report highlighted the combination of blockchain and conventional property right into a unified monetary ecosystem.

The researchers imagine that is the results of ongoing digitization, as blockchains present higher infrastructure for transactions and asset storage.

Though there could also be extra alternatives to use tokenization with real-world knowledge, conventional finance shouldn’t be neglected as a goal for the expertise’s improvement and adoption.

Chainlink has already develop into entrenched within the conventional finance market, partnering with corporations like ARTA TechFin and ANZ Financial institution to adapt their providers and facilitate the adoption of tokenization.

Actual-world knowledge tokenization isn’t merely a spotlight, however a contributor to the rising real-world adoption of blockchain expertise.