Actual-World Assiva (RWAS) are actually a class of $ 10 billion, in keeping with information compiled by Defillama, with maker, BlackRock’s Buidl and Ethena’s USDTB, locked each accounting for greater than $ 1 billion in whole worth (TVL).

Of the three USDTB – a stablecoin that’s designed to distinction with Ethena’s used – add the quickest development by greater than 1,000% to TVL previously month.

USDTB is supported by Tokenized BlackRock Cash-Market Fund shares, whereas Usde Crypto-Axets and perpetual futures methods are used for crypto-driven yields.

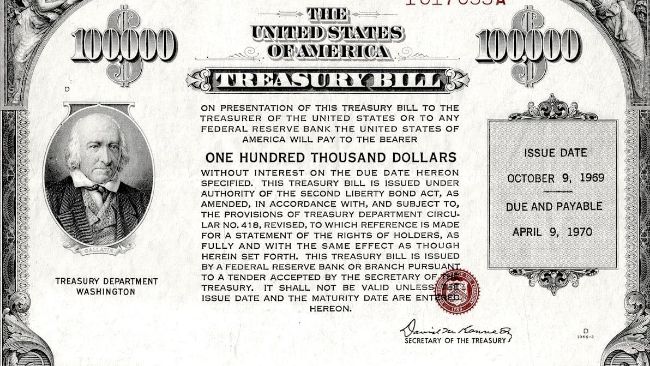

Coindesk beforehand reported that Treasury-stundled tokens achieved a report of $ 4.2 billion market capitalization within the first quarter, pushed by development in OUSG and USDY tokens from ONDO Finance, BlackRock and Securitize’s Buuidl, Franklin’s Benji and Superstate’s.

Treasury-supported tokens dominate, in keeping with information aggregator RWA.XYZ. The subsequent highest class, tokenized uncooked supplies, involves $ 1.26 billion, with Paxos Gold main with TVL of simply over $ 500 million.

Analysts say that this displays the desire of traders for safer property in the course of Beerarish cryptiment, the place T-Payments carry out higher than what is obtainable for yields with massive Defi protocols akin to connection.

Learn extra: RWA-Tokenization: What does it imply to Tokenize Actual-World property?