DKosig

Introduction

I’ve written two articles on SA about RCM Applied sciences (NASDAQ:RCMT), the most recent of which was in June after I mentioned that I count on EBITDA for the total 12 months to stay above $20 million.

On November 9, RCM launched its Q3 2023 monetary outcomes, and I’m shocked that the share worth spiked by 14.1% on that day contemplating they appear considerably underwhelming. Income progress was flat whereas EBITDA went down by 8.9% 12 months on 12 months to $4.7 million. Whereas This autumn 2023 is prone to be robust and I proceed to suppose that EBITDA for the total 12 months will surpass $20 million, the valuation is beginning to look stretched, and this might be time to take earnings. I’m reducing my score on the inventory to impartial. Let’s assessment.

Overview of the Q3 2023 monetary outcomes

When you aren’t acquainted with the corporate or my earlier protection, here is a short description of the enterprise. RCM Applied sciences is concerned within the provision of enterprise and expertise options and its enterprise is cut up into three segments – engineering, life sciences and data expertise, and specialty well being care companies. All three segments carry out workers augmentation companies, and the corporate generates revenues from everlasting placement charges. The specialty well being care companies phase accounts for about half of revenues and specializes within the provision of long-term and short-term staffing and placement companies involving well being care professionals corresponding to nurses, paraprofessionals, and physicians. Most of its purchasers are colleges and this enterprise received a powerful enhance to revenues and margins through the COVID-19 pandemic, notably in late 2021 and the primary half of 2022. The engineering phase supplies engineering and design, engineering evaluation, technical writing and technical help in addition to EPC companies and it has a retention fee of about 95%, with over 20 Fortune 500 firms amongst its clients. Life sciences and data expertise, in flip, makes a speciality of enterprise enterprise, utility, infrastructure, and life sciences options.

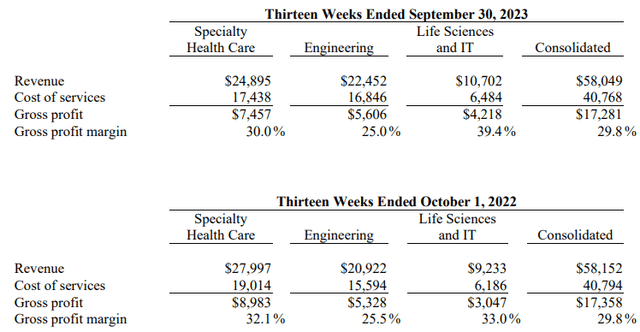

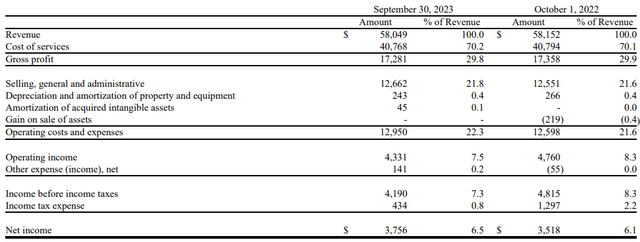

Wanting on the Q3 2023 monetary outcomes, we are able to see that income inched down by 0.2% 12 months on 12 months to $58 million whereas the gross revenue margin stayed unchanged. The income of the specialty well being care phase declined by $3.1 million as a result of weak demand from non-school purchasers as revenues from these slumped to $7.6 million from $11.4 million a 12 months earlier (see web page 35 right here). The corporate is simply not getting a lift from COVID-19 lockdowns anymore and I count on the expansion of this phase to stay in destructive territory for one or two extra quarters. The income of the engineering phase rose by 7.3% as a $3.1 million enchancment in power companies income was partly offset by $1.4 million and $0.2 million decreases in aerospace and industrial processing income, respectively. Aerospace income was decrease primarily as a result of a contract discount with a significant shopper (see web page 36 right here). Turning to the life sciences and data expertise phase, I feel it’s encouraging to see income rising by double digit percentages as this 12 months has been difficult for the IT trade. RCM defined throughout its Q3 2023 earnings name that the rise was pushed by focusing investments on market segments with secular progress. For my part, the income progress of this phase is prone to stay excessive over the following few quarters as the corporate expanded its life sciences observe in regulatory compliance, ERP design and implementation throughout Q3 2023.

RCM Applied sciences

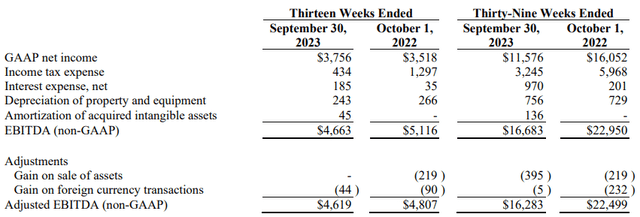

But, EBITDA for the quarter decreased by 8.9% regardless of the income and gross margin remaining on the similar ranges and the primary causes for this included an absence of capital positive factors in addition to barely larger promoting, basic and administrative (SG&A) bills.

RCM Applied sciences RCM Applied sciences

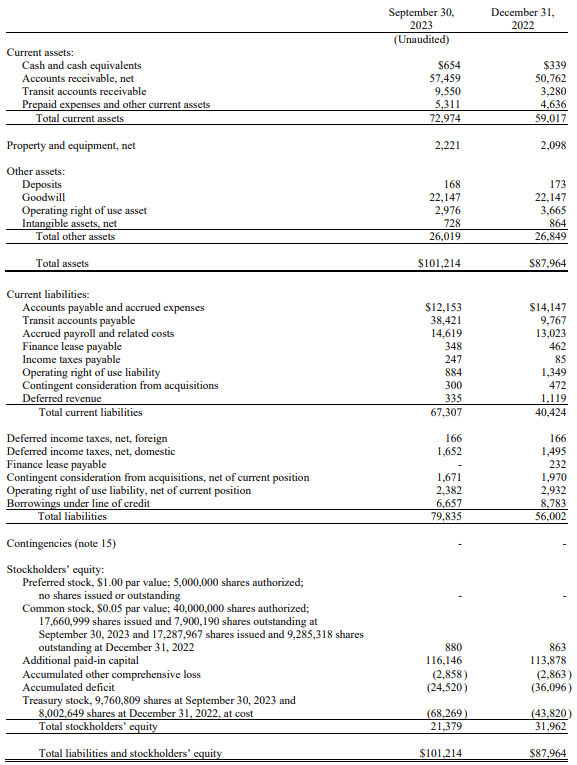

Wanting on the steadiness sheet, I’m involved that transit accounts payable has soared to $38.4 million whereas the transit accounts receivable was simply $9.5 million as of September. Whereas absolutely the quantities and spreads fluctuate considerably from quarter to quarter, it’s uncommon to see the unfold that prime and this $22.4 million improve accounted for almost all of the $27.1 million free money circulate for the primary 9 months of 2023. RCM spent a complete of $24.4 million on share buybacks through the interval , together with $3.4 million in Q3 2023. In consequence, the tangible e book worth is now destructive.

RCM Applied sciences

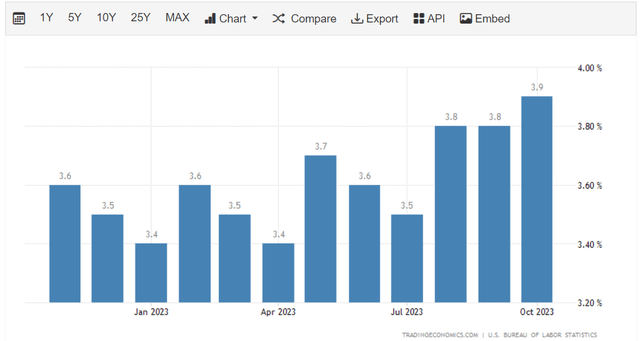

what to anticipate for the long run, RCM mentioned throughout its Q3 2023 earnings name that it expects This autumn to be its strongest quarter for the 12 months with EBITDA returning to progress and that the outlook for 2024 and past being vibrant. I discover this encouraging contemplating EBITDA for This autumn 2022 got here in at $6.9 million, which implies that EBITDA for 2023 ought to surpass $23 million ($6.9 million in This autumn 2022 plus $16.7 million for the primary 9 months of 2023). But, I feel RCM might be overly optimistic for 2024 contemplating the unemployment fee within the USA has began to inch up as rates of interest stay excessive. For my part, that is prone to dampen demand for the staffing companies sector in 2024.

Buying and selling Economics

Wanting on the valuation, RCM Applied sciences has an enterprise worth of $180.2 million as of the time of writing and is buying and selling at an EV/EBITDA ratio of seven.6x on a TTM foundation. For my part, RCM is unlikely to develop a lot in 2024 because the US labor market cools off and I’m involved that the energy of the steadiness sheet has deteriorated for the reason that begin of 2023 because the tangible e book worth is now destructive. I feel that the corporate ought to be buying and selling at about 8x EV/EBITDA, which leaves a small margin of security right here and I feel that buyers ought to begin fascinated by taking earnings right here.

Investor takeaway

RCM’s EBITDA shrank in Q3 2023, however the firm is optimistic that will probably be again to progress in This autumn. Nonetheless, I’m involved that the tangible e book worth has slipped into destructive territory as a result of aggressive share buybacks and I feel that 2024 might be a troublesome 12 months because the unemployment fee within the USA has began to extend as soon as once more. I feel this might be time for buyers to trim or shut their positions right here.