izusek

Actual property shares edged down within the week ended June 21 after a blended financial knowledge and the most recent housing market replace, whereas the key market averages gained marginally.

The Actual Property Choose Sector SPDR Fund ETF (NYSEARCA:XLRE) ended the holiday-shortened week 0.13% decrease at $38.48. The fund posted positive aspects in two out of the 4 periods, because the markets see the Might inflation knowledge encouraging, however notice that the disinflation course of could take longer.

The Federal Reserve held charges regular, however central banks throughout Europe proceed to chop rates of interest. The Swiss Nationwide Financial institution trimmed its key benchmark charge by 25 foundation factors for the second time this 12 months, after turning into the primary main economic system to start out an easing cycle again in March. The European Central Financial institution has adopted with a charge lower of its personal.

“Markets additionally acquired a three-course housing market replace which painted the image of a sector that is still rocked by increased rates of interest,” Wells Fargo mentioned, including that a lot of the week’s disappointing knowledge have been concentrated in interest-rate delicate sectors.

Housing Begins dropped 5.5% month-over-month in Might to 1.277M, effectively under the 1.373M consensus, from 1.352M in April. Constructing Permits declined 3.8% to 1.386M, lacking the 1.450M consensus, from 1.440M within the prior month. Current house gross sales got here in at 4.11M in Might, in contrast with the 4.08M consensus and 4.14M in April.

Regardless of the pullback in gross sales, house costs climbed. The nationwide median gross sales value reached $419,300, an all-time excessive on data going again to 1999. “It is considerably of an odd phenomena,” mentioned Lawrence Yun, the Nationwide Affiliation of Realtors’ chief economist. “We had low house gross sales exercise, costs are hitting report highs and houses appear like they’re nonetheless getting a number of provides.”

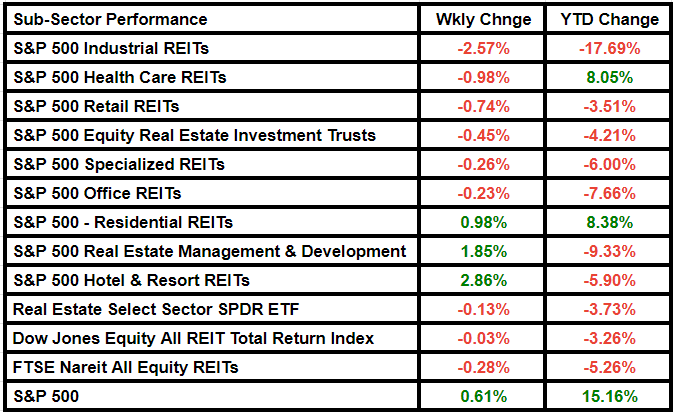

FTSE Nareit All Fairness REITs fell 0.28% from final week, whereas the Dow Jones Fairness All REIT Complete Return Index declined marginally by 0.03%. In the meantime, the broader S&P 500 superior 0.61% to finish at 5,464.6 factors.

Sentiments

The NAHB/Wells Fargo Housing Market Index declined for the second month to 43 in June, vs. 45 consensus, from 45 in Might, as mortgage charges proceed to hover within the 7% vary together with elevated building financing prices. The index represents homebuilder sentiment.

“Perhaps the Federal Reserve rate of interest lower coverage, which was projected to occur, however didn’t occur — it is getting delayed and delayed and delayed —- perhaps that is inflicting the house gross sales restoration to be delayed,” Yun mentioned.

Searching for Alpha’s Quant Ranking system grades The Actual Property Choose Sector SPDR Fund ETF a Promote, with a rating of 1.99 on a scale of 5. The fund’s Momentum is rated D+, Bills A, Dividends C-, Threat D+ and Liquidity A+. In the meantime, SA analysts assign it a Purchase score.

REITs are standard amongst buyers, particularly these in search of increased yields within the inventory market. The ETF holds all REITs within the S&P 500, presenting a blended technical image with potential for substantial positive aspects post-Fed easing. The highest 5 holdings in XLRE are worthwhile however overvalued, whereas the REIT sector provides development potential in varied sub-sectors, SA writer Sungarden Funding Publishing mentioned.

Actual property is among the many 5 defensive sectors that J.P. Morgan analysts really feel bullish about. The sector was among the many worst three performers within the first quarter. Within the second quarter, this has modified. Quarter-to-date, these sectors have pushed a ten% efficiency restoration, the analysts mentioned.

The fund noticed internet inflows price $27.02M this week, up from $4.06M within the earlier week, knowledge from the knowledge options supplier VettaFi showed.

XLRE is buying and selling 3% above its 200-day easy shifting common, however ~4% down from the start of the 12 months.

Subsector Efficiency